So says the Lord:

‘They have forgotten how to do right,

those who store up in their fortresses

the wealth that they have plundered and looted.’

Therefore this is what the Sovereign Lord says:

‘An enemy will overcome your power,

pull down your citadels of advantage,

and plunder your institutions of oppression.’

Amos 3:10-11

"Capitalism is at risk of failing today not because we are running out of innovations, or because markets are failing to inspire private actions, but because we’ve lost sight of the operational failings of unfettered gluttony. We are neglecting a torrent of market failures in infrastructure, finance, and the environment. We are turning our backs on a grotesque worsening of income inequality and willfully continuing to slash social benefits. We are destroying the Earth as if we are indeed the last generation."

Jeffrey Sachs

"Caution in handling 'generally accepted opinions' that claim to explain whole trends of history is especially important for the historian of modern times, because the last century has produced an abundance of ideologies that pretend to be keys to history but are actually nothing but desperate efforts to escape responsibility.”

Hannah Arendt, The Origins of Totalitarianism

"[Henry Paulson] is wrong. It [financial crisis] is a failure of regulation. In fact, one of the ironies of this whole discussion is they want to give more power to the Fed. The Fed, which flooded the market with liquidity, which did not put in regulations until after the crisis, In fact, closing the barn door after the horse is out. And now to reward them for their excellent job, they want to give them more power."

Joseph Stiglitz, Lou Dobbs Show, March 2008

“Capitalism is contradictory as soon as it is complete [unfettered]; because it is dealing with the mass of men in two opposite ways at once. When most men are wage-earners, it is more and more difficult for most men to be customers. For the capitalist is always trying to cut down what his servant demands, and in doing so is cutting down what his customer can spend. He is wanting the same man to be rich and poor at the same time.”

G. K. Chesterton

Gold and silver inventories and trading positions are becoming increasingly interesting.

In the first chart below we see CFTC data that shows gold and silver short positions in the futures to be at record highs.

And in the inventory reports, physical gold marked as available for delivery, in both Hong Kong and New York, is approaching record lows.

Are gold and silver near a tipping point, at least for this long, long sideways chop through a trading range?

The signs seem to indicate that we have at least reached an extreme in the pursuit of speculative advantage through the manipulation of paper on the part of a segment of the trading community.

We have been here before, and the powers that be managed to find enough gold to muddle through. But this time the Banks are on the other side of that short trade, a most remarkable and arther unfamiliar circumstance.

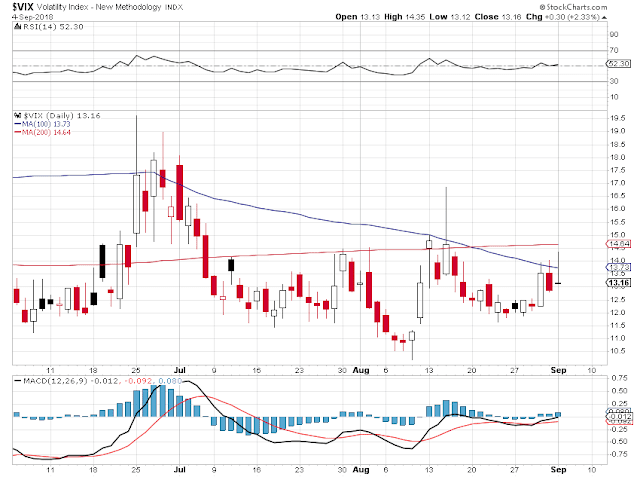

Stocks were indecisive, moving lower by the end of the day, with a few tech notables managing to move higher, in what perhaps may be remembered as a last hurrah.

The stock rally seems tired. And is often seen at the latter stages of long trends, risk seems to be almost phenomenally mispriced. Or at least it may be perceived so after the tumult is over and done, and the denouement of this latest phase of the ongoing control fraud that is modern finance collapses, once again.

And perhaps more importantly with regard to tipping points, the current regime of the domination of he real economies of the world by the Banks, with their enormous power to create and distribute the Dollar almost at will, may be nearing an end.

We cannot yet know. But what is certain is that all this too shall pass. Especially when it seems as though it never will.

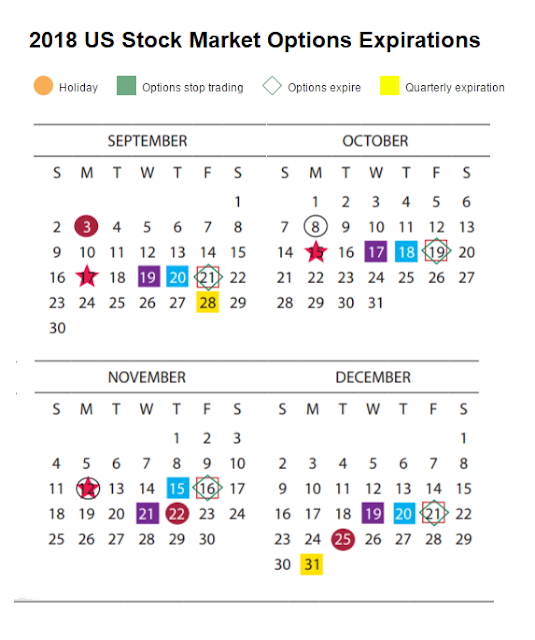

And in the short term, there will be a Non-Farm Payrolls report on Friday. Never forget than in these financial markets the short term and the long term are like alternative universes, with little singlular correlation.

I confess that this weekend was a bit more difficult than ordinary. Not that I am looking for sympathy, but just so those others who feel the weight of some loss know— they are not alone. No normal person is exempt from the suffering of a loss of a long time companion and best friend. There is an emptiness that creeps in to the heart.

But the cure is not to dwell upon the sick sweetness of despair, but to fill our hearts with acts of loving kindness, actions that take us out of ourselves, and reward us with repentance and forgiveness. And most of all with gratitude, for the many consolations and tender mercies that are too often overlooked.

If we do not, then first bitterness, and then hatred and pride may fill that emptiness in our hearts. And the proud cannot repent, and haters will not forgive. For them it is not 'thy will be done' but 'our will be done.'

And over time even the slightest thwarting of our wills may become an insurmountable trial, and create a sense of perpetual victimization and anger. It can rob our minds of peace, and our hearts of joy, and fill them instead with passing diversions, casual hatreds and cruelty.

And instead of a source of love and community, our fellows become a dread burden, and other people a type of hell for us, in our willful pride. We recoil from the unfortunate because they are reflections of our true selves, which we despise as weak.

How ironic, that the way to recover ourselves is through selfless acts, giving acts of love, and not through grasping at objects and strong negative emotions, and stuffing them into the growing void in our being, our emptiness.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.