|

| Another well-crafted bubble, shot to hell? |

Charles Kindleberger

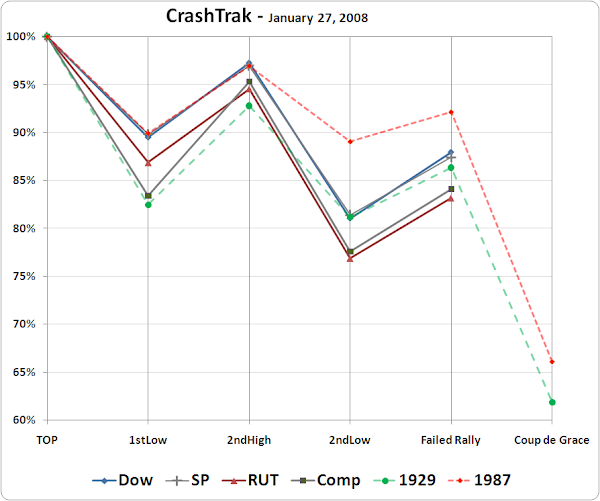

"Simply put, a market dislocation is when a sustained bubble begins to wobble and fall apart, and the realization comes generally that it is collapsing, with all participants remaining invested heading for the exits in a mass panic. These patterns of collapse tend to have a common framework.

The challenge is separating a market dislocation from an ordinary correction. In our work, we have arrived at some hallmarks that characterize a market dislocation, which as you know is always a low probability event.

The setup for a market dislocation begins with a sustained increase in price (the Ramp) to a significant new high (the Top) over a period of time which is multiples of the subsequent decline. US equity markets saw such a top late last year in October.

From there the first assault in confidence occurs as profit taking, creating a decline more significant than the declines serving as corrections up to the Top. It is usually an initial decline of ten percent or greater. Often we get an uncharacteristic decline. The rally back from this first low not exceed the Top (obviously) and is referred to as the Second High (with the TOP being the first or highest high). It can be equal to the TOP. The next low must set a lower low, ruling out a double bottom. It is preferable but not necessary that the Lows be noticeably lower than the Highs.

The lower the lows, the more likely that the dislocation will mark the start of a bear market rather than just a market clearing event like the Crash of 1987. It is not uncommon to reach this point, and the vast majority of times will merely be an A-B-C correction. The next step is a critical differentiator, the Failed Rally. If there is a bounce of 2 to 5 percent that fails to gain momentum, and drops back to a lower low, and fails to rally again from there, it sets up a higher than normal probability of a market dislocation which we define for our purposes as a market decline of 30 percent or greater within a one year period."

Jesse, Crash: the Rally that Fails as Hallmark of Major Market Dislocations, 27 January 2008

Stocks continued a leg lower today after the release of the Fed Minutes showed additional discussion of instituting a taper in purchasing towards the end of the year.

This looks so far to be just a correction for 'technical reasons' ahead of the stock option expiration.

Gold and the Dollar were unchanged.

Silver was off a bit.

Have a pleasant evening.