Yesterday a reader asked me to comment on a recent article from a blog that I happen to like which asserted that these large and recent declines in gold bullion inventory on the COMEX and ETFs are merely a sign that gold is now in a bear market, and that investors were simply liquidating positions.

I looked over the blog's argument, and after subtracting much detail that while technically correct was extraneous to the proposition, came to the conclusion that the basis for the argument was that if one is simply looking at bullion levels in the COMEX and maybe GLD, you could point to the fact that they were increasing while the price of gold was rising, and are decreasing now while price is decreasing.

QED.

The problem I have with this argument is that if it were true, if the disgorgement of gold from GLD and the COMEX was just a result of investor disenchantment, then the market should be awash in cheap physical gold.

Unlike debt paper assets, physical gold does not simply disappear when it is liquidated. You may see some paper gold evanesce as leverage is unwound, since it really has no substance of its own, and is merely a rehypothecation of many claims on the same physical bullion. But actual metal has to go somewhere.

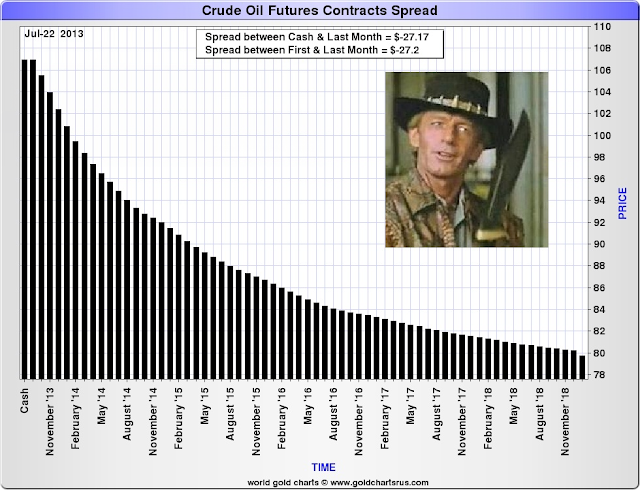

This is why the evidence of scarcity of bullion in the markets in Asia and the Middle East has been so important. And also the change to net buying, instead of steady selling, of gold bullion by the central banks, which is a phenomenon very new, relatively speaking. Indeed it is something we have not seen in over twenty years.

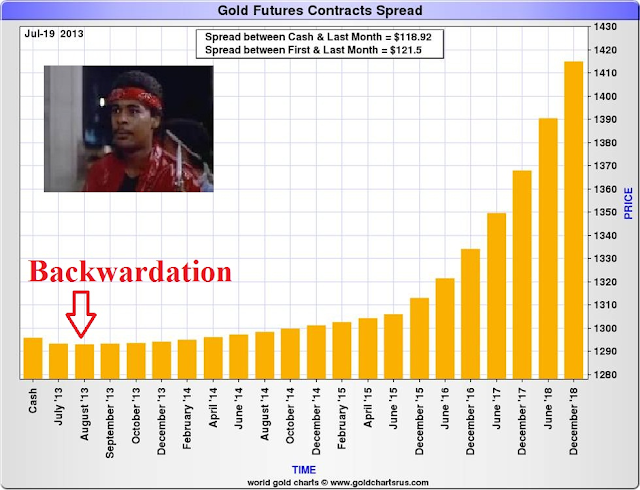

And this is why the leasing of gold for temporary use and even outright selling is important, and therefore the negative GOFO rates, as they point to the scarcity for near term delivery of gold and possible imbalances in longer term obligations. And of long lead times on retail purchases, and large delivery flows on other exchanges that are not largely paper markets like the COMEX.

And the absolutely incredible fact that a request for the return of Germany's sovereign gold from the custody of the Fed was flatly denied, and put off for seven years. If gold is in such disfavor that tonnes of it are being abandoned as a consequence by the market, why can't Germany have its gold back?

People who only watch a few familiar metrics and draw conclusions from them may be experts in them, and they may be right. But in times of dramatic

sea change, it often pays to cast one's eye across the broader horizon, towards foreign shores, to see if the receding of the ocean is something more significant than the simple ebbing of the tide.

Now, one might wonder, could the funds and the bullion banks in the gold market, who must surely be aware of what is happening behind the fog of their opacity, act in such a short sighted manner as to ship the gold east to be melted down and held closely in the vaults of strong hands, and in the private caches of the many, not likely to return? And yet still continue on in their game of leveraged ownership and price rigging? Is this not a recipe for a future disaster?

Is there any doubt, after all that we have seen in the past ten years, that betting on the foolish and often destructive greed of the Anglo-American bankers offers something less than long odds?

You are right, we don't know what is happening with certainty. I surely do not. And this is why we must try to keep looking for some alternative explanations and additional data. But one has to sort this puzzle out with all the available data, and not just from a few sources, especially those under the management of the same old group of Bankers and Traders.

The best way to address this is not to dismiss or even ridicule those who are seeking information and asking some very good questions. The most effective response is increased transparency and disclosure of data that is often unnecessarily hidden from public view so that the powerful can gouge a few more easy dollars from them by manipulating information and gaming the system.

It is the inability of money to flow freely without undue fees, distortions, and interference, and the commensurate problem of assessing risk, that is at the heart of the inability of our unreformed system to recover.

Unfortunately that difficulty in measuring risk is in the nature of an economy that has become founded in secrecy and an undue concentration of power, governed by foolish people whose primary concern is their own personal greed, almost to the point of madness, and to hell with the consequences. And if something should go wrong, well, the public is there to take the burden for them.

Weighed, and found wanting.

Stand and deliver.

"GLD Is Collapsing Its Shares And That Gold Is Being Shipped Directly To Asia"

By Tekoa Da Silver

August 9, 2013

I had the chance to reconnect with a source in the bullion management business, whose operations deal on a direct basis with the shipping desks at the GLD. While remaining unnamed at this time, it was a powerful conversation, and he was quite liberal in sharing thought.

Speaking to what his group is hearing from the main GLD custodian [HSBC], he noted that, “GLD is collapsing in [terms of] the number of share issuance, and [is] being redeemed…we are hearing from my end…that the GLD main custodian has been collapsing it and redeeming it, and that gold is just being shipped via their shipping desk directly to Asia.”

He further added that, “It is quite clearly a major establishment using their shipping desk to ship gold bullion, and potentially having it re-smelted down in Singapore, Hong Kong, etc. It (the gold) is moving.”

When asked his thoughts on the potential for a short-squeeze down the road as all this gold moves east, he concluded by saying, “Anything that can go down as hard as [gold] has, can obviously have a dramatic short squeeze at some time…at the end of this market [I expect] you will have a ridiculous squeeze.”

While much is left unanswered in the public domain regarding this year’s mysterious clearing out of physical gold from Comex warehouses, it would make sense for such events to occur right before a massive run-up in price—whether it be through freely traded markets or by governmental decree...

Read the entire article here.

Related:

GLD May Be in the Eye of the Gathering Storm.

Tonnes of Gold Removed From the COMEX and Major ETFs Since January 1

Stand and Deliver: How Germany Disrupted the World's Gold Market

This chart below comes from expert analyst Ned Naylor-Leyland via Mr. T. Ferguson's excellent

Metals Report blog.

I am not closed minded when it comes to coincidence. But after several of them, all in essentially the same direction, things tend to get a bit disquieting, suggesting that a closer examination is warranted.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, in private conversation, September 1999

How much should the people be expected to sacrifice to save a reckless and unrepentant few? Their homes, their health, their pensions, their children?

It is never enough, because the financiers will always need more, or more properly,

crave more. So change must come, before there is any sustainable recovery.