"It is the absolute right of the state to supervise the formation of public opinion." Paul Joseph Goebbels

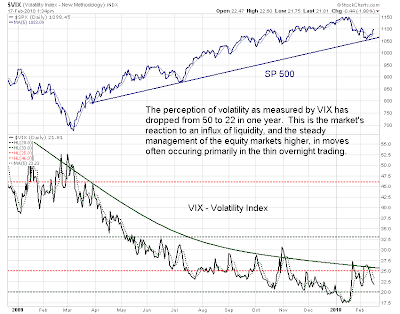

As measured by the

VIX, the volatility index, the perception of risk in US markets has declined significantly in the last twelve months from over 50 to current readings around 20.

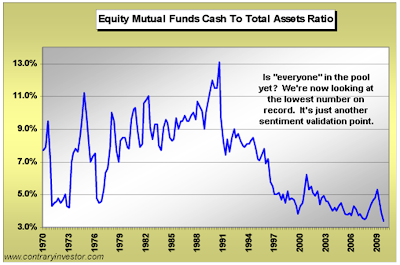

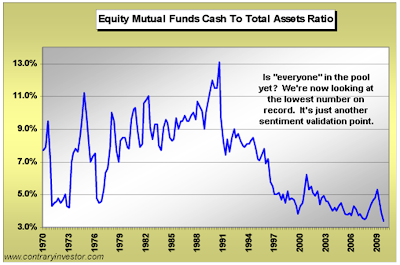

As a response to this changed perception, mutual funds are once again fully invested, with levels of cash reserves at record lows. In other words, the 'other people's money' crowd are all in.

There is an interesting distribution top forming in the US equity markets. This rally has been driven by liquidity delivered from the Fed and the Treasury primarily to the Wall Street banks, who are deriving an extraordinary amount of their income from trading for their own books, at least based on published results.

Much of the rally in US stocks has occurred on thin volumes and in the overnight trading sessions. Definitely not a vote of confidence, and a sign of potential price manipulation in fact.

Is this a 'set up' to separate the public from even more of their own money, using their own money? Perhaps.

The government is frantic to restore confidence in the US markets, and the toxic asset rich banks are more than capable of using that sincere interest to unload their

mispriced paper on the greater fools again.

The perception of risk is a powerful tool in shaping the response of markets, and as an instrument of foreign and domestic government policy actions. It is nothing new, as indicated by the quote from Joseph Goebbels, but it is rising to new levels of sophistication and acceptance in nations with at least a nominal commitment to freedom of choice and transparency of governance.

"There is a social theory called reflexivity which refers to the circular relationship between cause and effect. A reflexive relationship is bidirectional where both the cause and the effect affect one another in a situation that renders both functions causes and effects.

The principle of reflexivity was first introduced by the sociologist William Thomas as the Thomas theorem, but more importantly it was later popularized and applied to the financial markets by George Soros. Soros restated the social theory of reflexivity eloquently and simply, as follows:

markets influence events they anticipate – George Soros

This theorem has become a basic tenant of modern central banking. The idea is that manipulation of the psychology of market participants affects the markets themselves. Therefore, if you artificially suppress the price of gold, you reduce inflationary expectations and reduce inflation itself…so the theory goes."

Why Do the World's Central Banks Manipulate the Price of Gold?

For now we must watch the key levels of resistance around 1115 in the SP. A trading range is most probable but there is a potential distribution top forming with a down side objective around 870 on the SP 500.

It does bear watching, closely, keeping in mind that this is an option expiration week, and the traders expect the market to

misrepresent its price discovery, as the result of conscious manipulation.