"I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail."

Abraham Maslow, The Psychology of Science, 1966

Apparently while Maslow made this saying famous with a more elegant formulation, the original source of the image is from a Mr. Kaplan who wrote his 'law of the instrument' in 1964.

"I call it the law of the instrument, and it may be formulated as follows: 'Give a small boy a hammer, and he will find that everything he encounters needs pounding.'"

Speaking of boys and their toys, the word that has made its way across the trading desks is that the Fed's

put is back on, or more colloquially phrased, while Bernanke keeps printing, certain favored classes of assets can keep going higher, without regard to fundamentals, except for significant event-driven incidents, that will be quickly papered over.

Otherwise, the dips will be shallow and the trend will be maintained. For how long I do not know, but as the VIX shows, perceived risk is back down to low levels that we have not seen since the growing credit bubble of 2004-2007.

As an aside, before snarky propeller heads with little better arguments to make point out that the Fed does not literally 'print money,' we all know that. It is a degenerate profession that mixes a pretension to lofty equations and high science with the taunts and arguments of the schoolyard, when they act as the politicians' bullyboys.

The pity is that 'the printing press' is not the only instrument at the Fed's disposal. After all, they are a significant regulator of the banks, and have gained even more power and influence since the financial crisis. But as might be obvious to most, they are a terribly conflicted regulator, and given to remarkable lapses in judgement.

Monetary inflation without reform is the 'solution' that most favors the monied interests and the financial class given the extractive nature of the system as it is.

The second most favorable policy is 'austerity,' again without serious reform. One can increase the value of their own pile of ill gotten gains relative to others through either policy. It is no choice when you can pick the choices you give to the people, all of which are favorable to you.

Unfettered capitalism is remarkably inventive in its ability to transfer wealth and destroy value. It commoditizes everything, and subordinates all to a place on its hellish balance sheet.

The meme on the financial markets is that there may be shallow pullbacks, or even a greater correction in response to a specific event, such as the 'fiscal cliff,' but the Fed's policy is to target asset inflation once again, through the Too Big To Fail Banks and hedge funds, and their buying of paper at non-market prices.

There is also a belief, whether it is right or wrong, that the regulators will turn a blind eye to the capping of certain commodities like gold and silver, in the name of managing them as rival currencies. Even a folk hero like Paul Volcker has previously endorsed this as a policy.

This turning of things upside down is what has been called

Rubinomics, the principle that by supporting the buying of certain select instruments such as SP futures ahead of a crisis, one can more efficiently avert a financial problem than by allowing the markets to reflect the fundamentals, and then to clean up the mess afterwards. It's cheaper and easier he observed.

It is the belief that rather than an instrument of price discovery within the real economy, the financial markets ARE the economy, and will lead rather than follow. And it has become a form of financial totalitarianism through the manipulation of policy and money.

Robert Rubin articulated this policy perspective while he was the Secretary of the Treasury, and he somehow persuaded Greenspan, then the Chairman of the Fed, to go along with it, shortly after

the Maestro had made his famous 'irrational exuberance' speech. Although it should be noted that Greenspan had already found that tool, and used it. He merely took it to another level, not as a response to be used to a crisis as in the case of the Crash of 1987, but as a proactive tool of financial engineering.

And this was the genesis of the principles of new Modern Monetary Theory, which in fact is a concept as old as the hills, appearing over again with different names, and the source of much recent misfortune through several Presidencies.

"Notwithstanding anything said or done by the Congress this year, operating through trained surrogates such as Geithner, Summers and others, Robert Rubin is still pulling the economic and financial strings in Washington. The fact that there is a Democrat in the White House almost does not seem to matter. President Obama arguably has a subordinate position to Rubin because of considerations of money."

Chris Whalen, The World According to Robert Rubin

And this is the problem I have with this Modern Monetary Theory that would save the system by placing the ability to simply create money in the hands of the Treasury, to be wielded such titans of sound judgement as Robert Rubin, Hank Paulson, and Tim Geithner, with oversight perhaps by those incorruptibles and paragons in the Congress.

I do not like the banking system as it is, as you know if you frequent this Cafe. The corruption of insider dealings, opaque deals, and unequal justice has displaced the discipline of well run markets.

The system as it is has all the problems, inefficiences, and injustice of a corrupt and self-serving oligarchy. This is not to say that is a grand conspiracy, but rather a series of unfortunate events and human tendencies, aiding the actions of a relative few.

The solution seems obvious, which is

to reform the system, to provide for transparency and the rule of law, and a return to regulations and reforms that worked for decades. And it is not to replace it with some gimmicky solution that has the same faults or worse, that will be used by same rotten, self-serving gang of idiots and careerists.

And this is why I do not even favor something more rigorous like a return to a gold or mixed metal standard now, because with the system as it is, it would surely be used as an instrument of control and repression. A corrupt system can corrupt all. Ask the Greeks how an external standard like the euro is working for them. It has become an instrument of official plunder.

The thought of the central government having the power to set official gold prices and control inventory, which they most surely would do, makes one shudder. At least in a nominally free market they can provide some refuge against financial engineering, given a wide enough timeframe.

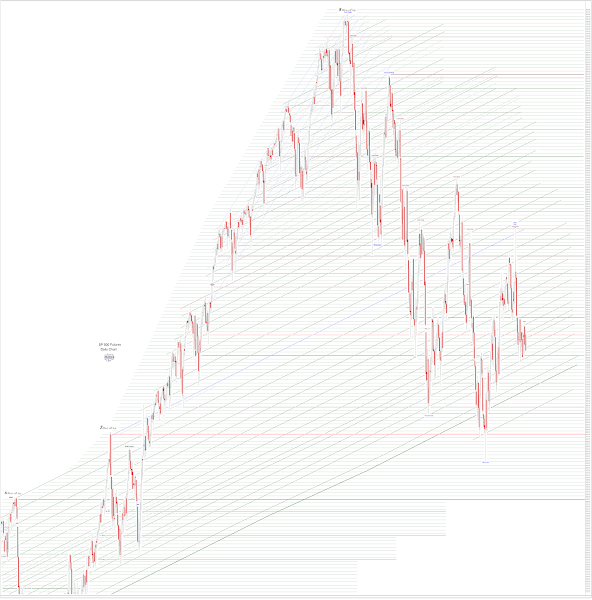

So what about the markets, and such similar financial engineering notions as

'Nominal GDP Targeting." Well, we can wonder how the Fed might want to actually achieve such a thing, short of going out and buying iPhones and foodstuffs. Would it be to continually stuff money into the banks and their associated companies and camp followers, and wait for the trickle down effect?

We have seen the result of such an approach in the past. The 'hot money' seeks beta, and that means financial paper, and frauds like collateralized debt obligations, tied to whatever hapless aspect of the real economy that is convenient, such as housing for example.

And the self same snarky economists will say, 'Where is the inflation?' and point to the very instruments of measurement of inflation that have been distorted and disabled so as not to show it, 'Chained CPI' being the most recent aberration. And they know full well that in a situation in which the money supply is being expanded selectively and distributed through a relatively narrow source like the biggest banks, the inflation will show up selectively for quite some time, in inflated assets, bonuses and even industries like the tech sector if one can remember back to the 1990's.

I know how tempting it is for 'a little boy with a hammer' to go about pounding everything in sight. But at some point, the adults have to come and take away that hammer, and restore the instrument to its proper usage in the service of real work and creative, productive activity.

Be careful in this market. In markets where stocks trade like commodities, the technicals tend to be dominant because the market is a cynical game of supply and demand, squeezes in both directions, divorced from the underlying economic fundamentals. And it has been made worse by the light volumes, as few bystanders want to put their money down on

the three card monte table, such as it is.

The pity is that it is strangling the flow of money to the real economy.

Max Keiser interviews Jesse Eisinger of ProPublica about his recent piece in Atlantic magazine,

"What's Inside America's Banks?"

I would like to see Mr. Eisinger interviewed on the Bill Moyers show on PBS.

I doubt he could obtain a fair hearing on any mainstream media channel which prefers to stage manage their discussions in the manner of red versus blue.