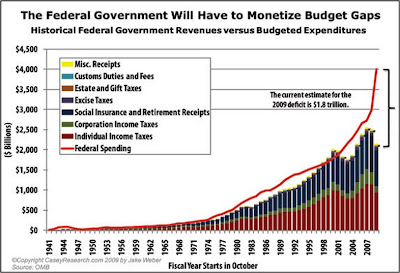

I like this graphic for several reasons, but especially because it puts everything in proportion with regard to the US' current obligations.

One thing I would like to highlight is the large surplus funds in the Social Security Trust and others. These were 'invested' in a special type of intra-governmental Treasury note.

These funds are not 'gone' anymore than a Treasury bond is 'gone.' It is a sovereign debt holding. If the US defaults on its debt, then it defaults. But let's call it what it is.

The Trust Funds are not the money that the government 'owes to itself.' It is a Trust fund, that is, money held by the government in Trust for others. The Trustees invested it in a special category of Treasury bonds that do not trade on the open market.

So to somehow suggest that Social Security is bankrupt now because the government spent the funds on general obligations is to assert a violation of Trust, a fraud, and a selective default on the sovereign US debt.

And do not think that the world would view it any other way, despite the spin put on it by faux economists, useful idiots, and mainstream propagandists for the money men.

Where would you think they would put a Trust Fund of this size? In a passbook savings deposit account? Federal Reserve Notes? The stock market? It was given to the government to be invested in bonds that were judged to be the least risky form of storing that wealth.

No, the real problem is that the US has malinvested too much of its revenue in too many fruitless and unfunded projects like wars, overseas military bases, and other subsides to oil companies, banks, and multinational corporations. The partnership between the money men, their corporations, and the government has allowed corruption to grow and prosper.

The money men and their cronies directed the peace dividend into their own pockets. And now that hard times have come, they wish to not only keep their gains but multiply them, and visit hardships on the very people whom they have defrauded. Their greed and hypocrisy knows no bounds.

"Adversity makes men; prosperity makes monsters."The US trade deficit and the stagnant real wage are major unaddressed problems, and has been so for the past twenty years. And those are the result of the distortions of fiat money regimes.

Victor Hugo

Reform and domestic growth is the answer to the US and UK problems, and not further looting and economic pillage of the laboring classes to provide largesse to the money men and paper manipulators.