"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, September 1999

“In times of change, learners inherit the earth, while the learned find themselves beautifully equipped to deal with a world that no longer exists.”

Eric Hoffer

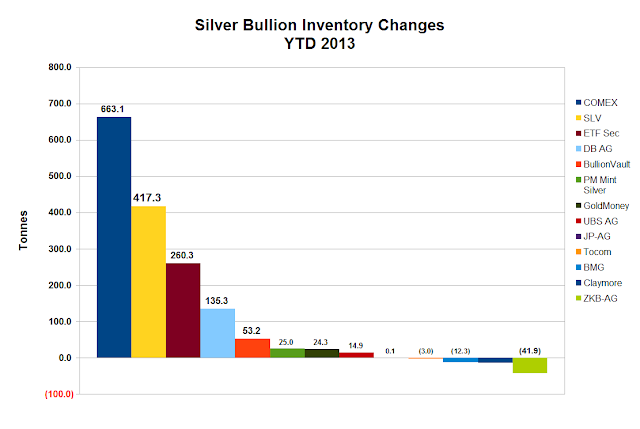

Here is the change, in tonnes, in the inventory of major exchanges and ETFs for gold and silver since the beginning of the year. Nick Laird of Sharelynx.com was kind enough to share the data which he has collected with me. He does a remarkable job in maintaining an enormous amount of data at his site.

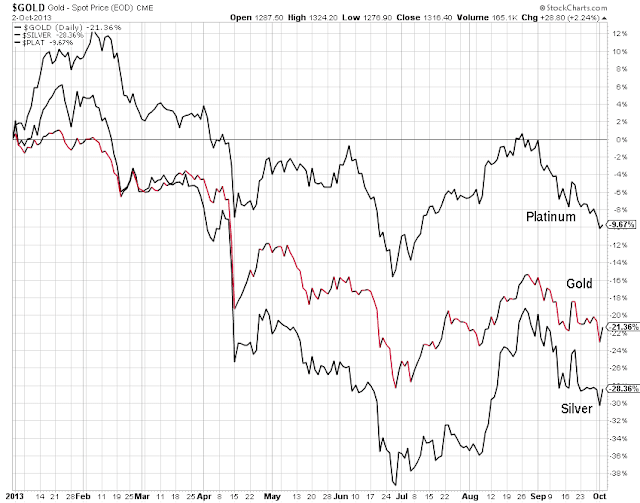

As you may recall, both silver and gold have seen price declines since the beginning of the year. As a reminder, silver is down 28.7% and gold is down 21.5%. I show this in the last chart. So they have both seen comparably stiff price declines this year.

Since the beginning of the year, the major exchanges and ETFs for silver have added about 1,494 tonnes of bullion.

But what is absolutely remarkable is that since the beginning of the year the Comex and some of the major ETFs have LOST about 856 tonnes of gold bullion. And I suspect much of that bullion has gone to the non-reporting vaults in Asia and the Mideast. And there is import/export data that corroborates that hypothesis.

Now, some might say that they don't see what this means, that they don't see the significance. Or that the significance is that people like silver but don't like gold, even though both have seen price declines, and even though demand for physical gold in Asia and the Mideast has been explosive this year according to trade records.

I will tell you what the significance is. The significance is that you are, figuratively speaking, watching water running uphill and out of sight. And some look at this and say, nothing to see here.

That gold which is disappearing from the reporting grid will not be coming back to these largely western vaults anytime soon. And it certainly will not be coming back at these prices. It is going into some fairly strong hands with an eye to the long term.

Silver is still acting like a precious metal, similar to platinum, which added 21 tonnes, and palladium which added about 1.5 tonnes.

Here is what is happening, as shown in the three charts below. Draw your own conclusions. But keep in the mind the negative gold forward rates and record leverage in potential paper claims for physical gold that we are seeing and hearing reported.

And this chart does not include the leased gold that is being occasionally disclosed by Western central banks, which seems to be going to satisfy the appetite of Asia.

It seems pretty darn obvious to me that there are some big buyers outside this reporting system that are taking down supply, and at a fairly aggressive rate, especially in the last twelve months.

You know that I think this exercise was triggered by the revelation that Germany's gold was missing, and a reflexive price manipulation that was intended to dampen demand, but instead set off an avalanche of physical buying.

Given that genuinely new gold supply is only added slowly from mining, once the West realizes what is happening the turnaround could take on the character of a short squeeze, and perhaps even a panic and market dislocation to the upside.

And if you are one of those who are holding receipts for gold held in this system, you may find that you have been rehypothecated with extreme prejudice, and given a forced cash settlement at another's discretion. When the time comes your assets may be found to have been used as cannon fodder in the currency war. Thank you for your support.

The German people asked for

their national gold back, and were told by the Fed to go sit down in the lobby for seven years and wait for it. Are you kidding me? What is it going to take to wake people up that something has gone seriously wrong in these markets?

What kind of new fraud or disclosure of fiduciary misbehavior will it take to bring the dawn? And what will happen when the dawn finally comes? Do you wish to be standing in a very long line holding a warehouse receipt or brokerage statement? Good luck with that.

You may be a financier, fearing the abyss and hanging on, obsessively doing what worked in the past. But here is some news. You don't have to fall into the abyss, the abyss is coming for you. And the longer this nonsense continues, the worse the drawdowns will become, and the more painful the final reckoning will be.

Weighed, and found wanting.

Stand and deliver.