In his recent commentary, Gold Derivatives Update: BIS Swaps, Reg Howe notes:

"Not surprisingly, revelation of these swaps has generated considerable discussion, comment and analysis by students of the gold market. What appears to have happened is that one or more central banks loaned gold to one or more bullion banks, which then swapped the gold with the BIS for cash, leaving the physical metal in place. Under this arrangement, the accounting conventions promulgated by the International Monetary Fund allow the central bank or banks to continue to count the gold in official reserves while the BIS enjoys a high level of security on the gold side of the swap."

This is how I described the swaps in

a July 6 blog entry:

"Some parties have mistakenly asserted that since a swap is not a lease for accounting purposes, which is quite correct, then the gold could not have been sold. That is just a simplistic misconception. A swap transfers the benefits of the assets from one party to another for a period of time in exchange for interest paid, generally on forex received. Its does not sell the property but it transfers the mineral rights for a time, if you will.

The party that then holds that gold asset can just hold it, or they can utilize it in some way, such as leasing it out for a period of time to another party, like a bullion bank, who can subsequently sell it. These types of 'three way deals' were very commonly seen when Lehman and Bear Stearns started to unravel and they needed to be unwound, and were a key component of the whole issue of hidden counter party risks. Remember that?

So on the books of the first party there are in fact no leases or sales shown, just swaps of varying duration and terms. But the swap has delivered an asset, in this case gold, into the hands of a party who may have no qualms about leasing that asset out to a third party to obtain funds, and that third party is likely to sell it. I would of course agree that this does not PROVE anything. How can it when the books of some of the parties are still opaque, and audits rarely conducted to verify ownership. But after what we have just seen over the last three years in these games of asset merry-go-round, how can anyone just blatantly dismiss that can and likely is happening, where there is an easy profit to be made. Especially considering the past history of transactions between the bullion banks and the central banks.

Personally I would view this report as bullish for the price of gold, since it is past history, and almost certainly an indication of concerns about Comex offtake. In other words, shortages are appearing, and fresh sources of bullion are becoming increasingly difficult to find."

Quite a few of the usual suspects and industry bottom feeders have questioned the significance of these swaps, while admitting they do not understand them. So confusing, who would care. Move on, nothing to see here. By the way, strike those nutters off the guest interview lists, and make sure people know that they are

persona non grata.The significance of these swaps seems almost transparently obvious to anyone who is following the commodity markets, but Reg Howe says it quite well, and has been illuminating this smarmy little scheme for several years.

"...an integral part of gold banking in recent years has been the suppression of gold prices, not least by increasing the ratio of paper claims on gold to the underlying amount of available real metal. In this sense, if the new gold swaps disclosed by the BIS are just the latest technique for giving official support to an increasingly shaky gold banking business, they might be viewed as a short-term negative for gold prices. But in a larger sense, the growing reluctance of central banks to part with whatever gold they have left can only be a positive development for committed gold investors."

The point is that some of the central banks, led by the example of the Fed and J.P. Morgan, have been leasing out their gold inventories to the bullion banks at very low rates, without reflecting those leases on their books. Technically this does not violate any prohibitions against selling sovereign assets without the oversight and consent of the people. In the case of Gordon Brown, when you do it, you invoke the secrets act and hide the details as well.

The bullion banks have been selling that bullion into the market, artificially suppressing the price, and occasionally having to be bailed out when there is a short term 'run' on their paper obligations as in the case of the sale of England's gold by Gordon Brown.

The reason, more properly rationale, for this 'arrangement' is the linkage shown in several economic papers, including an important one co-authored by Larry Summers, that leads them to believe that their is a linkage between lower gold prices and lower interest rates on the long end of the curve. I believe they have it wrong and are ultimately mistaken, but they believe it, and that's what counts. And this will be their cover story when they are brought to justice, the Greenspan defense for his own unindicted offenses.

I thought I was doing the right thing, but I was mistaken, and I am sorry.So why should we care? For two reasons. First, this is clearly become a reverse Ponzi scheme, wherein large paper claims exist for a shrinking pool of an available physical resource, ie. central bank and bullion bank gold. The same applies for silver.

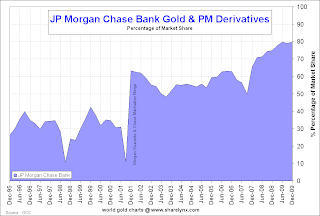

The derivatives short positions held by a few banks, like JPM and HSBC, are enormous. If the market ever breaks free of this scheme by the shorts, it is going to leave a crater in the international banking system.

And second, when one has a scheme started from good intentions that gets out of hands and is covered up by official government actions, it festers into corruption. That corruption spreads, and undermines the integrity of the institutions that it involves, namely the Treasuries and Central Banks of many of the developed countries.

"Corruption is a tree, whose branches are

of an immeasurable length: they spread

Everywhere; and the dew that drops from thence

Hath infected some chairs and stools of authority."

Beaumont and Fletcher, The Honest Man's Fortune

Sounds a little crazy huh? The SEC dismissed the whisteblower in the Madoff scandal as a cranks for years.

At least some of the monied interests, the privileged, and their demimonde of enablers have called it such. And yet the evidence keeps coming out and confirming it, little by little. The revelation of the fractional reserve nature of the world's largest bullion exchange was a blockbuster. The Fed resists audits of their dealings in gold, and an independent audit of the gold held by the Treasury and Fed with a full and clear disclosure of any obligations on those inventories has been resisted for years.

Like Enron, the tech bubble, the housing bubble, the Madoff Ponzi scheme, financial deregulation, OTC derivatives, relaxed pension fund rules, and the financial assets bubble, this bullion bank scheme is going to blow up and collapse, and the public is going to be asked to pay the bill, and ignore all the wrongdoing for their own good.

That is why this is important. And there will be hell to pay when the day of reckoning arrives. And that is why there is such moral hazard in the policy of not seeking indictments of key figures in this financial fraud because the perpetrators think they will be able to just keep the scheme going, and then lie and deny if the time of discovery comes, as their fellows have done already.

But it hasn't happened yet. And the pigmen live life on the edge, doing what they will, with a confidence that they can talk their way out of any difficulties that may arise, maybe make a few phone calls, call in some favors from the powerful. They are just that good.

I have known several of that type personally. This is how they think, and their actions follow their beliefs in their own power, and the distance they enjoy from common humanity. This is why deterrence is an even more important factor in intellectual or white collar crimes, because belief in the con is such a pivotal element.

This is what makes Obama's reluctance to take an aggressive stand against fraud, to follow through on the will of the people in their desire for justice, such a fatal flaw. His moral ambiguities and desire to go along respectfully with the desires of the powerful, shown clearly in his appointments and key decisions, makes him a nice guy to pal around with perhaps, but a tragic failure as a leader for reform, and an American president.

And they often have a good run of it. But eventually they have trouble talking their way out of trouble, especially when they are figuratively swinging from a lamp post, or hoist with their own petard.

"Watch therefore and pray always, that you may escape all these things that will come to pass, and be among those standing with the Son of Man.” Luke 21:36

Although it does not appear until almost the end of this article in the Financial Times, BIS Gold Swaps Mystery Unravelled, the source of the gold provided in the dollar swaps with BIS is coming from customers of about 10 European banks who are holding their gold at the banks in 'unallocated accounts.'

Although it does not appear until almost the end of this article in the Financial Times, BIS Gold Swaps Mystery Unravelled, the source of the gold provided in the dollar swaps with BIS is coming from customers of about 10 European banks who are holding their gold at the banks in 'unallocated accounts.'