soph·is·try (s f -str ). n. pl. soph·is·tries. 1. Plausible but fallacious argumentation. 2. A plausible but misleading or fallacious argument.

I see the Cullen Roche is back at it again, telling us all about the wonders of modern money.

The Biggest Myths in Economics

I will take these

myths, and comment on them one by one. Some things make sense, and others, not so much. But perhaps the discussion will help to shed some light.

I am going to try to do it simply and in straightforward language, because that is often the best antidote to sophistry.

1) The government “prints money”.

The government really doesn’t 'print money' in any meaningful sense. Most of the money in our monetary system exists because banks created it through the loan creation process. The only money the government really creates is due to the process of notes and coin creation. These forms of money, however, exist to facilitate the use of bank accounts.

This is the 'I didn't do it, because the guys who are working for me did it' argument.

As you might recall, the banks in the US, and most other places, operated under a license and regulation of the government. The banks are part of the Federal Reserve System. They create money under the supervision and regulation of the Federal Reserve Bank, which in turn is answerable to the government.

Most of the time the money is created, organically if you will, through economic activity. The Fed exercises quite a bit of direct and indirect control over this process as both actor in the markets and a regulator. This is the very basis of the Federal Reserve.

At other times, the Fed is able to create money on its own volition, by expanding its Balance Sheet. It can create money at will, and uses it to enact its policy objectives. Whether you say 'print' or 'create' money is a matter of usage, as they are both essentially the same in this context unless you are given to splitting hairs.

You want to know the difference here? If some bank or person started 'printing' its own money apart from the Federal Reserve system or the rules of the government over commercial paper they would shut them down in a Manhattan minute. Just ask the Liberty coins guy. The almighty dollar is a jealous god.

There were times in the past when the 'currency of the US' was created by private parties and circulated. That is not the case now, except in the fevered minds of creative imaginations.

2) Banks “lend reserves”

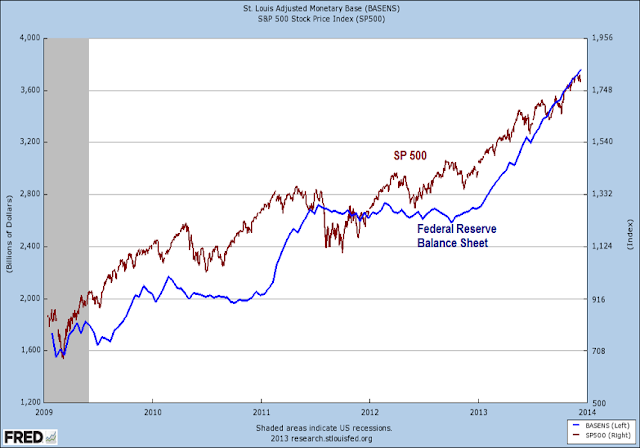

This myth derives from the concept of the money multiplier, which we all learn in any basic econ course. It implies that banks who have $100 in reserves will then “multiply” this money 10X or whatever. This was a big cause of the many hyperinflation predictions back in 2009 after QE started and reserve balances at banks exploded due to the Fed’s balance sheet expansion. But banks don’t make lending decisions based on the quantity of reserves they hold.

Banks lend to creditworthy customers who have demand for loans. If there’s no demand for loans it really doesn’t matter whether the bank wants to make loans.

This one gets definitionally tricky, because it involves the terminology of bank accounting and its own particular jargon. But let us cut to the heart of it by saying that banks make loans with some regards to their assets. A person cannot just stand up with no money in their pockets and say, I am a bank and am going to start making loans. They need to be licensed by the government, and must adhere to certain requirements from their books. Those nasty things like leverage, risk, etc.

As for Banks being in the business of making loans, that is nonsense. Banks are in the business of making money, and we should never forget that. Sitting idly on what in another business would be called working capital does not do them much good. And people tend to mistake 'working capital' for 'reserves' and that's where we go off into the jargon wilderness.

What is a

creditworthy loan? This is not some black and white threshold, good or bad, but more like better or worse, an analog measurement of risk and reward. Anyone who has ever funded competing projects in corporations understand this. It is intimately tied to risk return and competing opportunities.

I would certainly think that most people understand that making commercial loans for some meager basis points in return over the long haul is boring stuff compared to the opportunities to be had in gaming hot money markets for outsized gains and large bonuses tied to short term results.

And that is the heart of much of the problems in the financial system today. Speculation is crowding out investment from the commercial banking system due to the repeal of Glass-Steagall, and the laxity of regulating the abusive practices of large and powerful players in the markets.

3) The US government is running out of money and must pay back the national debt.

There seems to be this strange belief that a nation with a printing press whose debt is denominated in the currency it can print, can become insolvent. There are many people who complain about the government 'printing money' while also worrying about government solvency. It’s a very strange contradiction...

As I’ve described before, the US government is a contingent currency issuer and could always create the money needed to fund its own operations. Now, that doesn’t mean that this won’t contribute to high inflation or currency debasement, but solvency (not having access to money) is not the same thing as inflation (issuing too much money).

This is a nice piece of sophistry because while it knocks down a thesis, it does not prove its antithesis.

Because the US government is NOT running out of money, and it does NOT have to pay back the national debt, that does not mean that the national debt has no limit. It just means that we have not yet reached it, whatever that may be.

At some point you have to get off the theoretical merry-go-round and try to exchange some of that money which you declare that you have for real goods. And the perspective of the counterparty weighs in heavily on that transaction I daresay. One only has to look at the many, many failed currencies throughout history, from 'contingent currency issuers,' in order to understand the fallacy of this argument.

Certainly you can

force your own citizens to adhere to your commands, as the MMT crowd are often wont to imply. But it is still a larger world out there, and absent one world government, there are some degrees of freedom in determining currency valuations.

4) The national debt is a burden that will ruin our children’s futures.

The national debt is often portrayed as something that must be “paid back”. As if we are all born with a bill attached to our feet that we have to pay back to the government over the course of our lives. Of course, that’s not true at all. In fact, the national debt has been expanding since the dawn of the USA and has grown as the needs of US citizens have expanded over time. There’s really no such thing as “paying back” the national debt unless you think the government should be entirely eliminated (which I think most of us would agree is a pretty unrealistic view of the world).

This one is almost the same as myth number 3. The national debt is something that will always exist in a debt based system. The pricing of debt in a marketplace is how the Federal Reserve system and Treasury are theoretically restrained from the excessive creation of money.

The very money in your pocket is itself is a 'note' of obligation on the Balance Sheet of the Fed, and overall a debt obligation of the Treasury. The 'full faith and credit' of the United States if you will.

But that does not mean that the debt cannot become a burden on our children. If the debt is misspent and squandered and allowed to outgrow the capacity to manage it, it can become a very real burden.

But I find that those who make this argument are typically those who have already grabbed a good portion of the money from some financial bubble, and now seek to hold their gains. Debt must be managed.

To this point Cullen says

"All government spending isn’t necessarily bad just like all private sector spending isn’t necessarily good." And I agree with this completely.

5) QE is inflationary 'money printing' and/or 'debt monetization'

Quantitative Easing (QE) is a form of monetary policy that involves the Fed expanding its balance sheet in order to alter the composition of the private sector’s balance sheet. This means the Fed is creating new money and buying private sector assets like MBS or T-bonds.

When the Fed buys these assets it is technically 'printing' new money, but it is also effectively 'unprinting' the T-bond or MBS from the private sector. When people call QE 'money printing' they imply that there is magically more money in the private sector which will chase more goods which will lead to higher inflation. But since QE doesn’t change the private sector’s net worth (because it’s a simple swap) the operation is actually a lot more like changing a savings account into a checking account. This isn’t 'money printing' in the sense that some imply.

Well yeah, it is money printing, although I agree it is not magical. The Fed simply expands its Balance Sheet and creates, or prints if you will, Federal Reserve notes of zero duration, also known as dollars, and exchanges them for assets of various durations and quality at non-market based prices. It is not limited to Treasury debt, but can include almost anything really according to the Fed, whether it be toxic debt mortgages, or common stocks, etc.

And the Fed is not 'unprinting' anything, until it either writes off the debt, or return it to its issuer. The Fed is a private corporation. You can say that the Fed withdraws the liquidity from the market place by keeping it relativelhy inactive because the Fed does not purchase many things, but even that is no longer the case. The Fed has grown into quite the organization, with its

own police force. It merely surrenders any 'profits' remaining after all its discretionary expenses back to the Treasury.

If this was such a simple and benign swap why else would they do it? It is one of the primary levers the Fed uses to influence monetary policy.

They are increasing and changing the character of the money supply in the course of managing it. It is what they do for God's sake, besides riding herd on their banks who normally create the money for them, but occasionally get derailed by some financial bubble of their own creation.

7) Government spending drives up interest rates and bond vigilantes control interest rates.

Many economists believe that government spending 'crowds out' private investment by forcing the private sector to compete for bonds in the mythical 'loanable funds market.' The last 5 years blew huge holes in this concept. As the US government’s spending and deficits rose interest rates continue to drop like a rock. Clearly, government spending doesn’t necessarily drive up interest rates.

And in fact, the Fed could theoretically control the entire yield curve of US government debt if it merely targeted a rate. All it would have to do is declare a rate and challenge any bond trader to compete at higher rates with the Fed’s bottomless barrel of reserves. Obviously, the Fed would win in setting the price because it is the reserve monopolist. So, the government could actually spend gazillions of dollars and set its rates at 0% permanently (which might cause high inflation, but you get the message).

It is not government spending that drives up interest rates, but that does not mean government spending cannot drive up interest rates. It sure as hell can.

And I would hope to think that bond vigilantes can help to control interest rates, otherwise the entire Federal Reserve system and the US dollar is based on a fallacy. See what Mr. Bernanke has to say below. This is the confidence on which the dollar rests.

In fact the Fed COULD exercise reserve monopolist powers and print all the money it wishes at zero rates. And the 'vigilantes' could respond by shifting their wealth into other non-dollar instruments,

en masse.

What is somewhat confusing is that the relationship is not straightforward, but is a somewhat non-linear dynamic with a lag. You can get away with quite a bit of economic behavior in the short term. But eventually you can reach a tipping point, if there remain enough agents who are free to dissent from the dictates of a central authority that has fallen into error, aka 'vigilantes.'

8) The Fed was created by a secret cabal of bankers to wreck the US economy.

The Fed is a very confusing and sophisticated entity. The Fed catches a lot of flak because it doesn’t always execute monetary policy effectively. But monetary policy is not the reason why the Fed was created. The Fed was created to help stabilize the US payments system and provide a clearinghouse where banks could meet to help settle interbank payments.

...So yes, the Fed exists to support banks. And yes, the Fed often makes mistakes executing policies. But its design and structure is actually quite logical and its creation is not nearly as conspiratorial or malicious as many make it out to be.

This is r

eductio ad absurdam. The Fed is not a monster or inherently evil. But that does not make it good.

The Fed was created in somewhat extraordinary circumstances, wrapped in political secrecy in the aftermath of a banking crisis. And it was driven by a small group of powerful men who united to promote a common purpose. I will not speak to their motives.

There is a long controversy about the proper role of a central bank in the US, going back to its very founding, and this treatment makes light of that.

It is a great power to create and distribute money, that can be used for good or ill. And therefore it must be constrained, and subject to oversight. And history shows that this power is frequently abused.

9) Fallacy of composition.

The biggest mistake in modern macroeconomics is probably the fallacy of composition. This is taking a concept that applies to an individual and applying it to everyone.

Could not agree more, especially if you extend it to anecdotal information. But I would tend to refer to it as the fallacy of reasoning from the particular to the general. But I would not call it 'the biggest.'

One of the most perennial myths is that a skill in making money, especially through financial speculation, is the sign of wisdom in other things. Some of the best traders I have known are borderline savants and white collar criminals, whom I would hardly trust to handle my family's future.

Alas, wealth and beauty are not always companions of virtue in this world. They become accustomed to obsequiousness, and lose site of their common humanity. And there is nothing sadder or more tedious than a man who has become wealthy, who decides to grace the public with his wisdom, bad haircut and all.

I think a more pernicious and prevalent economic myth is the notion that economics can dictate public policy through some appeal to economic

laws as if they were physical laws like gravity. Public policy is best decided by determining goals and priorities and then allowing many things, including economics, to shape the implementation of that policy.

But economics has been elevated to a position in our societies which is wholly inappropriate and a source of great mischief, especially when the truly dangerous myths like 'naturally efficient markets' become the basis for policy decisions without proper regard for their effects. The

'austerity for the sake of the public while sustaining corrupt practices' myth is perhaps the most cruel and appalling.

10) Economics is a science.

Economics is often thought of as a science when the reality is that most of economics is just politics masquerading as operational facts.

Economics is a social science, and not a physical science. There are plenty of facts, and somewhat ironically Mr. Cullen has just leaned heavily on quite of few of the ones he tends to favor, whether they are right or not.

The worst of it is when economics is used by those who claim an 'authority' from it to promote policies that are quackery, as we have seen all too much in the past twenty years in particular with regard to the natural

goodness of the power of 'the Market.'

What concerns me though is the follow on to this declaration of the myth of economics as science. It is that extreme resort of relativism which holds that since economics is all bullshit, why not use it, and shamelessly, to promote a particular point of view, wrapping it in as much jargon and intimidating hoo hah as you can manage? Since there is no science, there are no necessary consequences, and we may do as we please. And that is a sophistry of the first order.

And this view is being promoted by the economists themselves, those few members of a 'disgraced profession' like accountants and regulators, who were willing to say and do almost anything for the promise of money, favors, and political connections.

And this deterioration in professional standards has long been my objection to much that has been said and is being said about money by these most modern of thinkers, caught up in the will to power, who believe that since there is no god of consequences, then everything is lawful.

They lose their grounding in the reality of commerce and risk, and start throwing around harebrained notions like 'platinum coins.' They bring the childish politics of their academic departments to weigh in on serious policy decisions with serious real world consequences.

Even a few faux Nobel laureates have been seen to join in this Dionysian dance, a filigree of modern monetary contrivance. Skip the coin, default, and be damned if you will, but a old fish wrapped in silk is still a dead and stinking fish.

Speaking about money, It is worth reading what Mr. Bernanke has written about money in this essay below. It speaks volumes.

"What has this got to do with monetary policy? Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.

By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

Of course, the U.S. government is not going to print money and distribute it willy-nilly (although as we will see later, there are practical policies that approximate this behavior). Normally, money is injected into the economy through asset purchases by the Federal Reserve.

To stimulate aggregate spending when short-term interest rates have reached zero, the Fed must expand the scale of its asset purchases or, possibly, expand the menu of assets that it buys.

Alternatively, the Fed could find other ways of injecting money into the system--for example, by making low-interest-rate loans to banks or cooperating with the fiscal authorities. Each method of adding money to the economy has advantages and drawbacks, both technical and economic.

One important concern in practice is that calibrating the economic effects of nonstandard means of injecting money may be difficult, given our relative lack of experience with such policies. Thus, as I have stressed already, prevention of deflation remains preferable to having to cure it.

If we do fall into deflation, however, we can take comfort that the logic of the printing press example must assert itself, and sufficient injections of money will ultimately always reverse a deflation."

Ben S. Bernanke, Deflation: Making Sure 'It' Doesn't Happen Here