Traders have recently been remarking about a highly unusual event in the metals markets.

For the first time in quite a while, the price of gold per ounce has exceed the price of platinum per ounce. This is shown in the first chart.

There is even a paired trade being touted, short gold and long platinum. The caveat is that this is said to be a profitable trade IF there is a global recovery. Personally I think one must also assume that the recovery is not due to money printing.

Platinum is largely an industrial and consumer metal, even moreso than silver. Platinum has wide industrial uses in jewelry, catalytic converters, fuel cells, and hard drives among other things. similar to copper, platinum is an indicator of industrial manufacturing activity.

The use of platinum as money a store of value has relatively little traction except among collectors. The big price drive is its very useful properties for industrial use. I am not aware that it has ever been used as a national currency except for a brief period of time in 19th century Russia.

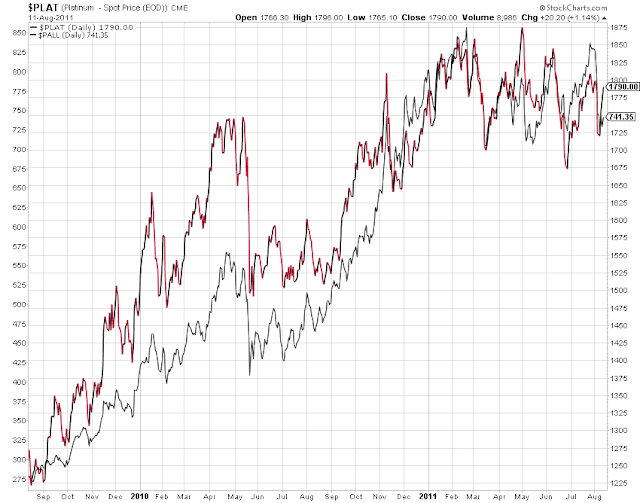

There is some secular effect on platinum, with substitution in some applications being achieved by palladium. But the two metals are tracking one another in price, as show in the chart below. So that seems to be a minor influence.

Some are confused because of the relative rarity of platinum, which is produced in fairly small quantities each year. But to look only at supply without considering demand is a basic fallacy of pricing. There is a definite shortage of honest politicians in Washington, but the ones that are there do not seem to be commanding very high prices amongst lobbyists, for example, as demand for honesty is also relatively low.

It does serve to look at a few more items as we see in the chart comparing price performance, rather than price, in the mix of gold, the SP500, the Commodity Index, and platinum. The Commodity Index is used as a broad reference and includes much more than metals.

Clearly industrial activity would seem to be lagging, while the money components of things like gold are increasing for some reason unrelated to commodity demand. That ought not to surprise anyone following the markets. The supply of paper money is increasing beyond demand of organic growth in the real economy, while demand for commodities used in production is slumping.

I would therefore not think the gold platinum pair to be particularly useful. I would consider something else if I believed that there would be an imminent industrial recovery.

Notice that I did not include copper or silver in these charts. That is because their performance tends to crush the meaning out of the others. Silver is responding to a massive break in a long term price suppression caused by artificial shorting activity. And copper is a more speculative market than most commodities.

I also did not include crude oil because, as nine out of ten Americans will remember, it is not a metal. And it sometimes has a speculative life of its own, especially as a reaction to certain regional conflicts. However being the indulgent sort I have included it in a final chart. It is a commodity.