skip to main |

skip to sidebar

Genuine enforcement or bread and circuses?

Only time will tell.

The fish seems to be getting a little bigger. But only a little, and still on the relative periphery of the school.

What will be most interesting to watch is how the investigations and settlements, if any, unfold. Will they be 'cost of business as usual with no admission of guilt' fines, or will serious federal prosecutors get involved and start turning over the small fry to get to the heart of the scandals. Will they merely rustle the branches or strike to the roots? That is the difference between the appearance and the reality of reform.

However it turns out, be aware that fraud is still pervasive on Wall Street and in the US markets, and the status quo has been maintained by both political parties who receive enormous funds from the corporations in the FIRE sector.

Connecticut is to financial racketeering what Chicago was to the Mob and Prohibition. But always the real power is headquartered in New York.

Massive Insider Trading Investigation Could Nail Wall Street's Biggest Names

I would be quite a bit more impressed if the raids were on a few of the TBTF banks who make these hedge funds look like small time street dealers by comparison. But that would expand the investigation uncomfortably close to the inner warrens of the Washington Beltway, and the real seats of power and corruption, the old powers and monied interests.

WSJ

FBI Raids Two Hedge Funds Amid Insider-Trading Case

By SUSAN PULLIAM, JENNY STRASBURG And MICHAEL ROTHFELD

Federal Bureau of Investigation agents raided the Connecticut offices of hedge funds Diamondback Capital Management LLC and Level Global Investors LP amid a far-reaching insider-trading investigation.

"The FBI is executing court-authorized search warrants in an ongoing investigation," said Richard Kolko, an FBI spokesman, who declined to comment further.

Both hedge funds are run by former managers of Steve Cohen's SAC Capital Advisors. Level Global Investors LP is a Greenwich, Conn., hedge-fund firm run by David Ganek, a former SAC Capital trader and art collector. He started Level Global in 2003 and earlier this year reported managing about $4 billion in assets.

Diamondback Capital Management LLC is based in Stamford, Conn., and was started in 2005. It oversees more than $5 billion in assets, according to SEC filings.

The move by the FBI follows an article by The Wall Street Journal describing an insider-trading investigation that is expected to encompass consultants, investment bankers, hedge-fund and mutual-fund traders. The investigation is said by people close to the situation to eclipse in size and magnitude past insider-trading probes..."

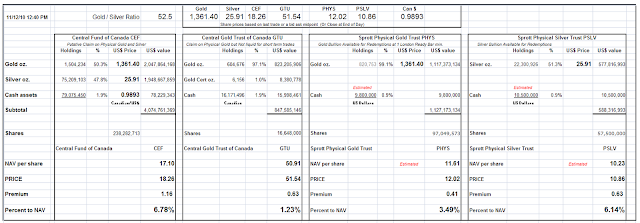

There has been no resolution of the charts ahead of the Comex option expiration and the holiday shortened week in the US.

See these comments about next week's option expiration in Comex gold and silver.

So far, a bounce after a steep decline. Follow through is everything.

It's that time again, another option expiration next week on November 23 for the Comex gold and silver options. And it will be a short week because of the Thanksgiving Day holiday in the states.

Generally the game is for the wiseguys on the exchange to stuff the call options buyers by driving the price below the largest groupings of calls. And if a large number of calls are converted to futures positions they like to take the price down again in the two days following expiration.

But keep in mind that the breakout in the metals was done in an expiration gambit that failed, in which the smart money was caught offsides of a failed attempt to push the price down, and fueled a sharp rally on short covering of their own.

James Turk provides a not dissimilar observation in his own way here, but much more confidently seasoned perhaps than your humble proprietaire.

So let's see what happens.

Yesterday I said:

"This is important support and if the market will find a bottom this is about where it will be.

At the least I think the stock decline may take a pause for the GM IPO. The Street and the government have a vested interest in its success."

So far the script is playing out predictably but let's see how the next two days go. If stocks, gold, and silver can start moving higher again it's game on. If not then hold your chips close and keep an eye on the door.

Gold was testing its 50 Day Moving Average, which now stands at 1331.89, the last two days. Testing, testing...

If gold and silver can start moving higher again with stocks holding their own it's game on.

This is important support and if the market will find a bottom this is about where it will be.

At the least I think the stock decline may take a pause for the GM IPO. The Street and the government have a vested interest in its success.

I have reopened a 'long bullion - short stocks' paired trade as of yesterday weighted to rather net short stocks but have added to the bullion side here to make it more 'balanced.' I like to capture profits on one side of the trade by adding slowly to the other side if I am running imbalanced but one has to be careful with this approach. The less experienced are better off in cash here, waiting to see where things settle down.

It will be interesting to see if support on the SP futures holds above 1174. I could be adding to the short US stocks position depending on how things progress.

There will be no sustained recovery or financial stability while the market is dominated by TBTF institutions supported by cheap money from the Fed. It really is all about the reform, or lack thereof, and a system that is based on political corruption, insider dealings, and control frauds by con men, what Charles Hugh Smith has called the banality of evil.

The financial jackals will need to look for fresh prey and new hunting grounds.

"The biggest opportunity for us is not necessarily to do more things, but to be Goldman Sachs in more places." Lloyd Blankfein

And the developed nations and their people in their suffering might keep this more famous aphorism in mind:

"Le secret des grandes fortunes sans cause apparente est un crime oublié, parce qu' il a été proprement fait." (Behind every inexplicably great fortune there is a crime that remains undisclosed because it was well executed.) Honore de Balzac, Le Père Goriot

The 'Washington-based' IMF chose the status quo, merely tinkering slightly with the dollar-euro-pound-yen balance in its SDR. The Anglo-American financiers threw a bone to the Europeans with a slight increase. Japan retained its place in the colonial powers club. I find it almost incredible that the UK remains a financial power to the exclusion of the BRICs.

I cannot imagine that Russia and China will be pleased with this rebuff to their concerns, although they were granted more of the trappings of power at the G20.

Now that the SDR is off the table as a broadly acceptable replacement for the dollar reserve currency regime, at least for the next five years, we might expect more regionalization of trade and the formation of new trading blocs. This implies less financial stability as the developing and commodity nations begin to rebel against the current foundations of global finance that continue to subject them to the monetary policies of the Big Four: US, Europe, UK and Japan.

As US analysts are so fond of saying, But what choice do they have? Time to open the door and let us in so we can set up a banking system for you such as that which has destroyed the economies of the developed nations.

Such are the burdens of financial leadership that 'bind your sons to exile to serve your captives needs.' And so it begins all over again.

Bloomberg

IMF Lowers Dollar, Yen Weights in Its SDR Valuation Basket, Increases Euro

By Candice Zachariahs

Nov 15, 2010 6:12 PM ET

The International Monetary Fund reduced the weighting of the U.S. dollar and the yen and increased that of the euro in its Special Drawing Rights valuation basket after its regular five-year review.

The value of the SDR, which the IMF created in 1969 to supplement its member countries official reserves, will continue to be based on a basket of currencies comprised of the dollar, euro, yen and pound, the fund said in an e-mailed statement. UBS AG, the world’s second-largest foreign-exchange trader, said in June that the fund may include the Australian and Canadian dollars in the SDR basket this year, boosting demand for the commodity-backed currencies.

“There’s a long-term trend towards less U.S. dollars and more euro in terms of where central banks are putting their reserves, and this is consistent with that,” said Joseph Capurso, a currency strategist at Commonwealth Bank of Australia in Sydney. “There was some talk of the IMF putting in other currencies like the Aussie, but they’ve kept to the big four.”

The greenback’s weighting declined to 41.9 percent compared with 44 percent after a 2005 review, the fund said in its statement dated Nov. 15. The euro’s share rose to 37.4 percent from 34 percent. The yen’s fell to 9.4 percent from 11 percent, while the pound was little changed at 11.3 percent. SDRs are the Washington-based lender’s unit of account.

The new valuations will be effective Jan. 1, the fund said.

"On November 12, 1999, President Clinton signed the Gramm-Leach-Bliley Act (GLB) into law. This landmark legislation does much to unravel the influence of the Glass-Steagall Act on the United States' financial system.

Now banks and other providers of financial services have far greater freedom to compete against each other. No doubt, the legislation will prompt an altering of the financial landscape in this country."

John Krainer, Federal Reserve Bank of San Francisco Economic Review, 2000