There were delivery strains at the Comex this month.

A few more months like this and they will be taking the metal bears out of the pits on stretchers.

Remember, nothing ever goes straight up.

Silver posts biggest monthly gain in 22 years; gold rallies

By Moming Zhou, MarketWatch

May 29, 2009, 2:29 p.m. EST

NEW YORK (MarketWatch) -- Silver futures gained 3% Friday, ending May with their biggest monthly gain in 22 years as inflation worries and hopes for an economic recovery boosted the metal. Gold rose to three-month highs as the dollar slipped.

Silver for July delivery, the most active contract, gained 45 cents to end at $15.61 an ounce on the Comex division of the New York Mercantile Exchange. The front-month June contract closed at $15.60 an ounce.

Meanwhile, gold for June delivery rose $17.30, or 1.8%, to close at $978.80 an ounce, the highest settlement since Feb. 23.

Silver has gained 26.6% this month, the biggest since April 1987. The metal has many industrial uses but is also seen as a hedge against a weaker dollar and inflation. In contrast, gold, which has limited industrial uses, has gained 9.8% in the month, the biggest monthly gain since November.

"What you may now be seeing is people think we are moving toward a recovery, and maybe we should be less pessimistic about the future of the metal, that may be factoring in the prices," said Jeffery Christian, managing director of New York-based precious metals consultancy CPM Group.

Silver, whose biggest single industrial use is in photography, is also used in medical applications and solar-energy devices.

Friday's economic news reinforced economic recovery hopes. The U.S. economy contracted at a revised 5.7% annual rate in the first quarter, a decline that's smaller than the 6.3% drop in the fourth quarter, the Commerce Department reported Friday.

More volatile

CPM's Christian also pointed out that silver had declined sharply in the second half of last year, when the global economy was entering into a sharp downturn. Its prices had fallen more than the price of gold.

"Silver is playing catch-up to some extent," said Christian.

The silver investment market is traditionally more volatile than gold, because the market is smaller than the gold market.

"The gold market is more participated, involved more money, and more liquid, and it tends to see lower volatility," said Christian. "In silver, you have few people with less money. It's a much more illiquid market and prices are always more volatile than gold."

In exchange-traded funds, iShares Silver Trust ETF has gained 38% this year, following its 40% decline in the second half of last year.

SPDR Gold Trust , meanwhile, has risen 11% this year. It fell 6% in the second half of last year.

In other metals Friday, July copper gained 6.05 cents, or 2.8%, to $2.1975 a pound. Copper rose 7% in May.

The June palladium contract rose $4.05, or 1.7%, to $236.05 an ounce, while July platinum rose $46.20, or 4%, to $1,196 an ounce.

Among metals-sector equities, shares of Barrick Gold Corp. rose 2.2% to $37.98 and South Africa's Gold Fields Ltd. was up 2% at $13.34, while Newmont Mining Corp. gained 2.1% to $48.35.

The Amex Gold Bugs Index , which tracks the share prices of major gold companies, rose 2.6% to 395.52.

30 May 2009

Silver Rockets to a Record Gain

28 May 2009

SP Futures Hourly Chart at 1 PM

Wax on. Wax off. Generate brokerage fees and skin the small speculators.

The fundamentals continue to deteriorate but volumes are so light its a shadow puppet market slithering into the end of the month. Sell in May and go away.

Unless Ben has the guts to ignite a serious inflation this market will go back down to test the lows before the end of the year. We *might* be in for a long hot zombie summer.

It is interesting to watch these US financial markets on charts which have been deflated by some other measure of value such as gold or silver.

27 May 2009

Ten Year Note Yield

While a steeper yield curve is good for the financial sector and those other folks who borrow short and lend longer term, it does no good if those higher rates choke off growth in the real economy. that is an overlooked detail in the Bankers' grand plans for financially engineering a recovery. This is a nation by the Banks, for the Banks, and of the Banks and their demimonde in Washington and the media.

It reminds this blogger of days gone by, when Jesse was a boy programmer writing assembler level code for IBM mainframes and other tedious tasks befitting his junior status.

A group of systems guys had been working long hours to bring up a large mainframe running VM 360 including the operating system, the peripherals, the FEP and coms, storage for a major university.

When they finally got all the bugs worked out and the system was up they quite seriously celebrated their success, saying: "Now if only we could keep the users off the machine all our problems would be solved."

Indeed. Watch the consumer along with the bond and the dollar, for those are the weakest links. From where we sit, the consumer has rolled over and won't be getting up anytime soon ahead of a rising median wage or some other sort of income increasing faster than their expenses and debt servicing.

And the rest of the world appears to be gorged on US debt and their reserve currency, at least the non-official segments that still care about spending and profit in the real world.

26 May 2009

Purchase Accounting Rules Set to Deliver $29 Billion Profit Windfall to JP Morgan and Other Banks

"It's Not the People Who Vote that Count; It's the People Who Count the Votes."

Josef Stalin

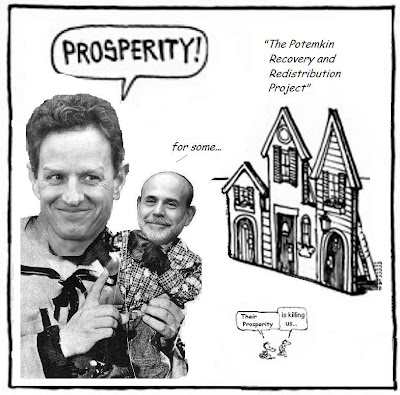

One of the many benefits of being a leading citizen of the Potemkin economy and a silent partner with the Treasury and Federal Reserve.

There is an analog to this in the tech sector, in which some companies may choose to write down the value of their components and subassembly inventories in fat quarters, and then take them as an improvement to their Cost of Goods Sold (COGS) in lean quarters, to boost EPS even as the top line revenues are flat to down.

And as for merger accounting, there are several companies showing excellent and consistent results using that rolling paintbrush of accounting embellishments.

Things are not always as they appear, especially when viewed through magic lantern of Wall Street.

RTTNews

JPMorgan likely to reap $29 Bln windfall on WaMu bad loans purchase

5/26/2009 8:29 AM ET

(RTTNews) - JPMorgan Chase & Co. stands to reap a $29 billion windfall due to an accounting rule that lets JPMorgan transform bad loans it purchased from Washington Mutual Inc. into income, the Bloomberg reported Tuesday.

Last year, the Seattle-based Washington Mutual, or WaMu, collapsed after it faced $19 billion of losses on soured mortgage loans and its credit rating was slashed, leaving it with insufficient liquidity to meet its obligations.

On September 25, 2008, JPMorgan Chase & Co. acquired all deposits, assets and certain liabilities of Washington Mutual Inc. for about $1.9 billion from the Federal Deposit Insurance Corporation, or FDIC.

The New York-based JPMorgan reportedly has used purchase accounting, which allows it to record impaired loans at fair value, marking down $118.2 billion of assets by 25%. JPMorgan took a $29.4 billion write down on WaMu's holdings, mostly for option adjustable-rate mortgages and home equity loans.

The purchase-accounting rule provides banks with an incentive to mark down loans they acquire as aggressively as possible. One of the benefits of purchase accounting is after marking down the assets, one can accrete them back in, which is said to be favorable over the long run.

Now, as borrowers pay their debts, the bank reportedly says it may gain $29.1 billion over the life of the loans in pretax income before taxes and expenses.

JPMorgan aside, Wells Fargo, PNC Financial Services Group Inc., and Bank of America Corp. are also poised to benefit from taking over home lenders Wachovia Corp., Countrywide Financial Corp. and National City Corp., the report said citing regulatory filings.