"At what point shall we expect the approach of danger? By what means shall we fortify against it? Shall we expect some transatlantic military giant, to step the Ocean, and crush us at a blow?

Never! All the armies of Europe, Asia and Africa combined, with all the treasure of the earth in their military chest; with a Bonaparte for a commander, could not by force, take a drink from the Ohio, or make a track on the Blue Ridge, in a trial of a thousand years.

At what point, then, is the approach of danger to be expected? I answer, if it ever reach us it must spring up amongst us. It cannot come from abroad. If destruction be our lot, we must ourselves be its author and finisher. As a nation of freemen, we must live through all time, or die by suicide." Abraham Lincoln

Earnings season begins again this week in the States.

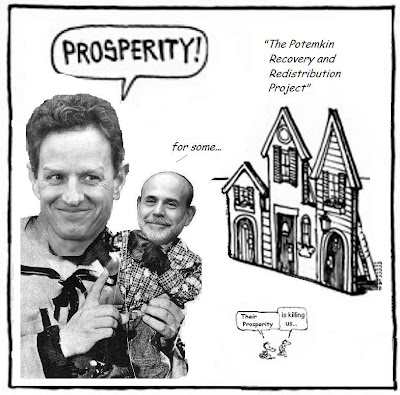

Investors remain skittish despite rosy predictions for earnings. This may be because of the suspicion that there are continuing misrepresentations of the true financial picture being permitted by the regulators, the ratings agencies, and the accountants.

For example, Bloomberg reports that if

Bank of America Corp., JPMorgan Chase & Co. and Wells Fargo were taking the appropriate reserves against loan losses,

it would virtually wipe out all their expected profits for 2010. And I suggest that this loss estimate is likely to be conservative. But of course this is not going to happen in the land of

'extend and pretend.'

Reserves against losses? We don't need no stinking reserve, not while we have the

Federal Reserve.

So don't get all short this market just yet, and provide grist for the mill as it might just grind higher. The good guys don't win until they get on their horses and do something. Wait for a key breakdown, probably triggered by some disclosures.

Misrepresentation of the facts and figures abounds. Through the years I noticed a common denominator amongst the kleptocracy and slippery sons of privilege: when the going gets tough, they cheat, even more than usual. And they become righteously indignant if you call them on it. As one pampered son said to me, "If the professors are not smart enough to stop me, why should you care?"

That is how they got through university, and how they get through life. They cheat on their taxes, on their wives, their community, their civic obligations, their business dealings, their friends, and even themselves. And they spend a lot of time and money stuffing the hole in their being with possessions, both things and people, to create the illusion of substance and self-worth. And so often they have learned this from their parents either through abuse or example. There must surely be a special place in hell for anyone who twists such a pathetic half-life out of the gift of a child.

Someone sent me the series currently playing on HBO,

"The Pacific." They knew I would be interested because my father was one of those kids who, right after high school graduation, took their first trip away from home, from Cherry Point to Tokyo via hell. Its a brutal series, but worth watching if you want a less romanticized version of what war is like, without the self-indulgence excess of the anti-war movies. I enjoyed the exposure they give to John Basilone, the only NCO to win both the Medal of Honor, and the Navy Cross posthumously, in WWII. I used to attend the church in his hometown of Raritan, NJ where they still have a parade in his memory every year.

That experience and the Great Depression made all our fathers and uncles as tough as nails, reminiscent of the character in the movie

Gran Torino. My father wasn't pretty. He was rather rough around the edges with a hard shell, did not suffer fools gladly, and had a truly remarkable command of rough language, as I understand is the custom among Marine Corps sergeants. But he always stood his ground, and did the right thing even when it hurt, out of a sense of duty, honor and pride. And he made sure that I knew that being honest, and honorable and truthful was the right thing, the only thing, to do. And I thank him for it. I am glad he is no longer around to see this triumph of the privileged, and the submission of the many, in a country that he loved.

Semper Fi, dad.

Bloomberg

Bank Profits Dimmed by Prospect of Home-Equity Losses

By Dakin Campbell and David Henry

April 12 (Bloomberg) -- Bank of America Corp., JPMorgan Chase & Co. and Wells Fargo & Co. may have to set aside an additional $30 billion to cover possible losses on home-equity loans, an amount almost equal to analysts’ estimates of profit at the three banks this year.

The cost of these reserves was calculated by CreditSights Inc., a New York-based research firm whose prediction almost four years ago proved prescient after banks reported unprecedented mortgage-related writedowns. Recognizing the home- equity loan losses is unfinished business from the housing bubble, CreditSights said in a March 29 report.

Potential writedowns on the loans are casting a shadow over earnings, as analysts try to determine how much, and how quickly, loan-loss expenses will decline from the industrywide peak reached in June 2009. Banks led by New York-based JPMorgan begin reporting first-quarter results this week....