Earlier today Clusterstock carried a story that said that Jim Rogers Is Now Shorting A Major Western Financial Firm That Everyone Thinks Is Sound

So, Le Café Américain polled its customers all day, to find out what financial firm that you thought Jimmy Rogers was shorting.

The results are below. The actual results as they appeared in our window are on the left, with a rank ordering of the results on the right.

I have to admit a little surprise to see J. P. Morgan listed as the clear favorite.

Seriously, I thought Morgan Stanley is the best pick of the better known names. If the PIIGS go under more than half their Tier 1 capital will be obliterated and they will have to be acquired by some larger bank, either Goldman or JP Morgan. What would their new name be, JP Morgan^2?

But it might be a lesser known candidate not even listed here, such as Banco Santander. Or even quixotically, the US Treasury. Who can say, except for the man himself.

Mais, les clients ont parlé.

Jimmy, feel free to email me with the actual name if you wish.

07 May 2010

Survey Says: The Western Financial Institution that Jim Rogers Is Shorting = JP Morgan

06 May 2010

PLUNGE! 1987 Style Sudden Drop in US Stocks Driven by Program Trading and a Ponzi Market Structure

“Lasciate ogni speranza, voi ch'entrate."

Dante Alighieri, The Inferno, Canto III, 9

US equities were gripped by panic selling as the Dow plunged almost 1,000 points driven by a cascade of 100 share high frequency program trading, estimated to have been about 80% of volume. Gold rocketed higher to $1,210.

The stock exchange circuit breakers do not effectively apply after 2:30 PM NY time unless the market declines over 20% and they close the exchange for the day.

A bit of a detail perhaps, but it serves to enhance the convenient artificiality of today's market break.

This is highly reminiscent of the 1987 crash driven by a flawed market structure based on automated trading and bad theories.

The entire stock market rally which we have seen this year off the February lows resembles a low volume Ponzi scheme, and formed a huge air pocket under prices.

This US equity rally was driven by technically oriented buying from the Banks and the hedge funds. There was and still is a lack of legitimate institutional buying at these price levels. This was machine driven speculation enabled by the lack of reform in a system riddled with corruption, from the bottom to the top.

This is yet another indication that the US regulatory and market oversight organizations, especially the SEC and CFTC, continue to be disconnected from and remarkably ineffective in their responsibilities in guarding the public against gross market abuse, price manipulation, and insiders playing games with cheap money supplied by the NY Fed.

And as you might expect, the anchors on financial television are trying to excuse and blame the sell off on a 'fat finger' order that caused Procter and Gamble to drop 20 points in 45 seconds. Or a typist inputting an order to sell 16 million e-mini SP futures, and typing "B" instead of "M." Oops. Crashed the free world.

"Ordinarily, the financial risk in a market, and hence the risk to the economy at large, is limited because the assets traded are finite. There are only so many houses, mortgages, shares of stock, bushels of corn, [bars of silver], or barrels of oil in which to invest.

But a synthetic instrument has no real assets. It is simply a bet on the performance of the assets it references. That means the number of synthetic instruments is limitless, and so is the risk they present to the economy...

Increasingly, synthetics became bets made by people who had no interest in the referenced assets. Synthetics became the chips in a giant casino, one that created no economic growth even when it thrived, and then helped throttle the economy when the casino collapsed."

US Congressman Carl Levin

Even if any of this was true, it was just the spark that caused the market to plummet because of its highly unstable and artificial technical underpinnings. There is no longer any legitimate price discovery. The US financial system is a casino, dominated by a few big Banks and hedge funds, the gangs of New York.

They'll never learn. Or is it 'we?' They may not really care.

The Market Makers were doing God's work and maintaining order flow, liquidity, and stability.

The Volatility Index VIX Rocketed

Procter and Gamble ONE Minute Chart

As noted in previous blogs, I have been long gold and short stocks all week. I took those positions off the table in the plunge.

Now we go into the Non-Farm Payrolls report. This is one broken market, and the plunge was no accident, but the consequence of corruption, neglect, and obscenely ineffective political governance and monetary policy. But we might see a bounce on Friday, and quite a bit of official reassurance over the weekend.

Bear in mind that there is a currency crisis on the horizon, and the IMF will be meeting to discuss it next week.

"Sanity ruled on the Stock Exchange Friday in place of the hysteria of Thursday...In its place was a decidedly improved sentiment; the atmosphere had been cleared and a period of normalcy again reigned.The pattern of that market dislocation was for an initial decline on Black Thursday (24th), a recovery on Friday (25th), an uneasy or blue Monday (28th), and then the Great Crash itself on Black Tuesday, October 29, 1929.Sentiment was extremely cautious. While most observers believed the worst of the sharp break was over , they did not look for any immediate recovery...It is the general view that nothing more than backing and filling movements can be expected. Then if conditions are favorable, the groundwork can be laid for a new advance later on."

Wall Street Journal, Saturday, October 26, 1929

But even then, with the market down about 40%, it had a remarkable distance to go. The bottom in US equities was finally reached, down 90% from the September 1929 top, in July of 1932, the trough of the Great Depression.

I am not saying that this will happen again. It turned out very differently in 1987 thanks to a flood of liquidity from the Greenspan Fed. Can Bernanke do the same thing again? One great difference between now and 1929 is that a fiat currency can be devalued, and enormous amounts of liquidity added, with a few phone calls. The Fed is already under pressure to open new dollar swaplines with the ECB. Central banks have the mechanisms of monetizing each others debt, but would generally choose to do so quietly to maintain 'confidence' which is their stock in trade.

But it is good to remember that caution is advisable when investing - always, but especially when one decides to exercise their greed reflex.

"Anyone who bought stocks in mid-1929 and held onto them saw most of his or her adult life pass by before getting back to even.”

Richard M. Salsman

The SP 500 Sell Signal Was Confirmed Yesterday

In case you were wondering the SP 'sell signal' was clearly confirmed by yesterday's chart.

I would look for this decline to continue down to the 1130, maybe 1120 support level, basis SP 500 June futures. Perhaps not a bottom but at least a relief rally or bounce as you prefer. I won't be getting in front of it, again, given the bias of the sell signal.

The Non-farm Payrolls report might modulate the trend, but not necessarily change it. Sovereign default risk fears is the driver. But the US economy pretty much sucks as well despite what the statistics say. It looks to be headed for a double dip. But for now there seems to be absolutely no discussion of this, or the risk of default of individual states, some of which are larger than most countries. The US Debt- GDP ratio is north of Portugal's and climbing fast.

Short financials and long gold but less short now.

Bullion Denominated in Euros, Pounds and Swiss Francs At New Record Highs as the IMF Prepares for a Currency Crisis

What many traders are starting to realize is that the precious metals plunged with stocks in the recent market dislocation in 2008 because it was a 'liquidity crisis' among private institutions triggered by the credit unworthiness of individuals that provoked a general selling of assets.

What we are experiencing now is a sovereign debt (credit worthiness) crisis, which is really a currency crisis. A fiat currency is backed by nothing except the 'full faith and credit' of the issuer. It is not that it would have to be 'different this time' as some would think. It's not even the same thing, a different type of a crisis entirely.

The markets are assessing the risks of various currencies and countries with regard to default. Gold, and to some lesser extent silver bullion, are wealth that is sufficient to itself, requiring no backing from any particular country. Quite the opposite, there are large short positions and highly leveraged paper commitments, that present significant counterparty risk to the upside, because it is unlikely to be deliverable at anything near current prices.

Regulators have long turned a blind eye to what some contend are officially sanctioned shenanigans and secretive leasing and selling. This is becoming increasingly difficult for the central banks to manage, and we may approach a breaking point unless the financial engineers and politicians can head it off once again. They have a strong vested interest in hiding their past dealings, as we saw in the case of Mr. Gordon Brown in the UK.

If there is a new panic selloff, all assets will again be liquidated in the short term, including the metals. But their rebound may be quite sharp and potentially rewarding if the sovereign debt crisis continues, since the search for safe havens will be even more aggressive, as the seats in the shelters are quickly taken.

This is why the IMF is meeting in Zurich on May 11, ahead of the formal discussions scheduled later this year to discuss the reweighting of the SDR. There is a currency crisis on the horizon, and it may involve not only the PIIGS, but the larger developing countries including the US and the UK. And they are preparing contingency plans, and seeking to head it off.

I do not necessarily view this as gold and silver positive, because when central bankers get together to work their schemes on the markets, valuations may not be based on any fundamentals. The financial engineering of the central banks has been largely deleterious to individual wealth among the public, and there may be some shocking disclosures of market manipulation yet to be heard. The central bankers may be as compromised and hypocritical as their corporate cousins.

But if 'the fix is in' and the wealthy have indeed been buying bullion ahead of the public, then we might see something happen later this, and it could be quite impressive. The amount of 'book talking' being done on behalf of large institutions by paid analysts approaches the level of the appalling, even for such a recently tarnished profession.

By the way, the 'tease' today is that Jimmy Rogers is said to have turned rather bearish on stocks, and says he is getting quite short on one of the big western financial institutions which everyone believes is solid and well founded. He thinks it may soon become involved in the financial crisis. He would not reveal the name. We have a poll running until 9 PM Eastern US time for you to take your best guesses. No I did not include the US Treasury in the list.

As for the theory that currencies gain in strength if there are debt defaults, this is only if the taxation and production levels remain relatively constant or higher, and the debt destruction is within the debt which is owed by private parties. When sovereign wealth is destroyed this is a de facto default, and potentially corrosive as acid to a currency's value.

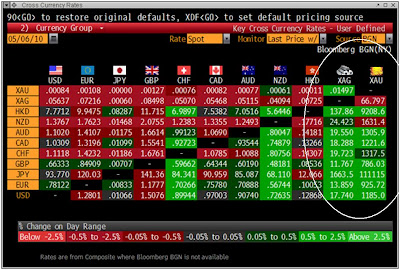

"Bullion denominated in euros and Swiss francs surged to new record highs this morning. The euro has again come under severe pressure as contagion risks increase. While all the focus is on Europe right now, similar risks face the UK and US economies and this is leading to significant safe haven demand for gold internationally. Prices have risen close to a new nominal record against the British pound and the highest level in yen since February 1983. Gold is slightly higher in most currencies this morning and significantly stronger in British pounds and euros - trading at $1,185.00, £786.03 and €925.72 per ounce this morning. Markets await the ECB rate decision and UK general election with interest."

Sovereign Debt Demands

"This is why the International Monetary Fund (IMF) and the Swiss National Bank (SNB) are jointly hosting a High-Level Conference on the International Monetary System in Zurich on May 11, 2010. The conference is set to analyse the global financial crisis and will provide an opportunity to exchange ideas on a number of related topics, including sources of instability in the international monetary system, improving the supply of reserve assets, dealing with volatile capital flows, and possible alternatives to countries’ accumulation of reserves as self-insurance against future crises.Metal Commentary by GoldCore

The conference will bring together a group of high-level participants, including central bank governors, other senior policymakers, leading academics, and commentators. The key objective of the conference is to examine weaknesses in the current international monetary system, and identify reforms that might be desirable over the medium to long run to build a more robust and stable world economy. The event will be concluded with a joint press conference by SNB Governor Philipp Hildebrand and IMF Managing Director Dominique Strauss-Kahn.

There is speculation that the conference may have favourable implications for gold with proposals that gold reserves may again have some form of role in bringing stability to the international monetary system."

Jim Rogers: More Turmoil Ahead in Global Financial Markets

Clusterstock: Jim Rogers Is Now Shorting A Major Western Financial Firm That Everyone Thinks Is Sound

As for my kitchen, we are plating financials short and bullion long all this week. But this may not be on the menu into the Friday US nonfarm payrolls, at least not in the same combinations and prices.