Occasionally a reader asks, "Why are the miners lagging the performance of gold?"

My standard reply is that the mining stocks are both stocks and a store and source of the underlying bullion which is the basis of their business.

Past regression analysis which I had done a few years ago indicated that it was about a 50 - 50 split. Over time, an 'average' mining company will correlate roughly 50% to the SP 500 and 50% to the metal which is its predominant business. The lags due to anticipation and expectations are taken care of in the size your sample.

Just to do a quick check, since these things do sometimes change over time, I ran a quick comparison of the GDX Mining Index, GLD as a proxy for gold, and the SP 500.

I think the results since mid 2008 shown below seem to indicate that the miners, on average, are still a rough split between a stock and a store of wealth, with bullion exerting a bit more pull than in the past. This is probably an effect of the underperformance of the financials, and their heavy influence in the SP index. I would caution against using this in place of a genuine regression analysis. But its close enough to make the point that the mining stocks are, to some significant degree, a stock.

Note: Please read what I have said before snapping off a quick comment objecting to it on the basis of the stellar performance of your favorite junior or senior mining company.

I have done very excruciatingly details multivariate regression analysis of the price of bullion itself. and have published the results in the past on my 'old site' the Crossroads Cafe. That correlation does change. Perhaps I will find the time to take out the big spreadsheets and run them again.

25 June 2010

Why Are the Miners Underperforming The Metal?

Not So Much Deflation as the Decay of Value: SP 500 Futures and Gold Daily Charts Updated at Market Close

Wash and rinse. Best way to get that stubborn money out of the public through fees, commissions, and of course front running for those perfect trading profits at the faux banks.

Chart Updated at Market Close

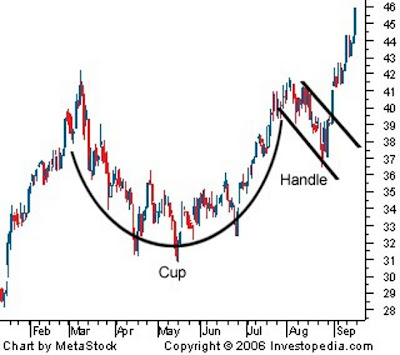

Now that option expiration is over gold is back to where it was a week ago, trying to break out of its large cup and handle formation. Silver is on the cusp of activating a massive and bullish multi-year chart formation of its own. It is an open question whether gold or silver will lead the way.

But I have to say that the CFTC is a disgrace. Eventually they will clean up their markets, but the foot dragging and dissembling is a mark against them. Chairman Gary Gensler knows better, but he is a Goldman alumnus, so what else would we expect? There are always many frustrated people in every organization trying to do a good job, so we should not paint them all with the same brush. The boss sets the tone, and Gensler's tone seems to be the status quo and crony capitalism. But that is the overall flavor of the Obama economic team.

Chart Updated at Market Close

Most people have a profound misunderstanding about the function that gold, and to a somewhat lesser extent silver, perform in the currency markets and wealth preservation trade.

The meme is that gold is a hedge against inflation. Over the past 100 years or so in particular, the greatest threat to the US dollar, and indeed to most currencies, has been inflation, which is the debasement of the value of a currency through printing or expanding supply faster than real growth in productive economic activity.

But was it really inflation that drove the gold hedge, or something more properly called 'currency risk.' Inflation through expansion of supply is just one facet of currency risk.

The risk today is not a gradual inflation through an overexpansion of the broad money supply, but something insidiously different, not seen since the last Great Depression. It is the risk of the default and devaluation, and the erosion of the assets backing the currency itself, which is not yet showing up in the conventional inflation figures.

What backs the US currency? Often referred to simply as 'the full faith and credit of the government,' it is the ability to collect taxes and service the debt with real returns, and of course and importantly the Fed's and the Treasury's balance sheets. I should have to say no more about this to anyone who has been following recent developments. The erosion of the ability of the government to produce revenue by taxing real income, and the rapidly declining quality of the assets held by the Fed, are obvious. Yes the US dollar may look good when compared some of the other wretched alternatives, but that appearance is like the portrait of Dorian Gray, not capturing the rapid decline in its own worth and well being.

So perhaps this will prove to be some help to those who are expecting debt deterioration and monetary deflation to deliver to them a stronger dollar and stable wealth. They fail to notice that this did NOT happen in the 1930's, and in fact quite the opposite occurred. I am now *hoping* for stagflation as an outcome because it seems better than the alternatives where the US and Europe now appear to be heading.

Yes, it can do so in the short term, particularly if you own the world's reserve currency, and that largely an illusion. But the decay is there for any who care to see it, and the rush to gold by the smarter money is also there to see, for those who will not willfully blind themselves to it.

There is nothing more disheartening than to watch otherwise good people fighting the last war, or perhaps most properly the wrong war, painfully unaware that their tactics and assumptions are misconstrued and self-defeating, and that they are committed to following 'leaders' who are articulate, persuasive, often very loud, and wrong.

24 June 2010

Silver, the Shiva of the Trading Pits: Gold and the SP 500 Futures Daily Charts Updated at 5:30 PM

Once again gold is rising with stocks falling, strongly indicating that gold is riding on the crest of the risk trade, and an underlying slow but steady short squeeze on the physical offtake, most likely driven by foreign central banks and large investors. The paper trade is another thing altogether.

Gold is attempting to break out, but needs to clear 1250 and 'stick it.'

It would not surprise me to see a breakaway gap to the upside on some overnight or weekend.

Someone asked me why I have so much interest in gold at this time.

Simply put, it is because I think gold is on the verge of an historic move, and a shift in the geopolitical money structure that will be talked about for many years to come. But I could be wrong. It could just be another leg up in the bull market.

Silver is poised to break out of a very large inverse H&S formation perhaps. I think we will learn quite a bit of market insight, depending on which metal leads the way, silver or gold.

Then again, of course, the breakouts may not come. But I think they will. The silver formation is so big and so powerful looking that the breakout, when it eventually comes, might well look like a shaped charge sending out a jet of hot plasma vaporizing a hole through stop losses and short positions.

The silver formation is so big and so powerful looking that the breakout, when it eventually comes, might well look like a shaped charge sending out a jet of hot plasma vaporizing a hole through stop losses and short positions.

"Now I am become death, Destroyer of Shorts, pinned on the wrong side of my trade. Lord of the cruel forces of nature."

JPM will get bailed out by the CFTC / Fed most likely, but they will be burning specs and tossing hedge funds onto the bonfire of the vanities.

Watch for a surprise trading house that slithers out of the dark pools to vampirically feed on the trapped shorts when the time comes. They won't be able to use stretchers to haul them out of the pits; they will have to use dust pans.

The actual timing of the event will be tough to forecast precisely. But we are getting closer.

What I find particularly fascinating about this chart is that it is such a good visual representation of the tension between the capping of price by paper shorting, the big line of resistance, and the steady rise in price driven by physical offtake, and the shrinking pool of physical supply against a growing demand for 'the real thing.' The shorts like JPM and HSBC can only push the price down so far using their paper tricks, but the metal keeps coming back.

23 June 2010

Gold: Cup and Handle Formation Update

This chart formation has been well behaved so far.

The dip today hit our target of 1225 right on the nose.

Let's see if the price can now consolidate and then begin its breakout.

Classic Example