12 June 2013

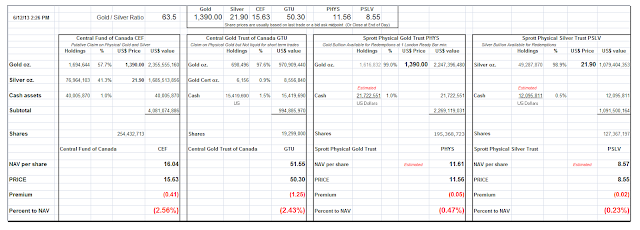

NAV Premiums of Certain Precious Metal Trusts and Funds

Subdued pricing even with today's little rally.

The specs are licking their chops to sell into an anticipated Friday decline, based on their recent experience. It is merely a herd behavior, similar to 'rally Tuesday' in stocks. That decline is generally for the period after the world markets close for the weekend.

Category:

NAV of precious metal funds

Some Thoughts on the Forex Rigging Scandal and Market Manipulation

The foreign exchange rigging scandal that is coming to light is very interesting, even in this time of financial scandals and corruption.

Here is the original Bloomberg story on it and you may wish to read it in its entirety.

The corruption in the enormous global foreign exchange market is coming to light not because of any surveillance by regulatory bodies. The multi-trillion dollar market is a genuine 'spot market' and is not considered a financial assets market, and is therefore lightly regulated.

As you may recall, a certain liberal economic columnist asserted some years ago that it was not possible to rig the price of commodities using the futures market because the price is set in the spot market. Well, he was wrong about that, since in those cases the spot price is a derivative of the front month in the futures.

But with forex we do have an actual spot market, and apparently that principle does not hold even where there is an actual spot market, and of a size that most would assert that price fixing was not possible. They forget that prices are set at the margins.

Efficient market theory dies hard because it is such a nice neat model and so attractive to the abstract mind. That it is a mere fantasy is another matter.

The story came to light because very large customers went to the regulatory body in London and complained that they were tired of being cheated. The authority was forced to respond.

There is quite a bit of talk that nothing that was done was 'illegal.'

While that may be technically true from a regulatory perspective, there is sufficient evidence that traders from different companies were acting in concert to fix global benchmarks knowing with the intent to steal from their customers. If that is not the very definition of a criminal conspiracy I am not sure what would be.

And finally, despite its enormous size, the foreign exchange market was able to be rigged against customers because of the concentration of market power in a few hands, and the manner in which trades are placed, taken and executed.

From the Bloomberg story:

"While hundreds of firms participate in the foreign-exchange market, four banks dominate, with a combined share of more than 50 percent, according to a May survey by Euromoney Institutional Investor Plc.We do not know what entities have been named in these revelations. These are merely the largest. We may never know depending on how the London regulators choose to dispose of it.

Deutsche Bank AG (DBK), based in Frankfurt, is No. 1, with a 15.2 percent share, followed by New York-based Citigroup Inc. (C) with 14.9 percent, London-based Barclays Plc (BARC) with 10.2 percent and Zurich-based UBS AG (UBSN) with 10.1 percent."

But it does shoot a gaping hole in the efficient markets theory. Here is a huge, widely dispersed market with literally millions of transactions affecting almost every economically involved individual in the world, and it became a chronically rigged market in a corruption scheme that went on for many, many years.

Put that in your free market neo-liberal pipe and smoke it.

I see where Singapore's regulator was threatening to reprimand the guilty parties. I submit that given the wide range of abuses and scandals that have been revealed and which are still ongoing, that there needs to be some serious action and soul-searching done about how markets are set up, what secrecies are permitted to the major players, the asymmetric distribution of information, and the invariable and pernicious, official sanctioned secrecy that marks every single financial fraud which we have seen over the past twenty years.

Secrecy is a privilege that has a limited place in markets that are honest, efficient and effective.

And I am sorry but if you still choose to believe that the markets, even very large and significant ones, are not being routinely rigged to the disadvantage of the public, then you are probably a fool, or a tool, or an obtuse, purblind ideologue.

And that goes in spades for the precious metals and equity markets that are saturated with outsized position shoving, event driven price rigging, collusion, and high frequency front running as a normal order of business.

Category:

efficient market theory

The Ongoing Debate Between Power and Conscience, Secrecy and Its Abuses

"At its very inception this movement depended on the deception and betrayal of one's fellow man; even at that time it was inwardly corrupt and could support itself only by constant lies. After all, Hitler states in an early edition of 'his' book: 'It is unbelievable, to what extent one must betray a people in order to rule it.'

If at the start this cancerous growth in the nation was not particularly noticeable, it was only because there were still enough forces at work that operated for the good, so that it was kept under control.

As it grew larger, however, and finally in an ultimate spurt of growth attained ruling power, the tumor broke open, as it were, and infected the whole body.

The greater part of its former opponents went into hiding. The German intellectuals fled to their cellars, there, like plants struggling in the dark, away from light and sun, to gradually choke to death."

The White Rose

Second Leaflet

Munich, 1942

"We can never forget that everything Hitler did in Germany was 'legal,' and everything the Hungarian freedom fighters did in Hungary [in 1956] was 'illegal.'

Martin Luther King

"All frauds, like the wall daubed with untempered mortar, with which men think to buttress up an edifice, always tend to the decay of what they are devised to support."

Richard Whately

I do not claim to have any particular authority in this difficult area of policy and ethics, except to note that we learn from history that this is a debate that must happen, always. Power that becomes too concentrated, that is accustomed to operating in secret, is deadly to a free society.

Individual judgment can be a dangerous thing. The great variety of people can rationalize almost any action in their private mind, whether it be a principled stand for justice, or a destructive and unjust act of violence.

As always, there is danger in the extremes.

We have seen, over and over as groups or self-defining classes of people come to power, that they can tend to rationalize actions that in retrospect were clearly not in the public interest, but largely in their own, from making their tasks more effective to lining their pockets with funds and abusing power.

Transparency, debate, and freedom of speech are the necessary safeguards that our Constitution has ensured. This has been one of the greatest and most effective innovations in political theory.

One of my greatest ongoing concerns is the secrecy and incestuous dealing between the government and the financial sector, bonded by enormous amounts of money and mutual power. I am convinced that this corruption is impairing the real economy for the indulgence of a privileged few, who have set themselves above the people, and above the law.

So I present this debate to provoke some additional thought on the subject.

One thing I will say is that the vilification of the messenger, in this case Snowden, by the mainstream media in the States has been disappointing, and at times, almost surreal.

But why does that surprise us? We have seen the same thing occurring in numerous whistle blower cases, including the slurs and marginalization against those who have stood up to expose corruption and fraud in the markets, even by otherwise intelligent and well-meaning people. That is a culture of conformity, the status quo, and the enabling of a power that will, in the end, serve only itself.

I promised you that this would be a time of 'revelations.' And that process is not done, but continues. My greatest concern is that given enough time and official messaging that people will come to accept almost anything, and come to thrive on the spectacles of misery. That is the Hunger Games.

Category:

civil disobedience,

civility,

conscience,

Hunger Games,

Power Elite,

Secrecy,

The White Rose,

will to power

Subscribe to:

Posts (Atom)