"Doubtless each individual housing bubble has its own idiosyncratic characteristics and some point to Federal Reserve monetary policy complicity in the US bubble. But the US bubble was close to median world experience and the evidence that monetary policy added to the bubble is statistically very fragile."

Alan Greenspan, The Fed Is Blameless on the Property Bubble, 6 April 2008

"Some men weave their sophistry until their own reason is entangled."

Samuel Johnson

"A senior Bank of England official today compared the banking system over the last 20 years to the South Sea bubble of the early 18th century and said bankers had merely 'resorted to the roulette wheel' to keep up with each other. The Bank's executive director for financial stability, Andy Haldane, said in a speech in Chicago that having been stable over much of the 20th century, returns in the banking system relative to the wider stock market shot up after 1986 until 2006. 'Banking became the goose laying the golden eggs. There is no period in recent UK financial history which bears comparison,' he said."

Ashley Seager, Guardian: Banking System Like South Sea Bubble, 1 July 2009

"The crash has laid bare many unpleasant truths about the United States... Recovery will fail unless we break the financial oligarchy that is blocking essential reform."

Simon Johnson, The Quiet Coup, May 2009

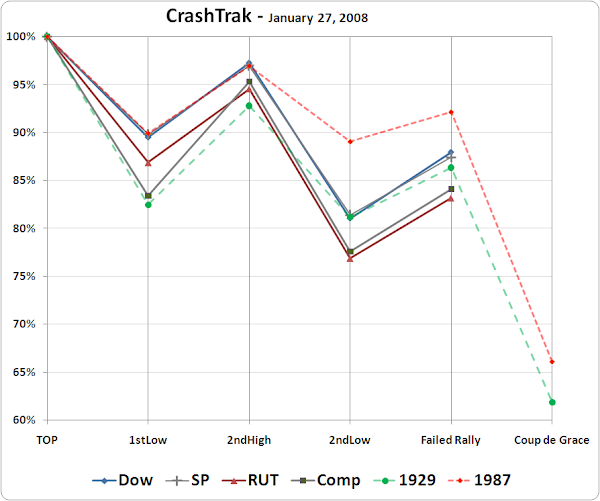

Stocks went on a tear higher today, with the storied tech stocks leading the charge to new equity bubble highs.

Gold and silver caught a bid and took back some of their highly contrived losses from last week's Dr. Evil smackdown.

Gold took back and held the 1800 price level, which is mostly big number emotional.

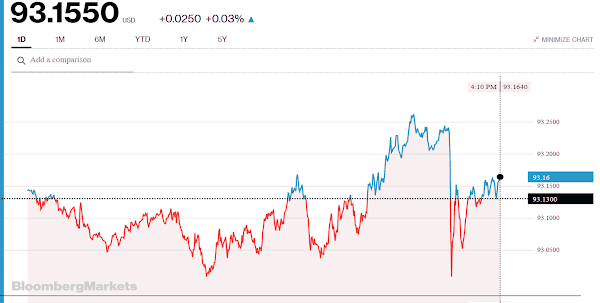

The Dollar fell back to the 93 handle.

The Fed will have their Jackson Hole Symposium this Thursday and Friday.

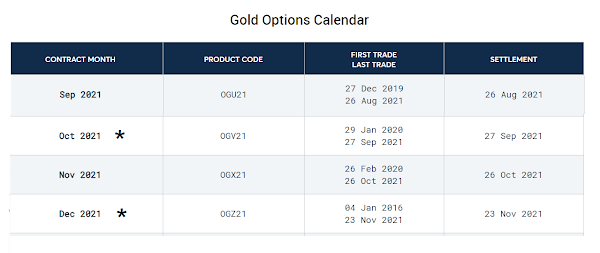

There will be a Comex precious metals option expiration for the September contract this Thursday the 26th.

We were deluged with rain as hurricane Henri parked itself just north of NYC and pump a fire hose of rain onto New Jersey. Our rain gauge topped out at 5" and just overflowed.

Our garden has been enjoying this hot wet weather, and I have started canning different kinds of jelly and tomatoes, among other things, which is something we have not done in many years.

Have a pleasant evening.