"The woods decay, the woods decay and fall,

The vapours weep their burthen to the ground,

Man comes and tills the field and lies beneath,

And after many a summer dies the swan."

Tennyson, Tithonus

Among the usual suspects worth watching, there are two things that any experienced trader watches carefully: counterparty risk and liquidity.

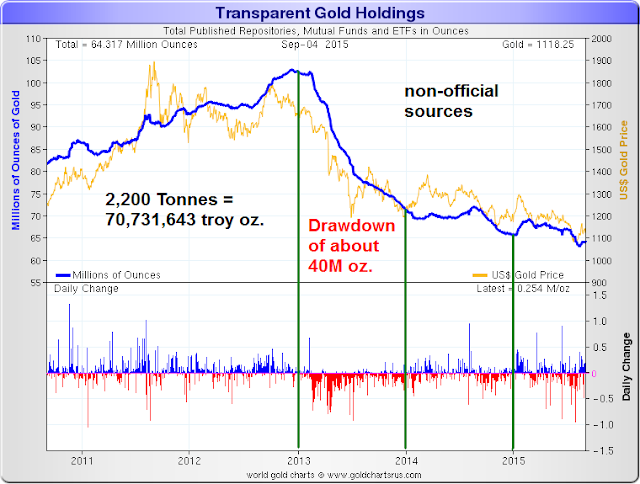

The issue of liquidity in the physical gold market is quite easily overlooked, because its true nature, and that of counterparty risk, and kept veiled behind an opaque curtain in a market structure that might have been designed by carnies. And that is probably being unkind to most carnival folk.

There was intraday commentary titled Claims Per Deliverable Ounce' Likely Soars to over 200:1. You may wish to read it, consider the pros and cons, and then do what you will.

I am getting a bad feeling about the markets in general. Especially with regard to the precious metals markets. Perhaps I should just blithely dismiss all these things that seem unusual as some are wont to do. Things will just continue on forever, in a downward spiral that we will keep calling 'the new normal.'

I do think that an ounce of caution here is advisable.

I do think that an ounce of caution here is advisable.But I have had a similar caution and have been mistaken in my caution before, particularly in 2013. I underestimated the audacity of the privileged and the powerful.

But I was all too right about 2000 and 2007. And I made quite a bit of money in them, and protected my portfolios extraordinarily well.

And I have made mistakes also, and paid for their tuition dearly. Every experienced trader, if they are honest with themselves, has done the same thing. It is part of the learning process.

Only act on your own convictions, or otherwise circumstance will blow your decisions here and there, and dissipate your plans.

I do not expect these jokers in the financial sector to give up their 'good thing' too readily, that is, the gold and silver market manipulation so similar to so many others they have had.

I will feel much more confident in my suspicions when I see an actual chart pattern form and work.

Right now the markets seem well in hand, someone's hand at least. But unlike purely speculative markets, at some point the precious metals may prove to be a worthy nemesis for their protracted abuse.

But there are signs enough that the night grows long in the tooth, and the party is almost at its miserable but inevitable end, and so some caution here is advisable I think.

Have a pleasant evening.