It is reasonable to estimate that London, in all the vaults, has only about 900 to 250 tonnes of gold available for physical delivery, which is a shockingly low figure given the current demand from 'The Silk Road' nations alone that is running about 1,700 tonnes per year. And even that 250 number is questionably high, depending on the status of the gold in the Bank of England.

The objective is to attempt to determine how much available physical gold for delivery can be wrung out of London and New York, in excess of what can be had from scrap, minining and leasing. We are calling that 'the gold float,' and it is feeding the demand for bullion in Asia. At that point we might estimate when the pressure on price becomes irresistible.

We are thinking months, not years, at least with things as they are.

I wish to acknowledge up front the debt that is owed to Ronan Manly and Nick Laird especially for the data contained herein, as well as Koos Jansen for his ground breaking work in estimating Asian gold demand, and Bron Sucheki for his participation.. I have listed some of the pertinent published articles below.

It is regretful that one can only provide estimates. But that is the nature of this beast that operates with secrecy of supply and distortion of actual demand.

What manner of business is this to enable price discovery in a public market, by covering so many fundamentals with secrecy? Where is the mining community in all this?

The LBMA is said by those who are in a position to know these things to be running 90:1 or more leverage to each of its unallocated ounces of gold, which according to Jim Rickards is all of them.

The potential claims per deliverable ounce at the Comex right now is at an historic nosebleed high by of about 255:1, supposedly because the owners which to avoid a 'short squeeze' in bullion, although the party who said this did not say 'where.' London probably, maybe Switzerland.

Peter Hambro says that "there is not enough physical about. There are

endless promises."

In a nutshell, we now know that physical gold for global delivery, of which the London vaults are a major supplier, are rather tight, especially given the increasing demand for physical bullion in the East.

There is plenty of room for questioning the numbers and casting doubt on them, while hiding behind a curtain of exchange secrecy. One might suppose that the gold bullion bank apologists will be hard at it soon enough again.

They too often do not help to advance the understanding of the public, preferring to selectively twist the data to say 'all is well.' They deride the supply problems that people in the industry are encountering, always saying they are not real. And they like to include all the gold that exists in the warehouses for their calculations, whether someone else already owns it and is clearly not interested in selling at these prices.

More details would be useful, because if we could obtain a better idea on the extent of central bank leasing, we would be better able to estimate the risks and the relative fragility in the highly leveraged and hypothecated supply of gold in New York and London.

One would think from the known data that the unallocated gold in London is counter-claimed many times, and even the allocated and custodial gold is likely to have multiple claims upon it. So the actual 'gold float' is probably quite a bit less than 1,361 tonnes. Each of us has our own favorite ballpark number ranging from 900 to 250 tonnes and less, not fully accounting for leases and leverage on the remaining stock.

Nick Laird had a secondary outlier estimate which he expressed in colloquial Australian, which I dare not repeat here. But it was quite low. lol. Maybe four months worth of float left.

And it would certainly be nice to have more information about silver, especially since to my knowledge the central banks have dealt their own supply away some years ago and there are quite a few indications of tightness of supply, although not in the Comex yet.

I do consider this analysis to be a work in progress, Nick Laird and Ronan Manly are the key data organizers I believe, with help from Koos Jansen and Bron Suchecki, and the odd bit from Jesse the consulting detective. So I would look to their sites for explication of their methods and sources. Ronan Manly in particular is a public source and he goes into quite a bit of detail.

Given the struggle it has been to obtain the data, and the refusal of central bank personnel to discuss their own supplies on orders from above, there may surely be gaps and errors in this, but not for lack of effort.

If I have any major concern it is that the management, the exchanges and the regulators, will allow the traders to sleep walk themselves into a rather serious situation. And don't we know how little self-restraint these traders have been showing.

The remedy for this situation is not even more leverage, or more hypothecation of the unallocated stock, or even more leasing by the central banks, or more programs in India to dampen demand.

The longer they allow this price rigging and leveraging up, the slower productive mines will come on line, and the worse the tightness on the remaining physical supply will become. But as they say in New York and London, 'nothing is broken yet.'

The

market solution for this tightness of supply is HIGHER PRICES and not increasingly ludicrous jawboning, spin, and bear raids.

And if higher prices might inconvenience the policy and perception management aspirations of the Wall Street financiers, their enablers and associated hirelings, well then too bad. Try to behave more responsibly, and stop attempting to make the rest of the world pay for your excessive gambling losses and poor judgement.

Related:

On the LBMA and Their Unallocated Holdings

Lions and Tigers and Deriding the Tightness of Gold Supply

How Many Good Delivery Bars Are In the London Vaults - Ronan Manly

Central Bank Gold at the Bank of England - Ronan Manly*

(detailed sourcing of this data)

The London Bullion Market and International Gold Trade - Koos Jansen

Detailed London Charts and much data gathering - Nick Laird

(available to the public)

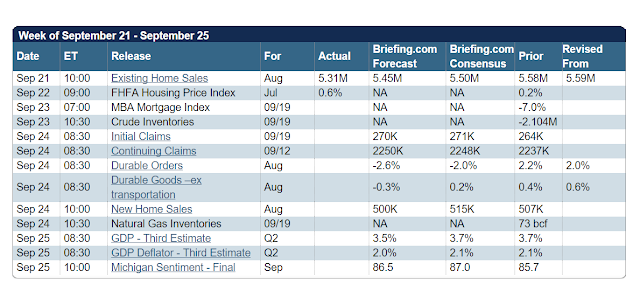

Here are a few additional charts from Nick Laird's site at

goldchartsrus.com to break out a bit more detail and to provide some context for the estimated physical supply compared to physical demand.