"The conventional wisdom seems to be that the problems of the euro zone are, as economist Martin Feldstein once put it, 'the inevitable consequence of imposing a single currency on a very heterogeneous group of countries.'

What this commentary gets wrong, however, is that single currencies are never the product of debates about optimal economic solutions. Instead, currencies like the U.S. dollar itself are the result of political battles, where motivated actors try to centralize power.

This has most often occurred 'through iron and blood,' as Otto van Bismarck, the unifier of Germany put it, as a result of catastrophic wars. Smaller geographic units were brought together to build the modern nation state, with a unified fiscal system, a common national language that was often imposed by force, a unified legal system, and, a single currency. Put differently, war makes the state, and the state makes the currency....

European leaders weren’t stupid or self indulgent when they decided to move ahead with the euro, without fiscal union or strong Europe-level democracy. They just cared more about politics and international security than economics. They wanted to build a Europe that had transcended the divisions of the Cold War, and bind together Germany, which was reunited and much more powerful, with the rest of Europe."

Kathleen McNamara, This is what economists don’t understand about the euro crisis – or the U.S. dollar

Why is it that 'great people' always seem compelled to build their dreams of empire on the backs and broken bodies of innocents. As always, it is for the greater good, and there will be collateral damage.

I do think some of the things that McNamara says is just a rationale for a certain philosophy of government. The historical example of the US is almost embarrassing, revisionist, especially when she discusses the civil war, and how aimless the US had been until the creation of the Federal Reserve in 1913.

But it serves the hypothesis that the ends of pursuing 'order' justify the means including the overthrow of freedom, and that this is the lesson from history. It certainly is a lesson, but I am not sure it is the one that she intends.

Money is indeed a medium of exchange, and a store of value. And it can also be a means of power, if it is abused and distorted to serve selfish ends. We certainly have seen enough of that sort of thing in the first fifteen years of this century, with bailouts, and selective justice, and the abuse of regulation and monetary policy to favor a few over the many.

According to this line of thought, those who foresaw the pitfalls of the euro wanted nevertheless proceed in order to foster a unified political system which they felt would be more orderly, controlled by a collection of technocrats.

There is a similar school of thought with regard to a single world currency like the US dollar for example, that is to be controlled centrally by a cadre of technocrats that will be able to bring order, if not freedom, to everyone. And somehow these benevolent technocrats always turn out to be merely human. And then with time something less, much less.

After all, we must have order. And in establishing that order, there must be collateral damage. Like Greece.

Have we forgotten the long line of thought that money and the banking system are utilities, that were put in place under state charter and regulated to provide for their function within a greater, productive economy in order to serve the public good? And not as a tool of power and oppression by a privileged few?

Is this not the message one receives in reading of the law, and the long history of thought from the founders to the New Deal, with the usual digressions and abuses of monopoly power that will use a variety of means, including finances? And not as an instrument primarily of state power and control over the people.

The central hypothesis of Professor McNamara seems to be that money, like most other things, is primariily an instrument of power, and that the deployment of the euro is an exercise in the centralization of power over a heterogeneous collection of nations and economies, and a means to bring Germany to its natural place at the head of a United Europe.

I am not saying that this view of public finances, banking and money as instruments of power is the intention or perspective of all economists. Such a view of monetary theory exists as a willful distortion and abuse of economics, fostered by hubris and the will to power.

"What is good? All that enhances the feeling of power, the will to power, and the power itself in man. What is bad? All that proceeds from weakness. What is happiness? The feeling that power is increasing--that resistance has been overcome. Not contentment, but more power; not peace at any price, but war; not virtue, but competence."It is a perspective that is shared by some of the powerful and the privileged. It is just not normally associated with popular or democratic governments. Just as other public utilities like the police are not intended as a force used to terrorize the people and quell any dissent, or the judiciary exists to permit and facilitate the abuses of a privileged few, while serving as an instrument of oppression over the general populace. Such things can and do occur. But these are aberrations, and not the norm, except in a society that has lost its conscience and moral moorings.

Friedrich Nietzsche

It is ironic that McNamara is a Professor of Government and Foreign Service at Georgetown, Carroll Quigley's old university. I am not familiar with her body of work, and so admit I may be construing what she has written about the European Monetary Union, or was even being satirical. But what she says calls to mind the writings of another Georgetown professor Carroll Quigley who, as you may recall, was Bill Clinton's mentor, and sponsor for his Rhodes Scholarship.

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences."As old as Babylon— or Babel.

Carroll Quigley, Tragedy and Hope, 1966

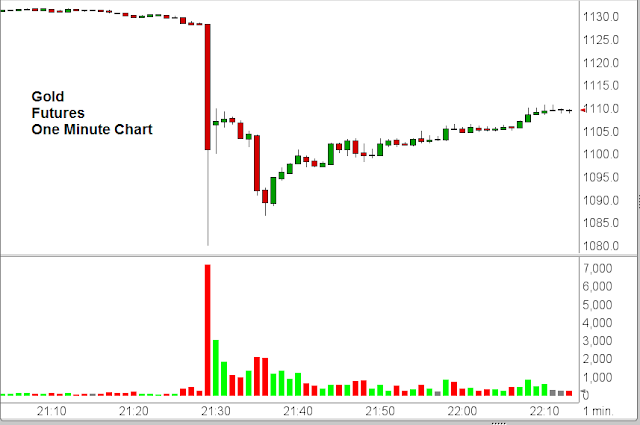

The amount of gold deliverable at these prices at the Comex seems to be a bit thin by historical standards.