Ronan Manly has published a fascinating analysis of the LBMA gold refining statistics today.

The gold refined by LBMA 'good delivery' refiners is sometimes involved in converting existing gold bars into kilobars which are suitable for export to the Asian Markets.

Ronan Manly offers quite a bit of detail with regard to a very large revision in the LBMA 2013 refining data and suggests that such a large restatement of gold statistics, almost 1/3, without explanation, seems odd.

The supposition is that the LBMA originally counted gold bars that were taken from existing sources, such as their own stores, ETFs, and the Bank of England and re-refined them into kilobars for delivery into Asia. Later they restated the number much lower, by 2,200 tonnes. We have not been given the exact reason for this, but one suggestion is that the gold did not come from new mining or traditional recycling. And the LBMA was reluctant to advertise such a huge spike in gold refining spurred on by Asian demand.

Depending on how the GFMS and the WGC uses the statistics and sources, this could result in a significant (~2,200 tonnes) understatement of the flow of gold from Western sources into Asia in just that one year. Considering how tight gold supplies have been this might explain quite a bit.

What exactly is the LBMA policy decision here, and what about subsequent years of 2014 and 2015?

What is the source of this gold? And what is so special about 2013?

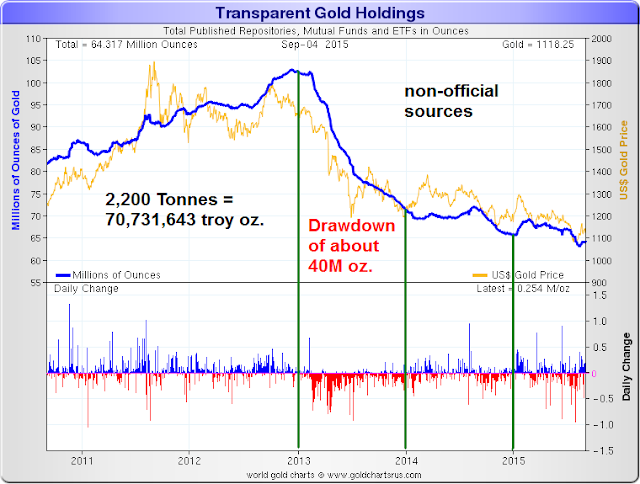

The one thing that seems significant about 2013 is that the price of gold was hit rather hard by selling after hitting a peak in 2012, and the total amount of gold held in Western depositories and ETFs dropped considerably concurrent with that hit in price. A chart is included below for your convenience.

So far we have more questions than answers. Perhaps more information will be forthcoming. I am given to understand that the LBMA is not open to discussing the matter.

I have my own hypothesis. There was a major effort to hold down the price of gold in 2013 after it had run to a new high. That effort to suppress the price resulted in a huge spike in physical demand from China.

'Stopgap measures' were taken to meet that physical demand, but without allowing the price to increase.

As more and more gold was shaken loose from various sources, a campaign of stifling Western interest in gold was undertaken to permit even more gold to be taken out of ETFs and repositories.

However, the demand from China and India were not passing events, and have continued until even now. And so the stopgap measures of 2013 have turned into an ongoing shuffling around of existing bullion to try and keep the price of gold from running higher, and threatening some of the bullion banks and institutions who cannot possibly replace all that has been loaned out and sold at anything near today's prices.

Or it *could* be something else entirely. Time will tell I am sure. But I think that there are now two events that might be remembered as potentially pivotal: one in 2007 in which the world's central banks became net buyers of gold for the first time in about thirty or more years, and 2013, in which the flow of gold from West to East put the Gold Pool into unsustainable endgame from which it could not recover without allowing prices to eventually run higher.

Ronan Manly suggests that he will have a follow up article explaining his own analysis, and I will most likely defer to his more informed judgement and wait to see what he says. I do not have all the information and a few things still puzzle me a bit. But I do congratulate him on finding this and writing it up so well with so much thought.

For the detailed analysis about what happened read the entire piece Ronan Manly,

The LBMA’s shifting stance on gold refinery production statistics

This is a quote from his article:

"There are 2,200 tonnes of 2013 gold refining output in excess of combined mine production and scrap recycling being signalled within the 6,601 tonnes figure that was removed from the LBMA’s reports on 5th August 2015.

Could it be that this 6,601 tonne figure included refinery throughput for the huge number of London Good Delivery gold bars extracted from gold ETFs and LBMA and Bank of England vaults and converted into smaller gold bars in 2013, mainly using LBMA Good Delivery Swiss gold refineries? And that maybe this 6,601 tonne figure stood out as a statistical outlier for 2013 which no one wanted to talk about?

The objectives of HM Treasury’s Fair and Efficient Markets Review (FEMR) include transparency and openness. It would appear that altering already published gold refinery statistics, especially for 2013, seems not to be in the spirit of these FEMR objectives.

Part 2 of this analysis of the LBMA’s 2013 gold refinery statistics looks behind the 6,601 tonne number at the phenomenon of Good Delivery bars being processed through the Swiss gold refineries in 2013, the gold withdrawals from the London-based gold ETFs, and the huge shipments of gold from the UK to Switzerland in 2013. Part 2 also examines the 2013 withdrawal of gold from the Bank of England, and how GFMS and the World Gold Council tried to, or tried not to, explain the non-stop processing of Good Delivery gold bars into smaller finer kilobars during 2013."

Related follow up article from Ronan Manly:

How Many Gold Bars Are In the London Vaults