"The enemy of the conventional wisdom is not ideas but the march of events."

John Kenneth Galbraith

This is from John Hussman's latest weekly observations which you can read

here.

In every instance he cites with which I am familiar, any concerns about the gross mispricing of risk were lightly dismissed, because 'the market says that everything is all right.' As if the financial markets were some prescient, infallible instrument, and not overtaken by the manipulation of insiders and the monied interests.

The 'rising market' kept most criticism of the policy errors in the growth of the credit bubble cowed and quiet, until the inevitable market break and crisis. That the financiers have not yet completely destroyed the global economy is not particularly reassuring, while they are still working at inscribing their arrogance, writ large on the pages of history, chapter by dreadful chapter.

Or more cynically one can conclude that yes, things are getting out of control, but we must keep dancing while the music is playing, and say nothing while the money is flowing in order to 'save the system,' while disabling the smoke alarms and stuffing one's pockets.

As long as the Fed can keep

printing money and delivering it to the Banks and the one percent, and not to the real economy, through its purchases of their (fraudulently) mispriced financial assets, this could keep going, while maximizing the damage. While it does give the financial engineers some feeling of control, it really does nothing constructive except to delay the essential reforms.

The combination of constructively applied stimulus and sweeping financial reform was the genius of Roosevelt, and the lack of it is the failure of Obama.

And the big correction might not even show up all that readily, in nominal terms at least, in the equity markets for some time, being papered over by a blizzard of new money. And so that implies a crash in the bond markets, as we saw a few years after the Great Crash of 1929. But they are getting better at the cover ups, so who can say.

The tail of financialization and leverage is still 'wagging the dog' of the real economy. After reading the current thoughts in mainstream economics, and Modern Monetary Theory, it seems quite likely that history is about to deal out another hard lesson in real wealth and

value.

I am ambivalent to the exact timing since I cannot know it. And so if another year passes and 'nothing happens' I may not be cheered by it while the fundamentals like median wage continue to deteriorate. This is the mechanism in which bubbles develop, and we have seen more of them than most, and with increasingly intensity.

But I am more confident that the punchline to this comedy, if it continues unabated, will be the devaluation of the currency and at least a

de facto default on the debt which can take several forms. And the usual yahoos will rise up and seek power, promising an hysterical people to take away their pain, while inflicting it on 'the others.'

"Present market conditions now match 6 other instances in history: August 1929 (followed by the 85% market decline of the Great Depression), November 1972 (followed by a market plunge in excess of 50%), August 1987 (followed by a market crash in excess of 30%), March 2000 (followed by a market plunge in excess of 50%), May 2007 (followed by a market plunge in excess of 50%), and January 2011 (followed by a market decline limited to just under 20% as a result of central bank intervention). These conditions represent a syndrome of overvalued, overbought, overbullish, rising yield conditions that has emerged near the most significant market peaks – and preceded the most severe market declines – in history:

- S&P 500 Index overvalued, with the Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) greater than 18. The present multiple is actually 22.6.

- S&P 500 Index overbought, with the index more than 7% above its 52-week smoothing, at least 50% above its 4-year low, and within 3% of its upper Bollinger bands (2 standard deviations above the 20-period moving average) at daily, weekly, and monthly resolutions. Presently, the S&P 500 is either at or slightly through each of those bands.

- Investor sentiment overbullish (Investors Intelligence), with the 2-week average of advisory bulls greater than 52% and bearishness below 28%. The most recent weekly figures were 54.3% vs. 22.3%. The sentiment figures we use for 1929 are imputed using the extent and volatility of prior market movements, which explains a significant amount of variation in investor sentiment over time.

- Yields rising, with the 10-year Treasury yield higher than 6 months earlier.

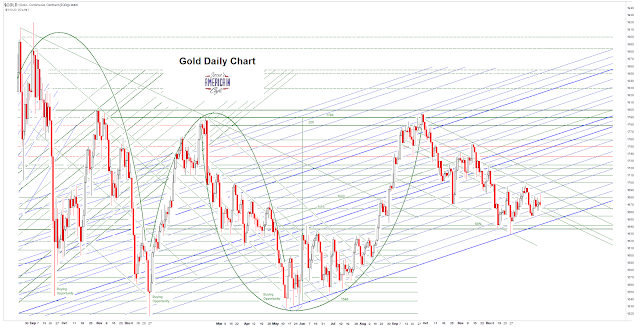

The blue bars in the chart below identify historical points since 1970 corresponding to these conditions.