The Growth Rate of Total Credit at all US Commercial Banks is dropping precipitously as can be seen from the chart below.

This is a negative indicator for most banks involved in the actual business of banking, even as the spreads between Fed money and money on loan widen.

Advantage goes to those banks who are gaming the markets, also known as trading profits, which is probably the opposite outcome which Tim and Ben would desire, if they were thinking about it.

Should banks be trading in the markets at all for their own accounts? We think not.

Glass-Steagall should be reintroduced as quickly as possible to get the banks back in the business of banking. It is a profound disappointment that the Obama Administration with the Democratic leadership have done little or nothing to reverse the speculative trends in the money center banks.

That they have been the recipients of huge campaign contributions from these same banks make the situation all the worse, for how can one stand on principle when the outcome is at odds with your stated objectives, and you are taking money from those who favor that outcome?

If you wish to get the banks lending again, stop giving them hot money and a free ticket to the speculative gaming tables where the rules, or a lack thereof, are in their favor.

08 April 2009

Bank Credit Growth Drops Precipitously

07 April 2009

SP Futures Hourly Chart at the Close

Alcoa kicks off earnings season after the bell.

Two formations are on the chart: one bearish and one bullish. The market will tell us which one will be dominant. We are in very light trading because of the short holiday week and trader uncertainty.

Keep an eye on the VIX which is at historically high levels on average, as a symptom of the huge fear and volatility in this market.

P.S. Yesterday when this chart was posted the Pivot label was on the chart but the line associated with it had been left off. It has now been added.

McClellan Oscillator Daily for the NYSE Cash Market

Money Supply Growth

For those of you who are not familiar with the various measures of money supply here is a relatively easy to understand reference.

Money Supply: A Primer

MZM is currently the preferred measure of broad money supply 'liquidity' growth with M2 as the longer term measure standing in place of M3 which was the best and broadest measurement.

06 April 2009

US Dollar Weekly Chart with Commitments of Traders

When the Funds turn negative on the Commitments, the Dollar rally will be over.

The Fed engaged in more emergency currency swaplines this morning as the dollar short squeeze continues in Europe.

When that short squeeze is over, unless there is a coordinated devaluation in key currencies, the dollar will probably test that 80 support and fail.

05 April 2009

Congressional Watchdog to Drop a Bombshell on the US Financial Industry

"...set to call for shareholders in those institutions to be wiped out. 'It is crucial for these things to happen...'"How about a stiff haircut for the bondholders and defaults on the credit default swaps held by JP Morgan and Goldman Sachs?

It will be most interesting to see how Tim Geithner and Larry Summers respond to this advice from Congressional oversight.

The Guardian UK

US watchdog calls for bank executives to be sacked

James Doran in New York

The Observer,

Sunday 5 April 2009

Elizabeth Warren, chief watchdog of America's $700bn (£472bn) bank bailout plan, will this week call for the removal of top executives from Citigroup, AIG and other institutions that have received government funds in a damning report that will question the administration's approach to saving the financial system from collapse.

Warren, a Harvard law professor and chair of the congressional oversight committee monitoring the government's Troubled Asset Relief Program (TARP), is also set to call for shareholders in those institutions to be "wiped out". "It is crucial for these things to happen," she said. "Japan tried to avoid them and just offered subsidy with little or no consequences for management or equity investors, and this is why Japan suffered a lost decade."

She declined to give more detail but confirmed that she would refer to insurance group AIG, which has received $173bn in bailout money, and banking giant Citigroup, which has had $45bn in funds and more than $316bn of loan guarantees.

Warren also believes there are "dangers inherent" in the approach taken by treasury secretary Tim Geithner, who she says has offered "open-ended subsidies" to some of the world's biggest financial institutions without adequately weighing potential pitfalls. "We want to ensure that the treasury gives the public an alternative approach," she said, adding that she was worried that banks would not recover while they were being fed subsidies. "When are they going to say, enough?" she said.

She said she did not want to be too hard on Geithner but that he must address the issues in the report. "The very notion that anyone would infuse money into a financially troubled entity without demanding changes in management is preposterous."

The report will also look at how earlier crises were overcome - the Swedish and Japanese problems of the 1990s, the US savings and loan crisis of the 1980s and the 30s Depression.

"Three things had to happen," Warren said. "Firstly, the banks must have confidence that the valuation of the troubled assets in question is accurate; then the management of the institutions receiving subsidies from the government must be replaced; and thirdly, the equity investors are always wiped out."

03 April 2009

The Credit Bubble Was a Ponzi Scheme Enabled by the US Dollar

They say a picture is worth a thousand words.

Here is a picture of the US credit bubble, with the deleveraging which has just begun.

It is/was a Ponzi scheme, enabled by the advantages of controlling the reserve currency of the world, pure and simple.

It was the US dollar that was monetized, or more specifically US debt obligations, which are now substantially worthless and will have to take a significant haircut in real terms. This is similar to the Japanese experience in which they monetized their real estate.

Ironically, those expecting this deleveraging to result in a stronger dollar could not be more mistaken. The Obama Administration is scrambling to obtain relief from Europe and Asia, getting them to inflate their own currencies through 'stimulus,' in order to continue to hide the unalterable truth - the US must partially default on its debt as expressed in the dollar and the Bond.

This is the inevitable outcome of all Ponzi schemes. Several smaller, private schemes already have collapsed. The big one is yet to come down. And when it does, the foundations of democracy will shake, several governments will fall, and we will once again experience the kind of uncertainty more familiar to those who lived in the first half of the twentieth century.

The sad truth is that the Obama Administration has barely begun the real work of rebuilding the economy. Everything to date is simple looting, paper-hanging, and the rewriting of history.

Until the median wage improves significantly in real terms, and the economy is put back on a productive basis without relying on the unsupported expansion of credit, there will be no recovery, merely sound byte opportunities for the smoke and mirror crowd.

This is the reality.

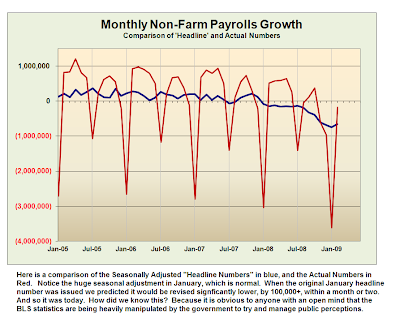

Non-Farm Payrolls: Revisio ad Absurdum

Orwellian manipulation of government economic statistics, par excellence.

The moving average of the Non-farm Payrolls marked the downturn in the economic expansion with amazing clarity by a steep drop in late 2007. It will also mark the bottom and a sustained upturn when it arrives.

Pictures From a Monetary Bubble

Credit bubbles are very much like pyramid, or Ponzi, schemes.

The middle class is particularly hard hit as they exchange their remaining real assets in an increasingly corrupted financial system. They are dulled by falling from crisis to crisis. We seem to be at the stage where the wealth transfer from the many to the few has it last parabolic gasp before the collapse.

All turns to ashes, one way or the other, when we abandon our commitment to justice and the truth, with things as they really are.