Mr. Buiter,

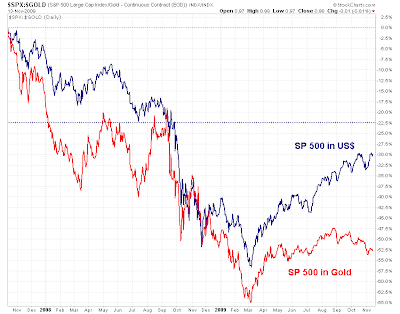

advisor to central banks and to Goldman Sachs, is at it again, comparing gold to Yap Island stone money, ranting against those who would trade valuable bank paper for something that he does not like, (but has endured as a store of wealth nonetheless for thousands of years).

Once is a phenomenon, but twice is a trend. What can be dismissed as a crank rant must now be seen as a symptom of a man talking his book, and none too gracefully.

We give more credence now to the rumours that the Bank of England has miscalculated badly and the LBMA et al. are 'on the hook' for more gold than they can provide, precipitating a crisis for their advisors, especially those on the wrong side of the trading advice. And further, that gold held offshore by some prominent members of the European Union are having difficulty getting their collateral back from some of the bullion banks in a deliverable condition.

Quite a few options are coming due on the US Comex next week, and the bankers may be once more 'staring into an abyss.' Or setting up for a big push lower to 'save the banks.' That would be traditional central banking stewardship of late days.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake..." Eddie George, Governor Bank of England, in a conversation with CEO of Lonmin, September 1999

"W. Buiter, CBE, Member Monetary Policy Committee of the Bank of England (1997-2000)" Shoulder to shoulder with Sir Eddie on the brink, eh? That must have been rather intense. Oh, bravo.

People can remain rational and place their trust in the timeless longer than central bankers and politicos can feed them arbitrary illusions and promissories for wealth on the bankers' terms. At least while they retain free market choice.

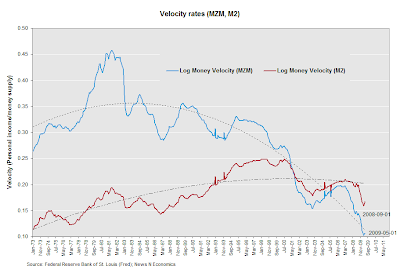

Welcome to the unintended downside of quantitatively easing your way to wealth, ie. a loss of credibility.

Welcome to the world of bubble-nomics with negative returns on savings.

By Willem Buiter

November 16, 2009

Far be it from me to assert that a fate similar to that suffered by the Yapese Rai will befall gold - another intrinsically worthless fiat commodity. But the demise of the Rai as a store of value and means of payment, when taken together with the historical experience of pre-columbian native American tribes and nations that attached very little value to the shiny metal, should give the gold bugs some sleepless nights. More importantly, it ought to discourage investors who are not rich enough to survive a speculative disaster from putting too much of their savings into this frivolous store of value.

(Pre-columbian native American tribes that atttached very little value to the shiny metal Oops1 and Oops2 not to mention the Aztecs and the Mayans, who were rumoured to have existed prior to the arrival of the Europeans. Fact check please, other than watching American 'cowboy movies.'

Oh, perhaps your understanding of early American economic history pivots on the sale of Manhattan island to the Dutch by a tribe of Indians for some beads? A bit selective perhaps, and a narrow experience for a pivotal historical thesis. It may be like basing a general history of European Banking on Wall Street's recent selling worthless CDO "wampum" to the continent's commercial banks. - Jesse)

Comment 5 to this article from some fellow named 'Jesse'

"Perhaps if I phrase it this way it might be more clear.

In one philosophic sense, gold is indeed a fiat valuation, if all valuations are fiat,

nothing being essential but air to breathe, food to eat, shelter and clothing in

roughly that order. All else is discretion.

Gold, however, may be less fiat, less arbitrary a a money, a medium of exchange

and a store of value, rather than the essential itself, in an other than barter economy. Just as the Aussie dollar or the euro may be less ephemeral than the US dollar,

This is what is happening. The Bank of England made an error in selling its nation's

gold 'at the bottom' and will pay a price for this; live with it.

Oh, and try to move on please, else you may begin to resemble

King Canute, sitting

on his throne at ocean's edge, ordering the incoming tide to stop its inundation.

Mr. Willem Buiter’s CV Summary

Previous academic appointments in economics at Princeton University, the LSE, the University of Bristol, Yale University and Cambridge University.

Former external member of the Monetary Policy Committee of the Bank of England (1997-2000)

Former Chief Economist and Special Counsellor to the President, European Bank for Reconstruction and Development (2000 - 2005)

Advisor/consultant for the International Monetary Fund, the World Bank, the Inter-Americal Development Bank, the OECD, the European Bank for Reconstruction and Development, the European Commission, many national governments and central banks.

Advisor to Goldman Sachs International (2005 - present)

P.S. If Goldman Sachs is holding gold short on your advice and getting face-ripped by it (sweet) I'll let you be my Facebook BFF for life.