With a physical commodity like gold, as several others have pointed out, 'supply' is not how much there may be, since most of the gold that has ever been mined is closely held in treasuries and private vaults, and is not on offer, available for purchase.

It is a monetary metal, a store of wealth, with some industrical applications.

The amount that has ever been mined would likely fit in a modern four bedroom house. In other words, there is not a lot of it, and the supply is increasing at a fairly slow rate over time.

Physical Supply On Offer

So 'physical supply' is that which is thought to be for sale at the current prices.

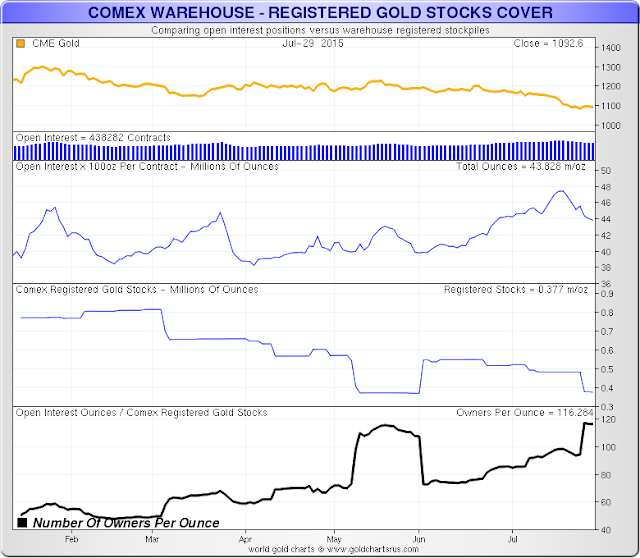

At the Comex, this bullion is designated as 'registered' or deliverable to someone who chooses to exercise a contract for it at the current price.

Demand

And also at the Comex, 'demand' is synonymous with open interest, that is, a contract created when someone goes long, or buys a contract that had not previously been owned by another.

Yes, there are significantly larger physical markets for gold bullion, almost all of which exist outside the US. But let us put those aside for now.

Rising open interest with rising prices and a steady or rising supply is easy enough to understand. More people are seeking to go long or buy a claim on some gold bullion, and the price rises to entice more who have their gold in storage to meet that demand.

What is also easy to understand, if you have a mind to open your eyes, is when demand is steady and historically high, but the price and the physical supply for delivery is falling. The explanation is naked shorting, the creation and selling of contracts based on increasing leverage.

That is, speculators, of whatever size and for whatever reasons, are nakedly meeting demand with an artificial inflated supply that ordinarily could not possibly be met in an efficient physical market.

This is why I have come to think that the Comex precious metals market is like The Bucket Shop, although technically it does not meet the statutory definition since 'a transaction on a exchange' has been made.

The bullion banks and the Exchange are playing 'The Bank' in a situation in which an actual physical transaction is unlikely to occur. And, given a reasonable probability of execution, impossible to demand at anything like the prices being quoted.

Leveraged Speculation

So why does it happen, and why does it matter?

It happens because gold is in this case is now being treated purely as a paper instrument, a derivative, although it is representing and price setting for a vast global industry and physical market from which it has become increasingly decoupled.

This is not surprising because rampant speculation in derivatives and paper assets has become de rigueur in these financially captured markets, and radically so since 1999.

And the same forces that blew up the collateralized debt obligations and their mispricing of risk derivatives in 2007 seem as though they are going to blow up the global commodities markets, starting with the precious metals.

The exchanges in this case may try to force settle everything in cash and for pennies on the dollar. And so they dismiss the risks, and since the 'right people' are making money, no one will say a word.

The exchanges in this case may try to force settle everything in cash and for pennies on the dollar. And so they dismiss the risks, and since the 'right people' are making money, no one will say a word.

Consequences

While the sources of new supply dry up with the decline of the mining industry, the urge to grab the available physical supply while it lasts continues to intensify.

But like the financial derivatives collapse in 2007 quickly metastasized to the global financial system, this relatively small precious metals market will also shaken the global financial system, and threaten to bring down the Too Big To Fail institutions once again.

I am not speaking of a 'default' on the exchange. A paper exchange cannot default when cash settlement in paper can be enforced. Rather, I am talking about a 'break in confidence' that finally persuades the rest of the world that the Anglo-American financial markets are a long con. Let's call it 'a fraud too far.'

We certainly have seen some mind-boggling systemic frauds and market rigging exposed in everything from derivatives pricing to LIBOR in recent memory. We keep sloughing these events off in our walking amnesia. But such things have long term and highly corrosive effects.

But just like the last time, while the money is flowing and the music is playing, the players will keep dancing, and the regulators and politicians will be keeping their eyes and ears closed.

'Nobody saw' the last crisis coming, except a few. That is because they who should have known knew, but went along to get along.

Consider the consequences of repeatedly ignoring the risks of excessive speculation. I do not think that we can afford it.

This chart is from Nick Laird at sharelynx.com.