As soon as the 'active month' of August was over at The Bucket Shop, JPM took a chunk of gold back off the registered for delivery roster. In the silver market JPM is gaining the reputation for a large physical silver hoard, and the role of a 'fireman' to maintain the stability of leverage in supply and demand.

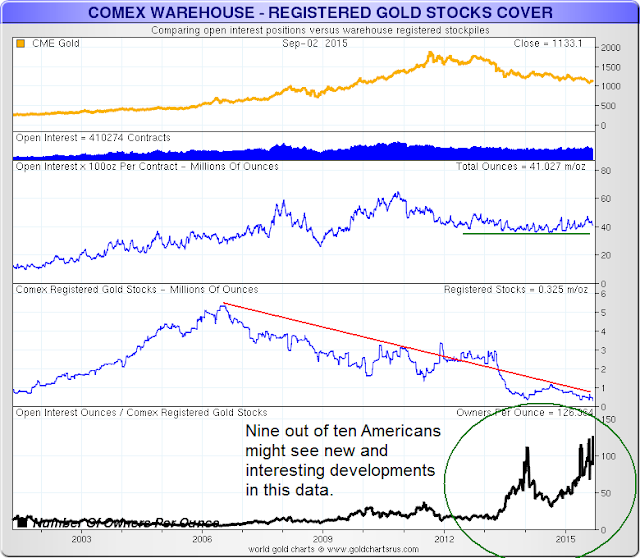

These spikes higher in the ratio of open interest to deliverable bullion at current prices is not something that has happened in the past fifteen years at least. And neither has the steady increase in the ratio which we have been seeing in the past couple of years. This is shown in the last chart.

The Financial Times has finally noticed that the price for 'borrowed' gold bullion that is taken to Switzerland for re-refining and then final shipment to Asia for purchase and withdrawal is rising.

These are signs that one might expect to see in a late stage gold pool in which the manipulation of a market has gone too far for too long. One thing you can say about the financial speculators is that they never know when to quit. Remember the London Whale? He never stopped trying to rig the prices until the rest of the professional participants raised a fuss that he was disrupting the entire market!

The clever quislings for the bullion banks will note that an actual default on the Comex is unlikely, and they are right. It is not really a 'physical delivery' exchange, but is now primarily a betting shop. There is plenty of gold in the warehouses, if you do not concern yourself with the niceties of property rights. And claims can be force settled in cash on a declaration of force majeure.

Heck, as we saw in the case of MFGlobal, when JPM shoved to the front of the assets allocation line, even receipts for actual physical gold owned outright can be forced settled in cash. If you hold gold in a registered warehouse or an unallocated account, then your ownership is philosophically 'conceptual.'

The physical delivery exchanges are in other places, like the LBMA in London and especially the markets of Asia such as the Shanghai Gold Exchange.

And this is where we will see the first signs of a breakdown in the gold price manipulation pool of the bullion banks, first as signs of 'tightness' in the delivery of metals, and then in the initial 'fails to deliver.'

Rising prices will provide relief. But the pool operators are not shy about pressing and doubling down, in a familiar pattern of overreach. Remember the eventual demise of 'the London Whale?'

And although it is hard to believe, perhaps rising prices may not be so easily allowed.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, September 1999

And it might not surprise anyone if it turns out that the wiseguy bullion banks are operating under the 'cover' of some bureaucratic boobs and a policy exercise gone horribly wrong. It would be like giving a platinum credit card to a gambling addict. Except you do not think that you ever have to pay the bills when they come due, since you are playing with other people's money.

"I have one other issue I'd like to throw on the table. I hesitate to do it, but let me tell you some of the issues that are involved here. If we are dealing with psychology, then the thermometers one uses to measure it have an effect. I was raising the question on the side with Governor Mullins of what would happen if the Treasury sold a little gold in this market. (just a little)There's an interesting question here because if the gold price broke [lower] in that context, the thermometer would not be just a measuring tool. It would basically affect the underlying psychology.Now, we don't have the 'legal' right to sell gold but I'm just frankly curious about what people's views are on situations of this nature because something unusual is involved in policy here. We're not just going through the standard policy where the money supply is expanding, the economy is expanding, and the Fed tightens. This is a wholly different thing."Alan Greenspan, Federal Reserve Minutes from May 18, 1993

Just a little 'perception management' gone horribly wrong, right? And no one could have seen it coming.