The 1920's were marked by a credit expansion, a significant growth in consumer debt, the creation of asset bubbles, and the proliferation of financial instruments and leveraged investments. The Federal Reserve expanded the money supply and the Republican government pursued a laissez-faire approach to business.

This helped to create a greater wealth disparity, and saddled a good part of the public with debts on consumables that were vulnerable to an economic contraction.

The bursting of the credit bubble triggered the stock market Crash of 1929. The Hoover administration's response was guided by Secretary of the Treasury Andrew Mellon. As noted by Herbert Hoover in his memoirs, "Mellon had only one formula: 'Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.'"

Indeed, the collapse of consumption and credit, and the ensuing 'do nothing' policy of liquidation by the government crippled the economy and drove unemployment up to the incredible 24% level at the climax of the liquidation and deleveraging.

Although some assets fared better than others, virtually everything was caught up in the cycle of liquidation and everything was sold: stocks, bonds, farms, even long dated US Treasuries, all of them collapsing into the bottom in late 1932.

The Federal Reserve made tragic policy errors most certainly with regard to interest rates. They were hampered by a lack of coordinated effort because of the official US policy focus on liquidation and non-interference, along with mass bank failures which rendered their attempts to reflate the money supply as largely futile.

Thrifty management of the credit and monetary levels when the economy is balanced in the manufacturing, service, export-import, and consumption distribution levels is a good policy to follow.

But good policies applied with vigor during a period of economic illness may be like forcing patients seriously ill with pneumonia to swim laps and run in marathons because you think such physical activity is inherently good and beneficial in itself at all times.

Additionally, monetary expansion alone also does not work, as can be seen in the early attempts by the Fed to expand the monetary base without policy initiatives to support expansion and consumption. Hoover's administration raised the income tax and cut spending for a balanced budget.

A combined monetary and government bias to stimulating consumption while restoring balance and correcting the errors that fostered the credit bubble is the more effective course of action.

Today it seems to us that the Fed and Treasury are trying to cure our current problems by filling the banks full of liquidity with the idea that it will eventually trickle down to the real economy through their toll gates.

We believe this will not work. The financial system is rotten, and not only in its toxic and fraudulent assets. It is a weakened, rotten timber that will provide scant leverage for the rescue attempts.

Better to cauterize the bleeds in the financial system and assume a 'trickle up' approach by reaching the econmy through the individual rather than the individual through the banks.

Provide secure FDIC insurance to everyone to a generous degree , and let those banks who must fail, fail. You will encourage reform and savings, we guarantee it. Stimulate work and wages, and then consumption, and the financial system will follow.

While the financial system as it is constituted today remains the centerpiece of our economy, we cannot sustainably recover since it is a source of recurring infection.

Globalists like to cite the introduction of the Smoot-Hawley tariffs as a major factor in the development of the Great Depression. This appears to be largely unsubstantiated, and attributable to a dogmatic bias to international trade as a panacea for failing domestic demand.

In fact, before Smoot-Hawley both exports and imports were in a steep decline as consumption collapsed around the world. If the US had declared itself open for free trade, to whom would they sell, and who in the US would buy? Consumption was in a general collapse around the world. Smoot Hawley did not help, but it also did not hurt because it was largely irrelevant.

It is a lesser discussed topic, but the US held the majority of the gold in the world in 1930 as the aftermath of their position as an industrial power in World War I and the expansion that followed. Since the majority of the countries were on some version of the gold standard, one could make a case that the US had an undue influence on the 'reserve currency of the world' at that time, and its mistaken policies were transmitted via the gold standard to the rest of the world.

The nations that exited the Great Depression the soonest, those who recovered more quickly and experienced a shallower economic downturn, were those who stimulated domestic consumption via public works and industrial policies: Japan, Germany, Italy, Sweden.

As a final point, we like to show this chart to draw a very strong line under the fact that the liquidationist policy of the Hoover Administration caused most assets to suffer precipitous declines. Certainly some fared better than others, such as gold which was pegged, and silver which declined but not nearly as much as industrial metals and certainly financial instruments like stocks which declined 89% from peak to trough.

FDR devalued the dollar by 40%, but he never followed Britain off the gold standard, maintaining fictitious support by outlawing domestic ownership. As the government stepped away from its liquidationist approach the economy gradually recovered and the money supply reinflated, despite the carnage delivered to the US economy and the world, provoking the rise of militarism and statist regimes in many of the developed nations.

There is a fiction that the economy never really recovered, and FDR's policies failed and only a World War caused the recovery. In fact, if one cares to look at the situation more closely, the recession of 1937 was a result of the aggressive military buildup for war in the world, the diversion of capital and resources to non-productive goods and services, and of course the general reversal of the New Deal by the US Supreme Court and the Republican minority in Congress.

As an aside, it is interesting to read about the efforts of some US industrialists to foster a fascist solution here in the US, as their counterparts and some of them had done in Europe.

What finally put the world on the permanent road to recovery was the savings forced by the lack of consumer goods during World War II and the rebuilding of Europe and Asia, devastated by war, significantly aided by the policies of the Allied powers.

A Depression following a Crash caused by an asset bubble collapse is a terrible thing indeed. But it does not have to be a prolonged ordeal.

Governments can and do make policy errors that prolong the period of adjustment, most notably instituting an industrial policy that discourages domestic consumption and money supply growth in a desire to obtain foreign reserves through exports.

From what we have seen thus far, we believe that the Russian experience in the 1990's is going to be closer to what lies ahead for the US. Unless the US adopts an export driven, low domestic consumption, high savings policy bias, non-productive military buildup and public works, and discourages population growth we don't believe the Japanese experience will be repeated.

Preventing the banking system from collapsing is a worthy objective. Perpetuating the symptom of fraud and abuse and 'overreach' that was becoming pervasive in the system before the collapse is not sustainable, instead leading to more frequent and larger collapses.

Balance will be restored, and a reversion to the means will occur, one way or the other. It would be most practical to accomplish this in a peaceful, sustainable manner, with justice and toleration.

31 October 2008

Avoiding a Great Depression: Rescue, Rebalance, Reform

Does a Weakness in Banking Regulation Result in Economic Imbalances and Asset Bubbles?

"The man who is admired for the ingenuity of his larceny is almost always rediscovering some earlier form of fraud. The basic forms are all known, have all been practiced. The manners of capitalism improve. The morals may not."

John Kenneth Galbraith

There is a hypothesis that the financial sector in the US is oversized, and as such commands an excessive amount of capital allocation and overly influences GDP. We arrived at this conclusion ourselves by studying the percentage of the major stock indices represented by the financial sector, and the expansion of new financial instruments and forms of credit in the growth of asset bubbles.

There are obviously other explanations for this. One thing to bear in mind is that during the 1990's the financial sector mounted a determined, well-funded, and deliberate assault on the regulations that had been put in place in the 1930's to limit its ability to create exotic instruments and speculate in areas beyond the traditional role of commercial banking.

There is an interesting area of study by Thomas Philippon of NYU, which has been written about recently by Zubin Jelveh in Odd Numbers and is starting to receive more widespread attention.Financial Relativism: Fraud by Any Other Name 15 May 2008

The banks were central to the scheme from the inception as they spent years and many hundreds of millions of dollars to overturn Glass-Steagall to allow this coup de grâce to be delivered to all holders of US dollars.

Its interesting because it tends to support the notion that as the financial sector overcomes the regulatory restraints, it begins to expand its influence in the real economy, ultimately distorting its structure through the introduction of asset bubbles, with a resulting period of significant economic contraction. It also results in disproportionate incomes and the polarization of wealth distribution.

Why Has the U.S. Financial Sector Grown so Much? Thomas Philippon

Human Capital in the U.S. Financial Sector: 1900-2005 Philippon Reshef

"We find a very tight link between deregulation and human capital in the financial sector. Highly skilled labor left the financial industry in the wake of the depression era regulations, and started flowing back precisely when these regulations were removed."

"We find that in 1920-1940 and in 1990-2005 employees in finance are overpaid."

Thomas Philippon

The banks must be restrained from distorting the role of money and finance in the national economy to obtain and direct a disproportionate amount of wealth and power. Such unrestrained financial power is a corrosive influence that destroys the fabric of a free and democratic society by distorting the allocation of resources and corrupting the institutions of the press, of education, and of the government.

Does a weakening of banking regulation result in economic Imbalances and asset bubbles? Yes, always and everywhere.

30 October 2008

Charts in the Babson Style for 30 October 2008

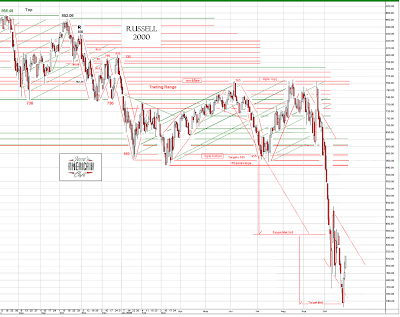

The broadest index here, the Russell 2000, suggest that we may have made an important bottom. We will look to see if this is confirmed by the other indices, and by the VIX.

The market is 'guilty until proven innocent' in a bear market downtrend.

As we stated earlier today our bias is to think this is end-of-month paiting of the tape. Do not expect the economy to recover or the financial system to gain efficient function in service of real economic activity until serious reforms are put in place.

Even in a "Market Meltdown" and a "Once-In-A-Lifetime Financial Panic...."

...the Other People's Money (OPM) managers can still find time to paint the tape into the end of month.

When this coat dries, they *might* try to slip on one more layer of paint before the weekend, but if we break to the downside we would look for a complete retrace of this rally to retest the lows.

Why? Because it is based solely on speculation, market manipulation and esperimentation by the Fed and Treasury. It is not based on anything organic to the economy, neither reform nor restructuring.

Wall Street corruption is one of the biggest impediments to an economic recovery. It has become an inefficient obstacle to capital allocation, price discovery, and real economic growth.

The US financial system represents a general systemic risk to the rest of the world because of the manipulation of the US dollar as reserve currency to serve the short term secular interests of a small but powerful financial elite.

29 October 2008

"Dubai Runs Out of Gold"

Bahrain Tribune

Bahrain Tribune

Dubai runs out of gold

Oct 29 (Bahrain) - A massive rush at jewellery shops has led to a shortage of gold at some outlets, prompting some shopkeepers to overcharge customers, reports Gulf News.

Jewellers are seeing a huge rush of buyers as gold prices are currently at a two-year low.

Shopkeepers said the rush, a combined result of the Hindu festival of Diwali and lower prices has resulted in a shortage of gold bars. But they denied any hoarding by outlets.

"There is enough gold available in the market and sales are at their peak over the last couple of days with the market falling drastically," jewellers said across the emirate.

A buyer who asked not to be named said: "The price of gold prompted me to visit the Gold Souq in Sharjah. However, most retailers claimed they were sold out. Outlets where gold was available were openly overcharging. They said it was in short supply. The price of 24 carat stood at Dh88.75 but they were openly charging Dh92.50. This is clearly an unfair practice."

Shubash Golati, a buyer, said: "It is a tradition to buy gold during the four-day Indian festival of Diwali. I bought 22 carat jewellery worth Dh5,000. I wanted to buy a 100 gramme gold bar but was told that it is out of stock."

HR Bafna, financial controller from Siroya Jewellers, said a physical shortage of gold is happening worldwide.

He said: "It is matter of physical delivery. It might take a day or two to replenish the stocks. But I am sure that there is no hoarding by jewellers because the market rate has dropped. This has resulted in a tremendous rush of buyers and so the gold bars are out of stock."

In reply to buyers’ complaints that gold outlets are cashing in on the limited stocks and buyer rush, Bafna said: "There is a possibility, but I can’t confirm this."

A counter salesman at the Joy Alukkas outlet in Bur Dubai said for the last couple of days there have been no fluctuations in gold prices.

He said: "From a customer’s point of view this is an excellent time to buy."

He too denied any hoarding taking place. "If the demand for gold is high it is but obvious that some stocks will run out. Some retailers take advantage of this."

Countrywide Holds Record Inventory of Foreclosures for Sale

19,618 Homes Offered For Sale on Countrywide Financial's Website

Total REO Asking Price: $3,308,329,521

(As of October 17, 2008)

Source: CountryWide Foreclosures

28 October 2008

Pssssst - Here's a Tip for You

The Five Year TIP Yields have crossed up and over the conventional Five Year Treasury Yields for the first time in their admittedly short life span.

That would tend to signal inflation dead ahead. And/or a negative real return on Five Year Treasuries.

It will be interesting to see how those move in the future as the currency crisis unfolds in phase two of the Credit Crisis.

Important Support Level on the Monthly Gold Chart

The support level around 730 is important. It is easier to see on the monthly chart.

If it holds any retests and gives us a monthly print there may be significance for this well beyond the gold market.

Let's see what happens.

In 2009 the US Will Be Forced to Selectively Default and Devalue Its Debt

We have seen estimates that next year the US will have to finance a $2 Trillion annual deficit. They may be able to push it further into the next Administration than that by the forbearance of the world, but not by much. We'd expect a significant drop in Treasuries by 2011 at the latest.

It should be obvious to anyone that we are approaching the apogee of the Treasury bubble, with the credit bubble having broken already.

When the Treasury says they are facing unprecedented challenges in financing the US public debt next year that is an understatement.

Once the deleveraging of the markets subsides, the dollar and Treasuries will drop, perhaps with some momentum, as the rest of the world realizes that the US has no choice but to default. This can be resolved in several ways, including continued subsidies from foreign sources in the form of virtual debt forgiveness, devaluation of the dollar, raising of taxes, and higher interest rates on debt.

The problem now is that the US has breached the point where it can service its debt out of real cash flows, and turning this around will require a severe devaluation of the US dollar.

Devaluation and selective default are the only foreseeable systemic alternatives. There are other exogenous paths of a more political nature such as consolidation and war that may color the default a slightly different color, but a selective default it remains.

This is the fundamental situation. Everything else is speculation and commentary.

Bloomberg

Ryan Says Treasury Faces `Unprecedented' Financing Needs in '09

By Rebecca Christie

Oct. 28 (Bloomberg) -- The U.S. Treasury faces historic demands to fund a growing budget deficit and raise money for a $700 billion Wall Street rescue program the department's top domestic finance official said today.

``This year's financing needs will be unprecedented,'' said Anthony Ryan, the Treasury's acting undersecretary for domestic finance, at a Securities Industry and Financial Markets Association conference in New York, where he was a last-minute substitution for Treasury Secretary Henry Paulson.

To raise the necessary funding, the Treasury is looking at selling more long-term debt and possibly bringing back three- year note sales at the Nov. 5 refunding, Ryan said. The Treasury also is raising money to address ``many different policy objectives'' and reduce bond market disruptions and will try to keep its borrowing patterns as regular as possible, he said.

``We firmly believe that investors value greatly and pay a premium for Treasury's predictable actions,'' Ryan said. ``To the very best of our ability, we intend to stay the course.''

Ryan also said the U.S. government now ``effectively guarantees'' debt issued by mortgage companies Fannie Mae and Freddie Mac, the government-sponsored enterprises placed into government conservatorship on Sept. 7. The preferred stock agreement included in the government takeover means the U.S. now backs ``both existing and to be issued'' GSE debt.

``The U.S. government stands behind these enterprises, their debt and the mortgage-backed securities they guarantee,'' Ryan said. The GSEs have almost $6 trillion in outstanding debt and mortgage securities.

U.S. equity and credit markets remain under ``considerable strain'' and face ongoing challenges, he said. That said, Federal Reserve efforts to backstop commercial paper are ``helping'' to stabilize markets, he said.

To contact the reporter on this story: Rebecca Christie in Washington at Rchristie4@bloomberg.net;

Last Updated: October 28, 2008 10:47 EDT

27 October 2008

IMF: Gold Leases, Loans, Swaps and the Gold Forward Rate

As you may recall we have a hypothesis that gold, the swiss franc, and the yen have all been helping to fuel the carry trade.

The yen has exploded higher, while the swiss franc has languished because of that country's heavy exposure to the financial system (16% of GDP) and the toxic debt problems throughout Europe.

As far as we know, gold does not have a similar issue with toxic bank debt, and from the numbers still looks to be heavily involved in carry trades based off leased central bank gold.

In reading this, it becomes clear that the IMF believes that once gold is lent out it becomes the property of the borrower who may in turn lend it out to third parties. What the lender holds is the 'promise' of the return of the gold at some future date.

What we find shocking however is that on the books there is no accounting for this potential liability. The gold that is lent out is still marked as 'gold reserves.'

What is the extent of this lending? How many ounces of central bank gold are really just paper promises for its return? If the dominos start falling in this carry trade it is very likely that there will be a declaration of force majeure, and the contracts will be settled in paper.

But it could be very embarrassing to the monetary authorities who have dealt away the possessions of their countries without inquiring about their ability to do so, or making their behind the scenes deals public. One way to settle this ahead of time is to promote 'gold sales' in which the paper settlement process is accelerated.

Watch this, because its sure to get interesting.

The Nature of Lease Payments on Gold Loans

BOPTEG ISSUES PAPER # 21A

IMF COMMITTEE ON BALANCE OF PAYMENTS STATISTICS

BALANCE OF PAYMENTS TECHNICAL EXPERT GROUP (BOPTEG)

Prepared by International and Financial Accounts Branch

Australian Bureau of Statistics

November 2004

Gold Loans

Gold loans or deposits are undertaken by monetary authorities to obtain a non-holding gain return on gold. The physical stock of gold is "lent to" or "deposited with" a financial institution (such as a bullion bank) or another party in the gold market (such as an intermediary for a gold dealer or gold miner with a temporary shortage of gold). In return, the borrower may provide the monetary authority with high quality collateral, but no cash, and will make a series of payments, known as lease payments.

The party who borrows the gold from a monetary authority may in turn "lend" the gold to a dealer or miner.

This ability to on-lend indicates that, while the package of transactions which makes up a gold loan is clearly very different from an outright sale of the gold, the rights and privileges associated with ownership of the gold have changed from the monetary authority to the borrower.

The loan or deposit may be placed on demand or for a fixed period. The amount of gold to be returned is based on the volume initially lent, regardless of any changes in the gold price.

The security and liquidity aspects of the monetary authority's gold loan claims on the depository corporations are regarded as a substitute for physical gold, such that the loan values are retained within the monetary authority's monetary gold reserves, leaving monetary gold stocks unchanged. If the loan is for a fixed period, it is usually available on short notice, to help meet the criteria for inclusion in reserve assets.

Gold loans or deposits share many of the characteristics of securities repurchase agreements (repos) and securities lending, the statistical treatment of which has proved intractable.

Gold Swaps

In order to analyse gold loans, it is useful to first understand gold swaps.

A gold swap involves an exchange of gold for foreign exchange deposits, with an agreement that the transaction be unwound at an agreed future date, at an agreed price. Gold swaps are usually undertaken between monetary authorities, although gold swaps sometimes involve transactions when one of the parties is not a monetary authority. In this case, the other party is usually a depository corporation. (A monetary authority is a central bank or Treasury. We wonder if J. P. Morgan is one of these swap parties since they are the major player int he global gold derivatives market - Jesse)

Gold swaps are undertaken when the cash-taking monetary authority has need of foreign

exchange but does not wish to sell outright its gold holdings. The monetary authority acquiring the foreign exchange pays an agreed rate, known as the gold forward rate. At maturity, the volume of gold returned is the same as that swapped, while the value of the foreign exchange - as determined at the time of initiation of the swap - is returned.

While, because of the limited number of players, gold swaps are unlikely to be tradable, they have all of the other characteristics of a financial derivative. The gold forward rate, which determines the payments associated with a gold swap, is set taking into account current and expected interest rates and gold prices. If gold swaps are considered financial derivatives, in statistical terms the payments associated with a gold swap are transactions in a financial derivative. Otherwise, the payments may be considered margin payments on a forward contract.

Components of a Gold Loan

A gold loan can be seen as a gold swap where the borrower of the gold provides no foreign exchange in exchange for the transfer of the gold. That is, a gold loan is a gold swap with an extra leg, whereby the gold lender lends the money received back to the gold borrower.

In order to gain an understanding of a gold loan, it is useful to separate it into three parts:

1. Change of Ownership of Gold - the monetary authority transfers the physical stock of gold to the borrower. The borrower can (and usually does) sell the gold to a third party.

2. Loan - as the borrower has ownership of the gold but has not paid for it, the monetary authority is deemed to have issued a loan to the borrower equal to the value of the gold. The borrower has a loan liability to the monetary authority. (Is the gold still reported in the lender's listed reserves? - Jesse)

3. Forward Contract - the borrower enters into a forward contract to deliver the original quantity of gold borrowed, to the monetary authority when the gold loan matures. At the maturity date, the monetary authority extinguishes the loan claim on the borrower in exchange for the receipt of the borrowed gold.

Analysing these components helps to understand the multiple positions and flows which are combined to make up a gold loan, and hence to understand the nature of the loan and the lease payments.

Lease Rates

In the case of a gold swap, the gold lender (cash taker) makes payments at an agreed rate, the gold forward rate, to the gold borrower.

If the above view of gold loans is correct, one component of the lease payments is the same payments as in a swap, but these are more than offset by interest on the loan going in the other direction, resulting in a net payment by the gold borrower to the gold lender (the opposite direction of the payment under a swap).

These payments are called gold lease payments and, according to the above view of gold loans, are made up of:

• interest on the loan, and

• transactions in a financial derivative or margin payments on a forward contract.

London Bullion Market Association Statistics

London Bullion Market Association Gold and Silver Fix and Forwards

To test the validity of this view, it is useful to look at how gold lease rates are determined in the market:

Gold lease rate = LIBOR - GOFO rate

LIBOR is the London Inter-Bank Offered Rate, a widely used international risk-free interest rate.

The GOFO rate is the Gold Forward Offered rate, which is the rate at which contributors (the market making members of the London Bullion Market Association) are prepared to swap gold against US dollars.

The charts below show the daily gold price and the daily one year LIBOR, GOFO, and gold lease rates over the past seven years.

The relationship of LIBOR and the GOFO rate to the lease rate is shown in Chart 2.

Comparing Chart 1 and Chart 2 shows that the gap between GOFO and LIBOR is significant in times of falling gold prices, and GOFO approaches LIBOR in times of rising gold prices.

The composition of the lease rate supports the view of the components of a gold loan outlined above. The payment of interest indicates the existence of a loan and the use of the GOFO rate indicates the existence of a gold swap.

Conclusion

The topic of this paper is the treatment of the lease payments on gold loans. The analysis of the positions and the flows has been done together as it is not possible to draw conclusions on the nature of the flows without looking at the positions to which they relate.

The description of components of a gold loan in this paper is likely to be controversial given the state of the overall debate on reverse transactions, but it is hopefully a useful contribution to that debate. The empirical support lent by the derivation of the lease rate, that is that the loan is seen by those setting the rate as a loan and a swap, may prove useful in that debate.

The conclusion on the nature of the lease payments is that they are the net of two flows, interest on a loan and transactions in a financial derivative or margin payments on a forward contract.

These should be recorded separately.

Hat tip to Steve Williams at CyclePro for bringing this paper to our attention.

I'm Proud to be an Okie Who Is Brokie..

It was a tossup this morning between this story and the one about how J.P. Morgan has virtually destroyed the New Castle school district through dodgy swaps with enormous undisclosed fees, now being investigated by the fraud unit of the FBI. New Castle is in western Pennsylvania near the Ohio border. McCain country. We'uns don't want any of that commie socialism here, unless it is for the good of the Republican party and the banks what ripped us off.

It was a tossup this morning between this story and the one about how J.P. Morgan has virtually destroyed the New Castle school district through dodgy swaps with enormous undisclosed fees, now being investigated by the fraud unit of the FBI. New Castle is in western Pennsylvania near the Ohio border. McCain country. We'uns don't want any of that commie socialism here, unless it is for the good of the Republican party and the banks what ripped us off.

This one about Oklahoma State seems to have more pathos since at one point they were actually ahead 70%, borrowed against ti all and spent it, and then went bust on margin calls that wiped out the gains and principal, leaving them holding the debt.

And they were not really defrauded directly it appears, just recklessly foolish and badly used by an egotistical windbag.

Maybe they can get a co-signer loan from the Aggies or the Sooners.

FanIQ

Oklahoma State Is Officially Screwed

You probably heard a few years ago that T. Boone Pickens, who chairs the hedge fund BP Capital Management, gave Oklahoma State a $165 million donation to be used all for helping the school's athletic program. And the largest portion of it was going to be used to beef up the school's football stadium and football facilities.

Well, there was one problem with Boone's donation. He left the donation in the hedge fund, which initially seemed to be a good idea as oil prices soared in a post Katrina economic climate, swelling the initial gift to over $300 million. That was before things began to turn in 2007, as international demand for oil failed to meet projections, causing the fund to come to a sudden standstill, and then dropping on mistakes made by fund managers, who were managed by Pickens.

Anyway, Pickens resisted pleas by some OSU Regents to bank a good deal of the balance out of the fund when it exceeded $300 million, which was only 14 months ago. Instead Pickens decided on borrowing almost $200 million needed to expand and renovate Boone Pickens Stadium on the Stillwater campus, despite the fact that the donation was dropping in value.

Now, here's the bad news. Yesterday all indications were that OSU Regents had been told last Friday afternoon that a large portion of the Pickens donation in the BP Capital hedge fund was virtually wiped out by margin calls on the funds investments in the third quarter.

Well, that's not actually the case. It seems that ALL of the money is gone (the link provided is for a members site, but you can read the full article here).

Officials were told that actually, the entire $ 165 million donation, and the earnings, which once inflated the gift to over $300 million, had recently been eliminated by margin calls due to drastically falling oil prices.

As of Monday OSU's gift had flat-lined completely and was declared 'gone.' And just so you know, the school has already made a lot of those improvements to the football field . That's because the school borrowed almost all funds used in the stadium expansion plans using the $300 million balance in BP Capital as collateral.

And just so you know, the school has already made a lot of those improvements to the football field . That's because the school borrowed almost all funds used in the stadium expansion plans using the $300 million balance in BP Capital as collateral.

Yikes. So, um, Oklahoma State is now in debt of close to $300 million dollars.

I have no idea how in God's name they're going to get out of this. State schools don't exactly have an extra $300 million sitting around.

Has a college ever actually declared bankruptcy? I'm not sure, but we're probably about to find out.

It can only get better, it can't get any worse...

25 October 2008

Escape Velocity: Take it to the Limit One More Time Like Its 1933

Escape velocity: in physics, the speed where the kinetic energy of an object is equal to the magnitude of its gravitational potential energy. It is commonly described as the speed needed to "break free" from a gravitational field without any additional impulse.

In economics, the growth rate at which the energy of monetary expansion exceeds the magnitude of deflationary forces generated by deleveraging of a prior monetary overexpansion.

In both cases, something gets put into orbit.

On 26 September 2008 Adjusted Monetary Base Rises to Record Levels we noted that the Fed was putting pedal to the metal, boosting the monetary base to levels higher than 911.

Here's an update.

When this reaches escape velocity it could be something to see. The last two times the Fed hit the afterburners we had stock market rallies leading to impressive highs.

Here is an interesting look at the history of the monetary base.

Hopefully the Fed has learned to allow the liquidity to percolate a little to trickle down to the real economy before yanking it back. We believe that this was the hypothesis of Friedman and Schwarz.

When the Fed does put on the brakes to stop the growing inflation, it might be even more impressive for those of you who were not around when Paul Volcker did his interest rate exercise in monetary restraint. Hint: zero coupons were a great buy at the top.

24 October 2008

Europe and Asia Seek a Consensus Ahead of Washington Meeting

Sounds as though a consensus is forming, without the United States, to set the agenda for the upcoming meeting in Washington on November 15.

Sounds as though a consensus is forming, without the United States, to set the agenda for the upcoming meeting in Washington on November 15.

One step closer to a world currency, and a world government.

Tonight I am sick at heart for the damage that has been done to the world over the last eight years. We have squandered the sacrifice of a generation.

ἐδάκρυσεν ὁ Ἰησοῦς

The Economic Times

Leaders call for new rules for financial system

25 Oct, 2008, 0644 hrs IST

BEIJING: Asian and European leaders agreed that the rules guiding the global economy should be rewritten and the International Monetary Fund should be given a lead role in aiding countries hit hardest by the financial crisis.

On a day when stock markets plunged around the world, leaders from nations including China, France, Germany and Japan said Friday that they were moving toward consensus ahead of next month's meeting of the 20 largest economies in Washington.

``Europe would like Asia to support our efforts and would like to make sure that on the 15th of November we can face the world together and say that the causes of this unprecedented crisis will never be able to happen again,'' French President Nicolas Sarkozy said in remarks to the opening ceremony of the Asia-Europe Meeting in Beijing.

A draft of a meeting statement on the crisis seen by The Associated Press called on the IMF and similar institutions to act immediately to help stabilize struggling banks and staunch the flood of red ink on regional stock bourses.

``Leaders agreed that the IMF should play a critical role in assisting countries seriously affected by the crisis, upon their request,'' the draft said.

If adopted, the statement would be among the strongest calls yet for a leading role in the crisis for the Washington-based fund, long known as the international lender of last resort.

Countries as varied as Hungary, Ukraine, Iceland and Pakistan have already turned to the IMF for help bridging their liquidity crunches.

The draft statement also states that leaders agreed to ``undertake effective and comprehensive reform of the international monetary and financial systems.''

Among the first to publicly endorse the proposal was Japanese Prime Minister Taro Aso, head of the world's second-largest economy. Aso ``strongly supports'' a critical role for the IMF, Japanese Foreign Ministry spokesman Kazuo Kodama said. The biennial gathering, known as ASEM, has no mandate to issue decisions and participants differ widely on their views toward international cooperation and intervention by global bodies. Free-trading Singapore and economic powerhouse Germany are attending, along with isolated, impoverished Myanmar and landlocked, authoritarian Laos.

The biennial gathering, known as ASEM, has no mandate to issue decisions and participants differ widely on their views toward international cooperation and intervention by global bodies. Free-trading Singapore and economic powerhouse Germany are attending, along with isolated, impoverished Myanmar and landlocked, authoritarian Laos.

Responses to the crisis have varied widely so far. Europe has already approved a plan under which the 15 euro countries and Britain put up a total of $2.3 trillion in guarantees and emergency aid to help banks.

Asian financial systems are less shaky, having had less direct exposure to the toxic sub-prime mortgages that are wreaking havoc on US and European markets. Showing a notable lack of urgency, South Korea, China, Japan and the 10-country Association of Southeast Asian Nations recommitted themselves to an $80 billion emergency fund to help those facing liquidity problems - to be established by next June.

China and other Asian economies are, however, expected to take a major hit from a drop in exports and foreign investment.

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed,

and everywhere the ceremony of innocence is drowned...

Charts in the Babson Style for the Week Ending 24 October 2008

A rough week indeed, with the US equity markets opening this morning with the SP futures down limits. We thought there might be a plunge to retest the lows, and set up a rebound rally, but that was not to be the case.

Is this the first weekend in some time we will not be waiting on some Fed and Treasury action on Sunday night before the Asian markets open? Seems like it. Treasury said they might start buying chunks of insurance companies and other financial firms. That failed to buoy the markets, but as they say, it could have been worse.

Do you remember when watching the market was 'like watching paint dry on a house' intraday? Now it feels like we're watching a tornado rip that house apart every day.

It looke like we'll be retesting the lows, perhaps next week, and continue to bleed on the downside, perhaps another ten percent or so until the market reaches value.

Try to pay the good things you receive forward, payez au suivant, which are the terms of this house. It is ironic indeed but well known that the help that those in need receive so often comes from those who have suffered themselves, and realize that it is by the grace and mercy of God that we are blessed. To learn to love we must first yearn to be comforted.

Have a pleasant weekend.

OCC Derivatives Report: The Four Horsemen of the Apocalypse

In the latest Report from the Office of the Comptroller of the Currency, Derivatives Holdings in the United States have reached some lofty levels as of June 30, 2008.

If Derivatives are Weapons of Mass Destruction, Here Are the Dealers

The even worse news is that the exposure is increasingly concentrated in the top four US Banks. With their intended acquisition of Wachovia, Wells Fargo gets to move up in the charts.

Commodity Derivatives are proving to be a popular preoccupation for some of the frat boys of Wall Street. As you may recall, commodity prices have been taking a wild ride up to about the middle of this year, and then collapsed spectacularly.

So what are we looking at here: the winners or the losers?

A special thanks to our friends at The ContraryInvestor who created the graphics from this OCC report. The site is invaluable to anyone who is serious about the US markets and the economy.

23 October 2008

A Record Number of Buyers Cannot Take Delivery of the US Treasuries that They 'Own'

He who sells what isn't his'n

Must buy it back or go to Prison.

Daniel Drew

Naked short selling and float and reserve plays are causing a record 'failures to deliver' in the US Treasuries markets. Some of this may be a 'kiting' scheme in which the sellers are playing an aribtrage against the slight fees and penalties versus returns on price distortions and extremes in volatility.

Or it might be a case of selling and using the same thing so many times as collateral that you don't really know what is your actual condition, solvent or insolvent. We can think of several (roughly nine) derivative and instrument laden banks that are utterly insolvent if forced to deliver their net obligations.

The Fed cannot even regulate its own products among its own dealer circles. What could possibly possess anyone to believe that they can do this with any other product in a larger, less exclusive market?

There are system breakdowns that have caused signficant spikes in failures, such as the widespread technical failures following the distruptions caused by 911.

But we are not aware of any massive computer system failures and shutdowns at this time. This may be a case of when the going gets tough, the frat boys bend the rules until they break, and then line up for a slap on the wrist from dad's business associates.

Is this because of the failures of Lehman and Bear Stearns and AIG? Hard to believe but we have an open mind. Transparency builds confidence more effectively than rhetoric and empty promises.

Who are the responsible parties? Let's have a list of the prime offenders of this market. We might *not* be surprised at who is failing to deliver what they sell. It might be an indication that they are in trouble. Oops, perhaps that is why we can't have it.

We suspect the Fed is turning a 'blind eye' to this activity. But more transparency would be helpful to alleviate that concern.

And do not be surprised when other things that you think that you are buying or think you own fail to show up.

There are some who see an approaching 'fail to deliver' spike at the COMEX and they may be right. There were some who believed that LTCM was short 400 tons of gold at the time of its failure, and that several central banks stepped in to depress price and increase supply to alleviate the potential shock on counterparties.

Replay in progress? It could get interesting if it is.

Stand and Deliver: Significant Fails in the US Treasury Market - 10 Oct 2008

Delivery failures plague Treasury market

Total hit a record $2.29 trillion as of Oct. 1

By Dan Jamieson

October 19, 2008

The credit crisis is causing a growing number of delivery failures with Treasury securities.

The latest data from the Federal Reserve Bank of New York showed that cumulative failures hit a record $2.29 trillion as of Oct. 1. The federal settlement period is T+1 (trade date plus one day).

The outstanding U.S. public debt is $10.3 trillion.

"Current [fail] levels are at historic levels," said Rob Toomey, managing director of the Securities Industry and Financial Markets Association's funding and government and agency securities divisions. "There's been significant flight to quality" with the market turmoil, he said.

With the strong demand for Treasury securities, "some of the entities that bought Treasuries are not making them available in the [repurchase] market, which is the traditional way to get them," Mr. Toomey said.

Unlike some past bouts with high failure rates that involved particular bond issues, the current high fails involve all types of maturities, he said. (Such as in the 2001-2003 market crash - Jesse)

This month, New York- and Washington-based SIFMA came out with a set of best practices to reduce failed deliveries.

This year, the New York Fed revised its own Treasury market trading guidelines. Its guidelines, originally released last year, warned that short-sellers "should make deliveries in good faith." (And all good boys and girls should remain pure until they are married - Jesse)

LACK OF LIQUIDITY

Chronic failures can increase illiquidity problems in the market and expose market participants to losses in the event of counterparty insolvency, according to the New York Fed.

"There is a question about there being some impact on liquidity if [delivery failures] last for a long period," Mr. Toomey said.

Many retail investors also own Treasury securities, either directly or indirectly. The Treasury market is also an important fixed-income benchmark, so any liquidity problems can affect all participants.

In extreme cases, chronic fails could cause participants to limit their trading in secondary markets, the New York Fed said.

"Who wants to buy what they're not going to get?" said Susanne Trimbath, a market researcher with STP Advisory Services LLC of Santa Monica, Calif. In a September research paper, she estimated that based on failure rates in 2007 and 2008, the cost to investors from failed deliveries is about $7 billion annually. (Pays for the facials - Jesse)

The cost arises because sellers don't have access to their money. In addition, the federal government loses $42 million a year in lost revenue, and the states miss out on an additional $270 million in revenue due to excessive claims of tax-exempt income on state-tax-free Treasury securities, Ms. Trimbath said.

She and researchers at the New York Fed said that some delivery failures are intentional. (We're shocked, shocked! - Jesse)

As with naked shorting of stocks, naked shorting of Treasuries "allows you to avoid the borrowing costs," Ms. Trimbath said.

"There can be circumstances in a low-rate environment where it's cheaper to fail" than deliver, Mr. Toomey said. Such an environment also reduces incentives to act as a lender of securities, he said.

A 2005 study by the New York Fed confirmed that episodes of persistent settlement fails are often related to market participants' lack of incentive to avoid failing. (Thanks for the kind of knowledge that most mothers, teachers, and adults over the age of 25 could have told us for free, propeller heads - Jesse)

"We've got to get the [Securities and Exchange Commission], the Fed and SIFMA in there to force" Treasury traders to deliver securities, Ms. Trimbath said. (That ought not to be hard. We hear the Fed has people on premise every day with most of the probable perpetrators - Jesse)

The Department of the Treasury has a buy-in rule for the cash markets, but the repurchase markets rely on contracts, Mr. Toomey said. Currently there are no penalties for failures, and regulators to date have not required disclosure whether the dealer or the client fails to deliver. (Self regulation at its finest. Sounds like the honor system my neighbor uses to sell tomatoes in the summer from a box in her front yard. Except for the most part the people here in our neighborhood are not greedy, self-centered, shameless, hedonistic shits - Jesse)

By industry convention, fails are generally allowed to roll over until they are eventually closed out, Ms. Trimbath said.

SCRUTINY

She said that scrutiny by the SEC and the Fed, and widespread investigations into short-selling practices, are driving the industry to rein in questionable practices with Treasuries. (Apparently with 'great success,' Borat, given the record number of fails - Jesse)

Mr. Toomey said that one of SIFMA's best-practices suggestions is to require that extra margin be provided by the party that is underwater due to a failed delivery. (Wrist slap by fines is a real deterrent - Jesse)

SIFMA also said that it is establishing a Treasury fails monitoring committee, with representatives from the Fed and Treasury.

The committee will alert the market "when marketwide mitigation, remediation and the attention of management is warranted" because of a high level of fails, SIFMA said in a statement.

The New Deal for the Banking System as the Financial Storm Intensifies

"Do you think he is so unskilful in his craft, as to ask you openly and plainly to join him in his warfare against the Truth? No; he offers you bait to tempt you. He promises you civil liberty; he promises you equality; he promises you trade and wealth; he promises you a reduction of taxes; he promises you reform... He prompts you what to say, and then listens to you, and praises you, and encourages you. He bids you mount aloft. He shows you how to become as gods. Then he laughs and jokes with you, and is familiar with you; he takes your hand, and gets his fingers between yours, and grasps them, and then you are his."

J.H. Newman, The Times of AntiChrist, 1889

We are seeing an enormous parody of Roosevelt's New Deal being rolled out in a hurried fashion for the bankers and the wealthy under the cloak of dire necessity prior to the likely change in political Administrations.

If we follow the political pattern of the 1930s, we will see a minority of Republicans and a sympathetic majority at the Supreme Court attempt to maintain the disbursal of liquidity largely to the corporations and banks, and to fight any progressive tax increases and social programs designed to push that liquidity directly to the public without passing through the tollgates of the financial system.

If this happens, we may see a powerful polarization in the country between a minority that will attempt to embrace state control to halt those programs and the encroachment on 'true American principles' and a suffering public, with a middle class pinned between them.

The corporatist appeal will be made to social conservatives, small businessmen, the banks and the corporations that spring up around them, and the lowest elements in the hatreds and prejudices and fears in the public, particularly the older middle class, to retrieve our national honor.

And if against all safeguards and probability this succeeds in gaining power, and burning the Constitution to preserve our freedom becomes a popular slogan, and a slyly articulate but otherwise inexperienced, almost mediocre, leader arises, and the corporate powers support this person in order to achieve their ends, then it will be time to leave, without looking back, before the storm breaks, and madness is unleashed, and a darkness falls over the land.

Bernanke May Seek New Ways to Ease Credit as Fed Rate Nears 1%

By Craig Torres

Oct. 23 (Bloomberg) -- Federal Reserve officials are likely to bring interest rates down so aggressively over the next few months that they will have to search for fresh tactics to continue easing credit.

The Fed's Open Market Committee will probably reduce the benchmark federal funds rate by half a point next week to 1 percent, the lowest since May 2004, according to futures trading. The official rate has never been lower since the Fed made it an explicit target in the late 1980s.

Further cuts below 1 percent could turn Fed Chairman Ben S. Bernanke's focus away from the main rate and toward more use of alternative tools. Those might include increasing its holdings of mortgage bonds to lower costs for homebuyers and purchasing securities directly from the Treasury in order to pump more cash into the economy, Fed watchers said.

``If there is need for more stimulus, the Fed will buy up government debt to keep borrowing costs low," said Adam Posen, deputy director at the Peterson Institute for International Economics and a co-author with Bernanke. That's tantamount to ``turning government debt, as it is issued, into money.'' (That is pure monetization and they can do it if they have the will and the need - Jesse)

Bernanke, 54, has already thrown the central bank's balance sheet into action in unprecedented ways. Working with the New York Fed, the Board of Governors has rolled out 11 new programs aimed at absorbing risk or making dollars available when banks don't want to loan. (A New Deal for the Banking System - Jesse)

Assets Doubled

The result: The central bank's assets, which include a loan to insurer American International Group Inc. and a pool of investments once held by Bear Stearns Cos., more than doubled to $1.772 trillion last week from a year-earlier total of $873 billion that comprised mostly Treasuries. The latest weekly figures are scheduled for release at 4:30 p.m. in Washington.

There's more to come. The Fed announced this week a backstop for money-market mutual funds to which it will commit another $540 billion. A commercial-paper program approved Oct. 7 could buy up to $1.8 trillion of securities.

``The net effect of these facilities has been a truly staggering pace of growth in the Fed's balance sheet,'' said Jan Hatzius, chief U.S. economist for Goldman Sachs Group Inc.

When the Bank of Japan fought deflation and a banking collapse earlier this decade, its balance sheet ballooned to more than 30 percent of gross domestic product as it pumped money into the economy, Hatzius said. He predicted ``further rapid growth'' in the Fed's, which is now equal to 12 percent of U.S. GDP. (The policy error is that they pumped the money into foolish projects and into an unreformed financial system, hopelessly compromised by the keiretsu corporatism of interlocking insider dealing. One does not start an engine that is broken by pouring more fuel into it. - Jesse)

`Helicopter Ben'

As a Fed governor, Bernanke did research on alternative policy tools between 2002 and 2004, when U.S. central bankers last cut the benchmark rate to 1 percent. Traders nicknamed him ``Helicopter Ben'' after a 2002 speech that referenced Milton Friedman's comments comparing such unorthodox methods to dropping money from a helicopter.

Vincent Reinhart, the Fed's director of monetary affairs at that time, said Bernanke's policy activism, which contrasts with his predecessor Alan Greenspan's almost exclusive use of the federal funds rate, derives from the chairman's research on policy errors in the Great Depression and during Japan's rolling recessions of the 1990s.

``He saw what we viewed as an obvious policy failure and it was in the ability of human reason'' to fix it, said Reinhart, now a scholar at the American Enterprise Institute.

`Quantitative Easing'

The Bank of Japan, struggling against deflation, slow growth and consumers' reluctance to spend, brought its policy rate close to zero before turning in 2001 to a so-called quantitative easing strategy of increasing money in accounts held for commercial banks. The policy lasted for five years, before the central bank began to draw down reserves and raised its benchmark rate to 0.5 percent, where it has been since February 2007.

The Fed has flooded the economy with so much cash that excess reserve balances at banks, or cash surpluses beyond what banks are required to hold against deposits, soared to $136 billion for the two-week period ending Oct. 8 compared with an average of $1.4 billion in the same month last year. (We showed this in a chart the other day. They are stuffing the banks with liquidity, and the banks are holding the reserves against writedowns and credit risk. At some point this will spill over and perhaps even break out, into what contrivances who knows. We may see a rise of 'superbanks' through acquisition. These will have to be taken apart in the coming years. - Jesse)

``The Federal Reserve has already entered a regime of quantitative easing,'' said Brian Sack, vice president at Macroeconomic Advisers LLC who also worked with Bernanke as an economist in the Monetary Affairs Division.

As their liquidity programs dump excess funds into the banking system, it's become more difficult for the Fed to keep the rate at which banks lend overnight to each other in line with policy makers' 1.5 percent target. (This is an absolutely key point to keep in mind - Jesse)

Below Fed Target

In an effort to put a floor under the overnight rate, the central bank started paying interest on the reserves banks deposit with it. That hasn't stopped the so-called effective federal funds rate from falling below the target every day since officials lowered their benchmark by half a point in an emergency move on Oct. 8.

In the two weeks since then, evidence of a deteriorating economy has mounted and will likely push Fed officials toward a further rate cut when they meet Oct. 28-29, economists said.

Industrial production in the U.S. fell in September by the most in almost 34 years, and retail sales dropped by the most in three years. Inflation pressures are easing as oil prices fall to a 16-month low, and nine months of job losses eliminates any pressure from wage increases.

Whether the target rate ends up below 1 percent depends on how fast consumers and businesses gain more access to low-cost credit. Economists at HSBC Holdings Inc. said the Fed would like to avoid cutting to zero. Still, if the economy doesn't improve, it ``could be at zero'' by the middle of next year, said HSBC economist Ian Morris.

``There is this understanding at the Fed that the worst thing you can do is save your ammunition,'' said Ethan Harris, economist at Barclays Capital Inc. ``You move fast -- that is the whole lesson of past crises in Japan and during the Great Depression.''

22 October 2008

Long Term Gold Chart and a New Set of Hedged Positions

We are in a market liquidation that is very powerful and ought not to be underestimated. In the short term value means little when the task is to raise cash and sell assets to do so.

Still, it is good to keep the longer term in mind, while we WAIT for the market to stabilize. Please also remember that the mining stocks are NOT the underlying asset, and should be treated as a speculation.

We started buying high yield and high cashflow per share energy and mining stocks today, hedging them dollar for dollar with QID and SDS and DXD. We will vary the ratios and positions accordingly. We have done this before in this cycle when we reach support and resistance levels we consider to be 'extreme.' The first few attempts were not entirely fruitful.

The objective is to emerge from a short term or intermediate term market bottom with our capital intact, holding a portfolio of very desirable stocks with attractive yields that pay while we wait.

This mix gives us some downside and upside protection, for those who have had this market whipsaw them on the bearish side with 400 point rallies. We actually came to this strategy from our approach to this decline from the short side.

This is not simple to do and we do not recommend it for those not experienced with hedged positions. Getting the ratios to work for you, and not against you for a double hit, is a critical competency. Overtrading is a definite risk.

G20 Leaders to Meet on November 15 in Washington DC

This will be interesting to watch, since it is conceivable that by the time of this meeting Bush's party may have lost the presidency and both Houses of Congress.

However it develops, for some reason it sends a chill to those who are not global unionists and who have an abiding distrust of statists.

This also spells potential volatility for the currency markets, since one thing these fellow do know how to accomplish is to 'fix' the currency markets if not the financial system.

NY Times

Bush Invites World Leaders to Economic Talks

By SHERYL GAY STOLBERG

October 22, 2008

WASHINGTON — President Bush has invited the leaders of 20 nations to come to Washington on Nov. 15 for an international meeting on the economy, the White House said Wednesday. The move could eventually lead to a far-reaching overhaul of the rules governing global financial markets.

The meeting, intended to be the first of several global economic meetings, will come less than two weeks after the presidential election, and its timing underscores the urgency the administration feels in addressing the financial crisis. The White House has said Mr. Bush would “welcome input” from the president-elect, although it is unclear if Mr. Bush’s successor would attend. (At this meeting Bush could be the lamest of lame ducks - Jesse)

The meeting will have a broad agenda, laying the groundwork for the leaders to “agree on a common set of principles for reform of the regulatory and institutional regimes for the world’s financial sectors,” Dana Perino, Mr. Bush’s press secretary, said in announcing the meeting.

Mr. Bush has been under intense pressure for several weeks from leaders in Europe, especially President Nicolas Sarkozy of France, to convene an international meeting of economic powers to address the financial crisis. Mr. Sarkozy has called for strengthening and rewriting the rules governing global financial institutions, fashioned after the 1944 meeting in Bretton Woods, N.H., in which 44 nations remade the global financial system after the Great Depression. (Is Sarkozy the new Tony Blair in Europe? - Jesse)

But the White House initially sounded skeptical of the idea; administration officials have said Mr. Bush is wary of any effort to allow other nations to exercise control over the United States banking system. Over the weekend, though, Mr. Bush; Mr. Sarkozy; and the president of the European Commission, José Manuel Barroso, had dinner at Camp David and apparently brokered an agreement.

While Mr. Sarkozy had been pressing for a meeting of the so-called Group of 8 world economic powers, Mr. Bush insisted that developing nations be included. After their dinner on Saturday night, the three men issued a joint statement saying they would reach out to world leaders with the intent of convening a series of economic meetings.

The venue also appears to have been an issue. Mr. Sarkozy said over the weekend that he hoped the first meeting would be held by the end of November, and suggested it be convened in New York. “Since the crisis started in New York, maybe we can find the solution in New York,” he said. “This is a worldwide crisis, and therefore we must find a worldwide solution.”

By convening the meeting in Washington, his home turf, and by insisting that leaders from developing as well as developed nations attend, Mr. Bush appeared to be putting himself firmly in charge. (The lame duck's swan song? Let's hope so - Jesse)

White House officials have said that the president is especially concerned that an effort to rewrite global financial rules could hurt capitalism and free trade; in her statement, Ms. Perino said the agenda would include “an opportunity for leaders to strengthen the underpinnings of capitalism by discussing how they can enhance their commitment to open, competitive economies, as well as trade and investment liberalization.”

The White House drew the list of invitees from the so-called G20, a forum of rich and emerging nations that was convened in 1999 after an earlier international crisis. Its members are Argentina, Australia, Brazil, Britain, Canada, China, France, Germany, India, Indonesia, Italy, Japan, South Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United States and the European Union.

Other international officials, including the managing director of the International Monetary Fund, the president of the World Bank and the United Nations secretary-general have also been invited to attend, the White House said.

21 October 2008

Goldman May Be the Fed's Consigliere, But JPM is Still a Capofamiglia

Bloomberg

Fed to Provide Up to $540 Billion to Aid Money Funds

By Craig Torres and Christopher Condon

Oct. 21 -- The Federal Reserve will provide up to $540 billion in loans to help relieve pressure on money- market mutual funds beset by redemptions.

``Short-term debt markets have been under considerable strain in recent weeks'' as it got tougher for funds to meet withdrawal requests, the Fed said in a statement in Washington. About $500 billion has flowed out of prime money-market funds since August, a Fed official said.

The initiative is the third government effort to aid money- market funds, which in stable times are a key source of financing for banks and companies. The exodus of investors, sparked by losses from the aftermath of the Lehman Brothers Holdings Inc. bankruptcy, contributed to the freezing of credit that threatens to tip the economy into a prolonged recession.

``The problem was much worse than we thought,'' Jim Bianco, president of Chicago-based Bianco Research LLC, said in a Bloomberg Television interview. Policy makers are trying to prevent ``Great Depression II'' by stemming the financial industry's contraction, he said.

JPMorgan Chase & Co. will run five special units that will buy up to $600 billion of certificates of deposit, bank notes and commercial paper with a remaining maturity of 90 days or less. The Fed will provide up to $540 billion, with the remaining $60 billion coming from commercial paper issued by the five units to the money-market funds selling their assets, central bank officials told reporters on a conference call...

How High Will the Dollar Go?

Let's call this one "Your Host Exhibits His Falliblity" and general inability to see the future. Its a good reminder to all of us, of how little we really 'know.'

This is an email sent in response to a question "How high will the Dollar rally? Give us a best guess."

Who can know these things with any certainty? As guesses go this is probably as good as any.

Tell me if the European banks are stabilizing and are no longer starving for dollars, and that there is a meaningful decline in the TED and LIBOR$ and the top in the dollar will be easier to project.

Its hard to say because I don't have the latest data on the Banks balances in europe from BIS.

For my best guess I have to go to the charts. Part of me says it tops this week, but I won't bet on it.

The charts alone call the top around 85. Currencies overshoot. That's why I cannot

be more precise, especially since we are in a short squeeze unrelated to fundamentals.

So I would estimate just on gut instinct and charting that we probably topped about 30 minutes ago, at 84.263,

but might continue on to test 85ish. and mess around there until this clears up. I'd like to see LIBOR$ and TED

confirm this by dropping like a rock. LOL. Then I might bet on it.

The Safety and Immediacy of Liquid Assets in a Deleveraging Panic: MZM, Home Currencies, Bank Reserves, and Gold

MZM is the broadest and most reasonable measure of liquidity in the US economic system. Bank Reserves and Cash are its narrowest component.

Bank reserves are becoming decoupled from MZM now since banks are borrowing heavily from the discount window and building reserves in anticipation of future financial shocks and writedowns of assets. We are in a deleveraging panic.

Breaking this impasse between fear of writedowns and moving forward with economic growth is the preoccupation of the Treasury and the Fed. We agree that this is the problem, we may merely differ on the approach to take to solve it.

This 'crunch' in primary liquidity, or bank reserves, in a deleveraging panic for the banks has a dampening effect on the broader components of liquidity in MZM.

One can make the case that the panic is originating with the banks as they reap the results of their misrepresentations of their assets and reckless speculation by deleveraging.

The Fed and Treasury approach seems to be to fill the Banks' reserves until they overflow and being to trickle down to the real economy. They believe that they will receive more benefit by placing their capital here because of the power of the fractional reserve money multiplier.

In the short term this may not be fruitful. The engine is seized. Pouring more gasoline in it may not be productive.

Banks need a kick start by a component of the economy that is still functioning normally, if in an impaired manner. That is in the real economy. Rather than reaching the real economy through the banks, the Fed and Treasury might well be more effective in focusing on stimulating real economic activity by stimulating consumption and production directly. Trickle up if you will.

One has to wonder what Keynes would have said about these different approaches to applying stimulus: provide stimulus to the broader public through increases in wages and economic activity, or to provide stimulus to the banks and hope that they will lend to the broader public at rates low enough to stimulate projects that would not otherwise be feasible.

This is a critical point, and little debated or understood as it is emotionally charged with words like 'socialism.' Most do not understand the fractional reserve banking system, but it seems more official, more palatable, to give them billions, enormous sums, and to give the public as little as possible for fear of debasing the value of work and the currency.

Paulson and Bernanke both view the economy as an adjunct to the financial system so from their perspective the choice is obvious.

The Fed and Treasury may succeed eventually in their approach of filling all banks, solvent and insolvent, stable and unstable, until they burst with liquidity and overflow into the broader economy.

In doing so they risk a significant bout of inflation and financial instability that may surprise them. But based on the experience of the Fed under Volcker they are convinced they can cure any inflation, having done it -- once.

MZM in turn has its correlation with secondary liquidity in the form of less liquid assets such as stocks and bonds, gold, forex and the time encumbered components of M2.

Do not think of this as 'cause and effect' but more in terms of a teeter totter, as individuals make decisions about their desire for immediacy and safety of assets and move capital, selling some assets and holding others.

If seen on the scale of immediacy and safety things will make more sense as they evolve.

There is a relationship between MZM and Gold, which as liquid assets which differ in Immediacy and Safety as an investment choice. In a short term panic immediacy overwhelms safety. As an aside and not illustrated in this chart, 'paper gold' which is less safe is diverging from 'Physicial Gold' in the lens of investor choice. That divergence may become greater in the short term as investor fears shift from the immediacy of capital to its safety.

Here is something to think about in the chart below. It shows the 'forex' component of liquidity falling to the immediacy of the home currency in a deleveraging panic.

More food for thought. The "why" is all important.