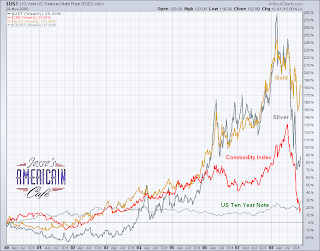

"Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses."

This is perhaps the gem in this article, the reminder that gold has proven to be one of the best stores of value through the turmoil of the turn of the century. People tend to lose sight of this, being preoccupied with the short term up and down of markets.

And it is most probable that it will continue to be an excellent store of value, a safe haven for wealth, over the next twenty or more years, as it has been over the past twenty or more centuries.

Why is this? Because although governments may seek to control it, prohibit it, monopolize it, disdain or disfavor it, they cannot create it, or prevent it from being valued by independent minds throughout recorded history as genuine wealth.

UK Telegraph

Citigroup says gold could rise above $2,000 next year as world unravels

By Ambrose Evans-Pritchard

7:29AM GMT 27 Nov 2008

Gold is poised for a dramatic surge and could blast through $2,000 an ounce by the end of next year as central banks flood the world's monetary system with liquidity, according to an internal client note from the US bank Citigroup.

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold. (A resurgence of inflation is hardly an extreme outcome, being more like the norm for the past 90 years. And we have had civil disorder and wars throughout the period of fiat inflation. - Jesse)

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

"Or it will not work because too much damage has already been done, and we will see continued financial deterioration, causing further economic deterioration, with the risk of a feedback loop. We don't think this is the more likely outcome, but as each week and month passes, there is a growing danger of vicious circle as confidence erodes," he said.

"This will lead to political instability. We are already seeing countries on the periphery of Europe under severe stress. Some leaders are now at record levels of unpopularity. There is a risk of domestic unrest, starting with strikes because people are feeling disenfranchised." (President Bush set record lows for popularity, and he did not require deflation to do it. Deflation is being held up as a boogeyman in this note. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)Gold traders are playing close attention to reports from Beijing that the China is thinking of boosting its gold reserves from 600 tonnes to nearer 4,000 tonnes to diversify away from paper currencies. "If true, this is a very material change," he said. (True and it would be an extremely intelligent move if they were to do so. - Jesse)

Mr Fitzpatrick said Britain had made a mistake selling off half its gold at the bottom of the market between 1999 to 2002. "People have started to question the value of government debt," he said. (Government debt has always been devalued and defaulted upon throughout history without exception. - Jesse)

Citigroup said the blast-off was likely to occur within two years, and possibly as soon as 2009. Gold was trading yesterday at $812 an ounce. It is well off its all-time peak of $1,030 in February but has held up much better than other commodities over the last few months – reverting to is historical role as a safe-haven store of value and a de facto currency. (This is not much of a prediction to be frank. Gold was bouncing along the 1000 level on the last leg up, and is now consolidating. A target of 2000 over the next two years seems a bit tame. - Jesse)

Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses.

Here we are, behind financial lines, huddled over our shortwave radios, waiting to hear about the true state of of our economy from the BBC... LOL.

Here we are, behind financial lines, huddled over our shortwave radios, waiting to hear about the true state of of our economy from the BBC... LOL.