There are a number of possibilities for the identity of the non-primary dealer domestic source of enormous purchases at the longer end of the yield curve in recent US Treasury auctions.

It could be a misclassification, a branch of a bank representing a foreign power. The problem with this theory is that foreign Central Banks have a reluctance to buy the long end of the curve.

It also could be a legitimate domestic purchaser like a pension fund compelled to match duration of obligations, as is required by a little noted ruling of the US government a couple of years ago. They might be shifting out of other long term instruments with similar durations but more risk.

It might even be PIMCO. They certain have the money as the world's biggest bond fund, and they do offer two Treasury ETF's which, although not directly related to the products bought, might be relevant on a cross trade. And PIMCO has recently been talking down Treasuries in favor of corporates, which doesn't mean anything since traders often 'talk their book.' Still, unless it is for the ETFs it is hard to justify buying the long durations straight up in size. And while PIMCO says they do not like Treasuries, Benny and the Fed said they are buying long to keep interest rates lower. Why doubt them?

And of course, it might very well be the Federal Reserve Bank, or the Treasury via the Exchange Stabilization Fund.

And of course, it might very well be the Federal Reserve Bank, or the Treasury via the Exchange Stabilization Fund.

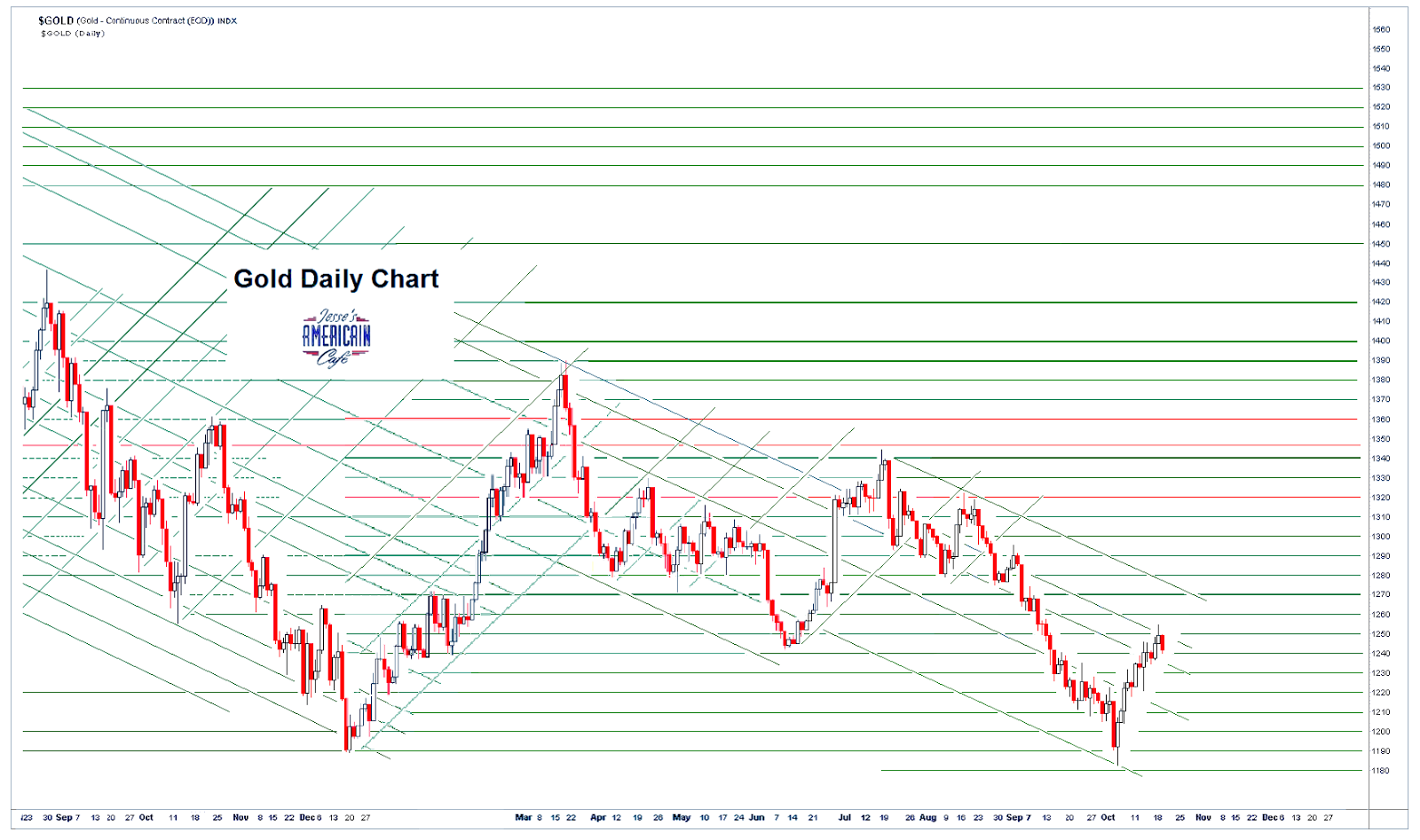

It could also be the big bidder who comes in with some regularity and smashes down the price of the precious metals, with the obvious intent of manipulating the market, like clockwork just after the PM fix in London with some frequency.

It might even be the mysterious bidder who stands ready to buy the SP futures at every weakness, maintaining a floor on the market, and a steady drift higher in prices, with no change in fundamental underpinnings. Their hand in the market is apparent.

It is less probable, given the state of market manipulation by a few big proprietary trading desks riding another wave of cheap FEd money, but it might even be the party that entered the US equity market yesterday at 12:03 PM with a HUGE order (228,000 contracts) to buy the SP futures. As Larry Levin noted, "As of now I don't have a firm answer, but whether it was HFT activity, the "Helicopter," or a massive cross trade, it sure set the bottom in for the afternoon. Everyone in the Dow, Nasdaq, and S&P pits were talking about it and nobody was willing to sell into that massive bid." And so the market rallied once again into its current peak. No doubt it will be blamed on Monsieur Fat Fingers. Funny how lucky the big prop traders are with their reckless accidents, with millions gained from gaming the market, and all by accident.

As the article from the Financial Times indicates, it might never be possible to find out who this is, unless there is an audit of the market that is made public. As Edmund Burke noted, "Fraud is the Minister of Injustice" and it is my experience that opacity is the accomplice of fraud. Who has the most to hide these days?

Personally I think the Fed is buying across the yield curve to affect interest rates, and Treasury takes care of stocks and commodities through the Exchange Stabilization Fund, and friends in a few key banks, but who can say for sure, without the power of wiretap, audit, and subpoena?

If this is price manipulation, no matter the intentions or beneficiaries, it is likely that it is mispricing risk in a big way, misallocating investments, and will eventually will fail. Its failure will cause a great deal of pain in the real economy for innocent bystanders, and will end in tears. And when that time comes, expect those who created the crisis to make the public another offer that they think you cannot refuse, in excess of their last demand for 700$ billions, tout de suite.

You decide what is most likely, and what needs to be done about it, if anything.

More than a few people are wondering at the lack of response from the people in various nations, particularly in the UK and the US. Here is some old knowledge that might prove illuminating.

National Madness

Gilbert Keith Chesterton 1910

"This slow and awful self-hypnotism of error is a process that can occur not only with individuals, but also with whole societies. It is hard to pick out and prove; that is why it is hard to cure. But this mental degeneration may be brought to one test, which I truly believe to be a real test.

A nation is not going mad when it does extravagant things, so long as it does them in an extravagant spirit. But whenever we see things done wildly, but taken tamely, then the State is growing insane...

For madness is a passive as well as an active state: it is a paralysis, a refusal of the nerves to respond to the normal stimuli, as well as an unnatural stimulation. There are commonwealths, plainly to be distinguished here and there in history, which pass from prosperity to squalor or from glory to insignificance, or from freedom to slavery, not only in silence, but with serenity."

And in this slow descent into madness, the worst is surely yet to come.

Financial TimesDirect bids for US Treasury notes lead to speculation over buyer

By Michael Mackenzie in New YorkJanuary 14 2010 02:00

Auctions of US Treasury notes this week have attracted extremely strong buying from domestic institutional investors, fuelling speculation that "

one big bidder" has decided to defy the conventional wisdom on Wall Street that US government debt is due for a fall.Yesterday,

direct bids accounted for 17 per cent of the sales of $21bn in 10-year Treasury notes, far higher than the recent average of 7.4 per cent. It was the highest percentage of direct bids in a 10-year Treasury auction since May 2005.

On Tuesday, direct bids accounted for a record 23.4 per cent of the bidding for $40bn in three-year notes, up from an average direct bid of 6 per cent.

Market participants say

the unusually high level of direct bidding suggests that a large investor is looking to accumulate Treasuries without alerting the primary dealers on Wall Street to its intentions.

"It appears to us that someone is trying to hide their apparent interest in owning these auctions from the rest of the market," said David Ader, strategist at CRT Capital.

Rick Klingman, managing director at BNP Paribas, said: "It is unusual to see such a spike in the direct bid and I would imagine it is one big bidder. There is no way we will find out who it is, not now, or ever."

The surge in direct bidding is particularly notable because it comes after predictions that the record levels of Treasury debt issuance would exhaust investor demand, driving yields higher.

Among the most high-profile warnings came from Pimco, manager of the largest bond fund, which raised concerns about the escalating supply of US Treasury debt.

Attention will now focus on

whether there is similar direct demand for today's $13bn 30-year bond sale.

The 10-year notes were sold at a yield of 3.754 per cent yesterday, the highest rate awarded for a note sale since June, when they were issued at 3.99 per cent. At the start of the year the yield on 10-year notes briefly traded at 3.90 per cent, as many investors talked down the prospects for Treasuries. The note traded at about 3.70 per cent earlier this week and was at 3.70 per cent late yesterday.

Under the three main classifications of buyers in Treasury debt sales, direct bidders are generally

domestic non-primary dealer banks and large institutional investors. Normally their presence at Treasury auctions is small, as they usually buy debt through the primary dealer network, which currently numbers 18 banks and broker/dealers.

"On a side bar. remember a couple of years ago, when I went on CNBC to talk to them about things that were happening in the markets in the afterhours that didn't make sense, and looked like an 'outside force' was moving them? And they laughed at me, and told me to take my theory to Hollywood, and see if they would make a movie of it! And then a month or so later, a guy came out and proved my theory? Well. I have to believe that the rise of Gold and Silver, the rise of Treasury yields, and Oil, all being reversed on a dime, smells like PPT. it walks like PPT. and it talks like PPT."