How interesting that the Financial Times has finally noticed 'tentative signs of increased demand for bullion from consumers in emerging markets.' You know, those obscure places with difficult names such as I-N-D-I-A and C-H-I-N-A.

It's not all that new of a phenomenon, mates. Our friend Nick has been tracking it, and we have been talking about that here at Le Cafe, for a couple years now. Well, maybe almost a decade. See the charts below.

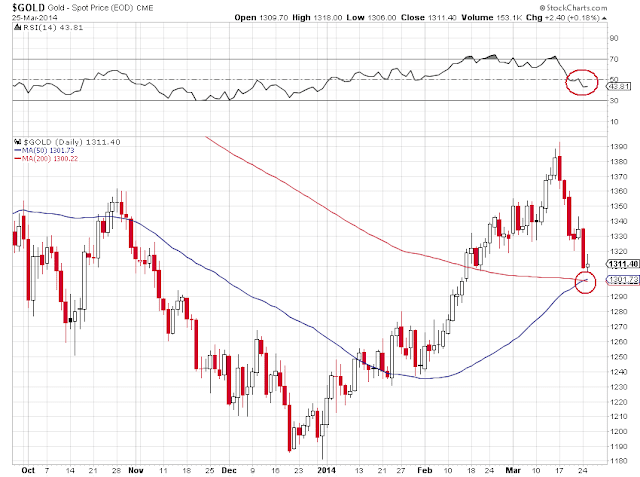

And we have also been hearing about 'physical tightness in the market for gold for immediate delivery.' While the 'cost of borrowing gold has risen sharply in recent weeks.'

Even while the price of gold was shoved lower on the non-delivery paper markets of The Bucket Shop, helping to crater the deveopment and production of mining companies.

Sounds like borrowing gold for physical delivery is starting to be a dodgy business, a little hard to manage at such high leverage of claims to items.

Wait until people start realizing that there is a diminishing mix of deliverable and of 'borrowed gold' backing up a pyramid of derivatives and paper claims. Is that the sound of a spoon scraping the bottom of the pot yet?

What happened to the theory of higher prices to relieve demand in excess of supply?

And where is that 'borrowed gold' coming from, by the by? It must belong to someone, and they may even think it is safely tucked away while it is on its way to Asia via Switzerland.

If the LBMA has been doing what some think they have been doing with demand and available supply, then we haven't seen anything yet.

Never be the last one out of the pool.

But let's see how all this plays out.

Gold Demand from China and India Picks Up

By Henry Sanderson

Financial Times, London

Wednesday, September 2, 2015

London's gold market is showing tentative signs of increased demand for bullion from consumers in emerging markets, after the price of the precious metal fell to its lowest level in five years in July.

The cost of borrowing physical gold in London has risen sharply in recent weeks. That has been driven by dealers needing gold to deliver to refineries in Switzerland before it is melted down and sent to places such as India, according to market participants.

The rise "does indicate there is physical tightness in the market for gold for immediate delivery," said Jon Butler, analyst at Mitsubishi. ...

... For the remainder of the report:http://www.ft.com/cms/s/0/eae18206-5154-11e5-b029-b9d50a74fd14.html