Watch for the SP futures to form a 'double bottom' at its pre-market morning lows of 1036.75.

Watch for the SP futures to form a 'double bottom' at its pre-market morning lows of 1036.75.

If that support gives way, the market will reach for a bottom, but with a 900 handle perhaps.

Still, the market is getting rather oversold here, and the techs are not confirming a break of their support in the trendline.

I remain on the 'Long gold - Short stocks' trade that was mentioned the other day.

Silver is starting to look interesting. Later this year I think it may show us an epic rally as the artificial short scheme collapses and retreats to a higher level in a short term buying panic.

It is very difficult to forecast the timing on such an event, so better to take small positions and throw them in a drawer to be looked at only on occasion. One cannot successfully trade the truly unpredictable except in their own selective memory. When will the CFTC and SEC act to create integrity in the US markets? That is why playing such a risk trade is best done with little leverage, highly discretionary funds, and long time frames.

The gold bears are mounting a 'goal line defense' just under 1200 as we are in option expiration.

Here is a look at the SP June Futures Daily Chart at 11:30 NY Time. 1055-1060 remains a key resistance point.

In the meanwhile here is a video interview with Eric Sprott on BNN regarding our farcical financial system presided over by the central banks.

And an interesting discussion about gold, naked short selling, and Goldman Sachs with Stacy Herbert and Max Keiser, with the engaging headline, Goldman Sachs: Undeclared Enemy of the State.

25 May 2010

SP Futures Daily Chart: 1037 Is a Potential 'Double Bottom' with the February Low

13 May 2010

Why There is Fear and Resentment of Gold's Ability to Reveal the True Value of Financial Assets

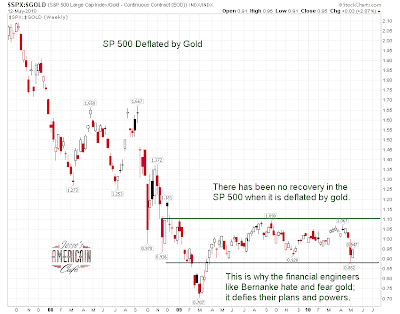

There were a few questions raised about the note on the long term chart of the SP 500 deflated by gold which was posted last night, and which is reproduced here on the right, which read "This is why the financial engineers like Bernanke hate and fear gold; it defies their plans and powers."

The chart shows something that most investors have suspected. There has been no genuine recovery in the price of stocks since the decline that cannot be fully explained by the monetary inflation of the dollar, as can be discovered by the ultimate store of value, which is gold.

The chart shows something that most investors have suspected. There has been no genuine recovery in the price of stocks since the decline that cannot be fully explained by the monetary inflation of the dollar, as can be discovered by the ultimate store of value, which is gold.I thought that this was a fairly straightforward observation, but it apparently jarred a few people and their thinking. So perhaps we have some new readers who are not familiar with the long standing animosity towards gold that is uniformly expressed by all those who promote centralized command and control economies, from both the left and the right.

Can any astute observer doubt the Fed's desire to act in secret and privacy? Their obsession with this is almost unbelievable and beyond comprehension, unless one understands that they are in a 'confidence game,' and use persuasion and even illusion to shape perceptions, especially at the extremes of their financial and monetary engineering of the real economy.

This animosity and desire for secrecy was described by Alan Greenspan in his famous essay, Gold and Economic Freedom, first published in 1966. In a fairly amusing exchange between Congressman Ron Paul and the former Chairman a couple of years ago, Mr. Paul asked Sir Alan about this essay, and if he had any corrections or misgivings about it after so many years. Would he change anything?

"Not one word." replied Greenspan, in one of his few candidly honest and straightforward statements.

It helps to understand the dynamics of the money world, which appear so mysterious to those who do not specialize in it, even economists, although some may feign ignorance to promote their cause or avoid unpleasant disclosures.

Money is power. Ownership of the means of production may provide for the control of groups of disorganized labor. But the power of the issuance of money allows for the control of whole peoples and governments, through the distribution and transference of wealth, by the most subtle of means. And this is why the US Constitution relegated this power to the Congress and by their explicit appropriation, and denied it to the States and private parties except in the form of specie, that is, gold and silver which have intrinsic value.

It might be useful to review a prior post in reaction to the self-named maverick economist Willem Buiter, who wrote a few attacks on gold, prior to his leaving academia and the Financial Times to take a senior position with Citibank. Willem Buiter Apparently Does Not Like Gold

It may seem a bit perverse, but I do not favor a return to a gold, or a bi-metallic gold and silver standard at this time. Each nation can be free to devalue or deflate their own money supply as their needs require, with the consent and knowledge of the people and their representatives.

What I do promote is for gold and silver to trade freely without restraint or manipulation as a refuge from monetary manipulation, and a secure store of value for private wealth. When nations adopt the gold standard, they invariably seek to 'fix' and manipulate its price, and reserve the ownership to themselves, with the tendency to seize the wealth of their citizen under the rationale of such an ownership, or dominant privilege.

Let those who have a mind to it have the means of securing their labor and efforts, and let the state do as it will, with the open knowledge and consent of the world.

"Gold is not necessary. I have no interest in gold. We will build a solid state, without an ounce of gold behind it. Anyone who sells above the set prices, let him be marched off to a concentration camp. That's the bastion of money."A draconian approach no doubt. It is much more common for the ruling parties to debase the coinage secretively while advantaging their friends and supporters, thereby manipulating the value of gold and silver covertly.

Adolf Hitler

In modern times of non-specie currency one might choose to select a few cooperative banks and the central money authority to manipulate the price using paper and markets, and hope that this scheme will remain undiscovered. But it always comes out, the truth is always known in the end.

"With the exception only of the period of the gold standard, practically all governments of history have used their exclusive power to issue money to defraud and plunder the people."There are any number of amateur economists and investing pundits around these days who betray an almost irrational opposition to gold, becoming jubilant in every decline, and despondent at every rally. And some of them even take the label of 'Austrianism' in their thoughts which is quite odd given that it is one of their schools strongest bulwarks.

F. A. Von Hayek

Most often this can simply explained as the envy of those who have not prepared for a crisis, and wish ill upon those who have, regretting and hoping for another chance to provide for their own security. And yet they will fail to take advantage of every opportunity to do so, as they are creatures betrayed alternatively by their own fear and greed.

One of the best indications of quack advice on the question of investing in precious metals is when one of the reasons against it includes the scurrilous non sequitur, 'You can't eat it,' as if nutritional content is a valid measure of the durability of wealth. It betrays a lowness of argument and intellectual integrity that should promptly urge one to run in the other direction.

And regrettably, there are always those who will say almost anything for money, and the profession of economist seems to be particularly infested with that sort, given the stochastic nature of the discipline, and its lack of scientific rigor, being based on principles which do not easily lend themselves to objectification with serious damage to the data being made by the assumptions in their equations and proofs.

But most of all, the financial engineers, politicians, and Wall Street Banks fear gold because it is the antidote to their frauds, and the informant to their confiscation of wealth.

Do not expect them to capitulate once and for all, but only slowly and grudgingly as it becomes more difficult for them to sustain their illusions and persuasion. Protecting wealth against official adventurism is never easy.

Here is Alan Greenspan's famous essay on Gold and Economic Freedom. I suggest your read it, because it will help you to understand much of what is said and done as the global reserve currency system changes and evolves.

Gold and Economic Freedom

by Alan Greenspan

Published in Ayn Rand's "Objectivist" newsletter in 1966, and reprinted in her book, Capitalism: The Unknown Ideal, in 1967.

An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense - perhaps more clearly and subtly than many consistent defenders of laissez-faire - that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other.

In order to understand the source of their antagonism, it is necessary first to understand the specific role of gold in a free society.

Money is the common denominator of all economic transactions. It is that commodity which serves as a medium of exchange, is universally acceptable to all participants in an exchange economy as payment for their goods or services, and can, therefore, be used as a standard of market value and as a store of value, i.e., as a means of saving.

The existence of such a commodity is a precondition of a division of labor economy. If men did not have some commodity of objective value which was generally acceptable as money, they would have to resort to primitive barter or be forced to live on self-sufficient farms and forgo the inestimable advantages of specialization. If men had no means to store value, i.e., to save, neither long-range planning nor exchange would be possible.

What medium of exchange will be acceptable to all participants in an economy is not determined arbitrarily. First, the medium of exchange should be durable. In a primitive society of meager wealth, wheat might be sufficiently durable to serve as a medium, since all exchanges would occur only during and immediately after the harvest, leaving no value-surplus to store. But where store-of-value considerations are important, as they are in richer, more civilized societies, the medium of exchange must be a durable commodity, usually a metal. A metal is generally chosen because it is homogeneous and divisible: every unit is the same as every other and it can be blended or formed in any quantity. Precious jewels, for example, are neither homogeneous nor divisible. More important, the commodity chosen as a medium must be a luxury. Human desires for luxuries are unlimited and, therefore, luxury goods are always in demand and will always be acceptable. Wheat is a luxury in underfed civilizations, but not in a prosperous society. Cigarettes ordinarily would not serve as money, but they did in post-World War II Europe where they were considered a luxury. The term "luxury good" implies scarcity and high unit value. Having a high unit value, such a good is easily portable; for instance, an ounce of gold is worth a half-ton of pig iron.

In the early stages of a developing money economy, several media of exchange might be used, since a wide variety of commodities would fulfill the foregoing conditions. However, one of the commodities will gradually displace all others, by being more widely acceptable. Preferences on what to hold as a store of value will shift to the most widely acceptable commodity, which, in turn, will make it still more acceptable. The shift is progressive until that commodity becomes the sole medium of exchange. The use of a single medium is highly advantageous for the same reasons that a money economy is superior to a barter economy: it makes exchanges possible on an incalculably wider scale.

Whether the single medium is gold, silver, seashells, cattle, or tobacco is optional, depending on the context and development of a given economy. In fact, all have been employed, at various times, as media of exchange. Even in the present century, two major commodities, gold and silver, have been used as international media of exchange, with gold becoming the predominant one. Gold, having both artistic and functional uses and being relatively scarce, has significant advantages over all other media of exchange. Since the beginning of World War I, it has been virtually the sole international standard of exchange. If all goods and services were to be paid for in gold, large payments would be difficult to execute and this would tend to limit the extent of a society's divisions of labor and specialization. Thus a logical extension of the creation of a medium of exchange is the development of a banking system and credit instruments (bank notes and deposits) which act as a substitute for, but are convertible into, gold.

A free banking system based on gold is able to extend credit and thus to create bank notes (currency) and deposits, according to the production requirements of the economy. Individual owners of gold are induced, by payments of interest, to deposit their gold in a bank (against which they can draw checks). But since it is rarely the case that all depositors want to withdraw all their gold at the same time, the banker need keep only a fraction of his total deposits in gold as reserves. This enables the banker to loan out more than the amount of his gold deposits (which means that he holds claims to gold rather than gold as security of his deposits). But the amount of loans which he can afford to make is not arbitrary: he has to gauge it in relation to his reserves and to the status of his investments.

When banks loan money to finance productive and profitable endeavors, the loans are paid off rapidly and bank credit continues to be generally available. But when the business ventures financed by bank credit are less profitable and slow to pay off, bankers soon find that their loans outstanding are excessive relative to their gold reserves, and they begin to curtail new lending, usually by charging higher interest rates. This tends to restrict the financing of new ventures and requires the existing borrowers to improve their profitability before they can obtain credit for further expansion. Thus, under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth. When gold is accepted as the medium of exchange by most or all nations, an unhampered free international gold standard serves to foster a world-wide division of labor and the broadest international trade. Even though the units of exchange (the dollar, the pound, the franc, etc.) differ from country to country, when all are defined in terms of gold the economies of the different countries act as one — so long as there are no restraints on trade or on the movement of capital. Credit, interest rates, and prices tend to follow similar patterns in all countries. For example, if banks in one country extend credit too liberally, interest rates in that country will tend to fall, inducing depositors to shift their gold to higher-interest paying banks in other countries. This will immediately cause a shortage of bank reserves in the "easy money" country, inducing tighter credit standards and a return to competitively higher interest rates again.

A fully free banking system and fully consistent gold standard have not as yet been achieved. But prior to World War I, the banking system in the United States (and in most of the world) was based on gold and even though governments intervened occasionally, banking was more free than controlled. Periodically, as a result of overly rapid credit expansion, banks became loaned up to the limit of their gold reserves, interest rates rose sharply, new credit was cut off, and the economy went into a sharp, but short-lived recession. (Compared with the depressions of 1920 and 1932, the pre-World War I business declines were mild indeed.) It was limited gold reserves that stopped the unbalanced expansions of business activity, before they could develop into the post-World War I type of disaster. The readjustment periods were short and the economies quickly reestablished a sound basis to resume expansion.

But the process of cure was misdiagnosed as the disease: if shortage of bank reserves was causing a business decline — argued economic interventionists — why not find a way of supplying increased reserves to the banks so they never need be short! If banks can continue to loan money indefinitely — it was claimed — there need never be any slumps in business. And so the Federal Reserve System was organized in 1913. It consisted of twelve regional Federal Reserve banks nominally owned by private bankers, but in fact government sponsored, controlled, and supported. Credit extended by these banks is in practice (though not legally) backed by the taxing power of the federal government. Technically, we remained on the gold standard; individuals were still free to own gold, and gold continued to be used as bank reserves. But now, in addition to gold, credit extended by the Federal Reserve banks ("paper reserves") could serve as legal tender to pay depositors.

When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage. More disastrous, however, was the Federal Reserve's attempt to assist Great Britain who had been losing gold to us because the Bank of England refused to allow interest rates to rise when market forces dictated (it was politically unpalatable). The reasoning of the authorities involved was as follows: if the Federal Reserve pumped excessive paper reserves into American banks, interest rates in the United States would fall to a level comparable with those in Great Britain; this would act to stop Britain's gold loss and avoid the political embarrassment of having to raise interest rates. The "Fed" succeeded; it stopped the gold loss, but it nearly destroyed the economies of the world, in the process. The excess credit which the Fed pumped into the economy spilled over into the stock market, triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed. Great Britain fared even worse, and rather than absorb the full consequences of her previous folly, she abandoned the gold standard completely in 1931, tearing asunder what remained of the fabric of confidence and inducing a world-wide series of bank failures. The world economies plunged into the Great Depression of the 1930's.

With a logic reminiscent of a generation earlier, statists argued that the gold standard was largely to blame for the credit debacle which led to the Great Depression. If the gold standard had not existed, they argued, Britain's abandonment of gold payments in 1931 would not have caused the failure of banks all over the world. (The irony was that since 1913, we had been, not on a gold standard, but on what may be termed "a mixed gold standard"; yet it is gold that took the blame.) But the opposition to the gold standard in any form — from a growing number of welfare-state advocates — was prompted by a much subtler insight: the realization that the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state). Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes. A substantial part of the confiscation is effected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.

Under a gold standard, the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government's promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets. A large volume of new government bonds can be sold to the public only at progressively higher interest rates. Thus, government deficit spending under a gold standard is severely limited. The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. They have created paper reserves in the form of government bonds which — through a complex series of steps — the banks accept in place of tangible assets and treat as if they were an actual deposit, i.e., as the equivalent of what was formerly a deposit of gold. The holder of a government bond or of a bank deposit created by paper reserves believes that he has a valid claim on a real asset. But the fact is that there are now more claims outstanding than real assets. The law of supply and demand is not to be conned. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise. Thus the earnings saved by the productive members of the society lose value in terms of goods. When the economy's books are finally balanced, one finds that this loss in value represents the goods purchased by the government for welfare or other purposes with the money proceeds of the government bonds financed by bank credit expansion.

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

Given his Randian audience and the mood at the time, it is interesting that Greenspan defines the culprits in the scheme of fiat monetization as 'welfare statists.' How ironic, that over a period of time there is indeed a group of welfare statists behind the latest debasement of the currency, the US dollar, but the recipients of this welfare are the Banks and the financial elite, who through transfer payments, financial fraud, and federally sanctioned subsidies are systematically stripping the middle class of their wealth. Perhaps they decided that if you cannot beat them, beat them to the trough and take the best for themselves until the system collapses through their abuse.

06 May 2010

Bullion Denominated in Euros, Pounds and Swiss Francs At New Record Highs as the IMF Prepares for a Currency Crisis

What many traders are starting to realize is that the precious metals plunged with stocks in the recent market dislocation in 2008 because it was a 'liquidity crisis' among private institutions triggered by the credit unworthiness of individuals that provoked a general selling of assets.

What we are experiencing now is a sovereign debt (credit worthiness) crisis, which is really a currency crisis. A fiat currency is backed by nothing except the 'full faith and credit' of the issuer. It is not that it would have to be 'different this time' as some would think. It's not even the same thing, a different type of a crisis entirely.

The markets are assessing the risks of various currencies and countries with regard to default. Gold, and to some lesser extent silver bullion, are wealth that is sufficient to itself, requiring no backing from any particular country. Quite the opposite, there are large short positions and highly leveraged paper commitments, that present significant counterparty risk to the upside, because it is unlikely to be deliverable at anything near current prices.

Regulators have long turned a blind eye to what some contend are officially sanctioned shenanigans and secretive leasing and selling. This is becoming increasingly difficult for the central banks to manage, and we may approach a breaking point unless the financial engineers and politicians can head it off once again. They have a strong vested interest in hiding their past dealings, as we saw in the case of Mr. Gordon Brown in the UK.

If there is a new panic selloff, all assets will again be liquidated in the short term, including the metals. But their rebound may be quite sharp and potentially rewarding if the sovereign debt crisis continues, since the search for safe havens will be even more aggressive, as the seats in the shelters are quickly taken.

This is why the IMF is meeting in Zurich on May 11, ahead of the formal discussions scheduled later this year to discuss the reweighting of the SDR. There is a currency crisis on the horizon, and it may involve not only the PIIGS, but the larger developing countries including the US and the UK. And they are preparing contingency plans, and seeking to head it off.

I do not necessarily view this as gold and silver positive, because when central bankers get together to work their schemes on the markets, valuations may not be based on any fundamentals. The financial engineering of the central banks has been largely deleterious to individual wealth among the public, and there may be some shocking disclosures of market manipulation yet to be heard. The central bankers may be as compromised and hypocritical as their corporate cousins.

But if 'the fix is in' and the wealthy have indeed been buying bullion ahead of the public, then we might see something happen later this, and it could be quite impressive. The amount of 'book talking' being done on behalf of large institutions by paid analysts approaches the level of the appalling, even for such a recently tarnished profession.

By the way, the 'tease' today is that Jimmy Rogers is said to have turned rather bearish on stocks, and says he is getting quite short on one of the big western financial institutions which everyone believes is solid and well founded. He thinks it may soon become involved in the financial crisis. He would not reveal the name. We have a poll running until 9 PM Eastern US time for you to take your best guesses. No I did not include the US Treasury in the list.

As for the theory that currencies gain in strength if there are debt defaults, this is only if the taxation and production levels remain relatively constant or higher, and the debt destruction is within the debt which is owed by private parties. When sovereign wealth is destroyed this is a de facto default, and potentially corrosive as acid to a currency's value.

"Bullion denominated in euros and Swiss francs surged to new record highs this morning. The euro has again come under severe pressure as contagion risks increase. While all the focus is on Europe right now, similar risks face the UK and US economies and this is leading to significant safe haven demand for gold internationally. Prices have risen close to a new nominal record against the British pound and the highest level in yen since February 1983. Gold is slightly higher in most currencies this morning and significantly stronger in British pounds and euros - trading at $1,185.00, £786.03 and €925.72 per ounce this morning. Markets await the ECB rate decision and UK general election with interest."

Sovereign Debt Demands

"This is why the International Monetary Fund (IMF) and the Swiss National Bank (SNB) are jointly hosting a High-Level Conference on the International Monetary System in Zurich on May 11, 2010. The conference is set to analyse the global financial crisis and will provide an opportunity to exchange ideas on a number of related topics, including sources of instability in the international monetary system, improving the supply of reserve assets, dealing with volatile capital flows, and possible alternatives to countries’ accumulation of reserves as self-insurance against future crises.Metal Commentary by GoldCore

The conference will bring together a group of high-level participants, including central bank governors, other senior policymakers, leading academics, and commentators. The key objective of the conference is to examine weaknesses in the current international monetary system, and identify reforms that might be desirable over the medium to long run to build a more robust and stable world economy. The event will be concluded with a joint press conference by SNB Governor Philipp Hildebrand and IMF Managing Director Dominique Strauss-Kahn.

There is speculation that the conference may have favourable implications for gold with proposals that gold reserves may again have some form of role in bringing stability to the international monetary system."

Jim Rogers: More Turmoil Ahead in Global Financial Markets

Clusterstock: Jim Rogers Is Now Shorting A Major Western Financial Firm That Everyone Thinks Is Sound

As for my kitchen, we are plating financials short and bullion long all this week. But this may not be on the menu into the Friday US nonfarm payrolls, at least not in the same combinations and prices.

28 April 2010

Guest Post: The Perils of Credit Money Systems Managed by Private Corporations

In this instance the 'paper money' system would be analagous to money created by private banks by means of expanding credit. The Second Bank of the United States is the predecessor to the Federal Reserve Bank System which was established in 1913.

"The paper system being founded on public confidence and having of itself no intrinsic value, is liable to great and sudden fluctuations, thereby rendering property insecure and the wages of labor unsteady and uncertain.

The corporations which create the paper money cannot be relied upon to keep the circulating medium uniform in amount. In times of prosperity, when confidence is high, they are tempted by the prospect of gain or by the influence of those who hope to profit by it to extend their issues of paper beyond the bounds of discretion and the reasonable demands of business.

And when these issues have been pushed on from day to day until the public confidence is at length shaken, then a reaction takes place, and they immediately withdraw the credits they have given; suddenly curtail their issues; and produce an unexpected and ruinous contraction of the circulating medium which is felt by the whole community.

The banks, by this means, save themselves, and the mischievous consequences of their imprudence or cupidity are visited upon the public. Nor does the evil stop here. These ebbs and flows in the currency and these indiscreet extensions of credit naturally engender a spirit of speculation injurious to the habits and character of the people. We have already seen its effects in the wild spirit of speculation in the public lands and various kinds of stock which, within the last year or two, seized upon such a multitude of our citizens and threatened to pervade all classes of society and to withdraw their attention from the sober pursuits of honest industry. It is not by encouraging this spirit that we shall best preserve public virtue and promote the true interests of our country.

But if your currency continues as exclusively paper as it now is, it will foster this eager desire to amass wealth without labor; it will multiply the number of dependents on bank accommodations and bank favors; the temptation to obtain money at any sacrifice will become stronger and stronger, and inevitably lead to corruption which will find its way into your public councils and destroy, at no distant day, the purity of your government. Some of the evils which arise from this system of paper press, with peculiar hardship, upon the class of society least able to bear it...

Recent events have proved that the paper money system of this country may be used as an engine to undermine your free institutions; and that those who desire to engross all power in the hands of the few and to govern by corruption or force are aware of its power and prepared to employ it. Your banks now furnish your only circulating medium, and money is plenty or scarce according to the quantity of notes issued by them. While they have capitals not greatly disproportioned to each other, they are competitors in business, and no one of them can exercise dominion over the rest. And although, in the present state of the currency, these banks may and do operate injuriously upon the habits of business, the pecuniary concerns, and the moral tone of society, yet, from their number and dispersed situation, they cannot combine for the purpose of political influence; and whatever may be the dispositions of some of them their power of mischief must necessarily be confined to a narrow space and felt only in their immediate neighborhoods.

But when the charter of the Bank of the United States was obtained from Congress, it perfected the schemes of the paper system and gave its advocates the position they have struggled to obtain from the commencement of the federal government down to the present hour. The immense capital and peculiar privileges bestowed upon it enabled it to exercise despotic sway over the other banks in every part of the country. From its superior strength it could seriously injure, if not destroy, the business of any one of them which might incur its resentment; and it openly claimed for itself the power of regulating the currency throughout the United States. In other words, it asserted (and it undoubtedly possessed) the power to make money plenty or scarce, at its pleasure, at any time, and in any quarter of the Union, by controlling the issues of other banks and permitting an expansion or compelling a general contraction of the circulating medium according to its own will.

The other banking institutions were sensible of its strength, and they soon generally became its obedient instruments, ready at all times to execute its mandates; and with the banks necessarily went, also, that numerous class of persons in our commercial cities who depend altogether on bank credits for their solvency and means of business; and who are, therefore, obliged for their own safety to propitiate the favor of the money power by distinguished zeal and devotion in its service.

The result of the ill-advised legislation which established this great monopoly was to concentrate the whole money power of the Union, with its boundless means of corruption and its numerous dependents, under the direction and command of one acknowledged head; thus organizing this particular interest as one body and securing to it unity and concert of action throughout the United States and enabling it to bring forward, upon any occasion, its entire and undivided strength to support or defeat any measure of the government. In the hands of this formidable power, thus perfectly organized, was also placed unlimited dominion over the amount of the circulating medium, giving it the power to regulate the value of property and the fruits of labor in every quarter of the Union and to bestow prosperity or bring ruin upon any city or section of the country as might best comport with its own interest or policy.

We are not left to conjecture how the moneyed power, thus organized and with such a weapon in its hands, would be likely to use it. The distress and alarm which pervaded and agitated the whole country when the Bank of the United States waged war upon the people in order to compel them to submit to its demands cannot yet be forgotten. The ruthless and unsparing temper with which whole cities and communities were oppressed, individuals impoverished and ruined, and a scene of cheerful prosperity suddenly changed into one of gloom and despondency ought to be indelibly impressed on the memory of the people of the United States.

If such was its power in a time of peace, what would it not have been in a season of war with an enemy at your doors? No nation but the freemen of the United States could have come out victorious from such a contest; yet, if you had not conquered, the government would have passed from the hands of the many to the hands of the few; and this organized money power, from its secret conclave, would have directed the choice of your highest officers and compelled you to make peace or war as best suited their own wishes. The forms of your government might, for a time, have remained; but its living spirit would have departed from it.

The distress and sufferings inflicted on the people by the Bank are some of the fruits of that system of policy which is continually striving to enlarge the authority of the federal government beyond the limits fixed by the Constitution. The powers enumerated in that instrument do not confer on Congress the right to establish such a corporation as the Bank of the United States; and the evil consequences which followed may warn us of the danger of departing from the true rule of construction and of permitting temporary circumstances or the hope of better promoting the public welfare to influence, in any degree, our decisions upon the extent of the authority of the general government. Let us abide by the Constitution as it is written or amend it in the constitutional mode if it is found defective.

The severe lessons of experience will, I doubt not, be sufficient to prevent Congress from again chartering such a monopoly, even if the Constitution did not present an insuperable objection to it. But you must remember, my fellow citizens, that eternal vigilance by the people is the price of liberty; and that you must pay the price if you wish to secure the blessing. It behooves you, therefore, to be watchful in your states as well as in the federal government.The power which the moneyed interest can exercise, when concentrated under a single head, and with our present system of currency, was sufficiently demonstrated in the struggle made by the Bank of the United States. Defeated in the general government, the same class of intriguers and politicians will now resort to the states and endeavor to obtain there the same organization which they failed to perpetuate in the Union; and with specious and deceitful plans of public advantages and state interests and state pride they will endeavor to establish, in the different states, one moneyed institution with overgrown capital and exclusive privileges sufficient to enable it to control the operations of the other banks.

Such an institution will be pregnant with the same evils produced by the Bank of the United States, although its sphere of action is more confined; and in the state in which it is chartered the money power will be able to embody its whole strength and to move together with undivided force to accomplish any object it may wish to attain. You have already had abundant evidence of its power to inflict injury upon the agricultural, mechanical, and laboring classes of society, and over whose engagements in trade or speculation render them dependent on bank facilities, the dominion of the state monopoly will be absolute, and their obedience unlimited. With such a bank and a paper currency, the money power would, in a few years, govern the state and control its measures; and if a sufficient number of states can be induced to create such establishments, the time will soon come when it will again take the field against the United States and succeed in perfecting and perpetuating its organization by a charter from Congress.

It is one of the serious evils of our present system of banking that it enables one class of society, and that by no means a numerous one, by its control over the currency to act injuriously upon the interests of all the others and to exercise more than its just proportion of influence in political affairs. The agricultural, the mechanical, and the laboring classes have little or no share in the direction of the great moneyed corporations; and from their habits and the nature of their pursuits, they are incapable of forming extensive combinations to act together with united force. Such concert of action may sometimes be produced in a single city or in a small district of country by means of personal communications with each other; but they have no regular or active correspondence with those who are engaged in similar pursuits in distant places. They have but little patronage to give the press and exercise but a small share of influence over it; they have no crowd of dependents about them who hope to grow rich without labor by their countenance and favor and who are, therefore, always ready to exercise their wishes.

The planter, the farmer, the mechanic, and the laborer all know that their success depends upon their own industry and economy and that they must not expect to become suddenly rich by the fruits of their toil. Yet these classes of society form the great body of the people of the United States; they are the bone and sinew of the country; men who love liberty and desire nothing but equal rights and equal laws and who, moreover, hold the great mass of our national wealth, although it is distributed in moderate amounts among the millions of freemen who possess it. But, with overwhelming numbers and wealth on their side, they are in constant danger of losing their fair influence in the government, and with difficulty maintain their just rights against the incessant efforts daily made to encroach upon them.

The mischief springs from the power which the moneyed interest derives from a paper currency which they are able to control; from the multitude of corporations with exclusive privileges which they have succeeded in obtaining in the different states and which are employed altogether for their benefit; and unless you become more watchful in your states and check this spirit of monopoly and thirst for exclusive privileges, you will, in the end, find that the most important powers of government have been given or bartered away, and the control over your dearest interests has passed into the hands of these corporations.

The paper money system and its natural associates, monopoly and exclusive privileges, have already struck their roots deep in the soil; and it will require all your efforts to check its further growth and to eradicate the evil. The men who profit by the abuses and desire to perpetuate them will continue to besiege the halls of legislation in the general government as well as in the states and will seek, by every artifice, to mislead and deceive the public servants. It is to yourselves that you must look for safety and the means of guarding and perpetuating your free institutions. In your hands is rightfully placed the sovereignty of the country and to you everyone placed in authority is ultimately responsible. It is always in your power to see that the wishes of the people are carried into faithful execution, and their will, when once made known, must sooner or later be obeyed. And while the people remain, as I trust they ever will, uncorrupted and incorruptible and continue watchful and jealous of their rights, the government is safe, and the cause of freedom will continue to triumph over all its enemies.

But it will require steady and persevering exertions on your part to rid yourselves of the iniquities and mischiefs of the paper system and to check the spirit of monopoly and other abuses which have sprung up with it and of which it is the main support. So many interests are united to resist all reform on this subject that you must not hope the conflict will be a short one nor success easy. My humble efforts have not been spared during my administration of the government to restore the constitutional currency of gold and silver; and something, I trust, has been done toward the accomplishment of this most desirable object. But enough yet remains to require all your energy and perseverance. The power, however, is in your hands, and the remedy must and will be applied if you determine upon it."

Andrew Jackson, Farewell Address, March 4, 1837

18 April 2010

JP Morgan Responds to Calls for Goldman Investigation By Warning Germany on Banking Regulation, Asks for More Influence On European Politicians

'"When profits fall too sharply then capital will move somewhere else, where there is more money to be earned, for example non-regulated markets," Chief Executive Jamie Dimon said in the German mass circulation Sunday paper Welt am Sonntag. "The question is, is that what regulators want?"... he also said the banking industry could do with more influence on politicians." Reuters

In response to calls for an investigation of Goldman Sachs and tighter regulations on the Wall Street Banks, the CEO of JP Morgan has delivered fresh promises of financial damage if the Banks are restrained in their derivatives dealings by government regulation, and even more arrogantly, demanded greater access to European politicians.

Germany would do well to send a strong message that the European government will not be intimidated by financial threats and manipulation by foreign banks, no matter how powerful in both size and political connections.

Appeasement does not work against unbridled greed and pervasive fraud. It picks its victims, one by one, but none are safe.

The solution to this is simple. Take away the power of the large Multinational Banks to sway markets with their enormous derivatives positions.

They seek to control you by controlling your currencies and the issuance of debt. This is nothing new, except for the scale and power of a few Banks, most of which are US based.

This interview could be the result of a cultural misunderstanding. The New York Bankers are accustomed to threatening the US politicians and people if they do not get their way. This is what they had done when they received their trillions in public money with much secrecy and little accountability

Break the Banks up, and put them to the traditional task of allocating capital to commercial markets. If the US will not reform the financial system, ban them from any banking activities in your region.

Change the dollar reserve currency system which is firmly in the hands of the Wall Street money center banks, their friends at the Treasury and in the Congress, and their employees at the Fed.

Do it now while you still can.

Reuters

JPMorgan chief warns of overregulation

By Vera Eckert

April 18, 2010

(Reuters) - The head of JPMorgan Chase & Co (JPM.N) in a German newspaper interview on Sunday turned against the possibility of stricter bank regulation and asked for better access for bankers to politicians.

"When profits fall too sharply then capital will move somewhere else, where there is more money to be earned, for example non-regulated markets," Chief Executive Jamie Dimon said in the German mass circulation Sunday paper Welt am Sonntag.

"The question is, is that what regulators want?," said Dimon who heads the second-largest U.S. bank.

Dimon has been an outspoken critic of the Obama administration's proposed financial regulatory reforms, particularly of a proposed bailout fee on big banks which he has called a "punitive bank tax."

In the German interview, he also said the banking industry could do with more influence on politicians.

Both the industry and government wanted what was best for their country and the economic system but there were areas where the banks lacked possibilities to demonstrate their arguments to politicians and supply them with the right facts, he said.

10 November 2009

Willem Buiter Apparently Does Not LIke Gold, and Why Remains a Mystery

Dr. Willem Buiter of the London School of Economics, and advisor to the Bank of England, has written a somewhat astonishing broadsheet attacking of all things, gold.

I have enjoyed his writing in the past. And although he does tend to cultivate and relish the aura of eccentric maverick, it is generally appealing, and his writing has been pertinent and reasoned, if unconventional. That is what makes this latest piece so unusual. It is a diatribe, more emotional than factual, with gaping holes in theoretical underpinnings and historical example.

I suspect that commodities such as oil and gold are giving many western economists with official ties to government monetary committees a stomach ache these days. Perhaps this is just another manifestation of statists and financial engineers facing the music, as illustrated by the second piece of news from Mr. Buiter on the US dollar, from earlier this year.

Here are relevant excerpts from his essay, with my own reactions in italics.

Financial Times

Gold - a six thousand year-old bubble

By Willem Buiter

November 8, 2009 6:02pm

"Gold is unlike any other commodity. It is costly to extract from the earth and to refine to a reasonable degree of purity. It is costly to store."This is inherent to its rarity. It is desirable because it is scarce and useful, and this requires greater protection against theft or accident. Euro notes are far more costly to store than the paper and ink which is used to make them, at least for now.

"It has no remaining uses as a producer good - equivalent or superior alternatives exist for all its industrial uses."

This is an absolute howler to anyone who cares to look into industrial metallurgy. Gold is one of the most malleable and ductile of metals, with excellent conductive properties, slightly less than silver and copper, but is remarkably resistant to oxidation; that is, it does not tarnish. It is widely used in electronic and medical applications for example. What limits its use is that it is scarce, it is expensive, and that there are other competing uses, not that superior solutions have been discovered based on their fundamental merits."It may have some value as a consumer good - somewhat surprisingly people like to attach it to their earlobes or nostrils or to hang it around their necks. I have always considered it a rather vulgar metal, made for the Saturday Night Fever crowd, all shiny and in-your-face, as opposed to the much classier silver, but de gustibus…"

"Because to a reasonable first approximation gold has no intrinsic value as a consumption good or a producer good, it is an example of what I call a fiat (physical) commodity. You will be familiar with fiat currency. Unlike what Wikipedia says on the subject, the essence of fiat money is not that it is money declared by a government to be legal tender.Silver is indeed an attractive metal, and had been used for jewelry and coinage throughout history for its unique characteristics. Silver was the metal of the common man, and gold was the metal of kings because of its greater beauty and scarcity.

The garishness and lower class status of gold is of course reflected throughout history, in the funereal artifacts of the Pharoahs, the Ark of the Covenant, the mask of Agamemnon and the adornments of Helen of Troy, the exquisite beauty of the Emperors of China, and the treasure of the Aztecs. Perhaps Willem is merely used to the cheap 'bling' being sold in market stalls, and should occasionally shop on High Street for better goods.

It need not derive its value from the government demanding it in payment of taxes or insisting it should be accepted within the national jurisdiction in settlement of debt. Instead the defining property of fiat money is that it has no intrinsic value and derives any value it has only from the shared belief by a sufficient number of economic actors that it has that value.

The “let it be done” literal meaning of the Latin ‘fiat’ should be taken in the third sense given by the Online Dictionary: 1. official sanction; authoritative permission; 2. an arbitrary order or decree; 3. Chiefly literary any command, decision, or act of will that brings something about."

I don’t want to argue with a 6000-year old bubble. It may well be good for another 6000 years. Its value may go from $1,100 per fine ounce to $1,500 or $5,000 for all I know. But I would not invest more than a sliver of my wealth into something without intrinsic value, something whose positive value is based on nothing more than a set of self-confirming beliefs.This is where Willem's tortured reasoning reaches a crescendo of nonsense. Firstly, we have already shown that gold has many industrial and decorative uses contrary to his misstatements, and has been valued throughout recorded history in its own right in diverse societies and cultures.

By his definition anything that is priced by the market is fiat. It is a broadening of the definition so as to make it completely useless, or a narrowing of the definition to a few 'essentials' by some unstated arbitrary measure so again to make it useless.

The definition of fiat with regard to an instrument of the state is perfectly well known, despite his attempt to distort it. The ruling authority makes a decree, and so let it be done based on that power. Willem seems to confuse a fiat currency with barter, or some traditional custom of value. What is customary is not 'fiat' but a popular convention ordinarily for fundamental reasons.If a valuation is highly peculiar to a region and time it might be an eccentricity, like tulipmania or ladies fashions. But calling a mania a "fiat" degrades the language in an Orwellian manner, because one comes from the people and is popular, and the other from the authorities and is often embodied in the laws.

If something has universality, the likelihood is that it is well-founded on an essential reasonableness, satisfying some basic need and utility. People desire a store of value that is stable and reliable everywhere and anytime, and not subject to the vagaries of the local ruling elite. And the judgement of the history is that nothing fulfills that desire better than gold, or gold in combination with silver.

If a price is established by law without regard to the market, it is 'fiat.' That is the difference between a decision of the marketplace and a regulation from a ruling authority. No wonder English banking is in such a mess, if this is their conception of valuation. They can no longer see any substantial difference between the will of the people and the diktat of the state.

The best way to explain this perhaps is by example. Let us imagine that tomorrow young Tim of the US Treasury announces that the US government will no accept Federal Reserve notes in payment of legal debts, public or private, and that further the US was issuing a new currency called the amero for which Federal Reserve notes would be redeemed at 100 to 1, that is 100 FRNs for one amero.

What would the market price of Federal Reserve Notes around the world do in response to this? Is this outlandish? No it is remarkably common in the history of paper currencies. I witnessed this personally while in Moscow during the collapse of the Russian rouble in the 1990s, and it made a distinct impression.

And what if young Tim decreed tomorrow that the US would no longer accept gold for taxes or provide as payment for its debts? Oops, too late. Nixon did that in 1971. And gold is now at $1,100 per ounce versus about $45 then.

A fiat currency is an instrument of debt, a bond of zero maturity, an IOU. It has a counterparty risk, and is not sufficient in itself.

That, Willem, is what is meant by fiat, the contingency of value upon some official source. If it were possible let Willem and I go back in time to ancient China, or even Victorian England, he with his pockets filled with euros, and mine with Austrian gold philharmonics, and we will see whose definition of value stands the better.Governments can effect the price of any commodity negatively, by force of law, but its value is not contingent on government backing per se, except in instance of subsidy, but based on the utilitarian decision of the marketplace. Governments do not force people to buy gold, except indirectly through reckless management of the national economy. They do often compel a people to perform their economic transactions in the official currency however, so that it may be taxed, directly by percent, or indirectly through inflation.

Or as George Bernard Shaw put the proposition, "You have a choice between the natural stability of gold and the honesty and intelligence of the members of government. And with all due respect for those gentlemen, I advise you, as long as the capitalist system lasts, vote for gold."

It is fortunate indeed that Willem does not wish to argue this point, because his proposition on this score smacks of mere petulance. In the words of financier Bernard Baruch, "Gold has worked down from Alexander's time... When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory." And he is right, unless you are looking at history with very selective contortions.

There are also historical benchmarks for the value of gold, that being one ounce of gold for a man's suit of fine clothing that holds remarkably well. How then could anyone say that gold is in 'a six thousand year bubble?'

But why such an odd, almost hysterical essay now, with such an outlandish title unsupported by any data?

It is probably simply the rankling irritation that all statists and financial engineers feel when confronted by something that resists their control and manipulation. Or it may be related to some unfortunate decisions made by the Bank of England, or the Bundesbank, to enter into trades with the people's gold on the well-intentioned advice of their economists, a decision which is now coming back to haunt them, causing them to peer into an abyss of public anger.

Who can say. But there is a time of uncertainly in stores of wealth and currency coming. Below is a news article from earlier this year about a European economist named Buiter, who is predicting that the US dollar will collapse. That is because the US dollar is contingent on the actions of the Obama Administration, the Congress, and the Federal Reserve.

And gold is not, unless the US begins to emulate Herr Hitler. "Gold is not necessary. I have no interest in gold. We will build a solid state, without an ounce of gold behind it. Anyone who sells above the set prices, let him be marched off to a concentration camp. That's the bastion of money."

And Willem, if you do not understand that, the principle of the contingency of fiat money, you understand nothing of economics. But I think you do understand it. Perhaps you are merely grumpy and out of sorts today, having eaten a bad sausage, with a case of dyspepsia. It does happen, off days and intemperate remarks, but not to eminent Financial Times columnists and distinguished professors when they wish to be heard on important matters.

It seems as though Mr. Buiter just doesn't like what gold is doing right now, rising in price, and the real story may lie in why he and the brotherhood of western central bankers are so concerned about it.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore, at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The U.S. Fed was very active in getting the gold price down. So was the U.K." Eddie George, Governor Bank of England, in a conversation with CEO of Lonmin, September 1999Financial Times

Willem Buiter warns of massive dollar collapse

By Edmund Conway

5:34PM GMT 05 Jan 2009

Americans must prepare themselves for a massive collapse in the dollar as investors around the world dump their US assets, a former Bank of England policymaker has warned.

"...Writing on his blog , Prof Buiter said: "There will, before long (my best guess is between two and five years from now) be a global dumping of US dollar assets, including US government assets. Old habits die hard. The US dollar and US Treasury bills and bonds are still viewed as a safe haven by many. But learning takes place."

He said that the dollar had been kept elevated in recent years by what some called dark matter" or "American alpha" - an assumption that the US could earn more on its overseas investments than foreign investors could make on their American assets. (I think it is related to a subsidy, a kind of droit de seigneur, granted to the dollar by the central banks as their reserve currency in lieu of a gold standard. And that is the regime that is collapsing with the overhang characteristic of a Ponzi scheme. - Jesse) However, this notion had been gradually dismantled in recent years, before being dealt a fatal blow by the current financial crisis, he said.

"The past eight years of imperial overstretch, hubris and domestic and international abuse of power on the part of the Bush administration has left the US materially weakened financially, economically, politically and morally," he said. "Even the most hard-nosed, Guantanamo Bay-indifferent potential foreign investor in the US must recognise that its financial system has collapsed."

He said investors would, rightly, suspect that the US would have to generate major inflation to whittle away its debt and this dollar collapse means that the US has less leeway for major spending plans than politicians realise..."

05 October 2009

China May Lead Coalition of Nations to Topple the US Petrodollar

It does make sense that this would happen, and many including ourselves have been forecasting this outcome as a viable trigger for a significant, but orderly, dollar devaluation.

It does make sense that this would happen, and many including ourselves have been forecasting this outcome as a viable trigger for a significant, but orderly, dollar devaluation.

The US has violated the premise under which the Dollar served as the world's reserve currency. As Alan Greenspan himself said, the US Dollar regime worked because it was managed as though it was still under an external monetary standard, mimicking the rigor of a hard currency while maintaining a flexibility for monetary policy adjustment. We questioned the veracity of that claim when he made it, but it was the appearance, if not the reality, of responsibility and discipline that made things work for the monetary wizards.

Ironically enough, the closet goldbug Mr. Greenspan shattered that discipline with a gearing up of financial engineering in response to economic and trading crises starting with 1987 and reaching higher notes with LTCM and the Asian currency crisis.

China devalued the yuan against the dollar, and was able to promote an aggressive program of industrialization through multinationals like Walmart who desired cheap labor. The Chinese were able to persuade Bill Clinton and then George Bush to grant them favored nation trading status, without the condition of a freely traded currency. This allowed China to import manufacturing jobs, and made the US politicians and financiers happy with their personal donations and profits.

The dogs of war were loosed by the Fed in 2002 with a remarkably reckless expansion of debt through over easy interest rates, with an explosion of fraudulently rated US dollar financial assets from an Anglo-American banking system grown utterly corrupt and in full bloom of a credit bubble.

Bernanke has taken the dollar into its endgame, while insiders grab fistfuls of dollars and quietly sell their financial assets behind the scenes during this recent market rally. Obama and his team are either corrupt or incompetent. The same can be said of his two predecessors, at least.

"The capitalists will sell us the rope with which we will hang them."However this plays out over the next nine years, it will be history in the making, and interesting to say the least. It will be neither straightforward, nor easy, nor transparent to the public. But it seems inevitable that the days of Empire based on dollars backed by oil and global military reach are over and gone-- until the next time.

Vladimir Ilyich Lenin

The Independent UK

The demise of the dollar

By Robert Fisk

Tuesday, 6 October 2009

In a graphic illustration of the new world order, Arab states have launched secret moves with China, Russia and France to stop using the US currency for oil trading

In the most profound financial change in recent Middle East history, Gulf Arabs are planning – along with China, Russia, Japan and France – to end dollar dealings for oil, moving instead to a basket of currencies including the Japanese yen and Chinese yuan, the euro, gold and a new, unified currency planned for nations in the Gulf Co-operation Council, including Saudi Arabia, Abu Dhabi, Kuwait and Qatar.

In the most profound financial change in recent Middle East history, Gulf Arabs are planning – along with China, Russia, Japan and France – to end dollar dealings for oil, moving instead to a basket of currencies including the Japanese yen and Chinese yuan, the euro, gold and a new, unified currency planned for nations in the Gulf Co-operation Council, including Saudi Arabia, Abu Dhabi, Kuwait and Qatar.Secret meetings have already been held by finance ministers and central bank governors in Russia, China, Japan and Brazil to work on the scheme, which will mean that oil will no longer be priced in dollars.

The plans, confirmed to The Independent by both Gulf Arab and Chinese banking sources in Hong Kong, may help to explain the sudden rise in gold prices, but it also augurs an extraordinary transition from dollar markets within nine years.

The Americans, who are aware the meetings have taken place – although they have not discovered the details – are sure to fight this international cabal which will include hitherto loyal allies Japan and the Gulf Arabs. Against the background to these currency meetings, Sun Bigan, China's former special envoy to the Middle East, has warned there is a risk of deepening divisions between China and the US over influence and oil in the Middle East. "Bilateral quarrels and clashes are unavoidable," he told the Asia and Africa Review. "We cannot lower vigilance against hostility in the Middle East over energy interests and security."

This sounds like a dangerous prediction of a future economic war between the US and China over Middle East oil – yet again turning the region's conflicts into a battle for great power supremacy. China uses more oil incrementally than the US because its growth is less energy efficient. The transitional currency in the move away from dollars, according to Chinese banking sources, may well be gold. An indication of the huge amounts involved can be gained from the wealth of Abu Dhabi, Saudi Arabia, Kuwait and Qatar who together hold an estimated $2.1 trillion in dollar reserves.

This sounds like a dangerous prediction of a future economic war between the US and China over Middle East oil – yet again turning the region's conflicts into a battle for great power supremacy. China uses more oil incrementally than the US because its growth is less energy efficient. The transitional currency in the move away from dollars, according to Chinese banking sources, may well be gold. An indication of the huge amounts involved can be gained from the wealth of Abu Dhabi, Saudi Arabia, Kuwait and Qatar who together hold an estimated $2.1 trillion in dollar reserves.The decline of American economic power linked to the current global recession was implicitly acknowledged by the World Bank president Robert Zoellick. "One of the legacies of this crisis may be a recognition of changed economic power relations," he said in Istanbul ahead of meetings this week of the IMF and World Bank. But it is China's extraordinary new financial power – along with past anger among oil-producing and oil-consuming nations at America's power to interfere in the international financial system – which has prompted the latest discussions involving the Gulf states.

Brazil has shown interest in collaborating in non-dollar oil payments, along with India. Indeed, China appears to be the most enthusiastic of all the financial powers involved, not least because of its enormous trade with the Middle East.

China imports 60 per cent of its oil, much of it from the Middle East and Russia. The Chinese have oil production concessions in Iraq – blocked by the US until this year – and since 2008 have held an $8bn agreement with Iran to develop refining capacity and gas resources. China has oil deals in Sudan (where it has substituted for US interests) and has been negotiating for oil concessions with Libya, where all such contracts are joint ventures.

Furthermore, Chinese exports to the region now account for no fewer than 10 per cent of the imports of every country in the Middle East, including a huge range of products from cars to weapon systems, food, clothes, even dolls. In a clear sign of China's growing financial muscle, the president of the European Central Bank, Jean-Claude Trichet, yesterday pleaded with Beijing to let the yuan appreciate against a sliding dollar and, by extension, loosen China's reliance on US monetary policy, to help rebalance the world economy and ease upward pressure on the euro.

Ever since the Bretton Woods agreements – the accords after the Second World War which bequeathed the architecture for the modern international financial system – America's trading partners have been left to cope with the impact of Washington's control and, in more recent years, the hegemony of the dollar as the dominant global reserve currency.

The Chinese believe, for example, that the Americans persuaded Britain to stay out of the euro in order to prevent an earlier move away from the dollar. But Chinese banking sources say their discussions have gone too far to be blocked now. "The Russians will eventually bring in the rouble to the basket of currencies," a prominent Hong Kong broker told The Independent. "The Brits are stuck in the middle and will come into the euro. They have no choice because they won't be able to use the US dollar." (Look for the NWO to start making a stronger play to control the EU - Jesse)

The US discussed the trend briefly at the G20 summit in Pittsburgh; the Chinese Central Bank governor and other officials have been worrying aloud about the dollar for years. Their problem is that much of their national wealth is tied up in dollar assets.

"These plans will change the face of international financial transactions," one Chinese banker said. "America and Britain must be very worried. You will know how worried by the thunder of denials this news will generate."

Iran announced late last month that its foreign currency reserves would henceforth be held in euros rather than dollars. Bankers remember, of course, what happened to the last Middle East oil producer to sell its oil in euros rather than dollars. A few months after Saddam Hussein trumpeted his decision, the Americans and British invaded Iraq.

24 August 2009

Why Is the Fed Creating Excess Reserves in the Banking System and Paying Interest on Them?

There have been some interesting side discussions at various venues including Naked Capitalism about the recent essay which I had posted titled When At First You Don't Succeed, Bring in the Reserves.

Let me clarify some points.

Yes, banking reserves in the US are a function of the Fed's Balance Sheet, by definition, because they are in the narrowest sense merely an accounting function, an entry on the books of the Fed reflecting actions undertaken by the Fed.

With purpose, I put the formal definitions of Reserve Bank Credit and Reserve Balances at the bottom of each chart. I had hoped this would make that point clear.

The essence of the essay was to point out the enormous increase in bank reserves which the Fed has created through their "New Deal for Wall Street" style banking programs. Because of this, the Fed has created a new function by which it pays interest on banking reserves, which to my knowledge it has never done before.

It is a new function at the Fed, and it does serve a important purpose. The purpose is to place a 'floor' under interest rates, in the face of a surfeit of liquidity which the Fed has created, and which shows up in the Adjusted Monetary Base, the Reserve Bank Credit figures, and so forth.Now, some people have taken issue with my bringing the notion of excess Reserves to your attention for a variety of reasons. Even the mighty NY Fed has written a paper which attempts to defuse the notion that the excess reserves are indicative of anything that might be impeding lending.

Let me be clear about this.

The excess reserves are absolutely indicative of the Fed's having added substantial amounts of liquidity to the financial system. If the Fed were not paying interest on reserves, this liquidity would crush their target interest rates, since the banks are loath to hold reserves that are not generating some return. This is what they do, generate a return on capital. Capital has a price, even if it is an opportunity cost.

By establishing a floor, the Fed is setting a more blatant artificial level for interest rates, moreso than merely tinkering with drains and adds to the system. They are offering a riskless rate of return, and crowding out other competing requests for capital. Not necessarily a bad thing, but a reality of what they are doing.

What would happen if the Fed raised the interest rate it pays on reserves to let's say, twenty percent?

Economic activity in the US would grind to a halt, as banks placed every available dollar idly with the Fed's program, eschewing all other deals, liquidating assets if necessary, to place capital where it would receive the highest risk adjusted return. In essence, the Fed would 'crowd out' all other transactions that offered a lower risk adjusted return.

What if the Fed subsequently lowered the interest rate from twenty percent to zero? It would then enable more lending from the banks, as they sought to deploy their capital at higher risk adjusted rates.

There are some by the way that claim the excess reserves are so high because there is no demand for loans. This is a point of view only supported by those who a) have no understanding of finance and b) are seeking to support an extremely odd and mistaken view of the economy which seeks to justify their bets on a serious deflation.

There is always a demand for loans as long as there is economic activity; what varies is the price! Money is not particularly inelastic; that is, there is a rather high threshold at which people say, "I have too much!" It is rather a question of price, relative to return. Make the opportunity cost high enough and they will come (or be fired).

I hereby assert that I will borrow ALL funds the Fed might loan to me with no collateral at zero interest, and gladly so, as long as the short term US Treasury bills are paying more than 25 basis points interest. I reserve the right to defer on this offer if the Fed should make the policy error of hyperinflation a reality.

I hate to make points like this in the extreme with distorted examples, but sometimes it is what it requires to pierce through obfuscation to common sense.So to summarize, what is the Fed likely to do if economic activity falters?

They are likely to lower interest rates paid on excess reserves closer to zero. They could even charge a 'haircut' on excess reserves which would highly motivate the banks.

These are all things which have been discussed before, often in the context of consumers! In fact, it is well known among bankers that as the Fed lowers interest rates money flows out of lower paying instruments like bank deposits and money markets, and into higher paying instruments that might be deemed too risky at high rates of riskless return. Such higher paying instruments are known as "stocks" and "corporate bonds." As former central banker Wayne Angell gleefully chortled in 2004, the Fed can indeed drive the public out of their savings and money market funds and into the equity markets by manipulating interest rates.

Does the Fed always 'create' excess reserves? It may be more correct to ask, does the Fed always create money, since excess reserves are an accounting function.

No. Banking reserves normally lag the creation of money, which is accomplished by lending, either from banks or more recently by neo-banks like Fannie, Freddie, GMAC, GE and so forth.

But at a time when economic activity is contracting, and the credit markets were seizing, the Fed took the lead in money creation by "monetizing" various types of debt. And they are going to enormous pains to maintain 'confidence' in the system and in particular the US dollar and debt. But we may ask, at what point does the confidence game become a con game? I would submit that it is when the Fed and Treasury purposely intervene in markets, beyond their normal interest rate targeting, and statistics and spread disinformation to manage perception.There are other ways in which the Fed might address the failure of the productive economy to 'pick up the ball and run with it.' But most, if not all, of them involve the monetization of something, which is what happens when the Fed (and US Treasury) are taking the lead in money creation and not the productive economy.