"Those who think there is little risk of a levy being imposed on other periphery members are missing the point. The seeds of doubt have been planted. As a saver facing zero yields on deposits and a potential haircut, why keep your savings in a bank? Sure it is convenient for electronic transactions, but individuals can adapt easily. As one of my more amusing colleagues put it, 'mattresses now hold a 10 per cent premium.'"

Ben Davies, Cyprus, Oh the Irony!

"Making small-scale savers pay is extremely dangerous. It will shake the trust of depositors across the Continent. Europe's citizens now have to fear for their money...

The Spaniards, Italians and Portuguese may not run to the banks today or tomorrow, but as soon as the crisis intensifies in a euro-zone country, the bank customers will remember Cyprus. They will withdraw their money and, by doing so, intensify the crisis."

Peter Bofinger, 'Europe's Citizens Now Have to Fear for Their Money,' Der Spiegel, 18 March 2013

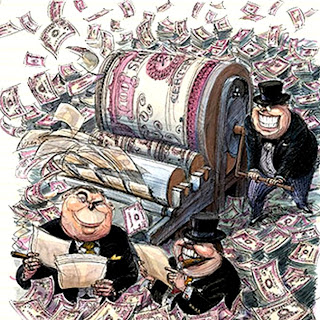

Modern money is a game of confidence, an arrangement based wholly on the perception of value founded in counterparty risk.

This sounds easy enough, but what is surprising is how few people really understand it. This is due to the illusion of the familiar.

We are so accustomed to using money in our daily lives that we give little thought to what it really is. It seems solid, immutable, and lasting. 'As sound as a dollar.'

We forget that money, like much of society, is a man-made, artificial construction based on a series of agreements. Sometimes those agreements are based on implied force, such as punishment for breaking the laws. But by and large the enforcement is not equipped to deal with all but the outliers to a general compliance with the law. This is, of course, the basis of the power of civil disobedience, and why autocracies are so sensitive to any mass demonstrations of dissent.

The President of Cyprus, Nicos Anastasiades, recently elected from the conservative DISY party, blanched at the original bailout deal offered by the

troika, the European Commission, the European Central Bank, and the International Monetary Fund, to assess a levy only on the non-guaranteed deposits in the troubled Greek banks, which are those deposits in excess of €100,000.

He proposed instead to limit the levy on large deposits to 9.9%, and to make up the difference by violating what had been the general guarantee in Europe by assessing a lesser amount, of about 6.7%, on the 'guaranteed deposits' of less than €100,000 by small savers. That the troika did not blanch at the prospect of violating what had been a generally established EU policy to ensure bank stability speaks volumes about their cravenness.

The arrangement was made all the more clever by promising equity in the (worthless) banks in return for the levy, and perhaps even a guarantee of return based on 'future natural gas discoveries' which seem to be of much less value to the EU and the government.

This was one of their conditions for a €10 billion loan to the government under the European Stability Mechanism (ESM). The other involved the usual austerity measures, which are a favorite of the International Monetary Fund.

The austerity proposal had been revealed last November and include cuts in civil service salaries, social benefits, allowances and pensions and increases in VAT, tobacco, alcohol and fuel taxes, taxes on lottery winnings, property, and higher public health care charges.

The troika did not care about the details of the levy as long as the 'bail in' by depositor funds occurred. This was a sacrifice of a general European principle and was a serious policy error.

When this 'levy' on bank deposits was revealed over the weekend during a bank holiday, because it had to be submitted to a vote by the Cypriot Parliament, there was a general revulsion expressed amongst the markets and the people of Cyprus at such blatant misuse of the money power.

Monetary inflation, such as had been used in the US and UK, is more often used because so few people see their loss as blatantly as when the government simply confiscates 10 percent of their wealth on deposit. It is much easier done in smaller amounts, over longer periods of time. But one needs to have their own currency to do it. These days monetary policy and inflation is merely the continuation of bank fraud and plunder by other means.

By the way, this is why I thought the 'platinum coin' of a notional and whimsical trillion dollars in value was such an awful, dangerously cynical idea. It exposed the farce of monetary inflation in too great an amount, in too short a period of time, in a way in which too many people would readily understand it. And it therefore had the potential of fomenting a money panic.

Cyprus had been reasonably stable before the financial collapse, but was rocked by the Greek bond restructuring. What dealt a fatal blow was the impediment to borrowing because of a credit downgrade to BB+, which made the Cypriot bonds unacceptable as collateral to the ECB, and certainly not viable on the public markets.

And like many small, warm weather island nations, it's economy was overly dependent on tourism, retirement, and an outsized financial sector. Since Cyprus had been a British crown colony, its legal system resembles that of Britain, which still maintains significant military bases on the island, involving approximately 3,500 serving members.

Cyprus is in a bit of a box, because it really needs to leave the Eurozone and default on its obligations, and issue a currency of its own at a devaluation to the euro. But how would they recapitalize their banks, and what would the basis be for any reasonable valuation on this new currency?

If Cyprus owned gold reserves, or even forex reserves of some stable currency, they could make this the basis of their currency, while imposing capital controls. They could liquidate, nationalize if you will, the banks, and keep the depositors whole. Although the conversion to the new Cyprus currency would be a haircut of sorts, and likely impair their banking haven status.

Iceland was able to do something like this, and so was Russia for that matter, when they defaulted, devalued, and reissued the rouble back in the 1990's.

What would the Eurozone say if Cyprus forged a deal with Russia and provided them with military bases similar to the Sovereign Base Areas, currently occupied by the British, in return for a Russian bailout? Russia is a key debtholder and a major stakeholder in Cyprus. Their interests and presence must be dealt with, and carefully.

The question of Cyprus is important, not because it is a large and significant portion of the Eurozone economy. It is most certainly not, being much less than one percent of the total.

Rather, Cyprus is showing the fatal flaws in the conception of the Eurozone, and their single currency without real fiscal union, transfer payments, a common system of taxation, and a banker of last resort.

And it has also demonstrated the weakness of the guarantees by the bureaucrats, not only in Europe but elsewhere, when it comes to money.

This is a lesson that every central banker around the world should keep in mind. And the bureaucrats should remember that there is a step beyond which they may go, which will shatter the confidence of the people. And once that confidence is broken, it is very hard to recover it.

There is one lesson I hope that the people of the world take away from this. And that is to remember that a single currency is not possible without a complete union of monetary policy, and therefore a fiscal and political union that is complete and comprehensive. Otherwise a powerful group will wield monetary policy for their own benefit, and the rest of the currency area be damned.

When the single world currency proponents come around again with their proposals, what they are really proposing is a one world government to be established in the ensuing crisis which their actions will eventually provoke.

And despite the consistent capping of the precious metal markets, it demonstrates that there is only one money of last resort, that provides for no counterparty risk. And that is gold. And to a lesser extent the reserve currency of the world, which for now is the dollar.

It is confidence that sustains the integrity of a system based on counterparty risk, and it is that confidence that supports modern money. And where confidence declines, force is required. And where both force and faith fail, a break in confidence happens, and hyperinflation ensues. Hyperinflation is not simply a very high level of inflation.

A hyperinflation is a break in confidence, a monetary panic.

And in what is certainly a bit of historic irony, the German people are once again flirting with bank failures and a hyperinflation. But in this case it is because they, in their righteous indignation, are imposing the same kind of collective punishment, in terms and conditions of economic austerity and privation on others, that were imposed on them in post war reparation. Oh the irony, indeed.

Spring is in the air

. Plus ça change, plus c'est la même chose.

Related:

New Zealand Adopts 'Cyprus style' Levies to Protect Their Banks From Insolvency