I have had some interesting discussions recently with correspondents about the problem which China has with its very large US dollar reserves.

To summarize what I think, China is attempting to diversify their portfolio of US Treasury dollar holdings. They are obviously accumulating 'real goods' including stockpiles of basic materials, gold, silver, oil and investments in the means of production in their own region and in key regions around the world.

This is more difficult than it might appear on the surface. Real goods are often strategic, and governments are sometimes reluctant to allow them to be acquired by a government considered a potential threat. The first difficulty is the strategic importance of some assets, such as the China's offer for the purchase of Unocal.

But there is also a need for confidentiality, stealthiness if you will. If word were to leak out that 'China is dumping its Treasuries' there would be a run on the market and the Chinese could lose a portion of their reserve wealth rather quickly.

Now, would it matter. Well, yes. It would matter because US dollars are still the currency of choice for most international trade including the all important international commodity, oil. If you think that philosophically dollars have no value because they are just paper, I would be more than happy to dispose of them for you. Limited time offer, of course.

I also posited that China, while accumulating its real goods quietly against the constraint of perturbing the markets, could do short term hedges against the less catastrophic scenario of further dollar devaluation by going into the very deep and liquid financial assets markets, and hedging risk with CDS and other obvious investments including shorts of various types.

As anyone who has attempted to acquire a company or take a substantial position in or out of an asset or company, at some point you can affect the price, making other participants aware that the asset is in play, and end up selling or buying against yourself. In the case of China it could also trigger a run on the bank of the US, which is an immediate endgame.

With regard to the use of financial instruments, someone raised the obvious issue of counter party risk. Well, of course it is an issue. But less so if you are merely hedging a portion of the portfolio for the devaluation scenario, and not a catastrophic default. And the choice of counter parties can be managed to some degree. It is a big world out there and the Swiss are always open for a bet.

But correctly, if there is a catastrophic failure of the dollar, they will be carrying banks and brokers around the world out on stretchers and almost all financial assets, or bets, will be in default. Those who are holding leap puts as insurance against a collapse may as well be holding food vouchers for a restaurant in Brigadoon.

China would most likely not lose the value of its reserves in the extreme case of a US default, even if every one of their remaining Treasuries and the financial hedges on those Treasuries became worthless. Why?

It's the Goldfinger Syndrome. As you may recall, Auric Goldfinger did not wish to steal the US gold supply, at that time the currency of the nation, from Fort Knox. He merely wished to eliminate it, making his own substantial gold holdings significantly more valuable. It is a form of increasing value through deflation, a concept that is much more familiar these days thanks to quite a few amateur economists patiently waiting for the US dollar to gain in value because of it.

If the US were to actually default, the value of real goods, from basic materials to gold and silver and oil, would absolutely soar in terms of dollars of course, but in most other fiat currencies of the developed world as well. The perception of the risk of a fiat currency would border on hysteria.

Returning to the deflation meme, the elimination of US financial assets from the 'world currency base' would make all the other currencies extremely valuable, and China would be flush with them. For real goods are a form of currency suitable for the exchange of wealth. They are merely less liquid, and not often used as the unit of value anymore. But real goods are a form of currency. They just cannot be printed, except perhaps on the Comex and at the LBMA it appears, and they would be absolutely discredited and out of business.

So, that is something to think about. China need do nothing but slowly and stealthily acquire real goods, and hedging their positions along with way with financial instruments, waiting for the US to play itself into some beneficial outcome for them. I think the financial hedging is important because of the relative illiquidity of some of the real goods, and the difficultly of acquiring them in sufficient supply without triggering a 'run on the dollar.' The financial markets are deeper and more discreet than the markets for real goods.

The problem facing the holders of dollars is not inflation or deflation, per se. They are merely particular manifestations of currency risk, and the uncertainty of holding substantial assets denominated in a fiat currency that is risky, meaning something abnormal or unstable in the classic sense of the term. A serious deflation or inflation are both unusual and risky.

This is not hair-splitting. Rather it is essential to understanding why gold can increase in value during periods of both a significant deflation and inflation, which on the surface seem like opposites. In fact they are similar if view in the terms of probability. They are both the opposite of currency stability, what I call currency risk. The further one gets out on the probability curve with a currency, the better gold looks in relation to it. Gold is the ultimate in stability, almost inert, and highly resistant to corrosion and decay, bordering on the timeless, comparatively uniform in its supply.

There are those who say that when the time comes, and what is happening becomes apparent, they will buy some real goods, foodstuffs, land, gold and silver. I can assure you that when that time comes, there will be little or none available at almost any price. One has to have lived through a currency crisis first hand to understand the phenomenon.

You are holding a currency in decline and there is little or no place to spend it except as a throwaway, because no one wants it anymore. Barter becomes predominant, and any hard currency is king. This is how it was in Russia in the 1990's with the old rouble before it finally imploded, at which time I was thankfully out of country. It was quieter than you might imagine, despite the headline antics of their mafia, and a sense of quiet desperation as people watched their life savings simply evaporate.

There is almost no doubt in my mind that this is how the Chinese are playing this, and certainly Russia and a few others as well, who are playing the long game. It explains some of the recent moves in price of certain forward looking assets, a phenomenon so little understood by the many, even now.

I still see the greater probability for the US as a devaluation and a stubborn stagflation for quite a few years. But the policy errors being committed by Bernanke and the Obama Administration are making the possibility of an actual collapse more likely than I would have thought even six months ago. I suppose it is never well to underestimate the self-destructive tendencies of obsessive greed.

See also The Last Bubble: The Problem of Unresolved Debt in the US Financial System and Currency Wars: Selling the Rope

22 July 2010

China and the Goldfinger Syndrome

21 July 2010

Fiscal Union Is Implied if Not Required by a Monetary Union

In 1991 during a visit to Brussels for a discussion of the EU '92 event with some of the bureaucrats engaged in planning there, my old economics professor predicted that no matter what they said, a monetary union implies a fiscal union, greater than the targets and harmonisation which they would admit, men being the creatures that they are.

It makes sense when one understands monetary policy and its theory, and the implications it has in restricting the freedom to save or spend as one may wish to pursue as a fact of fiscal policy.

Here is a story below in which France and Germany discuss their moves to bring more uniformity to their fiscal policies. Quite frankly I am surprised that it has taken this long for it to happen. With the financial crisis tearing down the facades, the extend and pretend policies of the EU have collapsed, and the cheating behind their targets have been exposed for the farce that they are.

And by extension, if one's monetary and fiscal policies are no longer their own, but shared with another and intimately bound by a common currency, then a greater political union and independent governance is a moot point.

This is what my old professor predicted in 1991. And on the train ride back to Paris he said, "Watch what happens if there is a move to establish a single world currency that is a sovereign instrument, and not merely a reference to a basket of currencies and commodities. And then he quoted the famous observation from Mayer Rothschild: "Give me control of a nation's money and I care not who makes the laws."

It has been many years since we have spoken. He was tottering towards his retirement then, and I suspect that he is smiling at all these developments from some better and kinder vantage now, as I know he would be even if it was a profane preference. It was always his first joy to probe the subtle mysteries of money, and how they related to the political follies of men. It was he who first infused me with an interest in the study of money, an aspect of macroeconomics which bordered on his obsession. And it opened a new world to me, and an endless fascination with what is difficult, but so wonderfully, and often subtlety vast.

"Much have I travell’d in the realms of gold,

And many goodly states and kingdoms seen;

Round many western islands have I been

Which bards in fealty to Apollo hold.

Oft of one wide expanse had I been told

That deep-brow’d Homer ruled as his demesne;

Yet did I never breathe its pure serene

Till I heard Chapman speak out loud and bold:

Then felt I like some watcher of the skies

When a new planet swims into his ken;

Or like stout Cortez when with eagle eyes

He star'd at the Pacific--and all his men

Look'd at each other with a wild surmise--

Silent, upon a peak in Darien."

John Keats, On First Looking Into Chapman's Homer

LesEchos.fr

France

et Allemagne s'attaquent à l'harmonisation de leur fiscalité

La bonne gouvernance européenne implique, notamment, l'harmonisation des politiques fiscales. Paris et Berlin en font leur credo, qui ont fait un pas ce mercredi vers une convergence de leurs systèmes fiscaux, à l'occasion de l'invitation au Conseil des ministres français du ministre allemand de l'Economie et des Finances Wolfgang Schäuble.

L'objectif est que « nos deux gouvernements soient ensemble en mesure de prendre des décisions pour aller vers la nécessaire convergence fiscale, tant dans le domaine de la fiscalité des entreprises que dans celui de la fiscalité des particuliers », a annoncé l'Elysée dans un communiqué. « La convergence entre nos systèmes fiscaux est un élément essentiel de notre intégration économique et de l'approfondissement du marché intérieur en Europe », a estimé Nicolas Sarkozy. La première étape de cette convergence devrait passer par un état des lieux des deux systèmes. La Cour des comptes s'en chargerait, côté français, un organisme équivalent s'y attelant outre-Rhin.

Le plan de rigueur allemand est soumis à des risques d'exécution

Le rapprochement franco-allemand en matière de fiscalité ressemble fort, côté français, à une volonté d'aligner le système fiscal sur le modèle allemand. Le poids des prélèvements obligatoires sur l'économie est globalement inférieur chez les deux plus proches partenaires de l'UE (42,8% du PIB en France et de 39,5% en Allemagne en 2008, selon les données énoncées par Nicolas Sarkozy ce mercredi), et leur répartition y est sensiblement différente (moins d'impôt direct, mais TVA plus forte

outre-Rhin)...

11 July 2010

Jesse's Paradox: Gold Can Perform Well In Both Monetary Inflation and Deflation

The average punter understands the first graph to the right. Gold tends to increase in price in times of monetary inflation, because as an alternative store of wealth it provides a safe haven from central bank debasement of the currency.

The average punter understands the first graph to the right. Gold tends to increase in price in times of monetary inflation, because as an alternative store of wealth it provides a safe haven from central bank debasement of the currency.By monetary inflation, we do not mean the simple, nominal growth in money supply, and of course the same can be said of a simple decrease and deflation. This is obvious when one considers that money must have a natural relationship to the demand for it relative to population growth, but most importantly to the growth of real GDP.

But notice the second chart, and this is the one which so many speculators and economists miss. Gold tends to perform well when the inflation adjusted returns on the longer end of the curve are low. In other words, when the real returns on bonds are inadequate to the risk. But the risk of what?

Inflation, pure and simple. Deflation is a prelude to inflation, and sometimes a brief hyperinflation, in a fiat currency regime. And even while the nominal money supply may remain flat or even negative, the decay in the underlying assets that support it may be declining, and sometimes dramatically so.

The smarter money is not chasing the latest wiggles in the Elliot waves, or the price manipulation shenanigans of the central bankers and their minions at the bullion banks. They have been buying ahead of the increasing likelihood of a monetary event.

The underlying value of the dollars are deteriorating. So even though there might be fewer dollars nominally, in fact there should be much fewer dollars because of the contraction in GDP.

The underlying value of the dollars are deteriorating. So even though there might be fewer dollars nominally, in fact there should be much fewer dollars because of the contraction in GDP. And the quality of the assets underlying those fewer dollars are much lower quality than only a few years ago.

Gold seems to perform less well, underperforming other asset classes, in a healthy economy where the growth of money is related to the organic growth of real production and not to financial engineering. Gold seems to be a hold in 'normal' times.

I would suggest that the extraordinary price in gold now is because for many years the central banks artificially suppressed the price and the means of production for gold by selling their holdings in a conscious attempt to mask their monetization and the unreasonable growth of the financial sector. They wanted things to look 'normal' while they were becoming increasingly out of balance, especially with regard to debt and international trade balances, and so they opted for appearance versus reality.

As Fernando of the Fed would day, "It is better for the economy to look good than to be good, and dahling while we were printing money and selling the public's gold it looked marvelous!"

And what if the Fed starts allowing the 10 year Treasury yield to start rising naturally. Will that be the time to start selling gold? Probably not because the money supply would most likely be artificially increasing again, and that yield increase would be a remedial reaction. Keep an eye to negative real interest rates if you can find an indicator of inflation that has not been corrupted.

Cargo Cult Economics

People who really do not understand what is happening in a complex system sometimes react in funny ways, and suggest things that would be laughable if there were not in a relative position of power. Anyone who has worked in a large corporation will understand what funny things bosses can be when struggling to deal with complexity that they do not understand. Our duty of course is to help them, for the good of all, but sometimes that is beyond our reach, especially in dealing with Type A bosses who cannot conceive that there might be something beyond their comprehension. Since 'killing the messenger' is their reflexive reaction, their learning curves tend to be quite long, generally resolved in the insolvency of the division or even the entire company.

What I find incredibly amusing are the high priests of the economic cargo cult, dressed up in the ritualistic accoutrement's of academic credentials, sporting the codpieces of monetary policy, carrying the totems of efficient market theory, arrogant and presumptuous even in their frustration and failure. They are just so incredibly and unsuspectingly funny. I am sure history will have a good laugh over it, and for us, well at times we have to grin and bear it.

Much of what Larry Summers is doing now makes me think of Dilbert's boss. If gold is the signal of a problem in the economy, well then, let's just manipulate the price of gold. If slumping stock prices are a sign of economic deterioration, well then, lets just buy the futures and prop them up whenever they slide. See how short term and easy things can be?

This is not always humorous of course. Powerful people who are frustrated and amoral can tend to do increasingly destructive things. And then the response of the people is to try to ignore them. If necessary one must basically tell them to 'stuff it,' and give them the boot. And if they persist and start acting out, well, tyrants eventually get replaced one way or the other, but it is far too early to discuss things like that now.

When Will the Gold Bull Market End

So, the frustrated investor says, when will gold finally start topping?

Gold have topped when the smart money is convinced that the real economy is becoming naturally sustainable, robustly organic in its credit creation and allocation, and healthy in the growth of the median wage to support consumption, without subsidy or interference or new unpayable debt from the Federal Reserve, or the draconian 'taxes' from an outsized financial sector that stifles real growth.

When people are no longer obsessed with what Goldman Sachs and their ilk are doing, or what Bernanke and his merry pranksters have to say that day, then will be the time to be out of gold. I do not see even a move in that direction anywhere on the horizon. Because of the credibility trap, the impulse to reform is stifled in the corridors of power.

This is no top, and sentiment is unusually bearish. As I have said, I believe this is the base for a new leg up that is going to surprise all but a few. No one knows the future and I could be wrong.

But I do not think that I am, unless there is a new market panic and a general liquidation of all assets. The hedge funds, BIS, and the Fed can play their games, but they cannot hold back the tide of history without being overwhelmed.

13 May 2010

Why There is Fear and Resentment of Gold's Ability to Reveal the True Value of Financial Assets

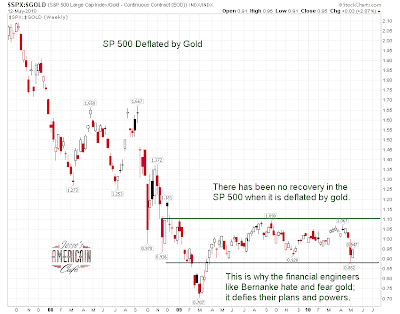

There were a few questions raised about the note on the long term chart of the SP 500 deflated by gold which was posted last night, and which is reproduced here on the right, which read "This is why the financial engineers like Bernanke hate and fear gold; it defies their plans and powers."

The chart shows something that most investors have suspected. There has been no genuine recovery in the price of stocks since the decline that cannot be fully explained by the monetary inflation of the dollar, as can be discovered by the ultimate store of value, which is gold.

The chart shows something that most investors have suspected. There has been no genuine recovery in the price of stocks since the decline that cannot be fully explained by the monetary inflation of the dollar, as can be discovered by the ultimate store of value, which is gold.I thought that this was a fairly straightforward observation, but it apparently jarred a few people and their thinking. So perhaps we have some new readers who are not familiar with the long standing animosity towards gold that is uniformly expressed by all those who promote centralized command and control economies, from both the left and the right.

Can any astute observer doubt the Fed's desire to act in secret and privacy? Their obsession with this is almost unbelievable and beyond comprehension, unless one understands that they are in a 'confidence game,' and use persuasion and even illusion to shape perceptions, especially at the extremes of their financial and monetary engineering of the real economy.

This animosity and desire for secrecy was described by Alan Greenspan in his famous essay, Gold and Economic Freedom, first published in 1966. In a fairly amusing exchange between Congressman Ron Paul and the former Chairman a couple of years ago, Mr. Paul asked Sir Alan about this essay, and if he had any corrections or misgivings about it after so many years. Would he change anything?

"Not one word." replied Greenspan, in one of his few candidly honest and straightforward statements.

It helps to understand the dynamics of the money world, which appear so mysterious to those who do not specialize in it, even economists, although some may feign ignorance to promote their cause or avoid unpleasant disclosures.

Money is power. Ownership of the means of production may provide for the control of groups of disorganized labor. But the power of the issuance of money allows for the control of whole peoples and governments, through the distribution and transference of wealth, by the most subtle of means. And this is why the US Constitution relegated this power to the Congress and by their explicit appropriation, and denied it to the States and private parties except in the form of specie, that is, gold and silver which have intrinsic value.

It might be useful to review a prior post in reaction to the self-named maverick economist Willem Buiter, who wrote a few attacks on gold, prior to his leaving academia and the Financial Times to take a senior position with Citibank. Willem Buiter Apparently Does Not Like Gold

It may seem a bit perverse, but I do not favor a return to a gold, or a bi-metallic gold and silver standard at this time. Each nation can be free to devalue or deflate their own money supply as their needs require, with the consent and knowledge of the people and their representatives.

What I do promote is for gold and silver to trade freely without restraint or manipulation as a refuge from monetary manipulation, and a secure store of value for private wealth. When nations adopt the gold standard, they invariably seek to 'fix' and manipulate its price, and reserve the ownership to themselves, with the tendency to seize the wealth of their citizen under the rationale of such an ownership, or dominant privilege.

Let those who have a mind to it have the means of securing their labor and efforts, and let the state do as it will, with the open knowledge and consent of the world.

"Gold is not necessary. I have no interest in gold. We will build a solid state, without an ounce of gold behind it. Anyone who sells above the set prices, let him be marched off to a concentration camp. That's the bastion of money."A draconian approach no doubt. It is much more common for the ruling parties to debase the coinage secretively while advantaging their friends and supporters, thereby manipulating the value of gold and silver covertly.

Adolf Hitler

In modern times of non-specie currency one might choose to select a few cooperative banks and the central money authority to manipulate the price using paper and markets, and hope that this scheme will remain undiscovered. But it always comes out, the truth is always known in the end.

"With the exception only of the period of the gold standard, practically all governments of history have used their exclusive power to issue money to defraud and plunder the people."There are any number of amateur economists and investing pundits around these days who betray an almost irrational opposition to gold, becoming jubilant in every decline, and despondent at every rally. And some of them even take the label of 'Austrianism' in their thoughts which is quite odd given that it is one of their schools strongest bulwarks.

F. A. Von Hayek

Most often this can simply explained as the envy of those who have not prepared for a crisis, and wish ill upon those who have, regretting and hoping for another chance to provide for their own security. And yet they will fail to take advantage of every opportunity to do so, as they are creatures betrayed alternatively by their own fear and greed.

One of the best indications of quack advice on the question of investing in precious metals is when one of the reasons against it includes the scurrilous non sequitur, 'You can't eat it,' as if nutritional content is a valid measure of the durability of wealth. It betrays a lowness of argument and intellectual integrity that should promptly urge one to run in the other direction.

And regrettably, there are always those who will say almost anything for money, and the profession of economist seems to be particularly infested with that sort, given the stochastic nature of the discipline, and its lack of scientific rigor, being based on principles which do not easily lend themselves to objectification with serious damage to the data being made by the assumptions in their equations and proofs.

But most of all, the financial engineers, politicians, and Wall Street Banks fear gold because it is the antidote to their frauds, and the informant to their confiscation of wealth.

Do not expect them to capitulate once and for all, but only slowly and grudgingly as it becomes more difficult for them to sustain their illusions and persuasion. Protecting wealth against official adventurism is never easy.

Here is Alan Greenspan's famous essay on Gold and Economic Freedom. I suggest your read it, because it will help you to understand much of what is said and done as the global reserve currency system changes and evolves.

Gold and Economic Freedom

by Alan Greenspan

Published in Ayn Rand's "Objectivist" newsletter in 1966, and reprinted in her book, Capitalism: The Unknown Ideal, in 1967.

An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense - perhaps more clearly and subtly than many consistent defenders of laissez-faire - that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other.

In order to understand the source of their antagonism, it is necessary first to understand the specific role of gold in a free society.

Money is the common denominator of all economic transactions. It is that commodity which serves as a medium of exchange, is universally acceptable to all participants in an exchange economy as payment for their goods or services, and can, therefore, be used as a standard of market value and as a store of value, i.e., as a means of saving.

The existence of such a commodity is a precondition of a division of labor economy. If men did not have some commodity of objective value which was generally acceptable as money, they would have to resort to primitive barter or be forced to live on self-sufficient farms and forgo the inestimable advantages of specialization. If men had no means to store value, i.e., to save, neither long-range planning nor exchange would be possible.

What medium of exchange will be acceptable to all participants in an economy is not determined arbitrarily. First, the medium of exchange should be durable. In a primitive society of meager wealth, wheat might be sufficiently durable to serve as a medium, since all exchanges would occur only during and immediately after the harvest, leaving no value-surplus to store. But where store-of-value considerations are important, as they are in richer, more civilized societies, the medium of exchange must be a durable commodity, usually a metal. A metal is generally chosen because it is homogeneous and divisible: every unit is the same as every other and it can be blended or formed in any quantity. Precious jewels, for example, are neither homogeneous nor divisible. More important, the commodity chosen as a medium must be a luxury. Human desires for luxuries are unlimited and, therefore, luxury goods are always in demand and will always be acceptable. Wheat is a luxury in underfed civilizations, but not in a prosperous society. Cigarettes ordinarily would not serve as money, but they did in post-World War II Europe where they were considered a luxury. The term "luxury good" implies scarcity and high unit value. Having a high unit value, such a good is easily portable; for instance, an ounce of gold is worth a half-ton of pig iron.

In the early stages of a developing money economy, several media of exchange might be used, since a wide variety of commodities would fulfill the foregoing conditions. However, one of the commodities will gradually displace all others, by being more widely acceptable. Preferences on what to hold as a store of value will shift to the most widely acceptable commodity, which, in turn, will make it still more acceptable. The shift is progressive until that commodity becomes the sole medium of exchange. The use of a single medium is highly advantageous for the same reasons that a money economy is superior to a barter economy: it makes exchanges possible on an incalculably wider scale.

Whether the single medium is gold, silver, seashells, cattle, or tobacco is optional, depending on the context and development of a given economy. In fact, all have been employed, at various times, as media of exchange. Even in the present century, two major commodities, gold and silver, have been used as international media of exchange, with gold becoming the predominant one. Gold, having both artistic and functional uses and being relatively scarce, has significant advantages over all other media of exchange. Since the beginning of World War I, it has been virtually the sole international standard of exchange. If all goods and services were to be paid for in gold, large payments would be difficult to execute and this would tend to limit the extent of a society's divisions of labor and specialization. Thus a logical extension of the creation of a medium of exchange is the development of a banking system and credit instruments (bank notes and deposits) which act as a substitute for, but are convertible into, gold.

A free banking system based on gold is able to extend credit and thus to create bank notes (currency) and deposits, according to the production requirements of the economy. Individual owners of gold are induced, by payments of interest, to deposit their gold in a bank (against which they can draw checks). But since it is rarely the case that all depositors want to withdraw all their gold at the same time, the banker need keep only a fraction of his total deposits in gold as reserves. This enables the banker to loan out more than the amount of his gold deposits (which means that he holds claims to gold rather than gold as security of his deposits). But the amount of loans which he can afford to make is not arbitrary: he has to gauge it in relation to his reserves and to the status of his investments.

When banks loan money to finance productive and profitable endeavors, the loans are paid off rapidly and bank credit continues to be generally available. But when the business ventures financed by bank credit are less profitable and slow to pay off, bankers soon find that their loans outstanding are excessive relative to their gold reserves, and they begin to curtail new lending, usually by charging higher interest rates. This tends to restrict the financing of new ventures and requires the existing borrowers to improve their profitability before they can obtain credit for further expansion. Thus, under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth. When gold is accepted as the medium of exchange by most or all nations, an unhampered free international gold standard serves to foster a world-wide division of labor and the broadest international trade. Even though the units of exchange (the dollar, the pound, the franc, etc.) differ from country to country, when all are defined in terms of gold the economies of the different countries act as one — so long as there are no restraints on trade or on the movement of capital. Credit, interest rates, and prices tend to follow similar patterns in all countries. For example, if banks in one country extend credit too liberally, interest rates in that country will tend to fall, inducing depositors to shift their gold to higher-interest paying banks in other countries. This will immediately cause a shortage of bank reserves in the "easy money" country, inducing tighter credit standards and a return to competitively higher interest rates again.

A fully free banking system and fully consistent gold standard have not as yet been achieved. But prior to World War I, the banking system in the United States (and in most of the world) was based on gold and even though governments intervened occasionally, banking was more free than controlled. Periodically, as a result of overly rapid credit expansion, banks became loaned up to the limit of their gold reserves, interest rates rose sharply, new credit was cut off, and the economy went into a sharp, but short-lived recession. (Compared with the depressions of 1920 and 1932, the pre-World War I business declines were mild indeed.) It was limited gold reserves that stopped the unbalanced expansions of business activity, before they could develop into the post-World War I type of disaster. The readjustment periods were short and the economies quickly reestablished a sound basis to resume expansion.

But the process of cure was misdiagnosed as the disease: if shortage of bank reserves was causing a business decline — argued economic interventionists — why not find a way of supplying increased reserves to the banks so they never need be short! If banks can continue to loan money indefinitely — it was claimed — there need never be any slumps in business. And so the Federal Reserve System was organized in 1913. It consisted of twelve regional Federal Reserve banks nominally owned by private bankers, but in fact government sponsored, controlled, and supported. Credit extended by these banks is in practice (though not legally) backed by the taxing power of the federal government. Technically, we remained on the gold standard; individuals were still free to own gold, and gold continued to be used as bank reserves. But now, in addition to gold, credit extended by the Federal Reserve banks ("paper reserves") could serve as legal tender to pay depositors.

When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage. More disastrous, however, was the Federal Reserve's attempt to assist Great Britain who had been losing gold to us because the Bank of England refused to allow interest rates to rise when market forces dictated (it was politically unpalatable). The reasoning of the authorities involved was as follows: if the Federal Reserve pumped excessive paper reserves into American banks, interest rates in the United States would fall to a level comparable with those in Great Britain; this would act to stop Britain's gold loss and avoid the political embarrassment of having to raise interest rates. The "Fed" succeeded; it stopped the gold loss, but it nearly destroyed the economies of the world, in the process. The excess credit which the Fed pumped into the economy spilled over into the stock market, triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed. Great Britain fared even worse, and rather than absorb the full consequences of her previous folly, she abandoned the gold standard completely in 1931, tearing asunder what remained of the fabric of confidence and inducing a world-wide series of bank failures. The world economies plunged into the Great Depression of the 1930's.

With a logic reminiscent of a generation earlier, statists argued that the gold standard was largely to blame for the credit debacle which led to the Great Depression. If the gold standard had not existed, they argued, Britain's abandonment of gold payments in 1931 would not have caused the failure of banks all over the world. (The irony was that since 1913, we had been, not on a gold standard, but on what may be termed "a mixed gold standard"; yet it is gold that took the blame.) But the opposition to the gold standard in any form — from a growing number of welfare-state advocates — was prompted by a much subtler insight: the realization that the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state). Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes. A substantial part of the confiscation is effected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.

Under a gold standard, the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government's promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets. A large volume of new government bonds can be sold to the public only at progressively higher interest rates. Thus, government deficit spending under a gold standard is severely limited. The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. They have created paper reserves in the form of government bonds which — through a complex series of steps — the banks accept in place of tangible assets and treat as if they were an actual deposit, i.e., as the equivalent of what was formerly a deposit of gold. The holder of a government bond or of a bank deposit created by paper reserves believes that he has a valid claim on a real asset. But the fact is that there are now more claims outstanding than real assets. The law of supply and demand is not to be conned. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise. Thus the earnings saved by the productive members of the society lose value in terms of goods. When the economy's books are finally balanced, one finds that this loss in value represents the goods purchased by the government for welfare or other purposes with the money proceeds of the government bonds financed by bank credit expansion.

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

Given his Randian audience and the mood at the time, it is interesting that Greenspan defines the culprits in the scheme of fiat monetization as 'welfare statists.' How ironic, that over a period of time there is indeed a group of welfare statists behind the latest debasement of the currency, the US dollar, but the recipients of this welfare are the Banks and the financial elite, who through transfer payments, financial fraud, and federally sanctioned subsidies are systematically stripping the middle class of their wealth. Perhaps they decided that if you cannot beat them, beat them to the trough and take the best for themselves until the system collapses through their abuse.

28 April 2010

Guest Post: The Perils of Credit Money Systems Managed by Private Corporations

In this instance the 'paper money' system would be analagous to money created by private banks by means of expanding credit. The Second Bank of the United States is the predecessor to the Federal Reserve Bank System which was established in 1913.

"The paper system being founded on public confidence and having of itself no intrinsic value, is liable to great and sudden fluctuations, thereby rendering property insecure and the wages of labor unsteady and uncertain.

The corporations which create the paper money cannot be relied upon to keep the circulating medium uniform in amount. In times of prosperity, when confidence is high, they are tempted by the prospect of gain or by the influence of those who hope to profit by it to extend their issues of paper beyond the bounds of discretion and the reasonable demands of business.

And when these issues have been pushed on from day to day until the public confidence is at length shaken, then a reaction takes place, and they immediately withdraw the credits they have given; suddenly curtail their issues; and produce an unexpected and ruinous contraction of the circulating medium which is felt by the whole community.

The banks, by this means, save themselves, and the mischievous consequences of their imprudence or cupidity are visited upon the public. Nor does the evil stop here. These ebbs and flows in the currency and these indiscreet extensions of credit naturally engender a spirit of speculation injurious to the habits and character of the people. We have already seen its effects in the wild spirit of speculation in the public lands and various kinds of stock which, within the last year or two, seized upon such a multitude of our citizens and threatened to pervade all classes of society and to withdraw their attention from the sober pursuits of honest industry. It is not by encouraging this spirit that we shall best preserve public virtue and promote the true interests of our country.

But if your currency continues as exclusively paper as it now is, it will foster this eager desire to amass wealth without labor; it will multiply the number of dependents on bank accommodations and bank favors; the temptation to obtain money at any sacrifice will become stronger and stronger, and inevitably lead to corruption which will find its way into your public councils and destroy, at no distant day, the purity of your government. Some of the evils which arise from this system of paper press, with peculiar hardship, upon the class of society least able to bear it...

Recent events have proved that the paper money system of this country may be used as an engine to undermine your free institutions; and that those who desire to engross all power in the hands of the few and to govern by corruption or force are aware of its power and prepared to employ it. Your banks now furnish your only circulating medium, and money is plenty or scarce according to the quantity of notes issued by them. While they have capitals not greatly disproportioned to each other, they are competitors in business, and no one of them can exercise dominion over the rest. And although, in the present state of the currency, these banks may and do operate injuriously upon the habits of business, the pecuniary concerns, and the moral tone of society, yet, from their number and dispersed situation, they cannot combine for the purpose of political influence; and whatever may be the dispositions of some of them their power of mischief must necessarily be confined to a narrow space and felt only in their immediate neighborhoods.

But when the charter of the Bank of the United States was obtained from Congress, it perfected the schemes of the paper system and gave its advocates the position they have struggled to obtain from the commencement of the federal government down to the present hour. The immense capital and peculiar privileges bestowed upon it enabled it to exercise despotic sway over the other banks in every part of the country. From its superior strength it could seriously injure, if not destroy, the business of any one of them which might incur its resentment; and it openly claimed for itself the power of regulating the currency throughout the United States. In other words, it asserted (and it undoubtedly possessed) the power to make money plenty or scarce, at its pleasure, at any time, and in any quarter of the Union, by controlling the issues of other banks and permitting an expansion or compelling a general contraction of the circulating medium according to its own will.

The other banking institutions were sensible of its strength, and they soon generally became its obedient instruments, ready at all times to execute its mandates; and with the banks necessarily went, also, that numerous class of persons in our commercial cities who depend altogether on bank credits for their solvency and means of business; and who are, therefore, obliged for their own safety to propitiate the favor of the money power by distinguished zeal and devotion in its service.

The result of the ill-advised legislation which established this great monopoly was to concentrate the whole money power of the Union, with its boundless means of corruption and its numerous dependents, under the direction and command of one acknowledged head; thus organizing this particular interest as one body and securing to it unity and concert of action throughout the United States and enabling it to bring forward, upon any occasion, its entire and undivided strength to support or defeat any measure of the government. In the hands of this formidable power, thus perfectly organized, was also placed unlimited dominion over the amount of the circulating medium, giving it the power to regulate the value of property and the fruits of labor in every quarter of the Union and to bestow prosperity or bring ruin upon any city or section of the country as might best comport with its own interest or policy.

We are not left to conjecture how the moneyed power, thus organized and with such a weapon in its hands, would be likely to use it. The distress and alarm which pervaded and agitated the whole country when the Bank of the United States waged war upon the people in order to compel them to submit to its demands cannot yet be forgotten. The ruthless and unsparing temper with which whole cities and communities were oppressed, individuals impoverished and ruined, and a scene of cheerful prosperity suddenly changed into one of gloom and despondency ought to be indelibly impressed on the memory of the people of the United States.

If such was its power in a time of peace, what would it not have been in a season of war with an enemy at your doors? No nation but the freemen of the United States could have come out victorious from such a contest; yet, if you had not conquered, the government would have passed from the hands of the many to the hands of the few; and this organized money power, from its secret conclave, would have directed the choice of your highest officers and compelled you to make peace or war as best suited their own wishes. The forms of your government might, for a time, have remained; but its living spirit would have departed from it.

The distress and sufferings inflicted on the people by the Bank are some of the fruits of that system of policy which is continually striving to enlarge the authority of the federal government beyond the limits fixed by the Constitution. The powers enumerated in that instrument do not confer on Congress the right to establish such a corporation as the Bank of the United States; and the evil consequences which followed may warn us of the danger of departing from the true rule of construction and of permitting temporary circumstances or the hope of better promoting the public welfare to influence, in any degree, our decisions upon the extent of the authority of the general government. Let us abide by the Constitution as it is written or amend it in the constitutional mode if it is found defective.

The severe lessons of experience will, I doubt not, be sufficient to prevent Congress from again chartering such a monopoly, even if the Constitution did not present an insuperable objection to it. But you must remember, my fellow citizens, that eternal vigilance by the people is the price of liberty; and that you must pay the price if you wish to secure the blessing. It behooves you, therefore, to be watchful in your states as well as in the federal government.The power which the moneyed interest can exercise, when concentrated under a single head, and with our present system of currency, was sufficiently demonstrated in the struggle made by the Bank of the United States. Defeated in the general government, the same class of intriguers and politicians will now resort to the states and endeavor to obtain there the same organization which they failed to perpetuate in the Union; and with specious and deceitful plans of public advantages and state interests and state pride they will endeavor to establish, in the different states, one moneyed institution with overgrown capital and exclusive privileges sufficient to enable it to control the operations of the other banks.

Such an institution will be pregnant with the same evils produced by the Bank of the United States, although its sphere of action is more confined; and in the state in which it is chartered the money power will be able to embody its whole strength and to move together with undivided force to accomplish any object it may wish to attain. You have already had abundant evidence of its power to inflict injury upon the agricultural, mechanical, and laboring classes of society, and over whose engagements in trade or speculation render them dependent on bank facilities, the dominion of the state monopoly will be absolute, and their obedience unlimited. With such a bank and a paper currency, the money power would, in a few years, govern the state and control its measures; and if a sufficient number of states can be induced to create such establishments, the time will soon come when it will again take the field against the United States and succeed in perfecting and perpetuating its organization by a charter from Congress.

It is one of the serious evils of our present system of banking that it enables one class of society, and that by no means a numerous one, by its control over the currency to act injuriously upon the interests of all the others and to exercise more than its just proportion of influence in political affairs. The agricultural, the mechanical, and the laboring classes have little or no share in the direction of the great moneyed corporations; and from their habits and the nature of their pursuits, they are incapable of forming extensive combinations to act together with united force. Such concert of action may sometimes be produced in a single city or in a small district of country by means of personal communications with each other; but they have no regular or active correspondence with those who are engaged in similar pursuits in distant places. They have but little patronage to give the press and exercise but a small share of influence over it; they have no crowd of dependents about them who hope to grow rich without labor by their countenance and favor and who are, therefore, always ready to exercise their wishes.

The planter, the farmer, the mechanic, and the laborer all know that their success depends upon their own industry and economy and that they must not expect to become suddenly rich by the fruits of their toil. Yet these classes of society form the great body of the people of the United States; they are the bone and sinew of the country; men who love liberty and desire nothing but equal rights and equal laws and who, moreover, hold the great mass of our national wealth, although it is distributed in moderate amounts among the millions of freemen who possess it. But, with overwhelming numbers and wealth on their side, they are in constant danger of losing their fair influence in the government, and with difficulty maintain their just rights against the incessant efforts daily made to encroach upon them.

The mischief springs from the power which the moneyed interest derives from a paper currency which they are able to control; from the multitude of corporations with exclusive privileges which they have succeeded in obtaining in the different states and which are employed altogether for their benefit; and unless you become more watchful in your states and check this spirit of monopoly and thirst for exclusive privileges, you will, in the end, find that the most important powers of government have been given or bartered away, and the control over your dearest interests has passed into the hands of these corporations.

The paper money system and its natural associates, monopoly and exclusive privileges, have already struck their roots deep in the soil; and it will require all your efforts to check its further growth and to eradicate the evil. The men who profit by the abuses and desire to perpetuate them will continue to besiege the halls of legislation in the general government as well as in the states and will seek, by every artifice, to mislead and deceive the public servants. It is to yourselves that you must look for safety and the means of guarding and perpetuating your free institutions. In your hands is rightfully placed the sovereignty of the country and to you everyone placed in authority is ultimately responsible. It is always in your power to see that the wishes of the people are carried into faithful execution, and their will, when once made known, must sooner or later be obeyed. And while the people remain, as I trust they ever will, uncorrupted and incorruptible and continue watchful and jealous of their rights, the government is safe, and the cause of freedom will continue to triumph over all its enemies.

But it will require steady and persevering exertions on your part to rid yourselves of the iniquities and mischiefs of the paper system and to check the spirit of monopoly and other abuses which have sprung up with it and of which it is the main support. So many interests are united to resist all reform on this subject that you must not hope the conflict will be a short one nor success easy. My humble efforts have not been spared during my administration of the government to restore the constitutional currency of gold and silver; and something, I trust, has been done toward the accomplishment of this most desirable object. But enough yet remains to require all your energy and perseverance. The power, however, is in your hands, and the remedy must and will be applied if you determine upon it."

Andrew Jackson, Farewell Address, March 4, 1837

22 March 2010

The Monetary Base During the Great Depression and Today

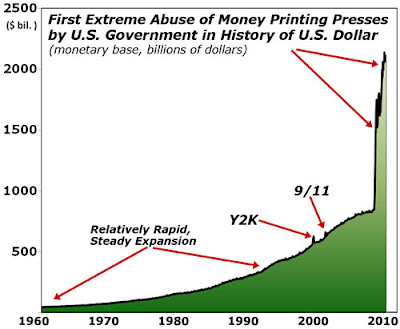

Economic commentator Marty Weiss has put out this chart with the somewhat florid headline, Bernanke Running Amuck

"Fed Chairman Bernanke is running amok, and for the first time since the birth of the U.S. dollar, our government is egregiously abusing its power to print money.

Specifically, from September 10, 2008 to March 10 of this year, he has increased the nation’s monetary base from $850 billion to $2.1 trillion — an irresponsible, irrational and insane increase of 2.5 times in just 18 months.

It is, by far, the greatest monetary expansion in U.S. history. And you must not underestimate its sweeping historical significance."

This chart with its editorial commentary are from Marty Weiss.

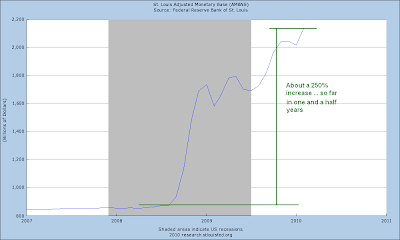

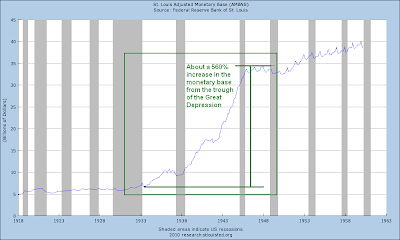

Here is a closer look at this monetary expansion, without the editorial comment

Is it without historical precedent? I wondered.

Let's take a look again at a prior period of dollar devaluation and monetary expansion in a period of deep recession, the period in the 1930's in which the US departed from specie currency to facilitate the radical expansion of the monetary base.

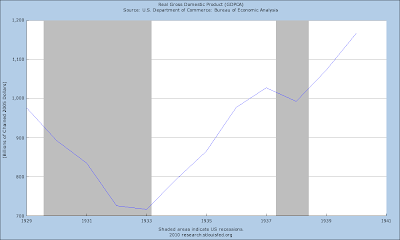

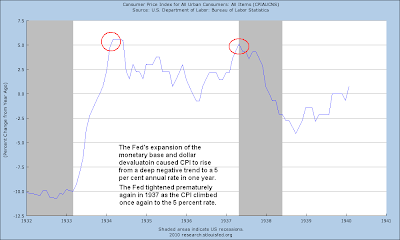

As you can see, the Federal Reserve increased the monetary base in several steps, resulting in an aggregate increase of about 155% in four years. In this chart above one can also nicely see the contraction in the monetary base, the tightening, that caused a dip again into recession in 1937.

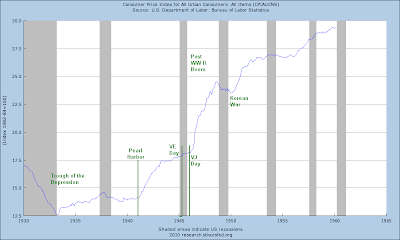

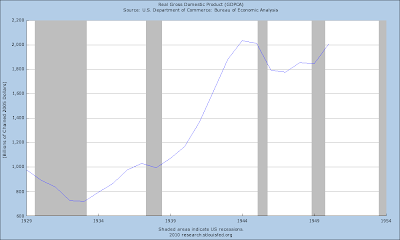

It is also good to note that the recession ended and the economy was in recovery prior to the start of WW II, which I would tend to mark from Hitler's invasion of Poland in August, 1939. There was a military buildup in Britain before then, but I believe that the common assumption that only the World War could have ended the Great Depression was mistaken.

If real GDP is any indication, the recovery of the economy was underway, but somewhat anemic compared to its prior levels, reflected in a slow decline in unemployment. It is absolutely essential to remember that the US had become a major exporting power in the aftermath of the first World War. The decline therefore of world trade with the onset of the Depression hit the US particularly hard. But the recovery was underway, until the Fed dampened it with a premature monetary contraction that brought the country back into recession, a full eight years after the great crash. Such is the power of economic bubbles to distort the productive economy and foster pernicious malinvestment.

What prolonged the Depression in the US was the Federal Reserve's preoccupation with inflation that caused it to prematurely contract the money supply. In addition, the Supreme Court overturned most of the New Deal employment programs before the economy had fully recovered from the shock of the Crash of 1929, and the severe damage inflicted by liquidationism on the financial system and the real economy. One can hardly appreciate today the impact of repeated banking failures, with no recourse or insurance, on the public confidence.

It is instructive to look at the Consumer Price Index for that period of time to see what was motivating the Fed.

It is fair to say that the Fed made several policy errors out of a fear of inflation. Keep in mind that it was only 1933 that the Fed had been freed of the gold standard, and there was tremendous pressure from the monied interests to maintain a strong currency, as we can see, to a fault. The public interest was sacrificed to protect the pre-Crash gains of the wealthy.

The US economy had a more difficult time adjusting to the collapse and the Depression because it had been a net exporting nation in the 1920's. The decline in markets for its exports, and the constrictions in international trade symbolized in the US by the Smoot-Hawley tariffs, affected it much more than other nations that had been net importers, and which exited the Depression earlier.

With the collapse of its export business, the US would have been well-advised to stimulate its domestic markets, to help take up the slack and help to rebalance its productive capacity. In this case, domestic liquidationism was exactly the wrong thing to do. This, by the way, is why the Wall Street money men starting looking at foreign direct investments in the domestic production of recovering economies such as Germany and Italy in the late 1930's. Indeed, the search for profit was so compelling that several of the money houses, and famous men, did not stop investing with the Nazis until they were prosecuted under the Trading with the Enemy laws.

This provides an instructive example to the exporters German and China in this modern crisis perhaps. Now is the time for them to stimulate domestic markets. China must create internal markets, and Germany best try and hold the EU together and keep it healthy.

Japan is in a much more difficult circumstance because of its particular demographics and cultural homogeneity. I see no way out for them in the short term.

Here is what the monetary base did during World War II. As one can easily see, war is bad for people but good for industrial output and monetary expansion.

Expansion of the monetary base during the war was nothing short of astonishing, if one forgets that there was a significant monetization of war debts occurring, and there was less opportunity for inflation because of rationing and wage and price controls. But inflation there was, and it gained a significant leg up after the War.

Here is our real GDP chart extended through the War so one can more easily see the build up and then the flattening of growth post War.

Where Do We Go From Here?

The status quo has failed in its own imbalances and artificial distortions. But while avoiding bubbles in the first place through fiscal responsibility and restraint is certainly the right thing to do, plunging a country which is in the aftermath of a bubble collapse into a hard regime, such as the liquidationists might prescribe, is somewhat like taking a patient which has just had a heart attack and throwing them on a rigorous treadmill regimen. After all, running is good for them and if they had run in the first place they might not have had a heart attack, so let's have them run off that heart disease right now. Seems like common sense, but common sense does not apply to dogmatically inclined schools of thought.

What the US needs to do now is reform its financial system and balance its economy, which means shrinking the financial sector significantly as compared to its real productive economy. This is going to be difficult to do because it will require rebuilding the industrial base and repairing infrastructure, and increasing the median wage.

The US needs to relinquish the greater part of its 720 military bases overseas, which are a tremendous cash drain. It needs to turn its vision inward, to its own people, who have been sorely neglected. This is not a call to isolationism, but rather the need to rethink and reorder ones priorities after a serious setback. Continuing on as before, which is what the US has been trying to so since the tech bubble crash, obviously is not working.

The oligarchies and corporate trusts must be broken down to restore competition in a number of areas from production to finance to the media, and some more even measure of wealth distribution to provide a sustainable equilibrium. A nation cannot endure, half slave and half free. And it surely cannot endure with two percent of the people monopolizing fifty percent of the capital. I am not saying it is good or bad. What I am saying is that historically it leads to abuse, repression, stagnation, reaction, revolution, renewal or collapse. All very painful and disruptive to progress. Societies are complex and interdependent, seeking their own balance in an ebb and flow of centralization and decentralization of power, the rise and fall of the individual. Some societies rise to great heights, and suffer great falls, never to return. Where is the glory that was Greece, the grandeur that was Rome?

The lesser concern for the US now is globalization, new trade agreements, and its debt, which is largely held by foreigners who have provided vendor financing while using exports to build their own economies. The mercantilists are addicted to exports because it provides them the means to bring in national wealth for the benefit of a narrow elite, without empowering the masses and allowing them a greater measure of say in their government, with only a modestly improved standard of living.

This Will Not Be Your Father's Inflation

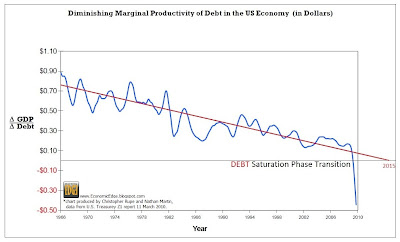

Why is this important? Because as I think is apparent in the stunning chart contained in Debt Saturation in the US Dollar Economy, the US dollar is already entering an inflationary spiral that will lead to its destruction and reissuance..jpg)

Although as you know I always allow that deflation and inflation are policy decisions, at some point a threshold can be passed, and the likelihood of one event or the other becomes more compelling. The US is at that crossroads wherein it must change, or go down the painful path of selective monetary default, of a degree different than a hyperinflation, more similar to that which was seen in the former Soviet Union, than the monetary implosion of a Weimar.

One can watch the growth of the traditional or even innovative money supply figures, and be reassured at their nominal levels, only to misunderstand that money has a character and quantity of backing, that can erode as surely as the supply of money can increase, to produce a type of inflation that comes upon a nation quickly, like a thief in the night. It will bear the appearance of stagflation, because it is caused by a degeneration of the productive economy coupled with a disproportionately increasing money supply.

A transactional economy can have all the appearance of vital growth and activity, when in fact it may be an increasingly hollow shell, a Ponzi scheme, and prone to unexpected collapse. Such a systemic collapse was almost witnessed when the US financial system was threatened by the fall of Lehman Brothers. That event was averted. But the system still remains in a precarious, unreformed state of imbalance.

What does a country have to providing a backing to its money, except its natural resources, its productive labor, and the ability to create products of value? Some countries, or more properly empires, may provide the backing for their currency through force and fraud, and a sort of indirect or de facto taxation on the many. These types of arrangements can last many years, but can disappear quickly, based as they are on conditional situations, subject to relatively sudden change.

Cutting expenses to reduce deficits is a weak attempt to reform. One does not starve themselves back to health. What is needed is growth, savings and investment, the reallocation of capital and true valuation of goods and services. The productive economy must come back into balance with the administrative sectors, those being finance and government.

At the end of the day, some of the greatest impediments to economic recovery reside in the selfish and fearful desire for control and power in rather narrow oligarchies, both in the East and the West. They were the primary beneficiaries of the status quo, and they will seek to maintain and even recreate it, even though it has proven to be unsustainable.

20 March 2010

Curtain of Tragedy Will Be Raised Soon Enough, But Perhaps Not Next in Japan

"Ninety-five percent of Japan's debt is domestically owned. Fickle foreigners have almost no sway. Indeed, Japan's problem is still an excess of savings ." (at abormally low rates of return that serve to subsidize government mismanagement and malinvestment.)

An interesting piece from the Japan Times below, raising the issue of a hyperinflationary collapse of their economy and the yen. As you know, I forecast in 2005 that a new school of economic thought is likely to rise out of the financial crisis which the world is in today. The crisis is certainly not over, despite the government propaganda and economic window dressing that is being applied. Quite likely we have only seen the end of the first Act in what is going to be a three part drama lasting about nine more years.

In particular, the understanding of money and monetary theory is still in its infancy, having been sidetracked by the ideologues in the service of corporatism and big government. In fairness, economics is difficult because there are an enormous amount of variables, and the time lags are highly significant and varied. The fact that economics is a social science with a profound impact on public policy decisions does not help advance academic research. It does seem that the field has a surfeit of economists for hire who often seem to produce studies in order to support pre-ordained conclusions and biases. The average person can only mouth the opinions given to them by television and these studies as 'proofs' of the opinions they hold so dear. Their judgement is easily led in this, since it has no depth.

Economics is a subject rarely taught in the general curriculum. A person reads a few articles by supposedly learned men, and thinks themselves in a position to pronounce broad judgements for or against anything. Those who would appear informed enjoy repeating slogans and cartoons of thought to support their biases, which they themselves do not really understand, but draw emotional comfort from them. The irony is that they are so often arguing nonsense, and against their own best interests. Such is the power of propaganda to hold up caricatures and denounce them, and energize the public to enslave themselves.

Most discussions which I read get the Japanese economic experience all wrong. There is a complete misunderstanding of the roots of their deflation, the bubble as it was occurring, their long deflation and national stagnation, the single party political system and oligarchic economic structure, and the tremendous psychological impact which defeat had on the Japanese national psyche at the end of World War II.

As I have pointed out before, deflation and inflation are part of a policy decision in a purely fiat regime. The bias is to expansion as it is in all Ponzi schemes. People constantly create artificial rules regarding the inability to expand the money supply at will. Their minds cannot accept that something which they value so highly is created out of thin air by the monied interests.

The assumptions one makes when engaging in economic analysis are all important. Data is often sketchy and selective. People take naive examples and extrapolate them into real-life scenarios, crushing their complexity. This is due to the weakness of their model.

I think the field will progress more quickly once some new insights are made, and a new model, or skeleton if you will, is struck that allows the mathematicians to begin to flesh it out again.

For now, at least in my opinion, most economic thought is impoverished since the revolutionary insights of Keynes and so many others in response to the world depression of the 1930's. The jargon that currently passes for knowledge is a sign of decadence. I find all of the schools to offer little more than caricatures of what is a highly complex and richly interactive system.

My personal opinion is that Japan will not collapse until its export mercantilism collapses, or the average age of the overly homogeneous population strangles its ability to maintain a high savings rate and a ready market for government debt at artificially low prices.

I expect the UK and a portion of the european region to founder first, and then perhaps China, which appears to be an enormous bubble, an accident waiting to happen. Its collapse may be a precipitant to collapses in the developed world. The US dollar will have its day to devalue into a reissuance, but perhaps not until Europe and the UK are sorted out first. But the dollar is a doomed currency, the vanity of vanities. All fiat currencies are doomed; they are invariably the victims of human willfulness.

The adulation which the media and financiers had showered on Mussolini and Hitler and their economic recoveries in the 1930's was widespread, as it was for Japan Inc. in the 1980's, and for China today. The crowd always gets it wrong, but it is surprising how often the monied interests and the professionals get it wrong as well, and remain stubborn in their misjudgement until they are overwhelmed by its consequences. Or perhaps that is their intention. Who can say, who can truly 'think like a criminal.' You are a prisoner of reason, balance, and natural restraint. These are creatures of their own appetites, with a hole in their being which one can barely appreciate.

The Bankers will make the world an offer which they think it will not be able to refuse. One currency, and then one government. People being irrational are not likely to take that deal, once again.

There are those who say that they very sure what is coming, what will happen, what the future will bring. For the most part they are speaking out of fear and false pride. The only certainty is that if they really knew what is going to happen, they would cast themselves down from high places in despair.

Grab something solid and hang on to it, and to the faith that sustains you. Do not be distressed if it feels as though the world has lost its reason, and is made blind, and all is deception and trial, for this is part of the process which has begun. If a war comes, then the world will lose its ability to reason in its temporary madness. We are in for a rough ride, and revelations of what is life and what is nothingness, what is true and what is false.

“When pride comes, then comes disgrace. But with disgrace comes humility, and with humility comes wisdom. The humility of the righteous will guide them, but the sly illusions of the proud will destroy them." Prov 11People will ask, and I can only say that I do not know if this is the end time, as no one can know this. What does it matter, since surely we are all heading towards the last things and a judgement, at our own pace. But it may certainly feel like it is something more general, more momentous, at some point before our blasphemous generation puts itself back into balance with God and nature again, and the crisis has past.

As the song says, "You ain't seen nothing yet."

How to Live Before You Die by Steve Jobs

Japan Times

Government Debt Crisis: Bubble prophet fears new disaster

By REIJI YOSHIDA

March 19, 2010

Economist Noguchi warns soaring public debt may bankrupt Japan, bring back hyperinflation

Prominent economist Yukio Noguchi is one of the few who correctly predicted the collapse of Japan's bubble economy in 1987, warning the preceding euphoria was based on a major distortion in land prices.

Now the doomsday prophet is making another terrifying prediction: Japan is likely to be devastated by a snowballing public debt that will bankrupt its government and trigger catastrophic hyperinflation.

"There is little hope," Noguchi said in an interview with The Japan Times at Waseda University's Graduate School of Finance in Tokyo. "Japan's fiscal conditions are so bad, it can no longer be fixed without causing inflation. I'm very pessimistic."

Noguchi is not the only one deeply fretting the debt.

They may still be a minority, but an increasing number of economists and market players are voicing deep concerns about Japan's fiscal sustainability and fear catastrophe may strike in the near future.

Compared with Greece, Japan's gross government debt is far worse, at 181 percent of gross domestic product — the highest among the developed countries. Greece's debt-to-GDP ratio is 115 percent.

Japan's present debt-to-GDP ratio is only comparable with what it was at the end of World War II. At that time, the only way the government could reduce the debt was through hyperinflation, which wiped out much of the people's wealth with skyrocketing prices.

"I can't tell exactly what will happen (this time), but what actually happened after the war was that the price level surged 60 times in just over four years," Noguchi said.

"If the same thing happens again, a ¥10 million bank account will have the same net value of just ¥100,000 today. It's actually possible," he warned.

The alarmists even include Ikuo Hirata, chief editorial writer of the Nikkei business daily.

Hirata predicts the huge debt will eventually force the Bank of Japan to purchase Japanese government bonds on a massive scale, eroding market confidence and pushing up long-term interest rates.

A rise in long-term interest rates of even a few percentage points would sharply increase debt-servicing costs on the bonds and critically damage the government's already precarious finances.

"The curtain of the tragedy will be raised next year," Hirata warned in a Nikkei article on Dec. 21.

Pessimists like Noguchi and Hirata are still in the minority — at least for now. The yield on 10-year JGBs, their barometer, hasn't indicated any trouble yet.

"Talk of a massive JGB bubble — let alone default — is far-fetched," the Financial Times said in its Feb. 8 editorial titled "Japan's debt woes are overstated."

The editorial pointed out that, for a long time, JGB yields have been effectively fixed at the ultralow level of around 1.3 percent — compared with the 3.6 percent yield on 10-year U.S. Treasury bonds and the 4 percent for its counterpart in Britain as of Thursday.

"Ninety-five percent of Japan's debt is domestically owned. Fickle foreigners have almost no sway. Indeed, Japan's problem is still an excess of savings," the FT said.

"For some time yet, the government will not find it hard to secure buyers for JGBs. Japan's debt problem will be worked out in the family."

But most experts, including those at the International Monetary Fund, agreed that Japan's midterm future is shaky, and that the government could face difficulty financing its public debt in around 10 years.

In a July report, the IMF warned that Japan may find it "difficult" to finance its debt domestically toward 2020 because household savings are expected to keep falling in line with its rapidly graying population and declining birthrate.