Nevertheless, it does start to chip away at Wall Street's usual answer to any dollar challenge, "Where else will they put their reserves, what else will they use for trade if not the US Dollar?" This has always seemed to be among the most arrogant, self-centered observations of an empire in recorded history. "Without us, who will tell them what to do, who will lead them, who will manage their money?" Were even the British at the turn of the 19th century that self-deluded, so blineded by the rationale of the white man's burden to manage other people's affairs?

Ecuador’s currency was called the sucre before it shifted to the US dollar nearly a decade ago. Jose Antonio de Sucre was an early 19th century South American Independence leader who fought alongside Simon Bolivar. Sucre is also the capital of Bolivia.

In this proposal, it is known as the Sistema Único de Compensación Regional (SUCRE), a new currency for intra-regional trade, to replace the US dollar in trade among several countries: Venezuela, Bolivia, Cuba, Ecuador, Nicaragua, Honduras, Dominica, Saint Vincent and Antigua and Barbuda.

Most of these countries have already withdrawn their participation with the World Bank, and it's Center for International Trade disputes, which had sought to arbitrate disagreements among the countries and several western energy firms. This may be important because Venezuela is a major source of oil imports to the US market. Will Chavez start demanding payment for his oil in the SUCRE? Will the US begin to discover the nuclear threat from Venezuela? Or merely encourage its neighbors and internal groups to challenge its sovereignty?

This may be important because Venezuela is a major source of oil imports to the US market. Will Chavez start demanding payment for his oil in the SUCRE? Will the US begin to discover the nuclear threat from Venezuela? Or merely encourage its neighbors and internal groups to challenge its sovereignty?

The exact composition of the SUCRE has not yet been disclosed, if it has been decided. Until that happens, and a firm timeline is disclosed, this is merely a proposal that has been discussed before.

The proposed sucre does not affect any discussions (if any are still continuing) with regard to the amero, which as we understand it is a potential North American regional currency amongst Mexico, the US, and Canada. If we were Canadian, we would resist that proposal with all the resources at our disposal.

But make no mistake, there are alternatives to the dollar and they are being discussed around the world. A broader based alternative that would include China and Russia among others would have more 'teeth.' Some composition including gold and silver backing of some sort, if it is sufficiently revalued higher, would give any regional currency a greater international acceptibility.

It made an impression, by the way, that this news story was first picked up here out of China, and not from any US mainstream news outlets.

And speaking of strategic moves, the US recently sought to obtain seven military bases in Colombia, strategically located in the midst of the ALBA countries.

CCTV China

ALBA member states plan new currency

2009-10-18 11:44 BJT

A meeting of the Bolivarian Alternative for the Americas, or ALBA, has announced plans to create a new single currency to replace the US dollar. The organization's 7th Summit has concluded with an aim to stop using the greenback for trade between member states next year.

ALBA groups Bolivia, Cuba, Ecuador, Nicaragua, Venezuela and other regional governments. A Russian delegation also attended the two-day meeting. Leaders announced a plan to eventually create a single regional currency, the SUCRE.

They also decided to explore creating state-sponsored food and mining multinationals.

The summit also touch the Honduras issue. The ousted Honduran Foreign Minister called on the Organization of American States to implement new measures to increase pressure on the de facto government of Honduras to end the political crisis.

18 October 2009

ALBA Gives Nod for Regional Currency SUCRE in Central and South America

Preparing for the Next Crash and Unexpected Consequences: Now Is the Time

A friend sent this along, and we thought it was worth publishing an extended excerpt. This is Part 1 of the essay, and we look forward to Part Two – Managing Your Own Money – Take Action Now.

That is really the challenge isn't it. Most people are financial non-specialists. Their lives are full enough as it is, with things that they understand and that are important to them.

Too often the call to 'take control of your own money' is a prelude to 'and buy into my advice, what I wish to sell to you.'

Financial advice is a difficult thing to provide in a blog. It would be like a doctor writing a prescription for the public at large, fitting for some, inappropriate for others, potentially deadly for a few. This is why I do not do it. Ever.

The prescription I use for my personal situation is the most that I will share, in addition to general opinions and analysis of the markets and the economy. I am 58 years old, and have amassed a fair amount of savings over the past twenty years. My general rules for the current period now are:

1. Get liquid. Have little or no debt. Be in cash and diversified. Reduce living expenses to essentials.

2. Get as far away as you can from Wall Street and riskier assets as is practical.

3. Put something you can spare from discretionary retirement savings into long term assets that are not directly contingent on anyone else whom you cannot trust:

a. Personal food production, preservation, and preparation4. Above all be flexible. If this stagflation we are in becomes a protracted deflationary spiral or an emerging hyperinflation, both possible outcomes, we will see it happening and may need to adjust. This is where being light on debt and long on liquidity is most helpful. There is no one right plan for the unexpected, ever.

b. Precious metals as insurance against monetary inflation / breakdown

c. Essentials for daily living and personal health care

d. Investments in practical education

e. Personal infrastructure and efficiency

f. Have a contingency plan for a systemic shock.

If you have 401k plans you cannot cash in, you might consider some very long term 'leap' puts to hedge them. But Cash or short term Treasuries is preferable. I have all my discretionary cash scattered across several very highly rated banks within FDIC limits. I have some money available for investment in foreign currencies although I have cashed in my loon and aussie dollar positions now. I have sold some 'collectible assets' that might have done very well if we get a prolonged period of high inflation similar to the 1970's in order to raise cash levels. I may regret this, but so be it. The cash can be deployed as the situation develops. Cash can otherwise be kept your home currency which you use on a daily basis, as long as it is safe and liquid.

If you wish raise your voice or to peacefully demonstrate, be prepared with a simple set of coherent positions and specific demands, avoiding anger. The mainstream media likes nothing better than to portray demonstrators as cranks or fools. In general they are not sympathetic to the less powerful. They will not lead change, but they will eventually follow.

Try to avoid squabbling amongst yourselves. When the reformers fight over fine points and petty egotistical issues, the status quo rejoices, often formulating and encouraging the bickering. Debate television where no serious discussion occurs, but plenty of sound bites and ad hominem attacks get thrown, is the model for media distraction. But it 'works' for the short term opportunists, and generally adds to the bread and circuses atmosphere masking an historic wealth transfer and the decline of an empire, as it has done in the past.

And as always, the banks must be restrained, and the financial system reformed, and balance restored to the economy before there can be any sustained recovery.

Reality Arbiter

The Extinction of Ethics in Finance – The Fallout

by Greg Simmons

October 13, 2009

"...To revisit my original intention in writing this article, I cannot stress to you the importance of understanding exactly what is going on in the world. No one is to be trusted with your money. Not Wall Street, not the banks, not the government – nobody is to be trusted! Does the investing public not realize that Wall Street almost lost every penny of American wealth? Now we’re supposed to believe they’ve saved the day? I beg to differ. Those parasitic liars nearly took us to zero. Who knows, they still might.

The grossly deluded public has been at the mercy of brokers, financial advisors, Wall Street, the Fed, congress, and the US Treasury far too long. This moral hazard and subsequent uneven playing-field created by the current financial structure (the trifecta of the Fed, Treasury, and the “Banksters”) wherein the scales of balance tip only upward, hence siphoning this nation’s wealth into the coffers of those that create such hazards. Their current solutions to this crisis, a crisis of their own making, is nothing more than a replication of the same idiotic practices that got us here in the first place; corporate bailouts, homebuyer tax-rebates, foreclosure moratoriums, cash-for-clunkers, all designed to forego the inevitable sanctification of sins past and deliver them on to the US taxpayer.

The difference between the past and present is that now we have a government willing to set up shop and take over entire industries; mortgage lending, auto, banking, and who knows going into the future. Just wait, we’ll be in the airline business in no time. I feel like I’m in a perpetual state of Déjà vu - with a repeat of September 2008 barreling headlong around the next bend.

That we exist in a quasi public-private financial system wherein the government in collusion with the Fed and the “Banksters” take your money essentially by force (specifically through the leverage of ZIRP) or otherwise and shove it into new toxic instruments, bailouts, and ill-conceived stimulus programs that even these so-called best-and-brightest have no concept of the inherent risks, or hazard of unintended consequences, is proof that the entire game is rigged against you.

It is time to take control of your money.

Now, with regard to the subject of managing one’s own money, the rules of the game have officially changed. The EXTINCTION OF ETHICS in today’s financial markets IS the new rule. You must take total responsibility for the management of your own money and you must do it now! I don’t know how to make it any more clear. I could probably write an entire thesis about the utter abandonment of morality by today’s so-called investment community. I mean, does everybody have to cheat each other to make a dollar? The subject literally brings into question the human thread that binds our social fabric together.

Given the dire state of the global economy and the fact our collective economic situation has gotten significantly worse, not better, creates an opportune time to shift any misplaced philosophy of trust in a corrupt system and recognize that we’re in the middle of a COVER-UP, NOT A RECOVERY!

A comment I always appreciated and have tried to take credit for but know I plagiarized from somewhere is this; ANTICIPATING BAD LUCK IS GOOD LUCK; DEPENDING ON GOOD LUCK IS BAD LUCK. This so-called recovery is merely a papered-over facade made possible by trillions of newly created dollars. The time to prevent getting thrown back into the ditch is now. Remember, do not fall victim to the CNBC-induced epidemic of economic amnesia."

Read the entire essay here.

17 October 2009

Charles Walters: New Wealth and the Productive Economy

Here is an essay that explores the historical concept of "New Wealth" and what we call 'the productive economy.'

For us, there is a real place in the general economy for lawyers, bankers, merchants, and those who enable the organization and distribution of 'new wealth.'

It is a matter of balance. When one segment dominates the other destructive imbalance results.

When labor dominates, the economy will often slide into long periods of slow growth and cultural narrowing or even stagnation, with a badly lagging industrial development and technological innovation.

When the organizers dominate, the wealth transfer from the many to the few tends to strangle economic growth with the onset of weak-minded successors and heirs, leading to periods of degeneration as it overreaches its capability. The society becomes stratified into elites, enablers, systemic serfs, and free rabble. The imbalance of stratification stresses social cooperation and tranquility and leads to a change in governance as the organization collapses. The American Revolution was an example of this, the beginning of the end for the British Empire.

As communication and information technology improves, and behavioural persuasion becomes more sophisticated, the organizers and oligarchists can extend their domination to ever larger portions of the world population. The control of currency and commerce are almost as important as military power to the maintenance of empire. The Fall of Rome was as much an artifact of technological shortcomings, despite significant advances and innovations in the prime of the empire, exacerbated by a general weakening of governance through a corruption of leadership.

This essay is offered as a stimulus for thought and is not intended as a general endorsement of this author or his organization.

Enjoy your weekend.

THE PRIMACY OF NEW WEALTH

By Charles Walters

So 2008 is gone, leaving in its wake the end of an era conceived in iniquity, nursed along in delusion with religious propitiation to the capricious god called high finance. As promised in these newsletters and other editorials, we have already started making drastic adjustments in our political and institutional arrangements. A fuller version of the entire story is contained in my semi-autobiographical, fully historical novel, A Beast of Muddy Brain, which was released at the recent Acres U.S.A. Conference in St. Louis.

Usually the passage of an era is viewed in terms of leaders and military people who hog the pages of history. This is not the case with Beast. Here the nearly century-long story unfolds as the life of a single farmer and his family.

In this column, however, a small part of the story brought into focus by recent events lays out a few lessons found in unopened books.

Military Industrial Complex

By the time Dwight D. Eisenhower warned of a military-industrial complex in his farewell address, the complex was already a reality. Ike wanted to say, "Congressional-industrial- military complex," but his advisors convinced him to delete any reference to the "honorable ones," this in spite of their penchant for both hidden and open bribery.

The military-industrial complex was in fact launched February 27, 1947, in the White House cabinet room. The cast of characters included Secretary of State Dean Atchison, a few congressional leaders, including Republican Senator Arthur Vandenberg. The product of that meeting was the replacement of the republic with a national security state and a public policy of waging "perpetual war for perpetual peace," the last phrase a Gore Vidal quote. The first of these became characterized as cold. It became hot in Korea and tepid in terms of scale into the now present.

It was Senator Vandenberg who in effect told Harry S. Truman he could have his militarized economy if he employed the canard that the Russians were on the way. This dark secret was dressed up as the Truman Doctrine, war being the engine of credit used to save Greece, Turkey, then Europe and the rest of the world from the nearly prostrate Soviet Union.

Mark that date --- February 27, 1947. Align it with the buildup drive to pass new farm legislation and the full implementation of the new-fangled Bretton-Woods Agreement. Bretton Woods has already been described fully in this column (October 2008). The infamous farm act of 1948-1949 (the Aiken bill) has been the subject of commentary as long as this paper has been published.

The 80th Congress

Truman called the 80th Congress the worst in history. And yet its action in the matter of the Aiken bill fit hand in glove with the destruction of the simple and obvious system mandated by the U.S. Constitution. The end result that swung from the neck of the nation like a dead albatross was a provision called "60 percent of parity."

The military-industrial complex decreed that the nation's commissary could be maintained by underpaying agriculture by 40 percent, thereby releasing millions from the farms for factory work, military factory work included.

In perhaps another 50 years, economists may rediscover the awesome truth that a steady decline in farm income translated into a steady decline in national income, the ratio being 1 for agriculture, 7 for national income --- a ratio fixed by the state of the arts.

The shortfall in farm and national income became so uncomfortable during the second Eisenhower term, an injection of $72 billion was decreed for the military-industrial (and now university) complex status quo for agriculture. By the time rumblings that formed the National Farmers Organization became evident in 1955, hogs were selling for 10 cents a pound, corn 10 cents a bushel. War was ever triumphant in those days. There was a Communist under every stone, as is the case now with terrorists. Loyalty pledges were demanded, and neighbors were invited to fink on each other. By the mid-1960s, some 2,400 farms were closed down each week, the land and other assets being transferred into "a few strong hands."

What Was Wrong?

What indeed, was wrong with this equation? Agriculture --- Farm Bureau, agribusiness and academia excepted ---appealed to physics in its role as a new wealth industry and commonsense while institutional arrangements were being dismantled, and new ones constructed that were suitable to finance, esoteric manipulations, and a dream as old as Genghis Khan --- one world. Representative government of, by and for the people is now no more than a footnote in history. Only corporate America and a compliant military have true representation in Congress, the bribe is that powerful, whether paid in the dark or openly as an obscene fee for a speech while either in or out of office. The two-party vote has become so repugnant hardly half those eligible even bother with the exercise.

The Source

"The land is the source or the substance from which wealth is drawn;" wrote Richard Cantillon in Essai sur la Nature du Commerce en General, and he continues, "the work of man is the form which produces it, and wealth in itself is nothing other than food, commodities and the amenities of life."

Cantillon's treatise described the source of new earned income at a time when John Law ruled the economy of France. Cantillon and Law clashed, chiefly over the real character of money.

Law established the Banque Generale in 1715 and had it converted to a state bank three years later. His every move was designed to drive raw materials prices down while he, John Law, furnished substitutes to repair the deficit. In his own way, he developed a war against poverty, created make-work projects such as digging a canal at Briare, and he took steps to make Paris a seaport town. All tolls were abolished so that the grain trade could be "freed." Import duties were reduced on oil, leather, tallow and wines so that free trade could furnish France with cheap imports. Commodities fell in price. And new money issues were constructed by the Banque Generale, which simply monetized collateral. It took this economy only two years to explode.

After the dust settled, about the only thing left was Richard Cantillon's Essai, the masterpiece that reached the purity of theory in one lesson and limited itself to the possibilities of life in the next.

New wealth is not easily comprehended in a society addicted to wealth on the gaming table, at the end of a stock trade or embodied in currency created out of thin air by institutional arrangements that no longer ask the questions of a child: Where does it come from? Where does it go? The transition from the simple business equation to some idea of earned income at the national level that can emerge as national profits (social surplus) and savings leaves most people and most economists bewildered. They see the CEO who walks off with, say, $10 million after scuttling his company as wealth, and so it is in terms of the individual. But he has left in his wake disturbing exchange consequences and no direct effect on buildup of national profits and savings. The parasite creates no new wealth, and usually debilitates new wealth creation, because the predator merely transfers money from one pocket to another, and in terms of physics creates nothing.

There are close to one million lawyers in the United States. They transfer a great deal of money from their clients and victims into their own coffers. This transfer is called earnings. It adds to national income, but it adds nothing to national profits and savings.

Wal-Mart is said to be the largest corporation in the nation if not the world. Bentonville billionaires are now a part of American legend. Yet Wal-Mart produces no new national wealth. Like the baseball game or the professional football contest, it transfers the money called wealth by talk show hosts from one pocket to the next, but the net effect of these enterprises is to enable new wealth industries to fabricate things like baseball bats from lumber, helmets and gear from plastic --- all sourced from raw materials --- to stimulate economic activity, but adds little or no national profits and savings for stable investment.

To find the source of new wealth, we are required to examine new wealth industries.

Financial services are not new wealth creators. Quite the contrary, they make the stable dollar a relic of yesteryear because in the main they create money, but do not create the interest required to make this super-grift appear real. The grift called debt may enable instant gratification, but it also transfers the wealth of a nation into the hands of a few. That is why the interest mill delivers nations into convulsions at regular intervals in history.

In turn, debt is enabled by anything less than broad-spectrum distribution of landed resources and money income. Further, as new wealth industries are deprived of parity earnings, either instant depression or deferred depression (deferred by debt) must follow in the fullness of time.

Those French philosophers of the 18th century not only reasoned well, they forecast the inevitable as the court and its syncophants installed debauchery as public policy. Finance based on debt creation has replaced the court in our day, purchased the Congress and trapped the American worker into virtual indentured servitude. Finance now bills itself as a prime mover, not as a grim reaper that inevitably destroys the simple and obvious system gifted posterity by the Founding Fathers.

What, then, are the new wealth industries on which national solvency depends?

New Wealth Industries

It can be seen that even the making of a lead pencil involves a staggering complement of services, know-how, sales efforts, even advertising. The only part that meets the test of new wealth is the raw material component --- the lumber, the graphite, the ink for printing, all of which invite a look at nature's gift. Depending on the state of the arts, the raw materials component in products for the sales floor use up to eight times more labor than raw materials. Therefore we speak of new wealth industries as those that require a heavy raw material input.

Food to stoke the metabolic furnace of human beings comes first. It takes some 2,000 calories a day to feed a hard-working human being. That is why agriculture is the largest new wealth industry, accounting for fully 70 percent of the raw materials used to operate the economy.

Fuel, minerals, lumber, gravel, fossil fuels, fish all together account for approximately 30 percent of the raw materials used to run the economy.

The lumber used to make that No. 2 lead pencil may be a small component in the manufacture of the end product, but it is most important because along with graphite it accounts for the lion's share of national profits and savings possible based on the pencil's fabrication. People taking in each other's laundry can create employment, transferring money wealth from one pocket to the next, but that trade-off is strictly neutral in creating the profits and savings needed for sound investment and sound expansion.

Is Labor Primary?

The answer is "yes" --- but that "yes" has a codicil.

The only source for national profits and savings is the raw material input as monetized by the agency of price. That is physics speaking, once you trace those profits and savings back to their origin. That is why national profits and savings rely on new wealth industries.

It is hard not to belabor the point. Take the baseball stadium that Chamber of Commerce types chest-thump into being at the taxpayer's expense, usually with the declaration that a home team generates so-and-so much income. At the local level, it is made to look that way. But from the plane of observation called national profits and savings, the game creates nothing except the few dollars involved in bat, glove and paraphernalia manufacture and the little titanium used to mark base lines.

It is labor that enables the use of raw materials. It is labor that harvests the lumber, mines the minerals, catches the fish, grows the crop. Producers, processors, and an improved state of the arts all are essential. The apparatus of economy pyramids into national income, but not national profits and savings. The policeman, the fireman, we require their service, and their salaries help that pyramid called national income stand on its raw materials base. All facilitate civilization. But they create no national profits or savings. That chore is left to the food they eat, the clothes they wear and the gift from the planet traced to raw physical product.

The Attack

Why, then, do civilizations try to cut the legs from under the source of new wealth? It may seem an assault on the intelligence of the reader to point out that the worldwide scramble is for the control of raw materials, food included. This much stated, we have to wonder aloud why public policy always seems to cut off the nation's legs at the knees by underpricing all of agriculture and many of its other raw materials. In modern times we exacerbate this delusion by ignoring the values embodied in recyclables. The above expresses itself in food's role in energy transfer from the sun to plant to human metabolic necessity. The cycle has to replicate itself daily, monthly, annually!

Finance and debt appear to be prime movers, but they cannot substitute for national profits and savings based on raw materials without engineering convulsion at regular historical intervals.

We now know that interest doubles a debt very quickly. At 10 percent, the doubling time is seven years; at 7 percent, it is 10 years. It is interest that builds a collapse position in 80 to 90 years.

The Fed will be 100 years old on December 23, 2013.

This article is reproduced from Acres U.S.A. The Voice of Eco-Agriculture Volume 39, Number 1, January 2009.

AcresUSA.com

16 October 2009

How Goldman Sachs Leveraged $70 Billion in Government Money For Record Profits

Guess which two Wall Street banks were acting as informal agents of the government in order to support the bond and stock markets and reinflate them?

Two big banks that are showing record trading profits, and a small group of enablers and assistants.

Its a near layup when the US fronts you the money and then works with you to take the markets higher via its Working Group on Financial Markets. Especially when it is on thin volumes based on 'news' which you help to create and control via frequent calls to young Tim who is your coordinator, in addition to all your other well-placed backchannel sources. You get a heads up, you use the futures to prop the markets. You need some good news, some can be arranged. Just like the good old days when Timmy was riding herd on the NY Fed desk.

All for the good of the country. And if you happen to make a billion per month in trading profits, well, that is the price of freedom for a job well done. Besides, a lot comes back in lobbying and campaign contributions. And you get to be rather porky and demanding about new banking and derivatives regulations because after all, you have a job to do and if they won't let you do it, well its uh oh.

That's what we hear, rumour-wise. Makes as much sense out of this as anything. How about you? Max Keiser thinks it is a fraud, as he describes here.

Below is Dylan Ratigan and his guest's take on this rally and the record profits.

Life Imitates Art On Bloomberg News

Just a random thought, but the new reporter on Bloomberg television bears a remarkable resemblance to Louis Winthorpe III from Trading Places. The speech and mannerisms are an even better match than the look. To Adam's credit he actually knows the financial business, which makes him Einstein compared to the anchors Debby and Matt.

Bernanke and Summers can be the Duke Brothers.

And Timmy can be Clarence Beeks.

Life imitates art? If so where is Ophelia? Oh, she is on CNBC. Woof.

SP Weekly Chart Updated

Here is the chart we have been keeping through this decline and now into the bounce.

The bounce will end when it ends. It is a 'false flag' intended to spark a recovery in confidence and the economy. It is fueled by an enormous infusion of liquidity by the Treasury and Federal Reserve into a few favored banks, who are making the bulk of their newly found profits by trading.

The rally cannot be sustained without continuous printing of money. The difficulty with this tried and true monetary approach which has lifted the economy out of the last two bubble breaks is that the financial sector is closer to the heart of the credit bubble than tech or housing, which were just vehicles for the Ponzi scheme.

And the largesse is not being distributed evenly, as relative outsiders like Ken Lewis are finding out. "Not all animals are equal." And not all the pigs have purchased premier positions at the trough.

So, when will it end? On the charts, the area between 1060 and 1100 is likely, since it is in the area of a valid and confirmed neckline. But given the strength with which the SP has penetrated the prior resistance, one has to approach any forecast of an end to a rally like this with fear and trembling, and a generous portion of caution.

Still, our point is not to make a killing for the punters, but rather to help to illuminate the perfidy at the heart of the US financial system. It is truly amazing at how brazen it has become, especially under their token reformer.

The comments on this chart are those that had already been there. All that has been done is to update the chart from July, and to clean it up a bit for readability.

15 October 2009

An Opportunity for Purveyors of Gold in London

Le Proprietaire has favored shopping at Harrod's at holiday time for many years, and finds the Food Halls to be a delight. One has to wonder if buying gold bars 'off the shelf' in size such as this indicates that there is a market to be made in London for lower scale purchases.

Le Proprietaire has favored shopping at Harrod's at holiday time for many years, and finds the Food Halls to be a delight. One has to wonder if buying gold bars 'off the shelf' in size such as this indicates that there is a market to be made in London for lower scale purchases.

The Prechterian wave weenies may see anecdotal 'signs of a top' in this, but in general they have been chasing themselves silly throughout this entire multi-year bull market.

One has to wonder if the Harrod's card could be used for this type of purchase. Do they deliver the gold in their familiar green trucks? Perhaps at least provide a reinforced shopping bag for takeaway.

Ah, a ceramic post of Stilton and a box of cream crackers. Those were the days.

Harrods adds gold bars to its luxurious image

LONDON —

The store announced Thursday that it has joined with Swiss refiner Produits Artistiques Metaux Precieux to offer gold bars weighing 27.5 pounds (12.5 kilograms). The move comes as gold prices have been going through the roof. On Wednesday, they hit another record high of $1,072 an ounce.

Based on Thursday's afternoon gold fixing price in New York, a gold bar would cost about $462,440. Customers can buy the gold through Harrods financial arm Harrods Bank, which is located in the central London's department store (didn't that used to be Lloyds? - Jesse)

"The financial environment has kindled a new demand for physical gold amongst private investors in Britain," said Chris Hall, head of Harrods Gold Bullion. "Up until now, however, London has had no well-recognized name serving this market," he added.

"Up until now, however, London has had no well-recognized name serving this market," he added.

Many investors believe it is currently safer to invest in gold than in stocks, property, or currencies.

"The fact that a company like Harrods is moving into the physical gold market is interesting ," said Adrian Ash, head of research at Bullionvault.com, the online gold trading company. "It shows gold is moving back into the mainstream, having spent two decades in the arena of cranks and gold bugs."

Mehdi Bakhordar, managing director of Produits Artistiques Metaux Precieux, said Harrods was the only location in London where investors could buy a 27.5 pound (12.5 kg) gold bar "off the shelf."

Sumitomo Forecasts Dollar to 50 Yen, End of Dollar as Reserve Currency

"We can no longer stop the big wave of dollar weakness," said Daisuke Uno at Sumitomo.

Nothing goes straight up or straight down. Look for corrections in the precious metals and the dollar, and the strengthening currencies such as the Aussie dollar, which seems headed to US dollar parity. However, the macro trend is apparent.

We get a chuckle over this dollar weakness when free market people like Steve Forbes come out and look for market intervention to stop it. The market is taking the dollar where it should be, where it needs to go. If only countries with obvious pegs and ongoing manipulation to support export mercantilism were also to allow their currencies to float more freely. It is going to kill off global trade. It is the great failure of the WTO and US trade policy to have allowed pegs and overt currency manipulation policies which are de facto tariffs and subsidies on trade.

A 'crash' in the US stock market, should one occur, will temporarily jar nearly everything. More likely is a long slow slide as in the second phase of the Great Depression, from 1931 to 1933.

Monetary inflation can make the nominal charts more palatable as it is doing today. The problem is that all Ponzi schemes come to bad ends.

The only way out, the only viable path, is for the US to embrace a serious reform of its markets and its financial system, and to change system that encourages the debilitating corruption of decision-making in Washington, which is under the influence of an army of well-heeled lobbyists.

To that extent, the "straight talking" pre-Palin version of John McCain had it right. Little serious reform can be done until campaign finance and influence peddling in Washington is addressed. McCain saw the danger of this conflict of interest in his own career as part of the Keating Five, and his own party and the rise of the neo-con statism and its assault on republican ideals.

The Democrats have shown themselves to be no better, having gone down the slippery slope of Clinton capitalism, the partnership of special interests and government. Obama failed when he embraced it. And now both parties are deep in the mire of corruption.

The banks must be restrained, and the financial system reformed, and balance restored to the economy, before there can be any sustainable recovery.

Bloomberg

Dollar to Hit 50 Yen, Cease as Reserve, Sumitomo Says

By Shigeki Nozawa

Oct. 15 (Bloomberg) -- The dollar may drop to 50 yen next year and eventually lose its role as the global reserve currency, Sumitomo Mitsui Banking Corp.’s chief strategist said, citing trading patterns and a likely double dip in the U.S. economy.

“The U.S. economy will deteriorate into 2011 as the effects of excess consumption and the financial bubble linger,” said Daisuke Uno at Sumitomo Mitsui, a unit of Japan’s third- biggest bank. “The dollar’s fall won’t stop until there’s a change to the global currency system.”

The dollar last week dropped to the lowest in almost a year against the yen as record U.S. government borrowings and interest rates near zero sapped demand for the U.S. currency. The Dollar Index, which tracks the greenback against the currencies of six major U.S. trading partners, has fallen 15 percent from its peak this year to as low as 75.211 today, the lowest since August 2008.

The gauge is about five points away from its record low in March 2008, and the dollar is 2.5 percent away from a 14-year low against the yen.

“We can no longer stop the big wave of dollar weakness,” said Uno, who correctly predicted the dollar would fall under 100 yen and the Dow Jones Industrial Average would sink below 7,000 after the bankruptcy of Lehman Brothers Holdings Inc. last year. If the U.S. currency breaks through record levels, “there will be no downside limit, and even coordinated intervention won’t work,” he said.

China, India, Brazil and Russia this year called for a replacement to the dollar as the main reserve currency. Hossein Ghazavi, Iran’s deputy central bank chief, said on Sept. 13 the euro has overtaken the dollar as the main currency of Iran’s foreign reserves....

14 October 2009

Dow 10,000: A Celebration

Team coverage today on Bloomberg by the Money Honeys as the Dow Jones Industrial Average crossed 10,000 intra-day, led by J.P. Morgan, in a move that surely epitomizes the illusions of wealth granted by modern accounting practices.

Team coverage today on Bloomberg by the Money Honeys as the Dow Jones Industrial Average crossed 10,000 intra-day, led by J.P. Morgan, in a move that surely epitomizes the illusions of wealth granted by modern accounting practices.

Can you believe the NYSE had the nerve to prepare new Dow 10,000 hats and distribute them for today? The first time the Dow Industrials crossed 10,000 was in 1999. The last time it closed over 10,000 was in October of 2008, just before the most recent plunge of the collapsing credit bubble.

That does not speak well of equities for the "buy and hold" crowd, which has surely had a wild ride if they have indeed managed to hold on for the last ten years, and ex-dividends and fees and commissions and inflation and a plunging US dollar and soaring commodities are... even.

And all that was required to create this economic miracle was to repeal the Glass-Steagall safeguards created by Congress after the Great Depression, decimating the productive economy, amassing a mountain of debt that can never be repaid, restructuring the Dow Industrials every so often, most recently replacing such inconsequential names as General Motors and Citigroup, and of course the devastation of the US dollar and a general loss of reputation and credibility around the world for justice and liberty.

But look where we have been? But who do you think took us there? Al, Ben, Larry Summers, Robert Rubin, Sandy Weil, craven economists and the crony capitalists in corporate America and their enablers and dependents in Washington.

"At what point shall we expect the approach of danger? By what means shall we fortify against it? Shall we expect some transatlantic military giant, to step the Ocean, and crush us at a blow? Never! All the armies of Europe, Asia and Africa combined, with all the treasure of the earth (our own excepted) in their military chest; with a Buonaparte for a commander, could not by force, take a drink from the Ohio, or make a track on the Blue Ridge, in a trial of a thousand years. At what point, then, is the approach of danger to be expected? I answer, if it ever reach us it must spring up amongst us. It cannot come from abroad. If destruction be our lot, we must ourselves be its author and finisher. As a nation of freemen, we must live through all time, or die by suicide." Abraham Lincoln.And to what benefit? So that a bunch of pathetic sociopaths can try and fill the hole in their hollow beings with trophy wives and trophy houses, empty titles and hair pieces, extravagant lifestyles with ridiculously overpriced cars and jewelry and ugly art, spoiled idiot children who hate and fear them as they hated and feared their own parents, and the illusion of love and power while making asses out of themselves as a few paid sycophants sing their praises, trodding over corpses on the road to hell.

Oh, bravo. Well done. Surely a light for the ages.

Wall Street Set to Pay a Record $140 Billion In Bonuses Topping 2007

While the world suffers, Wall Street pays itself record bonuses, larger even than the peak year of 2007, by taxing the productive economy to maintain an extravagant lifestyle. These bonuses are being paid with your money, and your children's money, if you hold US dollars.

And while this happens, the US credit card banks are raising interest rates to 20+% even on customers with excellent payment records and jobs which is certainly usury, and with an arrogant impunity. The insider trading scandals and tales of government graft yet to be told are so blatant and shocking that only a captive mainstream press keeps them from being investigated.

The rest of the world looks on in shock and amazement. What has gone wrong with America? What are they thinking? America has not only lost the high ground, it is sliding into a ditch.

While Americans are pacified by bread and circuses, the rest of the world looks at a painful reality show in the States, a country in a death spiral of corrupt leadership and public apathy. If it was Zimbabwe or Iceland there would still be sympathy for the people, but far less concern.

A deflationist friend was railing about the US slide into bankruptcy, and I could not help but ask, "What happens to the paper of a bankrupt company, or country?"

Where indeed will the dollar gain its long anticipated strength, its renaissance of value?

Or yes, from "less dollars" through debt destruction. Mutant monetarism gone mad, an argument worthy of Herr Goebbels. The dollar will rise in value by immersing itself in a pool of corruption, and by destroying its shareholders, those who hold their savings in it, while oligarchs loot the financial system. Unless the US can turn its trade balance positive overnight, while raising interest rates, and maintaining a growing domestic economy based on consumption, it is not going to happen. The US is running out of degrees of freedom.

Wall Street holds the US public and government hostage by threatening financial armageddon if they do not get what they wish. We would anticipate a similar threat to the global economy based on dollar debt at some point, asking for a global monetary regime controlled out of New York and London, with perhaps a few associates.

Nothing goes straight up or down. There will be more sucker rallies and bubbles, but the train is starting to come off the rails a little more with each wrenching turn of this cycle.

The banks must be restrained, and the financial system reformed, and balance restored to the economy before there can be any sustained recovery.

Finfacts Eire

Wall Street firms set to break new records in 2009 with pay rising to $140bn; Bailed-out insurance giant AIG paid “retention bonuses” to kitchen staff

By Finfacts Reporting Team

Oct 14, 2009 - 6:10:22 AM

Wall Street firms are set to break new records with employee pay set to rise to $140bn this year. Meanwhile, it has been reported that the bailed-out insurance giant AIG paid “retention bonuses” to kitchen staff earlier this year from a $168m pot, that was ostensibly designed to keep staff from leaving the government controlled firm.

Workers at 23 top investment banks, hedge funds, asset managers and stock and commodities exchanges can expect to earn even more than they did in the peak year of 2007, according to an analysis of securities filings for the first half of 2009 and revenue estimates through year-end by The Wall Street Journal.

The Journal reports that total compensation and benefits at the publicly traded firms it analyzed, are on track to increase 20% from last year's $117bn -- and to top 2007's $130bn payout. This year, employees at the companies will earn an estimated $143,400 on average, up almost $2,000 from 2007 levels.

Average compensation per employee at investment bank Goldman Sachs, is set to reach about $743,000 this year, double last year's $364,000 and up 12% from about $622,000 in 2007, according to the Journal analysis...

13 October 2009

How Much Gold Does the US Have In Its Reserves?

Looking around the web, and considering some recent questions regarding gold and SDRs on the Fed's and Treasury's balance sheets and reserve statements, I came across quite a bit more confusion and misinformation than one might have expected to find on what should be a fairly straightfoward question, ranging from completely incorrect but precise numbers to 'shitloads' at Yahoo!Answers.

So, I spent some time reading the relevant source documents, and have decided to publish this little fact sheet here, so that one might at least be able to find some of the basic facts about the US gold holdings on the books of the Treasury and the Fed in one place, with references.

There is also a little detail about the SDRs. It should be noted that because SDRs may be added to the Treasury's books, as in the recent allocation from the IMF, it does not mean necessarily that they are monetized by the Fed and placed on their own balance sheet.

Not getting into issues of where the gold is, what claims there may be on it, and what fineness it may actually be, according to the US Treasury:

The US currently holds 261,499,000 fine troy ounces in its reserves. US International Reserve Position, US Treasury

The gold is valued on the books at $42.2222 per fine troy ounce.

This represents a total value of $11,041,063,078.

This value appears on the Treasury's International Reserve Position US Treasury on Line 4.

Since there are 32150.7466 troy ounces in a tonne, the US Treasury is holding 8,133.528072 tonnes of fine gold.

Federal Reserve Gold Certificates

The Federal Reserve holds $11,037,000,000 in gold certificates as assets on its Balance Sheet as shown in their weekly H.41 report. The Fed has no physical gold of its own. According to my reading of the relevant law, the Fed is not able to place claims upon or issue those gold certificates to any other entity other than the 12 federal reserve banks.

With regard to the Fed's Gold Certificates here is some history by way of explanation:

Acting under this authority [the Emergency Banking Act of March 9, 1933], the secretary of the Treasury issued orders dated December 28, 1933, and January 15, 1934, the latter requiring all gold coin, gold bullion, and gold certificates to be delivered to the Treasurer of the United States on or before January 17, 1934.

A new type of gold certificate, series of 1934, in denominations of $100, $1,000, $10,000, and $100,000, was issued only to Federal Reserve banks against certain credits established with the Treasurer of the United States. These certificates are not paid out by Federal Reserve banks and do not appear in circulation. They bear on their face the wording: "This is to certify that there is on deposit in the Treasury of the United States of America dollars in gold, payable to bearer on demand as authorized by law."

Gold certificates, however, have not been printed since January, 1935. Under the Gold Reserve Act of January 30, 1934, all gold held by the Federal Reserve banks was transferred to the U.S. Treasury, in accordance with Presidential Proclamation of January 31, 1934, the former receiving the gold certificate credits on the books of the Treasury at the former statutory price for gold $20.67 per ounce.Gold assets were valued at $35 per fine troy ounce, giving effect to the devaluation January 31, 1934, until May 8, 1972, when they were revalued at $38 pursuant to the Par Value Modification Act, P.L. 92-268, approved March 31, 1972. The increment amounted to $822 million.

Gold assets were subsequently revalued at $42.22 pursuant to the amendment of Section 2 of the Par Value Modification Act, P.L. 93-110, approved September 21, 1973. This increment amounted to $1,157 million. All of the U.S. Treasury's monetary gold stock valuation, including the preceding revaluation increments, has been monetized by the U.S. Treasury by the issuance to the Federal Reserve banks of $11,160,104,000 for their gold certificate account (total as of close of 1980). In addition, the U.S. Treasury monetized $2,518 million (as of close of 1980) of the U.S. special drawing rights by issuance to the Federal Reserve banks for their special drawing rights certificate account.

On the books of the Federal Reserve banks, neither the gold certificate account nor the special drawing rights certificate account plays any restrictive role in Federal Reserve banks' operations. With the U.S. losing monetary gold in recent years of balance-of-payments deficits, causing decline in gold certificates (credits), two restraints were eliminated: P.L. 89-3, March 3, 1965, eliminated the requirement contained in Section 16 of the Federal Reserve Act for the maintenance of reserves in gold certificates by Federal Reserve banks of not less than 25% against Federal Reserve bank deposit liabilities; and P.L. 90-269, March 18, 1968, eliminated the remaining provision in Section 16 of the Federal Reserve Act under which the Federal Reserve banks were required to maintain reserves in gold certificates of not less than 25% against Federal Reserve notes.

Gold certificates (credits) held by the individual 12 Federal Reserve banks, therefore, merely reflect the total of monetary gold held by the U.S. and also the individual Federal Reserve bank holdings of gold certificates (credits) to their credit on the books of the INTER-DISTRICT SETTLEMENT ACCOUNT. Nevertheless, both the gold certificate account and special drawing rights account at Federal Reserve banks were utilized as eligible assets to serve as part of the 100% collateral pledged with the Federal Reserve agent at each Federal Reserve bank for issues of Federal Reserve notes. (The Depository Institutions Deregulation And Monetary Control Act Of 1980 removed the collateral requirements for Federal Reserve notes held in the vaults of Federal Reserve banks.)

Encyclopedia of Banking & Finance (9th Edition) by Charles J Woelfel

Does any of this amount to a hill of beans? Perhaps, but probably not. At least the next time I need to look up some of these facts and history to explain or correct a question or misunderstanding, I will not have to look all around the web for it again, and wade through many links of incorrect misinformation and rubbish to find it.

This is in no way meant to imply that the Treasury actually possesses the gold it says it has, the fineness of the gold, and the nature of any claims that might be on that gold. This is not a trivial issue as the estimates of the fineness of the gold have shown that a meaningful portin of it may be 'coin melt' and not of deliverable quality unless it has been further refined. It is said that the Bank of England recently discovered that some of their own gold stocks were not suitable for a delivery to the London Bullion Market Association (LBMA) for example.

By the way, and just as a point of curiosity, I calculated that if the Fed wished to back its balance sheet with all the gold in the US Treasury, the amount today would be approximately $8,000 per troy ounce. Don't hold your breath. LOL

Some of this may become an issue IF the SDR does become the international reserve currency, and IF gold is added to the mix of its basket of currencies as some countries like China and Russia have requested.

And in a new Google search, How Much Gold Does the US Have In Its Reserves, this little blog pops right up on page one, so its 'mission accomplished.'

And in case you were wondering, here is a recent lineup of official gold reserves from the major countries around the world.

12 October 2009

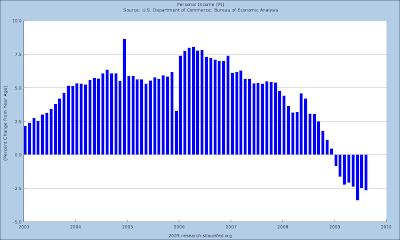

Consumer Credit Contracting at Record Levels

Total Consumer Credit Outstanding in the US is contracting at a year-over-rate of almost 5 percent, which is a record for the post 1960 economy.

The challenge facing Bernanke and the Obama economic team is how to get the US consumer spending again, if they cannot be paid a living wage, and if they can no longer be encouraged to borrow beyoned their means, by using their homes as a cash machine with variable interest rates, as they were encouraged to do by Fed Chairman Greenspan.

This is as much a public policy question as it is an economic question. Large segment of the population which are homeless and and jobless tend to be destabilizing to the community. The liquidationist school is not without its attraction to the let-them-eat-cake frame of mind, but from a societal perspective it is fraught with peril and unintended consequences.

For now the remedy being utilized by Bernanke and associates is to prop the financial system and allow the dollar to decline while artificially supporting the long bond. They may also be attempting to control certain indicators of monetary inflation such as gold and oil by using position limits exclusively on long positions and 'speculation.' while exempting the naked short selling. Similarly, pumping up equities provides a flowback into financial assets that helps to support the banks.

This is obviously no solution. The Fed is in maintenance mode, trying to coddle the banks through their ongoing crisis despite the recent appearances of vitality, which are an illusion.

The Obama Administration is not engaging in the systemic and financial reform that really is their responsibility. So what we have here is a bit of a mess with no clear way out at least to us, except to weaken the dollar, and perform their particular version of 'pray.'

I believe the colloquial American characterization of Team Obama's current policy might best be described as 'throwing shit at the wall and hoping something sticks.'

Yes, there is often a lag between credit contraction and the appearance of decline in the broader money stock. This may be a direct correlation with a lagged, or a colinearity resulting from the effects of the recession in the real economy on both, again with uneven impacts over time.

There can be no denying that the Fed is promoting money supply growth in ways never seen before in the US. Whether they can be successful is open to question. We think they will keep at it until they break something.

Wall Street has a gun to the head of the public, in the form of derivatives positions that are 'weapons of mass destruction.' For now it is a standoff. But there should be little doubt that this is artificial and unsustainable, and that something has got to give.

Stiglitz: The Banks Must Be Restrained, The Financial System Must Be Reformed

"We will have another armed robbery unless we prevent the banks, the banks that are too big to fail. We should say that if you’re too big to fail then you are too big to be. They need more restrictions, such as no derivative trading.” Joe Stiglitz

If a Nobel Prize winnter in economics says the obvious, besides a few diligent bloggers, perhaps other economists will obtain 'air cover' in speaking about the economic and regulatory absurdity taking place today in the US and the UK. Winning the Nobel is even better than tenure.

Here is a video of his speech in Brussels, because this Bloomberg article leaves out some of the more 'pithy' remarks on the Wall Street bank bonuses, the errors efficient market theory, political and ideological capture, lies (his wording) told by central bankers including Alan Greenspan, unproductive "taxes" by banks on the real economy, 'criminal' management of beta, and the social costs of this financial crisis from Joe Stiglitz from the Brussels banking conference.

Stiglitz characterizes the reforms being put forward by the US Congress as completely wrong, and harmful. Watch the video, and compare what Joe Stiglitz is saying with the ponderous mendacity of Larry Summers, and you may better understand why Obama's policies are doomed to failure.

It does not take much imagine to see how things might be quite different if Joltin' Joe was the Chief Economic Advisor or Fed Chairman, rather than 'Last War' Larry or Zimbabwe Ben.

Again, here is a link to this 'must see' video which can be a bit slow to start because of Bloomberg's video platform.

Bloomberg

Stiglitz Says Banks Should Be Banned From CDS Trading

By Ben Moshinsky

October 12, 2009 06:28 EDT

Oct. 12 (Bloomberg) -- Large banks should be banned from trading derivatives including credit default swaps, said Joseph Stiglitz, the Nobel prize-winning economist.

The CDS positions held by the five largest banks posed “significant risk” to the financial system, Stiglitz said at a press conference in Brussels. Big banks should have extra restrictions placed on them, including a ban on derivative trading, because of the risk that they would need government money if they fail, he said in a speech today.

“We will have another armed robbery unless we prevent the banks, the banks that are too big to fail,” Stiglitz said. “We should say that if you’re too big to fail then you are too big to be. They need more restrictions, such as no derivative trading.”

Derivative trading and excessive risk-taking are blamed for helping to spark the worst financial crisis since World War II. American International Group Inc., once the world’s largest insurer, needed about $180 billion of government money after its derivative trades faltered and pushed the company toward bankruptcy.

Financial markets should be subject to taxes that will discourage “dysfunctional” trading and help pay for the effects that the global crisis had on poorer nations, Stiglitz said last week.

U.S. and European regulators have pushed for tighter regulation of the $592 trillion over-the-counter derivatives market, amid concerns that it could create systemic failures in the financial system. Lawmakers have called for global rules covering derivatives to prevent financial institutions from exploiting jurisdictional differences in regulation.

Stricter Standards

Former German finance minister Hans Eichel said in an interview today that global regulation would ultimately be needed. The European Union should enforce tougher legislation, even if the U.K. is reluctant to adopt stricter standards, he said.

“The Eurozone is strong enough economically to go it alone,” Eichel said. European legislation could then become the blueprint for global rules, said Eichel.

Central Banks More Aggressively Reducing US Dollar Exposure In Their Reserve Portfolios

“Global central banks are getting more serious about diversification, whereas in the past they used to just talk about it,” said Steven Englander, a former Federal Reserve researcher who is now the chief U.S. currency strategist at Barclays in New York. “It looks like they are really backing away from the dollar.”

If The Independent and Robert Fisk can be dismissed as the tabloid fringe by the mainstream media and those desperately clinging to status quo, here is a piece on the diminishing dollar from the radical paparazzi known as Bloomberg news.

Currencies can have significant volatility even within long term trends, due to short squeezes and official intervention. Forex trading is for professionals only, as most amateurs become fooled by the leverage and the opacity of the market's positional dynamics, ie. they don't know who the patsy is at the table.

That being said, there is an interesting aspect to the currant position of the dollar as the long time, but fading,world's reserve currency known as The Prisoner's Dilemma.

In a situation such as this, the country which quietly sheds dollars first takes a lesser loss on their reserves than those who hold, but also risks punishment by the US and the G7 for deviating from the consensus of central banks and their financial engineers.

This is further complicated by the entanglement of some exporting countries in their own mercantilist support for large dollar surpluses. This requires a replacement for the dollar to be phased in slowly, and to gain support amongst non-US trading partners of the major exporting countries. The matter of the petrodollar is also an important aspect, but can probably wait until the move out of the dollar is well underway.

Is there anyone buying US dollar Agency Debt these days besides the Fed? It used to be a favorite among the Central Banks, but was dumped them in an amazingly short period of time once the perception of risk changed around the world. Almost overnight in Central Bank time.

As we pointed out several times previously, the SDR, which is a basket of currencies, is a logical replacement for the US dollar reserve. It is rebalanced in its composition every five years, and the next remix is going to occur in 2010.

If the equity market breaks and the US dollar carry trade reverses, the dollar may catch a sharp rally, which will bring the strong dollar crowd, especially deflationists, out of their funk and kicking their heels in "mission accomplished" mode. The celebration is most likely to be, once again, a kind of a 'false Spring' that merely serves to draw them deeper into losses, and ultimately over a cliff.

This sort of historic change always starts slowly, first a trickle, then a trend, but thereafter can quickly become a torrent.

Bloomberg

Dollar Reaches Breaking Point as Banks Shift Reserves

By Ye Xie and Anchalee Worrachate

October 12, 2009 00:40 EDT

Oct. 12 (Bloomberg) -- Central banks flush with record reserves are increasingly snubbing dollars in favor of euros and yen, further pressuring the greenback after its biggest two- quarter rout in almost two decades.

Policy makers boosted foreign currency holdings by $413 billion last quarter, the most since at least 2003, to $7.3 trillion, according to data compiled by Bloomberg. Nations reporting currency breakdowns put 63 percent of the new cash into euros and yen in April, May and June, the latest Barclays Capital data show. That’s the highest percentage in any quarter with more than an $80 billion increase.

World leaders are acting on threats to dump the dollar while the Obama administration shows a willingness to tolerate a weaker currency in an effort to boost exports and the economy as long as it doesn’t drive away the nation’s creditors. The diversification signals that the currency won’t rebound anytime soon after losing 10.3 percent on a trade-weighted basis the past six months, the biggest drop since 1991.

“Global central banks are getting more serious about diversification, whereas in the past they used to just talk about it,” said Steven Englander, a former Federal Reserve researcher who is now the chief U.S. currency strategist at Barclays in New York. “It looks like they are really backing away from the dollar.”

Sliding Share

The dollar’s 37 percent share of new reserves fell from about a 63 percent average since 1999. Englander concluded in a report that the trend “accelerated” in the third quarter. He said in an interview that “for the next couple of months, the forces are still in place” for continued diversification.

America’s currency has been under siege as the Treasury sells a record amount of debt to finance a budget deficit that totaled $1.4 trillion in fiscal 2009 ended Sept. 30.

Intercontinental Exchange Inc.’s Dollar Index, which tracks the currency’s performance against the euro, yen, pound, Canadian dollar, Swiss franc and Swedish krona, fell to 75.77 last week, the lowest level since August 2008 and down from the high this year of 89.624 on March 4. The index, trading at 76.489 today, is within six points of its record low reached in March 2008.

Foreign companies and officials are starting to say their economies are getting hurt because of the dollar’s weakness...

Dollar’s Weighting

Developing countries have likely sold about $30 billion for euros, yen and other currencies each month since March, according to strategists at Bank of America-Merrill Lynch.

That helped reduce the dollar’s weight at central banks that report currency holdings to 62.8 percent as of June 30, the lowest on record, the latest International Monetary Fund data show. The quarter’s 2.2 percentage point decline was the biggest since falling 2.5 percentage points to 69.1 percent in the period ended June 30, 2002.

“The diversification out of the dollar will accelerate,” said Fabrizio Fiorini, a money manager who helps oversee $12 billion at Aletti Gestielle SGR SpA in Milan. “People are buying the euro not because they want that currency, but because they want to get rid of the dollar. In the long run, the U.S. will not be the same powerful country that it once was.”

Central banks’ moves away from the dollar are a temporary trend that will reverse once the Fed starts raising interest rates from near zero, according to Christoph Kind, who helps manage $20 billion as head of asset allocation at Frankfurt Trust in Germany.

‘Flush’ With Dollars

“The world is currently flush with the U.S. dollar, which is available at no cost,” Kind said. “If there’s a turnaround in U.S. monetary policy, there will be a change of perception about the dollar as a reserve currency. The diversification has more to do with reduction of concentration risks rather than a dim view of the U.S. or its currency...”

Dollar Forecasts

The median estimate of more than 40 economists and strategists is for the dollar to end the year little changed at $1.47 per euro, and appreciate to 92 yen from 90.13 today.

Englander at London-based Barclays, the world’s third- largest foreign-exchange trader, predicts the U.S. currency will weaken 3.3 percent against the euro to $1.52 in three months. He advised in March, when the dollar peaked this year, to sell the currency. Standard Chartered, the most accurate dollar-euro forecaster in Bloomberg surveys for the six quarters that ended June 30, sees the greenback declining to $1.55 by year-end.

The dollar’s reduced share of new reserves is also a reflection of U.S. assets’ lagging performance as the country struggles to recover from the worst recession since World War II...

“The world is changing, and the dollar is losing its status,” said Aletti Gestielle’s Fiorini. “If you have a 5- year or 10-year view about the dollar, it should be for a weaker currency.”

To contact the reporters on this story: Ye Xie in New York at yxie6@bloomberg.net; Anchalee Worrachate in London at aworrachate@bloomberg.net

Crash 0f 2007 and Retracement From the Top

The US Equity Market Decline from the October 2007 Top on a Percentage Basis with Fibonacci Retracements.

The SP 500 Decline from the October 2007 Top Deflated by Gold in $US, with Fibonacci Retracements from the Point of Secondary Breakdown.

10 October 2009

The Speculative Bubble in Equities and the Case for Deflation, Stagflation and Implosion

As part of their program of 'quantitative easing' which is another name for currency devaluation through extraordinary expansion of the monetary base, the Fed has very obviously created an inflationary bubble in the US equity market.

Why has this happened? Because with a monetary expansion intended to help cure an credit bubble crisis that is not accompanied by significant financial market reform, systemic rebalancing, and government programs to cure and correct past abuses of the productive economy through financial engineering, the hot money given by the Fed and Treasury to the banking system will NOT flow into the real economy, but instead will seek high beta returns in financial assets.

Why lend to the real economy when one can achieve guaranteed returns from the Fed, and much greater returns in the speculative markets if one has the right 'connections?'

The monetary stimulus of the Fed and the Treasury to help the economy is similar to relief aid sent to a suffering Third World country. It is intercepted and seized by a despotic regime and allocated to its local warlords, with very little going to help the people.

Deflation

By far this presents the most compelling case for a deflationary episode. As the money that is created flows into financial assets, it is 'taxed' by Wall Street which takes a disproportionately large share in the form of fees and bonuses, and what are likely to be extra-legal trading profits.

If the monetary stimulus is subsequently dissipated as the asset bubble collapses, except that which remains in the hands of the few, it leaves the real economy in a relatively poorer condition to produce real savings and wealth than it had been before. This is because the outsized financial sector continues to sap the vitality from the productive economy, to drag it down, to drain it of needed attention and policy focus.

At the heart of it, quantitative easing that is not part of an overall program to reform, regulate, and renew the system to change and correct the elements that caused the crisis in the first place, is nothing more than a Ponzi scheme. The optimal time to reform the system was with the collapse of LTCM, and prior to the final repeal of Glass-Steagall, and the raging FIRE sector creating serial bubbles.

Stagflation

These injections of monetary stimulus to maintain a false equilibrium is in reality creating an increasingly unsustainable and unstable monetary disequilibrium within the productive economy. As the real economy contracts, the amount of money supply that the economy can sustain without triggering a monetary inflation decreases, and in a nonlinear manner. This is because the money multiplier does not 'work' the same in reverse, owing to the ability of private individuals and corporations to default on debt.

Ironically, with each iteration of this stimulus and seizure of wealth, the dollar becomes progressively weaker because there is a smaller productive economy to support it, even if there are less dollars, despite the nominal gains in GDP which are an accounting illusion. This has been further enabled by the dollar's status as reserve currency backed by nothing since 1971, which has created an enormous overhang of dollars in the hands of other nations.

One cannot have a sustained economy recovery in which the real median wage and domestic employment are stagnant or declining, and Personal Income is declining, as wealth is being increasingly concentrated in corporations and the upper 2% of the population.

This is why stagflation, rather than hyperinflation or a sustained monetary deflation with a stronger dollar, is most likely. There will be a mix of falling and rising prices, depending on the elasticity and source (imported content) of the products, with a wildly staggering dollar that could destabilize other parts of the world, and pernicious underemployment and growing civil unrest domestically.

Those who have taken a huge share of the last three bubbles would like to stop the bubble now, keep their gains, and return to a system of fiscal restraint with light taxation on their windfall of assets.

So why does this not just simply happen? Because the political risks become enormous. It is difficult to reduce a population of free men into debt slaves, without risking a significant reaction. Therefore, it seems most likely that the government and the Fed will try to 'muddle through' for the time being, and look for an exogenous event to break the stalemate.

The traditional solution has been a military conflict, which stifles dissent against the government while generating artificial demand sufficient to energize the productive economy. It is a means of exporting your social misery, official corruption, and fiscal irresponsibility to another, weaker people.

Implosion

One only has to look at the "German miracle" of the 1930's to see this progression from artificial stimulus, to domestic seizure of assets, to scapegoating and aggressive wars of acquisition, as described above. But this progress out of economic depression had made Hitler and Mussolini the darlings of Wall Street and the international financiers. Indeed, Time Magazine had even named Hitler their "Man of the Year" for this economic miracle, even though it was a fraudulent house of cards.

If the Fed continues to apply monetary stimulus and subsidy into this system, without a significant reform, the dollar will eventually "break" and the real economy will temporarily collapse. This will result in the mother of all stagflation, with a hyperinflationary edge to it, and a breakdown in the electoral process, the rise of demagogues, and soaring interest rates.

At this point the cure will not be a monetary stimulus, but more like a surgery to remove a life-threatening cancer, fraught with risk and a significant challenge to the continuing governance of the US not seen since the 1860's.

Conclusion

As you know, our own judgement on this is that we will go through a cycle of demand deflation, which we are in now, and then most likely a pernicious stagflation which may see some episodes that will be remniscent of the inflation of the 1970's. A persistent deflation with a stronger dollar, as well as hyperinflation, seem to be outliers that are dependent on exogenous factors.

If the world dumped its dollars tomorrow, we would see a US hyperinflation. If the Fed raised short term rates to 20 percent tomorrow under duress we would see a ture monetary deflation. As a reminder, in a purely fiat currency regime with an absence of external standards, the question of iflation and deflation is a policy decision. The limiting factor is the latitude with which that policy decision can be made.

The most probable path is a lingering death for the dollar over the next ten years, with a produtive economy that continues to stagger forward under the rule of the financial oligarchs.

See Money Supply: A Primer and Price Demand and Money Supply As They Relate to Inflation and Deflation. You might also take a look at Some Common Fallacies About Inflation and Deflation and Gold: Until the Banks Are Restrained and Balance Is Restored. And finally, if you intend to trade and invest in these markets, you really ought to take a look at A Priori Vs. Empirical Reasoning and Practical Decision-Making.

Reading for the Weekend

Surely, there is at this day a confederacy of evil, marshalling its hosts from all parts of the world, organizing itself, taking its measures, enclosing the Church of Christ as in a net, and preparing the way for a general apostasy from it...

Far be it from any of us to be of those simple ones, who are taken in that snare which is circling around us! Far be it from us to be seduced with the fair promises in which Satan is sure to hide his poison!

Do you think he is so unskillful in his craft, as to ask you openly and plainly to join him in his warfare against the Truth?

No; he offers you baits to tempt you. He promises you civil liberty; he promises you equality; he promises you trade and wealth; he promises you a remission of taxes; he promises you reform. He promises you illumination, he offers you knowledge, science, philosophy, enlargement of mind.

He scoffs at times gone by; he scoffs at every institution which reveres them. He prompts you what to say, and then listens to you, and praises you, and encourages you. He bids you mount aloft. He shows you how to become as gods.

Then he laughs and jokes with you, and gets intimate with you; he takes your hand, and gets his fingers between yours, and grasps them, and then you are his."

John Henry Newman

Beta Monster: The Most Dangerous Banks In the World

The most leveraged bank by far is the-investment-bank-which-must-not-be-named. It is followed by J.P. Morgan on a percentage basis, but JPM is far larger nominally than these charts indicate because of its much larger capital base. Its in the nature of the difference between a cardshark (GS) and a pawnshop (JPM). Or perhaps just the capital requirements of the short versus the long con.

Luckily for the US financial system the big banks are incapable of making errors in risk management, and always seem to get by with a little helpful information from their friends, and a lot of money from the public.

We would ask Timmy for an explanation on how this could happen so soon after a crisis in which the Treasury had to ask Congress to stop financial armageddon overnight because of the perils of excessive leverage on dodgy capital, but he is taking dictation from Lloyd on line 1, and Jamie is on hold on line 2.

Mutual Funds Are at Cash Levels Not Seen Since the 2007 Market Top

Trend following beta monkeys (TFBM) using Other People's Money (OPM).

Trend following beta monkeys (TFBM) using Other People's Money (OPM).

They'll never learn.

Because they don't care after they have collected their fees and bonuses.

Herd behaviour does not begin to describe this phenomenon.

The US financial system is designed to maximize financial management returns and encourage the mispricing of risk, and ultimately the distribution of wealth from the many to the few through fraud, fiduciary recklessness, and Ponzi schemes.