Disclosure: The title of this blog entry is almost as sensationalistically misleading as the headline of the Fortune news article below.

Social Security is broke and will need a bailout, "even as the bank bailout is winding down" according to a Fortune story by Allan Sloan. Notice how cleverly the correlation is made between bank entitlements because of speculative excess and what is essentially the paid for portion of a retirement annuity invested solely in Treasury debt.

And bank bailout winding down? That is an illusion. Wall Street has placed its vampiric mouth into the heart of the monetary system, and has institutionalized its feeding. The bank bailout will be over when quantitative easing it over, the Treasury stops placing the public purse in guarantee of toxic assets, and the Fed stops monetizing the Treasuries.

Social Security is broke IF the Treasury defaults on all the bonds issued to the Social Security Administration, not only in its interest payments, but also by confiscating the trillions of underlying principal for which it has issued bonds.

It is broke IF you expect Social Security to act as a cash cow to subsidize other government spending, in a period of exceptionally low interest rates due to quantitative easing to subsidize the banks, and diminished tax income receipts because of a collapsing bubble created by the financial sector.

It is broke IF there is no economic recovery. Ever.

We are not talking about future payments. We are talking about the confiscation of taxes already received, and of Treasury bonds. Granted those Bonds are not traded publicly, but the principle is the same. It is about the full faith and confidence of the US government.

I am absolutely shocked that an editor of a major US financial publication would so blithely presume to suggest that Treasury debt is no good, and that the US can default, albeit selectively, at will. At the same time they promote a 'strong dollar' as the world's reserve currency out of the other sides of their mouth. Do they think we are idiots? It appears so.

If the Treasury does not honor its obligations, if America can treat its own people, its fathers and mothers, so shamefully, what would make one think it would not dishonour its obligations to them, should the need and opportunity arise?

The flip answer might be, "It's gone, the government has stolen the Social Security Fund already. Too bad for the old folks, no matter to me." Well, if that is the case, my friend, what makes you think there is any more substance to those Treasuries you are holding in your account, and those dollars in your pocket? What is backing them? Are they not traveling down the same path of quiet confiscation ad insolvency? People have a remarkable ability to kid themselves that someone else's misfortune will not be their own, even when they are in similar circumstances.

The US has not quite reached this point yet I think. But it may be coming. First they come for the weak.

Is this merely a play to resurrect the Bush proposal to channel the Social Security Funds to Wall Street? It seems as though it might be. Or merely another facet of a propaganda campaign to set Social Security up for more reductions besides fraudulent COLA adjustments as the financial sector crowds out even more of the real economy through acts of accounting theft and seignorage.

Let us remember that if the Social Security Fund is diverted from government obligations, the Treasury will be compelled to issue even more debt into the private markets to try and finance the general government obligations. The only difference will be that Wall Street will be able to extract more fees from a greater share of the economy. That is what this is all about, pure and simple. Fees and subsidies for the FIRE sector.

It should be kept in mind that Social Security payments feed almost directly into consumption, which is a key factor to GDP in a balanced economy.

What next? Commercials depicting old people as rats scurrying through the national pantry, feeding on the precious stores of the nation? How about the mentally and physically disabled? Aren't they a drain on SS as well? Better deal with them. Some blogs and chat boards are calling for a population reduction, and the shedding of undesirables, as defined by them. This Wall Street propaganda feeds that sort of ugliness. "It can't happen here" is as deadly an assumption as "It's different this time."

If this is what passes for economic thought and reporting, sponsored by a major mainstream media outlet from one of its editors, God help the United States of America. It has lost its mind, termporarily, but will likely lose its soul if it does not honour its oaths, especially that to uphold the Constitution against all threats, foreign and domestic.

Fortune

Next in Line for a Bailout: Social Security

by Allan Sloan

Thursday, February 4, 2010

Don't look now. But even as the bank bailout is winding down, another huge bailout is starting, this time for the Social Security system.

A report from the Congressional Budget Office shows that for the first time in 25 years, Social Security is taking in less in taxes than it is spending on benefits.

Instead of helping to finance the rest of the government, as it has done for decades, our nation's biggest social program needs help from the Treasury to keep benefit checks from bouncing -- in other words, a taxpayer bailout.

No one has officially announced that Social Security will be cash-negative this year. But you can figure it out for yourself, as I did, by comparing two numbers in the recent federal budget update that the nonpartisan CBO issued last week.

The first number is $120 billion, the interest that Social Security will earn on its trust fund in fiscal 2010 (see page 74 of the CBO report). The second is $92 billion, the overall Social Security surplus for fiscal 2010 (see page 116).

This means that without the interest income, Social Security will be $28 billion in the hole this fiscal year, which ends Sept. 30. (Lots of people and institutions are in trouble if you assume that the Treasury stops paying them interest income on the bonds which they have purchased, starting with the banks. And that income is already little enough because of the quantitative easing being conducted by the Fed to bail out the financial sector, which you represent at your magazine. - Jesse)

Why disregard the interest? Because as people like me have said repeatedly over the years, the interest, which consists of Treasury IOUs that the Social Security trust fund gets on its holdings of government securities, doesn't provide Social Security with any cash that it can use to pay its bills. The interest is merely an accounting entry with no economic significance. (You can say the same 'accounting entry' thing about any Treasury debt that is in excess of current tax receipts. And the Treasury doesn't provide any 'cash' to SS because it does not have to, it is probably the only major government program operating still at a surplus. Social Security payments do not go into the aether, they proceed almost directly into national consumption, which is GDP. - Jesse)

Social Security hasn't been cash-negative since the early 1980s, when it came so close to running out of money that it was making plans to stop sending out benefit checks. That led to the famous Greenspan Commission report, which recommended trimming benefits and raising taxes, which Congress did. Those actions produced hefty cash surpluses, which until this year have helped finance the rest of the government.

But even then, it was clear the surpluses would be temporary. Now, years earlier than projected, Social Security is adding to the government's borrowing needs, even though the program still shows a surplus on paper.

If you go to the aforementioned pages in the CBO update and consult the tables on them, you see that the budget office projects smaller cash deficits (about $19 billion annually) for fiscal 2011 and 2012. Then the program approaches break-even for a while before the deficits resume.

Social Security currently provides more than half the income for a majority of retirees. Given the declines in stock prices and home values that have whacked millions of people, the program seems likely to become more important in the future as a source of retirement income, rather than less important.

It would have been a lot simpler to fix the system years ago, when we could have used Social Security's cash surpluses to buy non-Treasury securities, such as government-backed mortgage bonds or high-grade corporates that would have helped cover future cash shortfalls. Now it's too late...

Read the rest here.

06 February 2010

Fortune Editor Suggests That the US Treasury Will Have to Start Defaulting On Its Bonds

Volcker Rule: They Shoot Horses, Don't They?

If the Volcker Rule were posited as a panacea, much of the criticism that has been leveled by the bank lobbyists and their congressmen, and sincere critics who were surprised by its ungainly introduction into the reform deliberations, would be correct. However, I do not think it was, but I could be wrong.

If the Volcker Rule were posited as a panacea, much of the criticism that has been leveled by the bank lobbyists and their congressmen, and sincere critics who were surprised by its ungainly introduction into the reform deliberations, would be correct. However, I do not think it was, but I could be wrong.

Because a cure for heart disease does not also cure diabetes does not impugn its effectiveness in curing heart disease. And if the patient has both heart disease and diabetes, one might expect a variety of remedies used in careful combination.

What the Volcker Rule would have accomplished is to take the gamblers away from the new “discount window” of Fed and Treasury subsidized programs. It would have also put a serious dent in the ‘Too Big Too Fail’ meme, although it alone was not enough to do that, as it lacked some teeth. But it opened the door to a debate that is not occurring.

What exactly is the role of the financial system, and what needs to be done to regulate it, and help it to perform some utility to society's greater functions? Is the relationship between the financial sector and the productive economy out of balance?

I want to stress this. Any proposal that has not been hammered upon by multiple minds, and tempered with the objections and observations of many perspectives, is likely to be premature, needing much work. By its method of introduction, I fear that the reconsideration of the relationship between the FIRE sector and the productive economy is now off the table.

People seem to be making assumptions about what the Volcker Rule would and would not include. For example, there is reference to the 'shadow banking system' that is something relatively new, the intersection of investment banking and mortgage origination. Does anyone really believe that Volcker would object if mortgage origination and similar long term loans were relegated to the commercial banks and the GSE's? I think not.

For me, the 800 pound gorilla is who obtains access to the discount window and Treasury guarantee programs, and who can be a primary dealer for the Fed. I would say that a company that is not a bank cannot. It is as simple as that. And this is what Wall Street hates so much about anything like Glass-Steagall or the Volcker Rule. They want to be able to tap the Fed's balance sheet, and still maintain their aggressive leverage.

There is a reason that the banks engaged in a decades long effort, costing hundreds of millions in lobbying payments of various sorts, to overturn Glass-Steagall. To ignore that reality is to fall into the trap of the financial engineering distortion that is crippling the Western world. The bankers wanted to broaden their portfolio to intertwine their higher risk efforts with the public trust, as insurance against the occasional setback to even the best laid plans.

Relatively simple systems are more resilient and robust; needlessly complex systems are doomed to increase in complexity to the point of failure without accomplishing anything except more complexity.

The trade offs are always there, and a good system contains a mix of both.

Perhaps the new ‘reform legislation’ will be effective, but I doubt it quite a bit almost to the point of certainty. It will be hailed as an 'evolutionary effort' but will contain loopholes large enough to drive a CEO's bonus through. . If it does nothing to separate self interested, higher risk speculation from the trough of the Fed's balance sheet, it will institutionalize moral hazard, which has probably been the goal of the banks all along.

If the reform legislation relies on firms erecting 'chinese walls' within their firms, and regulators being able to sort out various types of regulated and unregulated activity within a firm, then it is my opinion that it is anathema to sound financial management, and doomed to failure. The problem is fraud, and deception, and regulatory capture. The rules must be as clear, simple, and difficult to cheat as is possible.

And then we will see the return of the financial pundits, suggesting this tweak, and that tweak, this addition to close that loophole, and if only we had made this change. Its a good game really, because it ensure a steady flow of funds from the bank lobby to the Congress, and full employment for financial engineers who can engage in endless argument about the relative merits of the latest tweak.

And the zombie banks will continue to drain the life from the real economy, not in dramatic bailouts, but in a steady stream of slow debilitation. But they will be able to pay enormous salaries and bonuses to their captains and lieutenants, by gaming nearly every financial instrument and market in the world.

This is what will doom the West to a stagflation that will mimic the long Japanese decline, their lost decades. It may not ultimately be resolved without social disorder.

The people are still too easily lulled by jargon and reassurance, and the econorati still believe in financial engineering. If only we put a clever tweak here, and an easy rule change there, things will be fine again. That is why allowing engineers to fix their own 'big system' problems is almost always doomed to failure, because they are too intellectually fascinated with their own creation, and cannot see it in the stark light of objectivity and its function as part of the whole.

How will we fix this? How will we accomplish that? Well, perhaps one can look at how those functions were addressed before the system started to go off kilter, say around 1990, and find an answer there. But that drives the financial engineering crew batty, because it sounds antithetical to Progress. It might stifle innovation.

Well, one might as well say that if they stop getting drunk and engaging in random sex, they will also not wake up next to so many new and interesting people. The point is, you do not have to engage in high risk behaviour to accomplish personal and institutional growth. And there is a role for stifling some things, so that only the good can thrive. It is a basic principle of what used to be called conservatism before it was co-opted by the neo-cons. We have to keep first principles in mind even as we change the specifics.

Was the real economy served better by subprime mortgage collateralization and the growth of an unregulated shadow banking system? Ask the average person, and the answer is clear. But the question is never put that way. To a financial engineer, it is the system itself that matters, and not its primary application, to serve the real economy. The objective of reform would ideally be more than merely preventing the next collapse of the same sort. It would involve giving the middle class a fighting chance to recover itself and prosper again. And that would involve shrinking the portfolio of the Wall Street banks, and expanding the function and stability or regional and local banking. Already the elite are softening up that hope, of a middle class recovery, by forecasting years of underemployment and decline as an inevitability.

The objective of reform would ideally be more than merely preventing the next collapse of the same sort. It would involve giving the middle class a fighting chance to recover itself and prosper again. And that would involve shrinking the portfolio of the Wall Street banks, and expanding the function and stability or regional and local banking. Already the elite are softening up that hope, of a middle class recovery, by forecasting years of underemployment and decline as an inevitability.

The title of this blog does not refer to the Volcker Rule, which was dead out of the gate by its method of introduction into the process, late and fleshless, and quite possibly by intent to stifle debate. It refers to the public, the poor horses that will be beaten senseless by the FIRE sector over the next ten years for their diversion and entertainment. Am I wrong?

So time to move on, to assess what will be coming out of Washington by way of reform. But I have little hope that there will be anything in it that does not serve about ten corporate institutions well, and a financial elite, to the disadvantage of the rest of the world in the form of distorted markets, institutionalized fraud, and the seignorage of the currency reserves.

Would that I am wrong, I doubt it very, very much.

05 February 2010

CFR: When the Fed Stops Monetizing US Sovereign Debt...

The people at the Council on Foreign Relations speculate that US interest rates on Treasury debt will be increasing around the end of the first quarter if the Fed discountinues its monetization of mortgage debt.

As the Fed has essentially purchased ALL new US Treasury issuance since 2009, that seems to be a reasonable bet.

"The Federal Reserve plans to stop buying securities issued by government housing loan agencies Fannie Mae and Freddie Mac by the end of the first quarter.

This is not only likely to push up mortgage rates; Treasury rates should rise as well. Throughout 2009, the private sector sold a portion of their agency holdings to the Fed and used those funds to buy Treasurys.

Once the Fed’s agency purchases stop, this private sector portfolio shift will end, removing a major source of demand in the Treasury market.

As the chart shows, since the start of 2009 the Fed has bought or financed the entire increase in Treasury issuance. As Fed purchases slow and Treasury issuance continues at a high level, interest rates will have to move up to attract new buyers."

Non Farm Payrolls Benchmark Revision and the Unemployment Rate as Cruel Farce

Well, we forecast the headline number exactly, with a loss of 20,000 jobs. No credit taken, it was as much a judgement call (aka SWAG) as any product of careful measurement.

As you may have heard, the Bureau of Labor Statistics did a benchmark revision. This is Washington speak for 'revised the numbers as far back as anyone might care to remember to give ourselves more wiggle room.'

The benchmark is a product of the Bernays Factor, that measure of public gullibility which permits obviously contrived government statistics to be taken seriously.

Did you react to the positive jobs trend initially announced in September - October 2009? Oops, it was really a greater loss than expected, and not a gain at all. One can only suspect that in a few years this whole recovery could be revised away without so much as a bureaucratic blush.

Here is a picture comparing the old and new headline numbers.

The change is pervasive. One item of note is the taking of more job losses in the earlier years, setting up a stable base for potential job gains in the present, without embarrassing oneself by getting out of synchronization with the actual growth of the civilian population. There will be more 'truing up' of the numbers in the future.

Unemployment Rate as Cruel Farce

Regarding that 'surprise drop' in unemployment to 9.7%, this is the result of people falling off the unemployment benefits radar, and becoming discouraged. It is essentially meaningless, if not downright misleading.

One may as well solve an unemployment problem by shipping people to Australia. Well, that does have some historical precedent. Hard to tell who has gotten the better deal on that one, at least over the long run.

A better measure of unemployment is the Labor Force Participation Rate, which provides information about the total number of people employed as a percent of the population, without benefit of official banishment.

That number continued its downtrend from 64.9% in November to 64.7% in January, with a slight uptick from December's low of 64.6%.

Here is a chart from the good folks at Calculated Risk that shows the employment situation in context with other post World War II recessions.

"Recession" hardly does it justice, does it?

04 February 2010

Proprietary Trading and Credit Default Swaps - Mission (Not) Accomplished

Here's why the Volcker Rule ran into a brick wall of Senatorial gravitas and pusillanimous punditry.

Give up prop trading AND banking status? The mutant Zombie Banks would not allow it.

Who needs insured deposits? What a bother. Its the Treasury guaranteed bonds and Discount Window access that count. When you are levering up Other People's Money you want it in bulk and wholesale, not retail.

Goldman is no surprise, because they are nothing but a hedge fund with the right connections and a rolodex full of Senators. But JPM bears watching, since they are at least nominally a bank, and Too Big Not To Leave a Mark (TBNTLM).

Prop trading - why lend when you can play at the tables?

Well, at least we have the Credit Default Swaps situation covered with the bailout of AIG, right?

Well, maybe not.... Two trillion down, but thirteen trillion to go.

I can see why the Fed completely failed to notice this little trend change in its banking oversight.

If the markets turn significantly lower, and the banks' balance sheets start wobbling again, and threaten to crash the system, or else, perhaps Obama can send young Tim up to the Congress with another scribbled request for a trillion dollar bailout. I can hear the sound of knives being drawn as he walks in the door...

Taleb: US Treasuries a 'No-Brainer' Short

"Investors should bet on a rise in long-term U.S. Treasury yields, which move inversely to prices, as long as Bernanke and White House economic adviser Lawrence Summers are in office..."

Directionally correct we would say, but it is certainly a contrarian view today, with Treasuries and the dollar acting again as the safe havens of choice as fears of US jobs losses and Eurozone sovereign defaults frighten the markets.

Keep in mind that his time frame is '2 to 3 years.' Most punters do not realize that funds and specs hold record long positions in the dollar according to the latest Commitments of Traders Reports. Treasuries were a strong performer last year, and may be overbought relative to underlying fundamentals. But one repeatedly hears the meme "Everyone is short the dollar." And dollar debt is not a short, if one has the option of default.

But it will take the appearance of the effects of the ongoing monetization of debt by the Fed and the government agencies and Treasury programs that Taleb cites to trigger the declines in the bond and the dollar. And the euro and the pound may go first, to cushion the blow. Everything is relative, and the US banks will throw their relatives, their European cousins, under the bus if it is required to save their bonuses. The saying "he would sell his mother for an eighth" is a Wall Street proverb.

With a fiat currency regime, one always has to say, "it depends..."

And China is looking a bit bubbly as well, although the Chinese bank is acting to try and stem the speculation. It may not be enough.

Bloomberg

Taleb Says ‘Every Human’ Should Short U.S. Treasuries

February 04, 2010, 11:01 AM EST

By Michael Patterson and Cordell Eddings

Feb. 4 (Bloomberg) -- Nassim Nicholas Taleb, author of “The Black Swan,” said “every single human being” should bet U.S. Treasury bonds will decline, citing the policies of Federal Reserve Chairman Ben S. Bernanke and the Obama administration.

It’s “a no brainer” to sell short Treasuries, Taleb, a principal at Universa Investments LP in Santa Monica, California, said at a conference in Moscow today. “Every single human being should have that trade.”

Taleb said investors should bet on a rise in long-term U.S. Treasury yields, which move inversely to prices, as long as Bernanke and White House economic adviser Lawrence Summers are in office, without being more specific. Nouriel Roubini, the New York University professor who predicted the credit crisis, also said at the conference that the U.S. dollar will weaken against Asian and “commodity” currencies such as the Brazilian real over the next two or three years.

The Fed and U.S. agencies have lent, spent or guaranteed $9.66 trillion to lift the economy from the worst recession since the Great Depression, according to data compiled by Bloomberg. Bernanke, who in December 2008 slashed the central bank’s target rate for overnight loans between banks to virtually zero, flooded the economy with more than $1 trillion in the largest monetary expansion in U.S. history.

In a short sale, an investor borrows a security and sells it, expecting to profit from a decline by repurchasing it later at a lower price.

“Dynamite in the Hands of Children”

President Barack Obama has increased the U.S. marketable debt to a record $7.27 trillion as he tries to sustain the recovery from last year’s recession. The Obama administration projects the U.S. budget deficit will rise to a record $1.6 trillion in the 2011 fiscal year.

“Deficits are like putting dynamite in the hands of children,” Taleb said in an interview with Bloomberg Television. “They can get out of control very quickly.”

Taleb argued in “The Black Swan: The Impact of the Highly Improbable” that history is littered with rare events that can’t be predicted by trends. The best-selling book came out in 2007 before the global credit crisis sparked an economic slump and $1.7 trillion of losses at banks and financial institutions.

“The problem we have in the United States, the level of debt is still very high and being converted to government debt,” Taleb said in an interview with Bloomberg Television. “We are worse-off today than we were last year. In the United States and in Europe, you have fewer people employed and a larger amount of debt.”

Credit Outlook

Moody’s Investors Service Inc. said on Feb. 2 that the U.S. government’s Aaa bond rating will come under pressure in the future unless additional measures are taken to reduce budget deficits projected for the next decade.

Treasuries soared during the financial crisis, gaining 14 percent in 2008, as investors sought the relative safety of U.S. government debt. They fell 3.7 percent last year, according to Bank of America Corp.’s Merrill Lynch Unit, as risk aversion eased and the Standard & Poor’s 500 Index rallied 23 percent. So far this year U.S. government debt has gained 1.17 percent.

Yields fell today on concern European countries including Greece, Portugal and Spain face difficulty financing budget deficits. The yield on the benchmark 10-year note fell 6 basis points, or 0.06 percentage point, to 3.64 percent at 10:54 a.m. in New York, according to BGCantor Market Data.

“Democracies can’t handle austerity measures very well,” Taleb added. “We’re going to have a severe problem.”

Bank Of America to Pay $150 Million Fine to Settle SEC Case

Breaking news...

Bank of America has agreed to pay a $150 million fine to settle a case with the SEC that it failed to disclose bonuses and other relevant information regarding the acquisition of Merrill Lynch.

Apparently there will be charges under the Martin Act against Mr. Ken Lewis, compliments of Mr. Andrew Cuomo.

The Martin Act, New York General Business Law article 23-A, sections 352-353, is a 1921 piece of legislation in New York that gives extraordinary powers and discretion to an attorney general fighting financial fraud. People called in for questioning during Martin Act investigations do not have a right to counsel or a right against self-incrimination. The act's powers exceed those given any regulator in any other U.S. state.

With a couple of his lieutenants, Mr. Blankfein could cover that bank fine suggested by the SEC with out of pocket money. But some banks are more equal than others, and GS would probably not condescend to subject itself to an SEC inquiry in the first place.

Mr. Lewis is an outsider, a non-NY banker. He could be food for the wolves, or the career of an ambitious AG.

If the Martin Act carries such power to safeguard the system, as Senator Bob Corker referenced yesterday in his critique of the Volker Rule, why don't they use it to probe the AIG scandal?

Non-Farm Payrolls Report Preview for January 2010

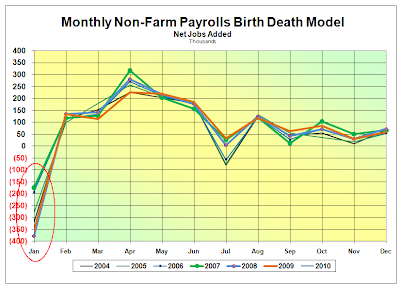

The markets breathlessly await the latest Non-Farm Payrolls Report for the US, which will be released tomorrow morning. January is the month in this report that contains the largest seasonal adjustments by far.

Here is a projection of what tomorrow's numbers may look like, and their historical context. The raw number unadjusted for seasonality may be a loss of around 4,000,000 jobs.

It is no accident that the BLS does the major adjustment to its Birth-Death Model in January. Keep in mind that the Birth-Death adjustment is applied BEFORE seasonal adjustment, that is, to the raw, unadjusted number.

Given that the expected raw number will probably be around 3.5 million jobs lost, and then adjusted to a headline number much closer to zero, adding even 380,000 or so job losses to that does not result in such an enormous adjustment in January.

In other words, the adjustment is largely adjusted away by the seasonality. Nonsense, hardly connected to the real world, but quite clever bureaucratic sleight of hand really.

Saying all this, it seems almost needless to stress that any projection of the headline number is a tough call in January, because the seasonality has such enormous latitude. More in the nature of a SWAG than a proper forecast.

Then there is also the matter of the revisions to the prior two months at least, and the possibility of a revision to the whole series going back two years, which sometimes occurs.

So, we'll look for a 'headline number' closer to zero than not, with a shade to the negative, maybe a loss of 20,000 or so. But we are very prepared to be surprised to the upside to a positive number, and downside to a loss of around 80,000. That speaks less to our inability to forecast, we hope, and more so to the arbitrary nature of the government's willingness and ability to fiddle with the numbers.

With pretty colors, it may look more like a sideways chop than a plunge, especially in light of a greater negative from December which will be adjusted but not higher.

And as for the reaction of US equity markets in anticipation today?

As I have stated before, the banks and their prop trading desks are always and everywhere screwing you, and frontrunning their better insights into the markets, even if only by a few milliseconds.

Watch the sovereign debt situation. This may place a heavy weight on the equity markets. But perhaps not just yet.

03 February 2010

Italy Seizes Bank of America Assets In Derivatives Fraud Probe

"more than 519 municipalities that face 990 million euros in derivatives losses"

As the quote indicates, its a big problem, and Bank of America is not the only bank involved. But they are a big player, and actively using derivatives to 'rip customer's faces off' as they saying goes.

Why does this happen? Bank of America just announced they will be paying, on average, a $400,000 bonus per employee for this year past. Any fines or penalities that are incurred from offenses are treated as a cost of doing business.

Crime does pay in the short term. Especially if you can buy off the government and co-op the regulators of a major developed nation. When someone succumbs to fraud, there is a tendency to blame the victim. The purpose of the law is to protect the weak. Perhaps they could have been more vigilant, but this in no way diminishes the guilt of the perpetrator, and the likelihood that this is something they have been doing in many places over a period of time, with a growing level of sophistication.

People argue that if a nation sets rules for banks, they will just move offshore and keep doing business in any way that they please. This is intended to undermine any reforms and the rule of law.

It is possible to ban a company from doing business in your nation if it engages in unlawful practices. As noted here previously, Citi was engaging in trading practices in Europe and Japan that put them on the receiving end of bans for fraud.

Globalization is used as a rationale for stripping nations of their sovereign rights, and the people from their ability to rule and protect themselves in accord with their own beliefs and preferences.

Why people accept this nonsense when it applies to the financial sector is amazing. Well perhaps not, given the force of a steady propaganda that has been promoting it for the past twenty years.

The truth is ugly when you see it in plain black and white. The US is a relative safe haven for multinational corporations that engage in various forms of fraud and market manipulation around the world, like modern day privateers. It appears unable to regulate them because of widespread political corruption and the self interest of its monied elite.

Corporate privateering in partnership with the state has been a perennial problem in developing nations, especially in South America and the western Pacific. But the economic hitmen are ranging further and wider these days, in search of greater profits and new fields of plunder, and in developed nations. Iceland and Greece are one thing, but if a G7 nation like the UK falls prey to the banks, the reaction may be severe.

This theme of national sovereignty versus corporatism will gain more traction over the next five to ten years.

Bloomberg

Italy Seizes Bank of America, Dexia Assets in Derivatives Probe

By Elisa Martinuzzi

Feb. 3 (Bloomberg) -- Italy’s financial police are seizing 73.3 million euros ($102 million) of assets from Bank of America Corp. and a unit of Dexia SA as part of a probe into an alleged derivatives fraud in the region of Apulia.

The police are sequestering a further 30 million euros that the municipality was set to place in a fund managed by the banks on Feb. 6, according to an e-mail from the prosecutor’s office in Bari today. The prosecutor also asked that Charlotte, North Carolina-based Bank of America be banned from doing business with Italian municipalities for two years. A hearing is slated for next month.

Prosecutors allege that when the banks arranged swaps and created a fund that invests money the region set aside to repay 870 million euros of borrowings due in 2023, they misled the region about the economic advantage of the package. Banks skewed the swaps to their advantage to hide fees, the prosecutor said.

Apulia, located in the heel of Italy, joins more than 519 municipalities that face 990 million euros in derivatives losses, according to data compiled by the Bank of Italy. In Milan, prosecutors seized assets from four banks including JPMorgan Chase & Co. and UBS AG and requested they stand trial for alleged fraud. Hearings started in Milan this month...

02 February 2010

On Monetary Inflation and M3

From a chatboard frequented on the occasional break from the kitchen.

Q. A Question for the Inflationists

"The government no longer tracks M3 because of its expense to generate (yeah, right) but private groups still do and it has basically fallen since the stock market entered its bear market a couple of years back. So by definition, do we have inflation or deflation? Gold driven to new highs could be more about gold fever than real inflation."

I usually try to avoid conversations that start this way, with a label and a challenge, since it generally implies an exchange of what are more like religious beliefs, from the opposing 'isms.' As an monetary agnostic, I am usually in the middle of two groups with ardently held beliefs, and a range of impassioned arguments, good and bad. But knowing the person who asked it, I think it is a sincere question, and so here is my answer, for what it is worth.

Within a relatively pure fiat currency system the conditions of inflation and deflation, and the broad range in between, are largely the result policy and fiscal decisions, constrained for the most part only by the acceptability of the bond and the dollar and the tolerance of the people.

Regarding M3, it is the eurodollar component that is primarily missing, and Williams and my friend Bart estimate it. I have discussed the difficulty of that and their specific methods with them. I estimate the eurodollar s well, from the BIS and TIC reports, for another reason. It is my measure of dollar demand from overseas, the sole cause of the last dollar rally that was sustained, the eurodollar short squeeze. But one can look at MZM or M2 and see the same trends essentially. Money Supply: A Primer

Money supply alone is not the sufficient to measure monetary inflation or deflation. That is like asking if someone is overweight, if they weigh XX pounds, without specifying their height. Are they four feet or six feet tall? One meter or two meters? It obviously matters.

The measure of monetary inflation is by definition money supply in relation to something else. If nothing else, to population growth or decline, one might imagine, even if one cannot measure economic vitality, or stagnation. As an aside, it is a curious fact of history that the Plagues decimated the people of Europe, but hard wealth and the land remained. So the survivors were richer per capita, helping to create the relief and ebullience that sparked the Renaissance.

Money supply is relative to demand, and potential money supply to potential demand. Even though money supply may not be growing, demand may be contracting faster than it is not growing. If one looks at GDP, and the Velocity of Money which is nothing more than GDP divided by some nominal measure of defined money, domestic demand is slack. And from non-domestic sources, demand for the dollar reserve currency is weaker than in years past.

But there is a funny thing about potential money supply. It can grow quietly in assets, stored in investments and other less repositories of value, and then spring into action relatively more quickly, when wealth is converted to money, the medium of exchange.

Money as the medium of exchange, the note of zero duration, is a very imperfect store of wealth, when real short term rates of return are negative. So the market does not value it, except perhaps for the daily needs, diminished, and a safe haven from unknown risk, and a refuge from bonds of longer duration whose returns may be even worse.

Monetary inflation is deceptively simple, and immensely more complicated than the average person can allow, and the pundit will admit. Credit is not money. Debt is not money. They are methods of creation of money, of financing the money used in an enterprise.

Credit is not money. Debt is not money. They are methods of creation of money, of financing the money used in an enterprise.

Money is the exchange, wealth in action, the others potential for transactions. Money bridges the gap between stores of supply and stores of wealth. Money moves, and goods and wealth are exchanged, and then stored again. Money supply is a snapshot of a dynamic process.

Credit/debt destruction are the preoccupation for the deflationary camp. Yes, they are important sources for the creation of money, over which the central bank exercises a remarkable degree of control, despite their occasional and highly disingenuous denials. As credit is destroyed, by writeoffs for example, potential sources of money are negated. But the real question is, what other mechanism for the creation of money remain, perhaps methods that have not been recently used, because they did not need to be used.

One very fine example of this is the method by which the Bernanke Fed expanded its monetary base, to a degree not seen since 1933. The monetary base is high powered money, because it is supposed to represent a pure financial asset, zero risk. Certainly more leveragable than a collaterized debt obligations. The Fed's balance sheet, and the Treasury's ability to issue sovereign debt based on that balance sheet, are the sorcerer's stone. Touch even the most toxic assets with them, as most recently seen in the case of AIG and Goldman Sachs, and they are now worth 100 cents on the dollar.

Debt/credit are one means of financing the enterprise. There is also equity. But a wise person will look at the organically generated flows of wealth in valuing the shares. Are you consuming more than you are creating? What are the future prospects for this flow of wealth? If there is no prospect of net positive wealth creation, then you are living on borrowed time, in a castle of sand, no matter how good the accounting tricks you are using to hide it from the shareholders.

One might look an an unconnected car battery and say, 'oh look it is benign.' But grab hold of each of its terminals with your bare hands while grounded, and see what happens then. And gold is in part measuring that potential, for the Fed and the monetary base and a resurgent economy to generate monetary expansion. There are lags of years involved in the process.

And this is the nature of Bernanke's challenge. He must at some point allow the economy greater access to his excess monetary reserves, and the swollen monetary base, but try to prevent the dollar and the bond from igniting. And gold is where the prudent seek at least a partial refuge while the central bankers conduct their experiments.

Is gold a bubble? It is said to be so by those who wish you to extend your willing hands, and grasp the poles of their mad experiment, without reserve, to help them measure the effect. And, of course, by those who merely to stand by and watch, and plan for their own per capita increase in wealth if you are subsequently reduced to toast.

"The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country." Edward Bernays, Propaganda, P.37It's about confidence, isn't it? And perception, and custom, as in habit. The acceptability of the dollar and the bond by the world is the limiting factor on the ability of the Fed and Treasury to create money, managing its supply, by whatever means direct and indirect, by action or allowance, in a fiat currency.

Is Blackrock Buying the US Equity Market?

One might conjecture from this enormous number of 13G filings noted below that Blackrock has taken what appears to be new 5+% stakes in over 1,800 US equities.

"We counted over 1,800 13Gs that Blackrock dumped on Friday...For those less familiar with the 13G...it’s a requirement when ownership exceeds 5% of the outstanding shares...these filings represented new positions for Blackrock since we only counted 11 amended 13Gs, which in itself seems very surprising, given the long list of stocks."

Holy guacamole!

Perhaps this is an error, or a misreading of the data. Someone 'fat-fingered' the Edgar filing button.

We are incredulous that a private investment firm, no matter how well connected, could have taken 5+% positions in most of the NY listed equity market so quickly. Driven madly bullish, with enormously deep pockets, and an abiding faith in their ability to defy the odds? Facilitating the hostile takeover of the rest of US real economy by a cabal of bonus taking Bonapartes? Starting a new Blackrock 1800 index fund from the bottom up, build it and they will come? LOL

Certainly the SEC will inquire as to their intentions, which is the purpose of such filings, and an explanation to the investment public will be forthcoming.

We suggested the other day that Blackrock and the NY Fed might turn out to be Obama's Halliburton and KBR - private contractors fulfilling administration policy. NY Fed Conspired to Hide Details of AIG There are repeated rumours of an invisible hand in several markets, as an arm of Washington. But this is a bit much.

The Robert Rubin Rule of Financial Crisis Management was stated in the mid 1990's. It held that buying SP futures to prop the stock market was cheaper than trying to clean up the mess after a stock market panic. But this was not about actually buying the market; it was about using price to manage perception, in the manner recommended by Edward Bernays.

The problem with this doctrine, of course, is that it requires larger and more pervasive interventions to maintain the illusion, unless the underlying conditions that set the primary market trend are changed. Rather like creating a short term euphoria by treating a patient with pain killers, to the point of harmful addiction, without addressing the underlying condition.

But buying over 5 percent positions in 1,800 listed equities? That is not your father's market rigging, and certainly a step above buying the SP futures contracts. Clumsy and heavy-handed to say the least.

Skeptically waiting, we are keen to see the clarification, legitimate investment or data error. Regardless of the punter, it's a hell of a bet if that is what it is.

Postscript with tongue still in cheek: As I suspected they are rebranding their ETF's purchased from Barclay's. Impressive amount of stock behind it. Still a hell of a bet, just risk spread more widely. They are just taking the management fees, the public is putting up the capital. LOL

footnoted.org

Blackrock’s massive Friday afternoon dump…

By Michelle Leder

February 1, 2010 at 9:30 am

As we monitored filings on Friday afternoon, we wondered why EDGAR seemed unusually sluggish. But it wasn’t until late Friday that we realized why: Blackrock (BLK) had done a massive document dump on Friday afternoon of 13G filings related to its acquisition of Barclay’s Global Investors.

We counted over 1,800 13Gs that Blackrock dumped on Friday, which explains why EDGAR might have been a tad bit pokey. The stream started at just after 2 p.m. est and didn’t let up until just after 4:30, when the last one, which reported a 6.5% stake in Vodafone came in.

For those less familiar with the 13G, since we don’t often write about these filings, it’s a requirement when ownership exceeds 5% of the outstanding shares. With few rare exceptions, these filings represented new positions for Blackrock since we only counted 11 amended 13Gs, which in itself seems very surprising, given the long list of stocks.

Though it’s hard to tell from the SEC’s EDGAR database the names of those 1,800-plus companies without clicking on each filing (and who has time to click on 1,800 of them?), it’s a bit easier in 10KWizard (now known as Morningstar Document Research). And, indeed, there’s a lot of household names on the list including some big names in tech like Apple (AAPL), AOL (AOL), Google (GOOG), Yahoo (YHOO) — several of which Dow Jones picked up on on Friday afternoon. But there’s a lot more names on the list too, including United Technologies (UTX), Toll Brothers (TOL), and even footnoted frequent flyer Martha Stewart Omnimedia (MSO) where Blackrock disclosed a stake of just over 7%.

Actually, a far more interesting project might be trying to figure out who wasn’t on the list since with 1,800-plus filings, just about any company over even a relatively modest market cap — Martha Stewart’s is currently around $240 million — seems to have made the cut.

Equal Protection (From the Zombie Banks)

"...the AIG bailout, a hideous political contrivance that ranks with the great acts of political corruption and thievery in the history of the United States."

Remarkable that in light of the massive failure of the Executive and Legislative Branches of the United States Corporatocracy to protect and defend the public from the outrages being committed by the FIRE sector, the Judicial Branch is providing a haven for the rights of the people under the Constitution.

Can this be due to the fact that federal judges do not require huge campaign contributions, which Wall Street doles out like a foreign power to the craven denizens of Foggy Bottom?

Indeed. The clauses that designate the Credit Default Swaps as super senior to nearly everything else (Some animals are more equal than others clauses) are being struck down by bankruptcy courts. The banks do not take precedent in the hearts and minds of everyone, despite assertions by Timmy and Hank to the contrary.

This is an old financiers trick in the equity world of venture capital, the Sand Hill Road clause, long used to strip the holders of common shares of their slice of the pie in the evolution of startups. The CDS and CDO variation took the gambit a step too far, stepping on the rights of the bond holders, and the courts are nullifying it. Good for them.

Wall Street does not always come first, when honest public servants uphold their oaths to protect and defend the Constitution against those confiscating the wealth of the people.

Do what thou wilt shall be the whole of the Law is the guide of those doing their darker god's work. In the short term it makes them strong, because they deny themselves nothing: no trick or falsehood, no claim or deceit, no act of betrayal or sympathetic ploy. They simply have no shame.

But there is also no honour among thieves, only greed and fear. The best part of honour is the love of something greater than ourselves. And so the bonds of their coalition are weak. Greed and self-interest will be unable to sustain the partnership of government and the Banks when the tide turns-- in the end only the fear remains.

And will Timmy whimper when the zombies turn on him?

Institutional Risk Analyst

Zombie Update: Loan Repurchases and REO Anyone?

February 2, 2010

...Our friends at HousingWire report that a federal bankruptcy judge in New York sitting on the Lehman Brothers bankruptcy, has voided the seniority claims of holders of various qualified investment contracts, ruling that their ipso facto clauses which subordinated other claims to their own were "null and void in bankruptcy." This is an important victory for fans of equal protection and due process, and a big setback for the OTC derivative dealer banks which exert considerable influence at the Fed and OCC.

We have always held the view that the attempts by the large dealer banks, ISDA and regulators to carve out a special, privileged place in the law for OTC derivatives contracts in the event of default is inherently unfair and is doomed to failure, or at least would be challenged, on Constitutional grounds. This case and others make that challenge and review process a reality and also leaves much of the world of complex structured finance in a shambles when it comes to the legal reality of counterparty risk.

Indeed, the same legal art that gave the swap counterparties in this latest case the impression that they were senior to the other creditors of the bankruptcy estate was used by former Treasury Secretary Hank Paulson and his successor, Timothy Geithner, to justify the rescue of American International Group. The very same type of investment contracts that Secretary Paulson and Secretary Geithner swore under oath, over and over again, just had to be paid at par in the case if AIG were just set aside by New York Bankruptcy Judge James Peck.

And notice that the world has not ended when the holders of OTC contracts are treated like everyone else. Indeed, Judge Peck has made a number of rulings over the past two years re-leveling the playing field between holders of OTC contracts and other claims against the Lehman bankruptcy estate. As we have noted before, the admirable conduct of the Lehman Brothers bankruptcy case by Judge Peck and US Bankruptcy Trustee Harvey Miller is the starkest condemnation possible of the AIG bailout, a hideous political contrivance that ranks with the great acts of political corruption and thievery in the history of the United States.

The question of the enforceability of the documentation in a complex structured securitization involving OTC swaps is not just a matter of debate in the AIG case. Across the US and around the world, investors and trustees are grappling with this same issue. The result is litigation by bond trustees against bond issuers as well as claims by guarantors such as MBIA (MBI) and the housing GSEs, including the Federal Home Loan Banks, against sponsor banks. Many of these claims regarding derivatives are being made in the context of claims for the repurchase of defaulted residential and commercial loans.

The wave of loan repurchase demands on securitization sponsors is the next area of fun in the zombie dance party, namely the part where different zombies start to eat one another. The GSE's are going to tear 50-100bp easy out of the flesh of the banking industry in the form of loan returns on trillions of dollars in exposure, this as charge-offs on the several trillion in residential exposure covered by the GSEs heads north of 5%. The damage here is in the hundreds of billions and lands in particular on the larger zombie banks, especially Bank of America (BAC) and Wells Fargo (WFC).

To put the growing combat in the loan repurchase channel into perspective, keen analysts will already know that a new item has appeared in the disclosure for non-interest income by many larger banks that have been active in the securitization markets. In the case of WFC in Q4 2009, gross income of $1.2 billion in mortgage loan originations was net of $316 million in loss reserves for loan repurchases. Imagine if we add a zero to the loss allocation, then another, and you get to the worst-case exposure on OBS loan repurchases.

Watch this heretofore obscure part of the mortgage banking business become downright material in coming quarters as a race of sorts develops between banks that want to restart the securitization markets and those that are being dragged under water by the weight of legacy liabilities. Notice, for instance, that in the MBI litigation against Countrywide Financial et al, MBIA Insurance Corporation v. Countrywide Home Loans, Inc. et al. that now includes BAC explicitly.

The action "arises out of the alleged fraudulent acts and breaches of contract of Countrywide in connection with fifteen securitizations of pools of residential second-lien mortgages" Take particular care to savor the fact that these are second lien pools and that, where defaults have occurred on the primary mortgage, loss severities on the seconds will tend to be 100%. Or the cost could be more than par if you count the cost of remediation and recovery efforts.

With private issuers trying to find a workable formulation for new securitizations, the mounting litigation in the secondary market for structured deals comes at a bad time for efforts to revive the patient and confirms our worry that there is a lot of tough work ahead in the loss mitigation channel. More, we worry that the level of claims and defaults now visible in the US markets is just a taste of the high tide we could see in 2010-2011, especially as and when interest rates start to rise even modestly. Did somebody say "interest rates?"

01 February 2010

31 January 2010

A Quartet for the End of Time

"The most ethereally beautiful music of the twentieth century was first heard on a brutally cold January night in 1941, at the Stalag VIIIA prisoner-of-war camp, in Görlitz, Germany. The composer was Olivier Messiaen, the work “Quartet for the End of Time.”

Messiaen wrote most of it after being captured as a French soldier during the German invasion of 1940. The première took place in an unheated space in Barrack 27. A fellow-inmate drew up a program in Art Nouveau style, to which an official stamp was affixed: “Stalag VIIIA 49 geprüft.” Sitting in the front row—and shivering along with the prisoners—were the German officers of the camp.

The title does not exaggerate the ambitions of the piece. An inscription in the score supplies a catastrophic image from the Book of Revelation: “In homage to the Angel of the Apocalypse, who lifts his hand toward heaven, saying, There shall be time no longer.”

Messiaen’s quiet answer to the ultimate questions of fear and faith stayed with me...not because he was a greater composer than Bach or Beethoven but because his reply came out of an all-too-modern landscape of legislated inhumanity. In the face of hate, this honestly Christian man did not ask, “Why, O Lord?” He said, “Lord, I love you.”

Alex Ross, Revelations: The story behind Messiaen’s Quartet for the End of Time, The New Yorker, March 2004

Front-Running the Markets And the Sickness Unto Death

"And that is the nature of Goldman. Gather up as many customers as possible, aggregate the available information to achieve a superior market view and then relentlessly extract rents from the marketplace. Better yet, tell yourself you’re smarter than everyone else and you’ve earned the rents from the symbiosis."

James Rickards, former General Counsel of Long Term Capital Management

This is a nice, concise, albeit somewhat simplified description, from a more mainstream and highly credible source, of how the markets are operating today to the extreme disadvantage of the public and the real economy. Between front-running and naked short selling the banks have things pretty well under their control.

The market makers are the Wall Street banks are the prop trading desks, trading at high frequency slightly ahead of the markets while peeking into your accounts, gaining just enough unfair advantage to defy the odds of winning and losing in a fairly regulated market.

From James Rickards, The Frog, The Scorpion, and Goldman Sachs:

"Now consider another example of data mining, not done by retail firms, but by giant investment banks such as Goldman Sachs. These banks have thousands of customers transacting in trillions of dollars in stocks, bonds, commodities and foreign exchange daily. By using systems with anodyne names like SecDB, Goldman not only sees the transaction flows but some of the outright positions and whether they are bullish or bearish. Data mining techniques are just as effective for this market information as they are for Google, Amazon, Wal-Mart and others. It’s not necessary to access individual accounts to be useful. The data can be aggregated so that the bank can look at positions on a portfolio basis without knowing the name of each customer.

One need not be a market expert to imagine the power of this information. You can see which way the winds are blowing before the storm hits. You get a sense of when momentum is draining out of a trade so you can get out of it before the market turns. You can see when bullish or bearish sentiment reaches extremes, suggesting it may soon turn the other way. This use of information is the ultimate type of insider trading because it does not break the law; you are not stealing the information, you own it.

So what do Goldman and others do with this mountain of market information? Do they send coupons to customers or text them with great trading ideas? A few lucky customers, usually giant hedge funds, may get a call on some insights, but this mountain of immensely valuable market information is used mainly to power their giant proprietary trading desks allowing them to rack up consistent excess returns. Economists have a name for this also. It’s called “rent seeking,” which means taking value from others without any contribution to productivity. The difference between value-added behavior and rent seeking is like the difference between Amazon trying to sell me a book or planning to steal my library. In nature, the name for a rent seeker is parasite.

The ideal existence for a parasite is symbiosis, or balance, where it offers some minimal service to the host, (some parasites devour insects which annoy the host), while extracting as much sustenance from the host as possible without killing it. But sometimes the symbiosis is disturbed and the parasite takes too much and actually destroys the host, which can end up destroying the parasite as well. This recalls the fable of the scorpion and the frog. Both are on the edge of a river looking for a way to cross. The scorpion cannot swim and asks the frog for a ride on its back. The frog at first says, “no,” for fear of being stung. But the scorpion assures the frog it will not sting him because they would both drown. The frog agrees to carry the scorpion. Once they reach the middle of the river, the scorpion stings the frog and they begin to drown. The frog cries, “why did you do that?” and the scorpion replies, “it’s my nature.”

And that is the nature of Goldman. Gather up as many customers as possible, aggregate the available information to achieve a superior market view and then relentlessly extract rents from the marketplace. Better yet, tell yourself you’re smarter than everyone else and you’ve earned the rents from the symbiosis."

How does it continue? Like the bailout of AIG, the stewards of the public trust are choosing to turn a blind eye. The politicians are the beneficiaries of huge campaign contributions. The regulators are overwhelmed, and desirous of Wall Street positions. The other traders are jackals, seeking to follow the lions as they tear into the flocks of sheep and cattle. The economists are timid, adverse to anything but painfully granular analysis of carcasses of other people's ideas and orthogonal scenarios.

"Worse yet, the parasite is now killing the host. The United States is drowning in debt, much of it incurred to bail out Goldman, AIG, GMAC, Fannie Mae and all of the other rent seekers. The U.S. is like the frog; well meaning but blind to nature of scorpions.

Wall Street likes to say, “what’s good for Wall Street is good for Main Street.” That’s the scorpion talking. What’s good for Wall Street is good for Wall Street. Never forget it."

The financial system did not need to be saved by bailouts, it needs to be saved from itself. Their insatiable greed, monstrous appetites, and arrogant pride will take them over the cliff.

Which would not be bad in itself, if our governments had not made us hostage to their reckless schemes, and if we, in our resignation and despair, do not allow them to take us with them.

The First Year of Obama's Failed Economic Policies: The Worst May Yet Be Avoided

"The banks must be restrained, the financial system reformed, and balance restored to the economy before there can be any sustained recovery."

We have been saying this for some time. The report below from Neil Barofsky says essentially the same thing.

"Even if TARP saved our financial system from driving off a cliff back in 2008, absent meaningful reform, we are still driving on the same winding mountain road, but this time in a faster car," Barofsky wrote.

The US is heading towards a double dip recession, and the next leg down may be more fundamentally damaging than before.

The reason for the decline will be the abject failure of the Obama Administration to address the roots of the problem, instead wasting trillions to prop up a banking system that is a useless distortion.

Worse than useless really, because it actually presents a huge negative influence by stifling the recovery, channeling funds to the crony capitalists and non-producing wealth extraction sector, who tax the people like feudal lords under license of a corrupt government.

So far, Obama has failed the people, but preserved the banks. A source of his failure has been his weakness in listening to Larry Summers and Tim Geithner, the Rubin-Clinton wing of Democrats, who have well established their incompetence and inability to act at a level suitable to their positions. They are captive to special interests, locked into the ways of thinking that brought the world to the point of crisis.

In response to the next leg down, Bernanke will monetize debt at an even more furious and clever pace, perhaps in alliance with the Bank of England and Bank of Japan. The ECB resists, and all who balk will be chastised by the monied powers and their demimonde, the ratings agencies and global banks. This is modern warfare of a sort.

We do not expect the corruption of the world's reserves to be so blatant that the inflation will immediately appear, except in more subtle manner. At some point it may explode, especially if Ben is particularly good at concealing its subtle growth.

Monetary inflation is the growth of the money supply in excess of the demands of the real economy, not nominal growth of the supply. The US has been shifting its growth into the reserves of other central banks for the past twenty years or so, and those eurodollar present an overhang that will egulf the Treasury should they come home to roost too quickly. The great nations see the US problem, most surely. The question is how to handle it, gracefully, since the US is still the world's sole superpower, and given to covert pre-emptive action when it feels threatened.

It is not a pretty picture. We had high hopes for Obama, because he was capable of rising to the challenge. He had the backing of his people. And he is choosing failure, for whatever reason. That is certainly is the template of a modern tragedy.

“Given the same amount of intelligence, timidity will do a thousand times more damage than audacity.” Karl von Clausewitz

ReviewJournal

Watchdog: Bailouts created more risk in system

By DANIEL WAGNER and ALAN ZIBEL

AP Business Writers

WASHINGTON (AP) -- The government's response to the financial meltdown has made it more likely the United States will face a deeper crisis in the future, an independent watchdog at the Treasury Department warned.

The problems that led to the last crisis have not yet been addressed, and in some cases have grown worse, says Neil Barofsky, the special inspector general for the trouble asset relief program, or TARP. The quarterly report to Congress was released Sunday.

"Even if TARP saved our financial system from driving off a cliff back in 2008, absent meaningful reform, we are still driving on the same winding mountain road, but this time in a faster car," Barofsky wrote.

Since Congress passed $700 billion financial bailout, the remaining institutions considered "too big to fail" have grown larger and failed to restrain the lavish pay for their executives, Barofsky wrote. He said the banks still have an incentive to take on risk because they know the government will save them rather than bring down the financial system.

Barofsky also said his office is investigating 77 cases of possible criminal and civil fraud, including crimes of tax evasion, insider trading, mortgage lending and payment collection, false statements and public corruption.

One case concerns apparent self-dealing by one of the private fund managers Treasury picked to buy bad assets from banks at discounted prices. A portfolio manager at the firm apparently sold a bond out of a private fund, then repurchased it at a higher price for a government-backed fund. A rating agency had just downgraded the bond, so it likely was worth less, not more, when the government fund bought it. The company is not being named pending the outcome of Barofsky's investigation.

Barofsky renewed a call for Treasury to enact clearer walls so that such apparent conflicts are less likely.

Treasury said it welcomed Barofsky's oversight but resisted the call to erect new barriers against conflicts of interest. The new rules "would be detrimental to the program," Treasury spokeswoman Meg Reilly said in a statement. The existing compliance rules "are a rigorous and effective method of protecting taxpayers," she said.

Much of Barofsky's report focused on the government's growing role in the housing market, which he said has increased the risk of another housing bubble.

Over the past year, the federal government has spent hundreds of billions propping up the housing market. About 90 percent of home loans are backed by government controlled entities, mainly Fannie Mae, Freddie Mac and the Federal Housing Administration.

The Federal Reserve is spending $1.25 trillion to hold down mortgage rates, and millions of homeowners have refinanced at lower rates.

"The government has stepped in where the private players have gone away," Barofsky said in an interview. "If we take government resources and replace that market without addressing the serious (underlying) concerns, there really is a risk of" artificially pushing up home prices in the coming years.

The report warned that these supports mean the government "has done more than simply support the mortgage market, in many ways it has become the mortgage market, with the taxpayer shouldering the risk that had once been borne by the private investor."

Barofsky's report echoed concerns raised by housing experts in recent months, as home sales and prices rebounded. They warn that the primary reason for the turnaround last year has been billions of dollars in federal spending to lower mortgage rates and prop up demand.

Once that spigot of cash is turned off, they caution, the market will be vulnerable to a dramatic turn for the worse. Daniel Alpert, managing partner of investment bank Westwood Capital, wrote in a report that national home prices are bound to fall 8 to 10 percent below the lows of last spring.

"The lion's share of the remaining decline will occur in markets that saw sizable bubbles but have not yet retrenched," he wrote.

Officials from the Obama administration counter that massive federal intervention has helped the housing market stabilize and prevented more dire consequences.

Barofsky's report also disclosed that, while the Obama administration has pledged to spend $75 billion to prevent foreclosures, only a tiny fraction - just over $15 million - has been spent so far. Under the Making Home Affordable program, only about 66,500 borrowers, or 7 percent of those who signed up, had completed the process as of December.

He said the key to preventing future crises is to reform Fannie Mae and Freddie Mac, create and improve loan underwriting and supervision of banks. He stopped short of endorsing specific proposals for overhauling financial regulation, but said many of the proposals would go far to improving the system.

30 January 2010

NY Fed Conspired to Hide Details of AIG Bailouts from Public and Congress

“I have to think this train is probably going to leave the station soon and we need to focus our efforts on explaining the story as best we can. There were too many people involved in the deals -- too many counterparties, too many lawyers and advisors, too many people from AIG -- to keep a determined Congress from the information.” James P. Bergin, NY Fed, in an email to his Fed colleagues

'Though it is hard to divine much understanding from the unredacted filing, it has become clear that Goldman had more involvement than previously believed: In addition to the credit default swaps it bought from AIG, the filing shows that Goldman Sachs also originated many of the underlying assets that AIG and the New York Fed bought back from Société Générale.

The American people have the right to know how their tax dollars were spent and who benefited most from this back-door bailout," said Kurt Bardella, spokesman for Issa. "Now that it's public, let's see if the sky really does fall as the New York Fed said it would to justify its coverup."

Other lawmakers believed that the New York Fed was trying to hide its ties to Goldman Sachs.' AIG Reveals the Story - CNN

"Wednesday’s hearing described a secretive group deploying billions of dollars to favored banks, operating with little oversight by the public or elected officials.

We’re talking about the Federal Reserve Bank of New York, whose role as the most influential part of the federal-reserve system -- apart from the matter of AIG’s bailout -- deserves further congressional scrutiny...

By pursuing this line of inquiry, the hearing revealed some of the inner workings of the New York Fed and the outsized role it plays in banking. This insight is especially valuable given that the New York Fed is a quasi-governmental institution that isn’t subject to citizen intrusions such as freedom of information requests, unlike the Federal Reserve.

This impenetrability comes in handy since the bank is the preferred vehicle for many of the Fed’s bailout programs. It’s as though the New York Fed was a black-ops outfit for the nation’s central bank...

New York Fed staff and outside lawyers from Davis Polk & Wardell edited AIG communications to investors and intervened with the Securities and Exchange Commission to shield details about the buyout transactions, according to a report by Issa.

That the New York Fed, a quasi-governmental body, was able to push around the SEC, an executive-branch agency, deserves a congressional hearing all by itself." Secret Banking Cabal Emerges From AIG Shadows - Reilly - Bloomberg

And this is the same Federal Reserve that was proposed by the Obama economic team to be the 'super regulator' with broad powers and consumer protection responsibilities over the entire financial system.

The Fed is a private agency, quasi-governmental, but not subject to discretionary audit or review by the government, except at arms length, through managed testimony. They make a point of demanding secrecy and independence at their own discretion, oversight on their terms.

This is a choice promoted by Geithner and Summers, who are creatures of the Fed and the banking system, almost sure to return to sinecures there after leaving government. And it is tempting choice for a president and congressmen of a weak character. If the Fed bears the responsibility they do not have to budget money and manage the process, and they can point fingers at its every failure. It is a formula for conflicts of interest, soft bribery and corruption. Confidence does matter.

The Fed and Blackrock are becoming to the Obama Administration what Halliburton and KBR were to Bush and Cheney, and the banking crisis -- the new Iraq. Can the handling of it be so inept that it becomes Obama's Watergate as well?

The Fed must be audited, and its power to disburse public money to private banks, except in the normal course of open market operations, curtailed. Only the Congress has the right to tax the people, and the Fed's ability to disburse billions of funds at its own discretion to domestic and foreign banks is a de facto form of taxation, since the Fed operates on a cost plus basis, without budgetary allotment from the Congress. The obligations of the Federal Reserve flow directly from its balance sheet, which is the basis for the national currency.

And despite the arguments from the Financial Times to 'stop snooping' the press and the Congress should delve deeply into the AIG bailout, because enough has already been exposed that it smells to high heaven.

It is remniscent of Watergate and Enron to see Timmy, Ben, and Hank falling all overthemselves in establishing that they had no knowledge or involvement in the payments of billions to AIG.

The truth must come out.

My own suspicion is that Goldman 'set up' AIG for a proper face ripping with its financial arrangements, playing both sides of the deal. There is further evidence of money flowing from Goldman to AIG executives before the bailout occurred. And at the least the major players saw what was happening and turned a blind eye to it, busying themselves with other things and establishing their plausible deniability.

A proper investigation can establish any specific guilt. It is a shocking scandal that the FBI and Justice Department are still not more actively involved in real investigation rather than these staged hearings.

But this incident should make it absolutely clear why the Fed cannot enjoy the expansion of its role as the regulator of the system. It is too conflicted in its mission of monetary independence, and at the same time the creature of the banks, to be a true civil servant fully answerable to the Congress.

Yes I understand the distinctions between the Fed Board of Governors and the NY Fed with regard to FOIA requests, and the appointmet process. What I am saying is that the distinctions obviously do not hold, do not work. The Fed is one organization. These distinctions are remniscent of the banking scandals exposed by then AG Elliot Spitzer. They simply do not work. They are a thin facade.

As Representative Marcy Kaptur told Geithner at the hearing: “A lot of people think that the president of the New York Fed works for the U.S. government. But in fact you work for the private banks that elected you.”

One difference I have noted, compared to the English and the Japanese, is that the American officials and CEO's never hesitate to hide behind the incompetency defense, but rarely have the dignity to resign when they do so. This is because they have no shame, no real loyalty to anyone but themselves.

And at the very least Geithner should be fired, if not for complicity, then for sheer inability to do the job.

Timeline of NY Fed Payments and Cover-Up: BusinessWeek

Financial Crisis Ahead - Thomas Donlan - Barron's

Paulson's People Colluded with Goldman to Destroy AIG and Get a Backdoor Bailout - Fiderer - Huffington

Sham Transactions That Led to AIG's Downfall - Fiderer - Huffington

Law: Corporate Counsel

Ssshhh ... E-mails Show Lawyers' Push to Keep AIG Details Hush-Hush

By Sue Reisinger

January 26, 2010