skip to main |

skip to sidebar

Next week Friday is an options expiration in stocks, and on August 25 is an option expiration in the metals on Comex.

I suspect world events will continue to drive the trade, with a steady undercurrent of high frequency price manipulation during periods of light participation by legitimate investors.

"To found a great empire for the sole purpose of raising up a people of customers may at first sight appear a project fit only for a nation of shopkeepers. It is, however, a project altogether unfit for a nation of shopkeepers; but extremely fit for a nation whose government is influenced by shopkeepers."

Adam Smith, Wealth of Nations

Most people do not realize that it was Adam Smith who wrote this famous characterization of England as a 'nation of shopkeepers.' He was writing about narrowly mercantile nature of the British Empire and its colonial markets strategy. The exploitation of the Empire's resources and peoples by a few legendary companies is well known.

If one substitutes 'crony capitalists' or 'financiers' for 'shopkeepers' it might well be a decent fit for the latter years of the American Century, which is based on a regime of guns and dollars.

As the Boer War marked the high tide for the Brits, and the invention of the concentration camp in their frustration, the American Century seems to be on the wane as well, resorting to camps of a sort of their own.

What broke it? Why is the American moment running out of steam? It is probably the failure to move to a non-military based economy after the cold war, and invest the peace dividend into domestic infrastructure and basic technology development for peaceful purposes and the improvement of life, instead of financial legerdemain, economic hoaxes and frauds. It is greed that kills the golden goose.

Having fed so well for many years on war, the crony capitalists have had to expand their operations at home again, and create new wars, to maintain their exorbitant privilege.

Will history judge them harshly? It all depends on who ends up writing the history. As the famous epigram observes:

"Treason doth never prosper: what’s the reason?

Why, if it prosper, none dare call it treason."

Perhaps not so much as treason in this case, but plunder, and the betrayal of oaths and trusts, and fraud on a grand scale. But this control of history and the interpretation of events is a major component of the credibility trap that impedes legitimate reform.

We may see more action on Sunday evening depending on the developments in Europe. I believe the Iowa straw poll results for the American election will be released tomorrow, but they do have a spotty record of forecasting the primary results.

The elections will be interesting as they will represent a major power struggle, but conducted largely 'behind the scenes.' It is confusing I know, since the candidates have a somewhat wispy and ephemeral character about them, more like an ad for toothpaste than a profound and substantial leader of the free world.

We seem to have left those kinds of leaders behind several decades ago. Or at least the leaders are still out there, but they cannot obtain the leverage to make it into the selection process which is dominated with the taint of corporate money and the vested interests that seek only to maintain the status quo, the public be damned. I am not so much an idealist as you might think, having first started observating politics during the Kennedy era, with the Nixon and Johnson administrations that followed. I even recall the dark days of McCarthy and the Watergate hearings.

Politics is always a dirty business. But at least there was some hope that things would get done, and that a love of country and the Constitution would prevail at the end. One has to reach a bit for that feeling these days. There has always been a bad element. It is just there as a minority, and not prevalent and so widely accepted and tolerated.

These things move in cycles. The idealistic youth of a hard pressed generation spawn greedy and self-centered children of privilege and relative ease, but their grandchildren rebel against vain materialism and find their voices again. And so it goes.

Traders have recently been remarking about a highly unusual event in the metals markets.

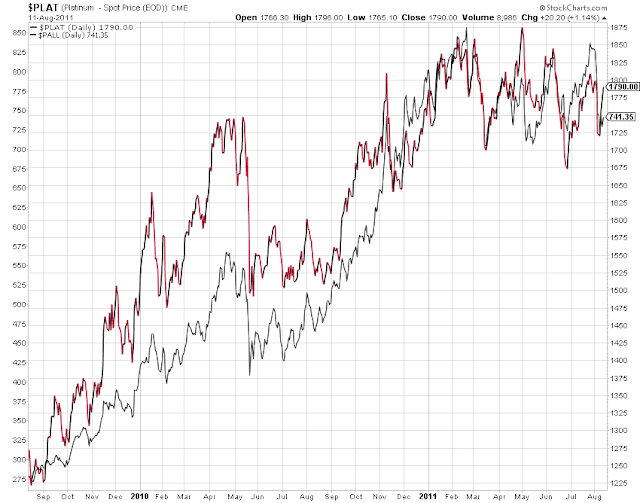

For the first time in quite a while, the price of gold per ounce has exceed the price of platinum per ounce. This is shown in the first chart.

There is even a paired trade being touted, short gold and long platinum. The caveat is that this is said to be a profitable trade IF there is a global recovery. Personally I think one must also assume that the recovery is not due to money printing.

Platinum is largely an industrial and consumer metal, even moreso than silver. Platinum has wide industrial uses in jewelry, catalytic converters, fuel cells, and hard drives among other things. similar to copper, platinum is an indicator of industrial manufacturing activity.

The use of platinum as money a store of value has relatively little traction except among collectors. The big price drive is its very useful properties for industrial use. I am not aware that it has ever been used as a national currency except for a brief period of time in 19th century Russia.

There is some secular effect on platinum, with substitution in some applications being achieved by palladium. But the two metals are tracking one another in price, as show in the chart below. So that seems to be a minor influence.

Some are confused because of the relative rarity of platinum, which is produced in fairly small quantities each year. But to look only at supply without considering demand is a basic fallacy of pricing. There is a definite shortage of honest politicians in Washington, but the ones that are there do not seem to be commanding very high prices amongst lobbyists, for example, as demand for honesty is also relatively low.

It does serve to look at a few more items as we see in the chart comparing price performance, rather than price, in the mix of gold, the SP500, the Commodity Index, and platinum. The Commodity Index is used as a broad reference and includes much more than metals.

Clearly industrial activity would seem to be lagging, while the money components of things like gold are increasing for some reason unrelated to commodity demand. That ought not to surprise anyone following the markets. The supply of paper money is increasing beyond demand of organic growth in the real economy, while demand for commodities used in production is slumping.

I would therefore not think the gold platinum pair to be particularly useful. I would consider something else if I believed that there would be an imminent industrial recovery.

Notice that I did not include copper or silver in these charts. That is because their performance tends to crush the meaning out of the others. Silver is responding to a massive break in a long term price suppression caused by artificial shorting activity. And copper is a more speculative market than most commodities.

I also did not include crude oil because, as nine out of ten Americans will remember, it is not a metal. And it sometimes has a speculative life of its own, especially as a reaction to certain regional conflicts. However being the indulgent sort I have included it in a final chart. It is a commodity.

I think he was caught off guard.

I think he intended to say, 'Corporations are my best friends' instead of 'Corporations are people, my friend.'

Well at least now we understand when he says that he is 'a man of the people.'

It could have been worse. He could have said that 'Soylent Green is people.'

I can see that my comedic talent is going to have fertile input during the upcoming American presidential election.

This is the 'sane one.'

Mitt Romney: Corporations Are People - Salon