skip to main |

skip to sidebar

My friend Dominique on the Côte d'Azur sent this to me, and it took me a little while to figure out why. So many things are going on.

I am stunned, surprised by joy. Thank you for your patronage.

Et merci à tous mes amis du café.

This is from The Big Picture by Barry Ritholtz. I assume he was too much the gentleman to allow his own blog to be included in the voting. It would certainly have been either number one or two. He and Yves are giants in the blogosphere alond with ZeroHedge, Calculated Risk, and Mish among others.

And yet there are so many places with special knowledge to frequent, from the hardy fare of LeMetropoleCafe, the cabaret atmosphere of MaxKeiser, and the classic cuisine of iTulip and EconomistsView, as well as those listed on the left hand side of this blog. We can all count ourselves to be very lucky for this creative environment. Let us hope that it will last through the currency war, and that the lights will remain on.

Gold December futures fell to 1535 and Silver to 26.15 in the overnight session as a determined night bombing raid took them down in the least liquid period of the 24 hour trading day, with the low being reached around 2 AM New York time.

Silver Dec futures are now at 30.78 in New York, virtually unchanged from their open at 30.85, or up over $4.50 from the low.

Gold is at 1623 now, or up $88 from its overnight low.

The December SP 500 Futures had bottomed at 1116 around the same early morning hours, and are now at 1158 or about 42 point from the overnight lows.

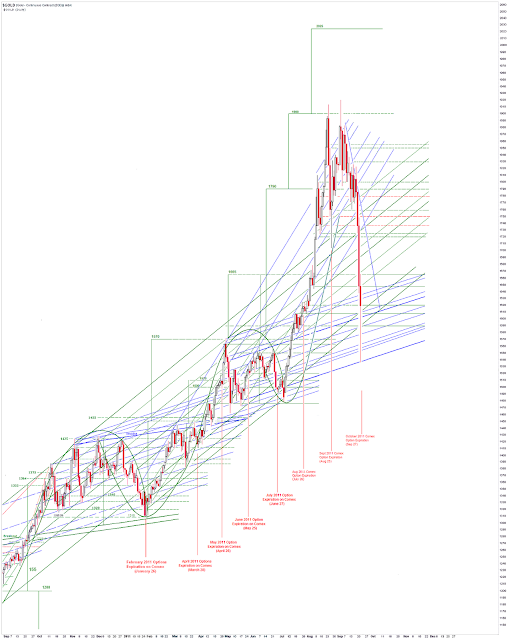

Gold has NOT yet broken the short term downtrend, marked with a sharply declining blue line on the chart.

Tomorrow is option expiration on the Comex as we might have expected. I would hope that long term investors would take advantage of these price drops by locking in physical bullion purchases when they can.

However, it is hard to do this with the leverage and margin requirements on Comex especially on the overnight globex trading session. How can an average trader hope to maintain a position? And that is the basis of their schemes.

"It is not immediately clear at this juncture who was selling or why - but in placing such a huge order into the market when the least number of market participants were active tells you that they were out for dramatic effect.

Anyone looking to offload significant amounts of metal at the best possible price would have done so when both London and New York were both open - this would have ensured they would have hit the market when it was most liquid and ensured they got the best price for their sale.

Clearly finessing gold into the market was not their motive - they wanted a statement."

Ross Norman, Sharps Fixley

The interplay between the LBMA 'physical market' and the New York 'futures markets' is fairly obvious. The leverage on the LBMA physical market for gold and silver, as opposed to the London Metals Exchange which trades base metals, is reputed to be around 100 - 1. So any 'run' on the metals will stress the system.

According to their website the LBMA market markers are some of the largest Too Big to Fail banks including UBS, Société Générale, Merrill Lynch (BoA), Credit Suisse, Barclays, Goldman Sachs, JPM, HSBC, The Bank of Nova Scotia ScotiaMocatta, Deutsche Bank.

US stocks bounced hard today from a deeply oversold short term position.

However, the proximity to support in a somewhat cynical trading range is notable.

If it breaks out of that channel, either direction for more than a day, stay out of the way unless you are riding the trend.

A friend from Strasbourg had sent me a long term gold chart, with the past prices updated for inflation, which I had termed, The Golden Bowl.

He has been kind enough to send the updated prices to it. The past prices are adjusted for inflation, but the current prices are nominal, and of course everything is priced in US dollars.

I should note that all the annotations are mine, so if it is wrong the blame is for me.

Gold Daily Chart Update and a Look at the Golden Bowl

Another reader or two have sent me a similar chart, not updated for inflation, which is The Silver Bowl. I struggle a bit with the reliability of chart formations over such long periods of time.

I should point out that gold has not yet reached the lip of the 'cup' in its formation, so any retracement now would be a conventional one since the last major consolidation or intermediate bottom if you will.

However, assuming that gold does make it to the lip of the cup and break out, the 'handle' ought not to exceed 1580 to the downside for a total 38.2% retracement.

As an aside, I think that anyone who thinks this is just a routine market correction, based on the charts, is not looking at the actual market action, which is highly suspect from any number of dimensions.

But in particular the unloading of large amounts of contracts in the least liquid periods of the 24 hour trading day is highly suspect, and there are far too many 'coincidences' occuring for an intelligent person to blithely dismiss. I do not mind anyone ignoring such information but to dismiss it in the most haughty of manner is not becoming.

And of course for the 'I told you so' crowd that comes out on every correction, well, what else can one expect. They are never long.

I have to admit I was caught a little by surprise with the severity of the reaction to the FOMC announcement, but it is telling in its own way.

But we are in a currency war, whether one realizes it or not, and this has been a 'shock and awe' exercise I think along with other dramatic fiat currency adjustments, especially the Swiss franc.

The Bankers will have their way, until they do not. So let us please exercise caution. I have said, 'wait for it.' I hope that now this lesson is embellished in your memory.

We have not yet broken the blue downtrend line on our Gold daily chart. It is better to miss the first ten percent of any rally and be confirmed in the move. And as always, the early loss is the best taken.

Tomorrow is option expiration on the Comex. I think the bankers once again 'looked into the abyss' and their actions, far from being based in confidence, were fraught with fear and desperation. But a frightened animal, whether it be a badger or a weasel, or a weasely banker, is most dangerous when cornered.