01 May 2015

Dangerous Markets: Here Are Some Levels and Triggers to Watch

We typically do not get major market corrections in May. They tend to cluster in the Spring and the Fall. By major correction I mean 15+%.

For example, in 1929 there was a 'market break' in March, and then the exchange shook it off and went on to have a bumpy summer of ups and downs with a final climb to a top in October.

Every market decline has its own specific course of events, but they do tend to have some things in common. There is generally a build up of conditions that make it the right kind of market, and then some trigger event occurs to set things in motion. It is much like what occurs in the build up to an avalanche, or a wildfire.

So we are talking about 'avalanche conditions.'

That does seem to be a little counter-intuitive, because we seem to have markets that are almost sleep walking within ranges with short term algo-driven volatility. These are very 'cynical markets.' The masters of the universe believe that they are firmly in control.

Looking at the composition of this market and the economies, I see bubbles both in the US and especially in China, in bonds and in stocks.

I see a paucity of liquidity of the right sorts, of determined investment money of the durable sort, and economies that are narrowing, with most of the discretionary money shoved well into the top tier of consumers and investors.

And the money is hot, compliments of the Fed, and the focus is for the most part short term. I think my opinion of the Fed is well known by now to any regular readers, and the ECB is no better.

Greece looms large. Despite the pooh-poohing and brinksmanship by both sides, a Greek failure could prove to be the underanticipated Lehman event that would set the cascade of dominos falling.

And then there are the many confrontational hotspots around the world, in the Mideast of course, in the South China Sea, and in the Ukraine among others.

What makes this particularly dangerous is the cavalier attitude of the neo-con chicken hawks towards military action, especially in some of the English speaking countries.

Two articles this morning brought this thinking into focus. But I have been having this conversation off and on with some trading friends for the past few weeks, and I also noted in the beginning of the year some signs of trouble. What 2000, 2008, and 2015 May Have In Common

The first, Shrinking Liquidity Exposes Markets to Crunch, sounds like a prelude to 'no one could have seen this coming.'

And the second from my friend Adam Taggart, For Heaven's Sake Hedge, shows some of the other aspects that make markets dangerous.

I have not yet seen the classic 'crash patterns' on the charts that I have documented extensively over the years, but as I am saying, and I hope I am clear about this, I see dangerous market conditions that, given the right kind of trigger event, could unleash quite a bit of mispriced risk and concealed fragility.

I don't get into sentiment or contrarian indicators all that often, because from my experience they can be very much in the eye of the beholder. But the tenor of the discussion on financial TV is especially disconnected from reality now, with a clueless bravado that is characteristic of a coming conflagration.

I don't get into sentiment or contrarian indicators all that often, because from my experience they can be very much in the eye of the beholder. But the tenor of the discussion on financial TV is especially disconnected from reality now, with a clueless bravado that is characteristic of a coming conflagration.

The discussion of the TPP this morning on Bloomberg and of gold on CNBC in particular were striking.

I am taking a defensive posture, not because I think we are going to crash the markets, since only mugs make those calls and bet on them with their own money. Rather, I think we are seeing dangerous markets, with the danger exacerbated by the willful arrogance of the market masters and their money men.

I extend this watch to October, and will keep looking for changes. I do not expect much to come of this. This is just a caution, but given a trigger event of sufficient magnitude, this could become a problematic market even during the dog days of Summer. Our leadership and financial management is just that bad, reckless and irresponsible.

One thing I learned, most painfully, is that the Fed can and will keep an obvious asset bubble going much longer than one might expect, given the lack of a major trigger event. And they have absolutely demonstrated a disregard for the consequences from doing so several times in the past fifteen years.

So keep your eyes open, and take some modest precautions.

Category:

stock market crash,

trigger events

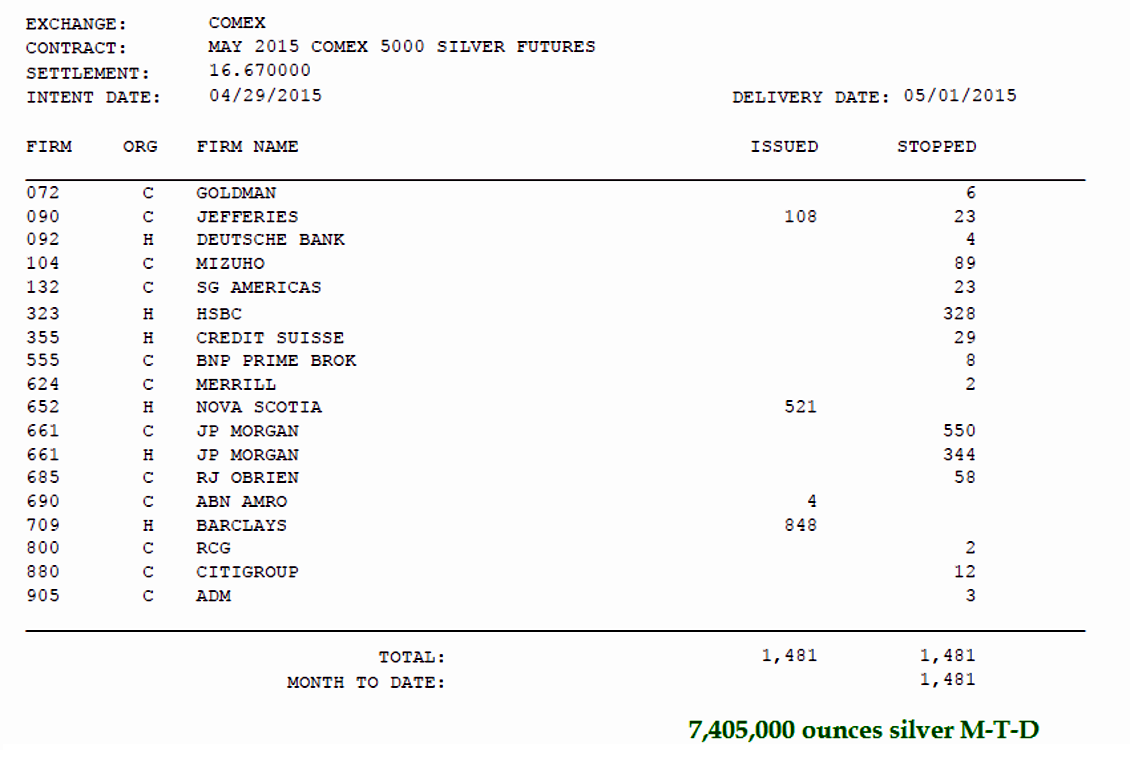

Silver in the Individual Comex Warehouses

Here is the current state of silver stockpiles in the Comex warehouses.

Several people have remarked on the accumulation of silver in the JPM warehouse.

CNT has become a major wholesale dealer in the silver market, largely as a result of their contracts to deliver silver to the US mint. The story of this small family coin business is interesting and you may read about it here.

It is not clear why JPM is accumulating silver in their warehouse, and why. And since this is a public warehouse, it is not even clear who in fact is the owner of the silver involved. Is this really JPM's silver, or are they merely acting as the agent for another party or group?

I would imagine if JPM is the owner then one would find some indication of this ownership on their 'books' and that one could look at their physical position in relation to their large derivative positions.

I would imagine if JPM is the owner then one would find some indication of this ownership on their 'books' and that one could look at their physical position in relation to their large derivative positions.

Category:

Comex Silver Warehouse,

silver

30 April 2015

Gold Daily and Silver Weekly Charts - Unfortunately Predictable Absurdity

Gold and silver were hit by a brutal takedown this morning.

Welcome to the post FOMC reaction, as well as the end of the month, and the beginning of the active month of May for silver.

These jokers aren't even feeling the need to pretend anymore.

I hear that a carefully coiffed, long time teddy bear acquaintance says that some big traders are rigging the metals market, but "the government isn't involved at all." For newbies, he has been saying this for about fifteen years so at least he is consistent. But it is getting old now.

NO involvement. Really?

When there is a blatant, wide open crime wave with daylight muggings and bombings, and the duly designated authorities aren't doing anything about it, I imagine you could say that technically they are 'not involved.' After all they didn't do anything. Except not do their jobs.

This kind of obstinate credulity is a big part of the problem. Of course they are involved. The only question is why?

I have been watching the markets for a long time. And this is starting to look like a bad dream. These jokers never know when to stop. They are emboldened by ever successful caper. They start to feel like rigging the market is like an entitlement.

I will never forget the reaction from an ex pat trader from a major US Bank in London, who when caught red-handed manipulating euro bonds by smashing a quiet market with sell orders, was indignant at being chastised for it. Hey, we do this all the time back home! It even had a cute frat name, the Dr. Evil strategy. He thought he had universal impunity.

It's funny but there seems to be a double standard for US traders and 'foreign traders.' Have you noticed? Doesn't it seem like the US always goes after the foreign banks and traders even when it involves a general free for all of criminality?

Is this some sort of imperial droit du seigneur when it comes to market rigging? Is this like being able to say that you are a citizen of Rome and entitled to be judged by the emperor alone?

Have a pleasant evening.

Category:

Dr. Evil

SP 500 and NDX Futures Daily Charts - Wash and Rinse Day - Surreal

So after the bell, here was one of the more surreal things I have seen lately, and that is saying a lot in this environment.

Cory Johnson of Bloomberg TV was pounding the table about LinkedIn after the bell, while their ticker showed the stock getting absolutely eviscerated, down over 20%.

I like CJ, and think he is just caught up in the silicon nonsense of stocks that are priced beyond perfection. Yes Cory, the stock is growing. But the momentum guys took it to an absurd level where any sniff of reality resulted in a pricing conflagration.

Get used to it. There are a lot of artificial puffballs out there.

This is a dangerous market. One of the more technically dangerous I have seen since 1987 and the tech bubble.

Be careful out there.

Have a pleasant evening.

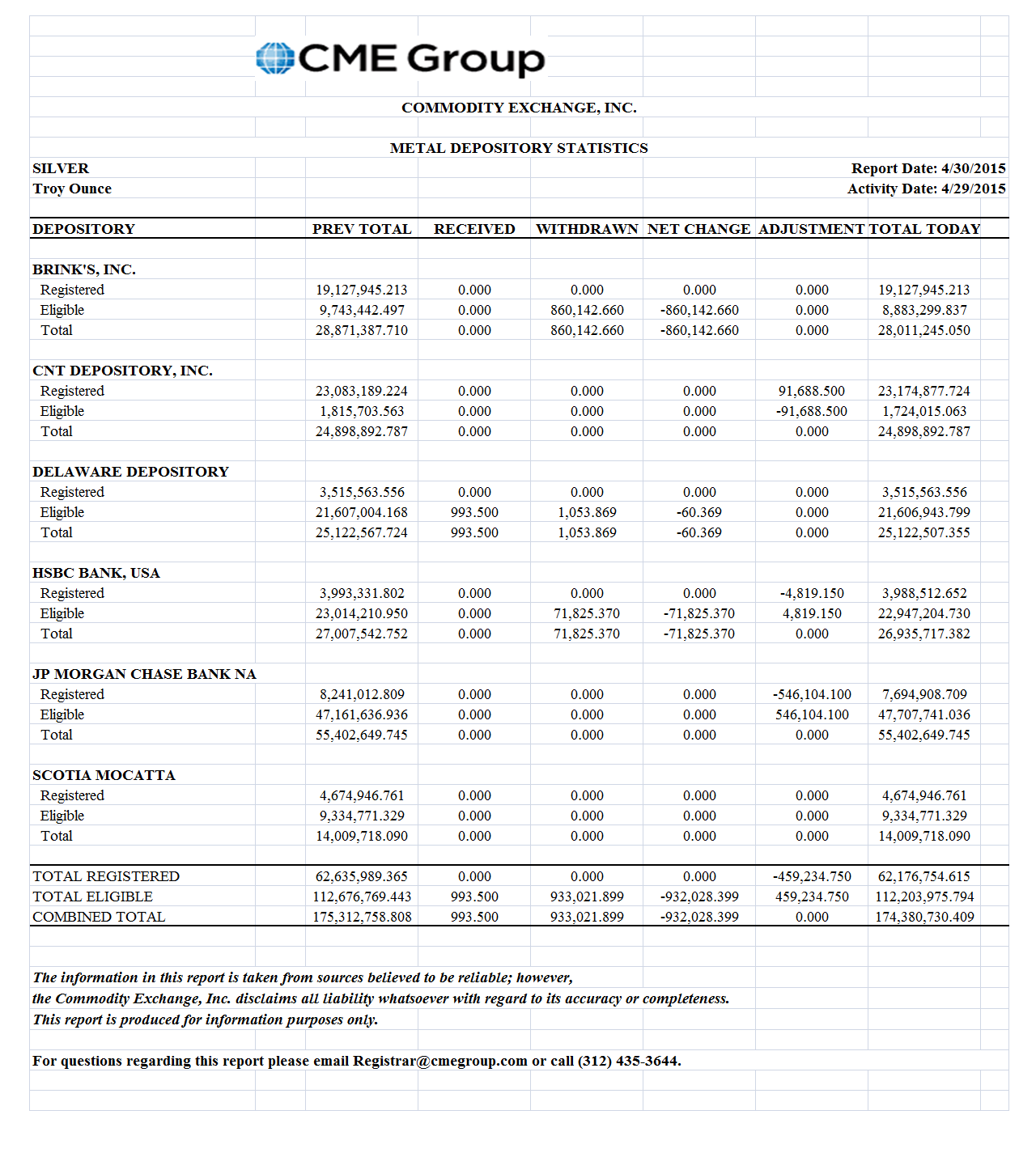

NAV Premiums of Certain Precious Metal Trusts and Funds - Silver Active In May Delivery Report

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."Sir Eddie George, Governor Bank of England 1993-2003

And I think they have been desperately attempting to cover up the consequences of their poor decision making in in bailing out the speculative interests of their banking cronies for the past sixteen years, while digging the hole in which they found themselves ever deeper.

The expected FOMC slam on the metals happened this morning with the news that new unemployment claims were much lower than expected.

That the economic news this morning also showed *zero* growth in personal income was ignored.

Jobs without living wages. Is this like making bricks without straw?

May is an active month for silver, but not for gold.

So we saw a spike for silver in the delivery report from yesterday as May becomes the silver front month.

I have included that report below. As a reminder, although the number of ounces is large, the volumes moving around the warehouses are also larger than gold.

Still, I wonder what the wiseguys will do if silver ever becomes in short supply, since the central banks do not hold any, and the US long ago depleted its strategic supply.

What happens when there is a run on the bullion banks again?

Excess leverage on supply constrained assets. Ain't it a bitch?

Category:

NAV of precious metal funds

Subscribe to:

Comments (Atom)