It will be good news for Japan indeed if the opposition Democratic Party in Japan can win their August 30 elections.

The LDP has been in power since 1955!

Can you imagine what kind of corporatocracy the US would have if the Republicans had won every election since Eisenhower? This is what exists today in Japan.

There is an embedded bureaucracy in the Japanese Ministry of International Trade and Industry that is formidable, and that will resist policy change. So there is room for pessimism.

And the election is far from won. Do they use voting machines in Japan?

Bloomberg

Aso Dissolves Japan’s Parliament, Admits Failings

By Sachiko Sakamaki and Takashi Hirokawa

July 21 (Bloomberg) -- Prime Minister Taro Aso dissolved Japan’s parliament, clearing the way for an Aug. 30 election that polls indicate will hand power to the opposition Democratic Party of Japan for the first time.

Lower-House Speaker Yohei Kono announced the dissolution in parliament today to a chorus of cheers. Aso’s ruling Liberal Democratic Party, in power for all but 10 months since 1955, will defend a two-thirds majority in the election.

“The era of one-party dominance is over,” said Gerald Curtis, professor of Japanese politics at Columbia University in New York. “This is the first election since the LDP was formed when just about everybody believes that the chance for a change of the party in power is very real.”

The DPJ plans to encourage consumer spending by providing as much as 5.3 trillion yen ($56 billion) in child support, eliminating road tolls and lowering gasoline taxes. The party also aims to shift tax money from public works spending to strengthen social security, DPJ legislator Tetsuro Fukuyama said in a July 14 interview.

“They are going to increase the purchasing power of the people directly and they are going to fund this by cutting out wasteful spending,” said Jesper Koll, Tokyo-based chief executive officer of hedge fund adviser TRJ Tantallon Research Japan. “That’s a good, sensible economic policy to have.”

Poll Lead

Forty-two percent of respondents in an Asahi newspaper poll published yesterday said they would vote for the DPJ, compared with 19 percent for the LDP. The opposition, which has controlled the less-powerful upper house since 2007, had a public approval rating of 31 percent, compared with 20 percent for the LDP, according to the poll.

Aso, who came to office last September, has resisted calls from within his own party to resign before the election. His administration has been plagued by cabinet scandals and a deepening economic recession.

“I’m sorry my unnecessary remarks damaged credibility in politics,” said Aso in today’s televised press briefing. Since taking power, he has said doctors lack common sense and mothers need discipline more than their children, angering both groups. “I also apologize the LDP’s lack of unity” created public mistrust.

Aso, 68, pledged to revive the world’s second largest economy and improve the financial security of voters with free pre-schools and higher wages for part-time workers....

21 July 2009

Is Change Coming to Japan?

20 July 2009

United States Postal Service Faces October Default Along With...

This is making the rounds, so we thought we might include both this article and its source article, with some commentary.

The postal unions are raising red flags, and using the "D" (default) word to bring attention to a gap in the forward funding of their retirement benefits which they see coming in the autumn.

Most federal agencies pay their retirement costs as they are incurred. The Postal Service pre-funds their projected retirement benefit costs a few years in advance.

The issue here with the unions is a bit bigger than just the September preparyment. The Postal Service has funds set aside for future retirement costs in a way that is similar to Social Security. Indeed, one might think of this system as their version of Social Security.

There is about $32 billion set aside (on paper) for their needs. The unions would like the postal service to get access to that money now. Think of it as taking the Social Security Trust Fund out of the Treasury and making it available for management by some private entity now.

What's the issue? Since the system has been in place for so long, and only now is such a fuss being raised, there is an obvious fear on the part of the Postal Employees of a government default and a devaluation of their pension fund, along with Social Security.

Make sense? I think it does when viewed in that light. Employees close to the government are fearful of a general default at the end of September that will erode the value of their own Pension Trust Fund.

There are other explanations of course. Union Management may wish to take over the management of their $32 billion pension fund to allow some of the Wall Street banks to help them 'improve earnings' and generate hefty fees.

The fear of default driven by rumours circulating amongst Federal employees and their kin makes a bit more sense, but we will not know for certain until the fall.

My Federal Retirement

USPS May Be Unable to Make Payroll in October and Retiree Health Plan Costs, Unions' Letter to White House Says

July 19, 2009

On July 14, unions representing United States Postal Service (USPS) workers wrote the White House with "extreme urgency" asking for a meeting to address lack of funding for both employee payroll in October and health benefits for retired employees.

The letter, which the FederalTimes.com blog provided a scanned copy late last week, says:

"[USPS] top executives are now saying that the USPS will default on a $5.4 billion payment to prefund future retiree health benefits on September 30, 2009. And its government affairs representative are now telling Congressional staff that the Postal Service may not be able to make payroll in October and will be forced to issue IOUs instead."

The letter was co-signed by the presidents of the American Postal Workers Union, National Rural Letter Carriers' Association, National Association of Letter Carriers and National Postal Mailhandlers Union, and sent to White House Deputy Chief of Staff, Jim Messina.

GovExec.com reported more on the letter in this column on July 17 which is included here below:

Postal unions seek White House help on pay, benefits

By Carrie Dann

CongressDaily

July 17, 2009

Four unions representing the nation's postal workers are pleading for a meeting with the White House to address possible funding shortfalls for workers' payroll and retiree health benefits, according to a letter obtained by CongressDaily.

The presidents of the American Postal Workers Union, National Rural Letter Carriers' Association, National Association of Letter Carriers and National Postal Mailhandlers Union co-signed the Tuesday letter to White House Deputy Chief of Staff Jim Messina, warning that the U.S. Postal Service is at risk of defaulting on a $5.4 billion payment to prefund retiree health benefits at the end of September.

The letter alleges that USPS "may not be able to make payroll in October and will be forced to issue IOUs instead."

Yvonne Yoerger, a spokeswoman for USPS, confirmed that the unions wrote the letter but disputed the claim that payroll deadlines will be missed.

"That's not something that's been discussed at all," she said. "We are committed to making payroll."

Yoerger said USPS will continue to work with OMB and the Office of Personnel Management to determine if and how the Postal Service can meet the Sept. 30 deadline to pay forward $5.4 billion in future health liability costs.

The Postal Service is required by law to set aside funds for future retiree health care costs, rather than paying recipients as costs are incurred as other government agencies do. As a result of a $3 billion loss to date this year, the unions wrote, no money is available for those future payments, and regular payroll deadlines may not be met unless other funds are tapped.

"Such a [financial] collapse can be averted without resort to a taxpayer bailout by reforming the retiree health prefunding provisions of the law and [by] giving the Postal Service access to its own resources in the Postal Service Retiree Health Benefits Fund, which now has a balance of $32 billion," the unions wrote.

But that transfer of funds would require congressional approval, and the unions fear that pressure from the White House will be needed to prompt quick action. "We believe that the Obama administration must intervene now to avoid both a political and economic train wreck," they wrote.

Reps. John McHugh, R-N.Y., and Danny Davis, D-Ill., introduced legislation this year that would amend the law to allow USPS to reach deeper into the flush Retiree Health Benefits Fund, but the unions argue the measure would not do enough to fix the financial problems.

CIT Averts Bankruptcy: Another Sunday Night Save (Perhaps)

It is good to hear that the 'well capitalized' CIT may strike an eleventh hour deal with its creditors and financiers to avoid an ugly bankruptcy for now.

Now if only the United States can do the same thing for itself with its bondholders...

Let's see if it is real, and what happens. Remember that what is being discussed here is 'bridge financing' for a company that is in a debt death spiral. The plan for their recovery will be more important than any temporary deal.

Financial Times

CIT seals rescue package

By Henny Sender and Francesco Guerrera in New York

July 20 2009 04:31

CIT on Sunday night clinched a two-year, $3bn rescue financing with its creditors that will enable the troubled US finance group to avoid a bankruptcy filing.

After round-the-clock weekend talks that included the possibility of a Chapter 11 filing, CIT and its main creditors sealed an agreement on the financial lifeline, according to people close to the situation.

“This paves the way for an orderly restructuring of the balance sheet with time and capital,” said one participant in the likely financing. “And it will give CIT’s customers plenty of capital.”

The company, which provides finance to nearly a million small and medium-sized companies in the US, and its creditors had to move quickly to arrest a slide into bankruptcy and prevent its best customers from defecting for fear that the lender could no longer support them. (We had thought the problem was that their customers had no alternative - Jesse)

The group of at least six creditors who are planning to provide the capital comprise a mix of traditional money management firms and hedge funds who bought into the debt at much less than 100 cents on the dollar. They include Baupost, a Boston-based hedge fund, CapRe, hedge fund and private equity firm Centerbridge Partners, Oaktree Capital, Pimco and Silverpoint Partners. Barclays is expected to act as agent on the financing package.

CIT’s board met on Sunday night and approved the financing. If the agreement holds, CIT will have enough time to work out which, if any, assets it should sell. The next step will likely involve cajoling other holders to exchange their debt into equity and then, having demonstrated that CIT has a viable survival plan, to go to the government and ask for help.

Jeff Peek, CIT’s chief executive who led negotiations with creditors, was likely to stay on following the financing, people close to the situation said. The management has been criticised for diversifying into high-risk businesses such as subprime lending and student loans and relying on capital markets to fund CIT’s balance sheet.

CIT’s creditors stepped in after it became clear that the government was not willing to provide any emergency assistance, whether in guaranteeing CIT’s debt, or in accepting assets in exchange for cash from the Federal Reserve or in allowing CIT to transfer more assets into the bank holding company it set up at the end of December.

The rescue financing will come as a relief to the government – had CIT filed for bankruptcy protection, the Treasury would likely have lost the $2.3bn of bailout funds CIT received late last year.

It would also have been a huge embarrassment for the Fed, which had described CIT as adequately capitalised when it approved of its banking application.

The creditor-led rescue of CIT may stave off political criticism of the government’s handling of the crisis. If CIT had gone under, at least some of its smallest customers in the business world would probably have had a hard time finding alternative sources of capital, adding to economic weakness.

17 July 2009

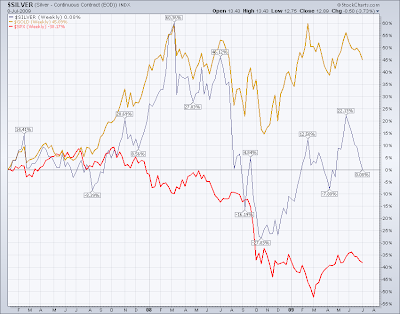

New Silver Fund

Silver Bullion Trust, an all silver fund from the CEF/GTU closed-end fund group, has its roadshow going on now.

Silver Bullion Trust, an all silver fund from the CEF/GTU closed-end fund group, has its roadshow going on now.

Initially it will only be available in Canada. It will trade on the TSX to start, then on the AMEX once it has risen to $75 million of assets which is a similar process used in the introduction of GTU.

It will trade in Canada in both U.S. and Canadian dollars.

The initial offering is reported to be for up to $200 million, so the $75 million threshold could be met immediately depending on the bid size of the deal.

It is expected to price at around US $10 (1 share + 1 $10 warrant) by July 29th.

This could be a interesting alternative to SLV and to CEF for those who wish to invest more heavily in silver.

16 July 2009

Paper, Scissors, Gold

As you may have heard recently, the Comex has asserted their right under their rules to deliver the equivalent paper interest in Exchange Traded Funds such as GLD in lieu of the delivery of physical bullion for those standing for delivery under the rules of the commodity exchange.

Is GLD really the same as physical bullion?

"...it appears that a lot of investors believe and trust that investing in GLD is the same thing as buying physical gold bullion. A close reading and analysis of the GLD Prospectus, however, reveals that investing in GLD is drastically different from owning gold. This analysis will show why GLD is nothing more than another form of a derivative security which is loaded with counter-party default risk."Here is a recent statement from Dennis Gartman who most often derides those he calls 'goldbugs.'

Owning GLD Can Be Hazardous to Your Wealth

"To finish, we do agree that recent decisions to allow for the "delivery" of ETF shares in the stead of actual physical gold against a futures position does cause us some concern. Indeed, it causes us some very real concern, for if we stand for delivery of wheat we expect to receive wheat, not paper. The same holds true for delivery processes on the COMEX, and if GATA and the "Bugs" have a complaint it is this new decision by the COMEX. On this, we’ll grant that the "Bugs" have something to complain about." Dennis Gartman in The Gartman Letter

We have often said that when the real crisis of liquidity comes, and the final flight to safety from the credit bubble collapse begins in earnest, the exchanges will alter the rules to allow for cash and paper settlement of claims for bullion, which they cannot or will not be able to deliver at the agreed upon prices.

This is what makes the current structure of the short positions held by a few banks on the precious metals exchanges a 'racket,' a type of Ponzi scheme where the same thing is sold repeatedly with no means of satisfying the aggregate of the claims and ownership.

We are sure the Comex is "well capitalized," and will continue to be so, even as it is rocked by de facto delivery failures and the substitution of more paper to back up the general failure of paper.

The wheels of justice grind slowly but they grind exceedingly fine.

CIT Called "Well-Capitalized" Even As It Teeters on Bankruptcy

This underscores the charade that is the Fed and Treasury stress testing. There is a cloak of accounting fraud covering many US financial institutions, even as their value soars on paper and the public continue to be robbed of their savings.

The Fed and Treasury are using their current position as de facto crisis regulators of US financial insitutions and pseudo-banks to cover up the deep problems of regulatory failure and financial fraud, largely their responsibility as the overseers of US credit and monetary policy and the financial system during the credit bubble.

They seem to have taken on the role of the Ratings Agencies in perverting their stewardship to serve the Wall Street bankers.

The Fed should not and cannot be allowed to obtain any more power over the US regulatory process. That they even resist a fair and honest audit of their lendings of public monies is an insult to our Republic.

Until the banks are restrained, and balance restored to the economy, and the financial system reformed, there can be no sustained recovery.

Bloomberg

CIT Group’s ‘Capital’ Was All Talk, No Trousers

by Jonathan Weil

July 15, 2009 21:00 EDT

July 16 (Bloomberg) -- Even as CIT Group Inc. teetered near collapse this week, neither the company nor its overlords at the Federal Reserve Board ever backed off their official position that the struggling lender was “well capitalized.”

Coming from the world’s most powerful central bank, that designation used to mean something about a company’s financial strength and ability to absorb losses. Not anymore.

Investors watched yesterday as yet another major financial- services company angled for a government bailout -- this time unsuccessfully -- while still sporting U.S. banking regulators’ highest capital rating. It’s a sure thing CIT won’t be the last.

Even the regulators say their capital standards are broken. Just last month, in an 88-page report outlining its regulatory overhaul plans, the U.S. Treasury Department wrote: “Most banks that failed during this crisis were considered well capitalized just prior to their failure.”

It was only last December that the Fed’s board of governors voted unanimously to let CIT become a bank-holding company, making the commercial lender eligible for federal rescue funds and allowing it to borrow from the Fed’s discount window. In doing so, the Fed said CIT would be well capitalized once it received its $2.3 billion of bailout money from the Treasury’s Troubled Assets Relief Program, which CIT got later that month.

CIT’s bosses, led by Chief Executive Officer Jeffrey Peek, had been touting the company’s well-capitalized status repeatedly ever since, in financial filings and investor presentations. In reality, whatever capital CIT possessed existed only in its executives’ heads -- literally.

Accounting Standards

The problem here is with the accounting standards as much as the government’s capital rules. Consider this disclosure from the footnotes to CIT’s latest annual report. As of Dec. 31, CIT said the fair market value of its loans was $8.3 billion less than the value it was using on its balance sheet. Loans at the time were about two-thirds of its $80.4 billion of total assets.

By comparison, New York-based CIT had $7.5 billion of so- called Tier 1 regulatory capital as of Dec. 31, and $8.1 billion of shareholder equity. Take away the inflated loan values, and CIT’s capital and equity would have been less than zero. CIT hasn’t said what its loans’ market values were as of March 31.

The craziest part is that the difference in the loan values came down to nothing more than CIT executives’ state of mind. (And the Fed's and the FASB's tacit endorsement of this accounting fraud on investor - Jesse)

Had CIT classified the loans as “held for sale,” the accounting rules would have required the company to carry them on its balance sheet at their cost or market value, whichever was lower. By labeling almost all its loans as investments instead, CIT got to avoid writing them down to market values.

Say the Word

So, for capital purposes, the only difference between an insolvent CIT and a well-capitalized CIT was a mere utterance by management that it planned to keep holding the loans. No wonder so many zombie banks continue to roam the country. All they have to do is wish away their ruin, and the rules let them.

There is one catch. As CIT said in its annual report, it’s allowed to classify loans as investments only if it “has the ability and intent” to hold them “for the foreseeable future or until maturity.” Otherwise, it must book the market losses.

It’s hard to see how CIT’s management could believe the company still has the ability to keep holding onto its loans now. Not with more than $3 billion of reported losses in the past eight quarters, a looming cash crunch, and its debt trading in the bond market as if the company might fail. A CIT spokesman, Curt Ritter, declined to comment.

Not Making Sense

Think how arbitrary these accounting labels are. A declining asset doesn’t stop falling in value just because its owner intends to keep it. Nor, if you were applying for a loan today, would a bank value your collateral based on what you think it might be worth someday after the economy rebounds. Its value would be what you could sell it for now.

Back on Dec. 22, when it approved CIT’s application to become a bank-holding company, the Fed released a nine-page statement explaining its rationale. While the Fed said its board considered “all facts of record,” nowhere in that document did it discuss the possibility that CIT’s loans might not be worth what the company’s balance sheet said, or that CIT might lack the ability to hold them for as long as it claimed.

The current capital rules “simply did not require banking firms to hold enough capital in light of the risks the firms faced,” the Treasury Department said in its report last month. The financial crisis, it said, “has demonstrated the need for a fundamental review of the regulatory capital framework.”

That review, to be led by the Treasury Department, won’t be completed until the end of this year. Whatever form the new rules take, the report said they must be “credible and enforceable.”

What a welcome change that would be.

(Jonathan Weil is a Bloomberg News columnist. The opinions expressed are his own.)

15 July 2009

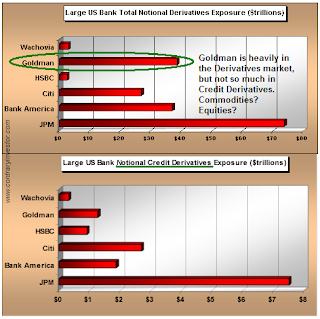

Derivatives Crisis: More Bailouts On Deck?

The derivatives market is about as ugly as it gets, and puts a new edge on 'too big to fail, to big to exist."

The derivatives market is about as ugly as it gets, and puts a new edge on 'too big to fail, to big to exist."

The banks want to keep the game going because it suits their current model of taking risks, making huge bonuses, and writing off the losses to the public.

It remains to be seen if the Obama Administration has what it takes to regulate and rein in the banks. While Larry Summers and Tim Geithner are on the team the answer is probably 'no.'

One thing which strikes us as odd in this Bloomberg article is the emphasizing of stimulus as a source of future crisis. All things considered two trillion in stimulus across the globe is a relative drop in the buck-et compared to what the bank bailouts are costing in direct and indirect taxation on the real economy. Bloomberg seems to be crusading against anyone but the bigh banks getting public money, so perhaps it is not surprising.

As you know, CIT is deeply troubled, and most likely heading towards some sort of managed bankruptcy. The company is said to be holding counter party risk with many banks including Goldman Sachs. The rally may be based on strong rumours of an imminent bailout for CIT. The word on the Street is that Geithner and Summers caved again after a few key phone calls.

Let's see how the Obama Administration handles yet another financial institution brought low by bad risk management in pursuit of outsized profit.

Wall Street and their demimonde in the government and the media hate stimulus packages designed to assist the ordinary Joe, even if all it does is ease the pain during a steep downtrend (which was caused by the financial sector). They hate it, unless there is a way to charge fees in its distribution, and turn it into a profit-making venture for them where they derive most if not all of the benefits.

The dollar and the US bond are taking it repeatedly on the chin. As are most of the US public and the holders of its debt.

The timeframe Mr. Mobius has for the next major crisis is way out on the far edge of any projection we think is probable by quite some distance. Its not clear that it really matters, given the significant hurdles facing the economy this year.

Let's see how the Boys handle the burgeoning Commercial Real Estate, Pension, and Stage Government crises. I think they may very well precede the derivatives coup de grace, and several of them are big enough to be show-stoppers, if not triggers for a larger systemic meltdown.

Until the banks are restrained, and the financial system is reformed, and balanced is restored to the economy, there will be no sustained recovery. The Obama team is incompetent, and probably worse. Its a great disappointment. They are showing all the wrong moves on the economy.

The Obama team is incompetent, and probably worse. Its a great disappointment. They are showing all the wrong moves on the economy.

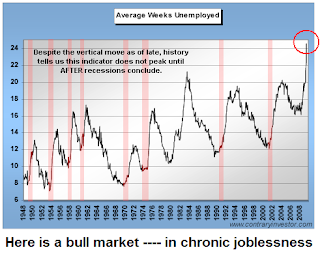

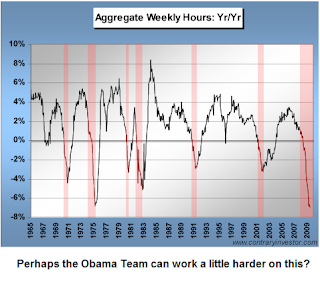

All the charts included here are from our friends at ContraryInvestor.

Bloomberg

Mobius Says Derivatives, Stimulus to Spark New Crisis

By Kevin Hamlin (Beijing)

July 15 (Bloomberg) -- A new financial crisis will develop from the failure to effectively regulate derivatives and the extra global liquidity from stimulus spending, Templeton Asset Management Ltd.’s Mark Mobius said.

“Political pressure from investment banks and all the people that make money in derivatives” will prevent adequate regulation, said Mobius, who oversees $25 billion as executive chairman of Templeton in Singapore. “Definitely we’re going to have another crisis coming down,” he said in a phone interview from Istanbul on July 13.

Derivatives contributed to almost $1.5 trillion in writedowns and losses at the world’s biggest banks, brokers and insurers since the start of 2007, according to data compiled by Bloomberg. Global share markets lost almost half their value last year, shedding $28.7 trillion as investors became risk averse amid a global recession.

The U.S. Justice Department is investigating the market for credit-default swaps, Markit Group Ltd., the data provider majority-owned by Wall Street’s largest banks, said July 13.

Mobius didn’t explain what he thought was needed for effective regulation of derivatives, which are contracts used to hedge against changes in stocks, bonds, currencies, commodities, interest rates and weather. The Bank for International Settlements estimates outstanding derivatives total $592 trillion, about 10 times global gross domestic product.

Looming Crisis “Banks make so much money with these things that they don’t want transparency because the spreads are so generous when there’s no transparency,” he said.

“Banks make so much money with these things that they don’t want transparency because the spreads are so generous when there’s no transparency,” he said.

A “very bad” crisis may emerge within five to seven years as stimulus money adds to financial volatility, Mobius said. Governments have pledged about $2 trillion in stimulus spending.

The Justice Department’s antitrust division sent civil investigative notices this month to banks that own London-based Markit to determine if they have unfair access to price information, according to three people familiar with the matter.

Treasury Secretary Timothy Geithner last week urged Congress to rein in the derivatives market with new U.S. laws that are “difficult to evade.” He said strong capital requirements were the key.

Geithner repeated President Barack Obama’s call to force “standardized” contracts onto exchanges or regulated trading platforms, and regulate all dealers.

Credit Freeze

The plan to regulate the derivatives market is part of a wider overhaul of financial industry rules meant to prevent any possibility of a repeat of last year, when the collapse of Lehman Brothers Holdings Inc. and American International Group Inc. froze credit markets and worsened the global recession.

In the Senate, Agriculture Committee Chairman Tom Harkin, an Iowa Democrat, is pushing for legislation that would require all over-the-counter derivatives trades be traded on regulated exchanges, not just standardized ones as the Obama administration is seeking. U.K. banks will be forced to curb trading activity that helped cause the global financial crisis, Britain’s top financial regulator said last month, while stopping short of seeking to separate their lending and securities units.

U.K. banks will be forced to curb trading activity that helped cause the global financial crisis, Britain’s top financial regulator said last month, while stopping short of seeking to separate their lending and securities units.

“Banks have lobbied hard against any changes that would make them unable to take the kind of risks they took some time ago,” said Venkatraman Anantha-Nageswaran, global chief investment officer at Bank Julius Baer & Co. in Singapore. “Regulators are not winning the battle yet and I’m not sure if they are making a strong case yet for such changes.”

Mobius also predicted a number of short, “dramatic” corrections in stock markets in the short term, saying that “a 15 to 20 percent correction is nothing when people are nervous.”

Emerging-market stocks “aren’t expensive” and will continue to climb, Mobius said. He said he favors commodities and companies such as London-based Anglo American Plc, which has interests in platinum, gold, diamonds, coal and base metals.

In China and India, Mobius sees value in consumer-oriented stocks and banks, he said.

14 July 2009

Spitzer Agonistes Redux

It is too bad Eliot could not have exercised better judgement, knowing that he would be targeted by the powers on Wall Street and Washington when he took them on. See the quote at the top of this blog for the most likely reason.

That he was exposed in his scandal by an intense Federal investigation speaks to the depth of the corruption of Washington under Bush, and even now, by the financial powers.

He is right of course, and everything that the Obama Administration is doing on the economic front is a sham.

There is a 'new regulatory spirit' and the Democrats under the skillful hand of Larry Summers and Barney Frank seek to channel it into irrelevancy.

Spitzer Says Banks Made ‘Bloody Fortune’ on U.S. Aid

By Laura Marcinek

July 14 (Bloomberg) -- Eliot Spitzer, the former New York governor and attorney general, said U.S. banks made a “bloody fortune” while receiving taxpayer money without a proven benefit to the wider economy.

Politicians understand the “populist rage” with excesses in the financial industry and in this case the “public is right,” said Spitzer in a Bloomberg Television interview today. “We have saved financial services, we have not created a single job. We are still bleeding jobs.”

As New York attorney general, Spitzer was known as “the sheriff of Wall Street.” He changed business practices and collected billions of dollars in settlements from financial corporations such as Merrill Lynch & Co., American International Group Inc. and Marsh & McLennan Cos. He later became governor, resigning in March 2008 after he was identified as a client of the Emperors Club VIP, a high-priced prostitution ring.

Spitzer said new rules proposed by President Barack Obama’s administration are irrelevant because regulators failed to enforce existing regulations.

“Regulatory agencies already had the power to do everything they needed to do,” he said. “They just affirmatively chose not to do it.”

“You don’t need new regs to do it, you just need the will to do what they were supposed to do,” he said.

‘Hands Off’

Former Federal Reserve chairman Alan Greenspan had “avowed a theory of hands off” while he oversaw the financial markets and didn’t consider himself a regulator, Spitzer said.

“What we’re seeing now is a new regulatory spirit,” he said.

Spitzer said the lessons of the financial crisis will only be remembered over a short period of time.

“Over and over we fall into the same trap,” he said. “Ten years from now we will have forgotten.”

13 July 2009

Stocks Rally With Wall Street Banks as King of the Hill

Meredith Whitney made a bull call on Goldman, and the stock market rallied as a result.

Meredith Whitney made a bull call on Goldman, and the stock market rallied as a result.

There are some important qualifiers in this that the markets seem to be ignoring.

Goldman is positioned as more of a 'one-off' in her forecast, which remains decidedly gloomy for the overall economy, with unemployment as it is under reported by the BLS rising to 13%.

She believes that Goldman will benefit from being in the position to take fees and profits from the heavy government debt issuance to come in the US, especially since it was able to eliminate some long term rivals in Bear Stearns and Lehman Brothers.

Ironically, a richer Goldman does little or nothing for the overall economy since the company pays out about half its profits in bonuses to employees. There is some trickle down to the real economy as they buy their luxury cars, place their children in the finest private schools, and make huge contributions to key politicians, but not much else.

Goldman is not a commercial bank. It has taken on that name to tap into the Government funds, and despite their noises about paying back their TARP, they are huge beneficiaries of the ongoing bailout of AIG with their 100% payouts on Credit Default Swaps.

So, the people give their tax money to Goldman, and in turn a little of it trickles back to those working in the luxury industries, perhaps as servants to great households, and certainly as politicians managing the outlays of public monies to Wall Street.

The debasement of the currency is going to hit the middle class particularly hard, since the monetary inflation is being so heavily targeted to the wealthy few, while little or no quality jobs creation is stimulated. And it is the middle class that is paying for this, in more ways than one.

And economists call gold a barbarous relic.

WSJ

Meredith Whitney Bullish On Goldman,Sees 2Q Above Views

By Ed Welsch

NEW YORK (Dow Jones)--Goldman Sachs Group Inc. (GS) will benefit from being a key player in a "tsunami of debt issuance" by governments as they try to fill gaps in underfunded budgets, financial analyst Meredith Whitney said Monday in an upgrade of Goldman to "buy."

Whitney predicted Goldman Sachs would post second-quarter results Tuesday above Street estimates - she expects earnings of $4.65 a share, compared with the average analyst estimate of $3.48, according to a survey of analysts by Thomson Reuters. She set her 12-month price target on Goldman shares at $186.

Shares of Goldman Sachs rose 2.7% in recent trading to $145.75.

A bullish call from Whitney is rare; she gained renown during the financial crisis for initially unpopular bearish calls on the stocks of large banks that ultimately proved to be correct.

However, Whitney said her bullish view of Goldman is rooted in her overall bearish outlook for the U.S. economy and other U.S. financial companies. While Goldman has made most of its money in the past through a focus on equity markets, Whitney said during the next two years the firm will shift focus to the government debt markets, facilitating new issuance from local, state, federal and sovereign governments as they try to raise money to fill budget gaps.

Whitney raised her earnings estimates for Goldman in 2010 to $19.65, compared to the average analyst expectation of $14.44, and for 2011 to $22.10, compared to the average expectation of $16.75.

She predicted that sovereign and municipal debt markets will grow more than 20% over the next 18 months, and that the state and local municipal debt market could eventually grow more than 50%.

While Whitney predicted U.S. corporate debt will reach about 60% of the levels of the last three years, she said Goldman will get a larger share of that market as well, due to the absence of formerly key players, including Lehman Brothers Holding Inc. (LEH) and Bear Stearns Cos.

Whitney also expects Goldman to take advantage of relatively high capital levels to buy back stock, and by late 2010 could reach the share count level it had before raising capital this year and last.

12 July 2009

There Will Be No Recovery...

"The banks must be restrained, and the financial system reformed, and balanceOften a closing comment from our blog, essentially this is what Robert Reich is saying in his recent essay on the economy.

restored to the economy, before there can be any sustained recovery."

The median wage must increase for consumption to resume, and for this to happen the heavy taxes of the financial sector and the oligarchs on the real economy must be lowered significantly.

There is reason for pessimism that this can happen voluntarily. I have come to the conclusion that there is a pathological drive in some small portion of the population to acquire and control and devour rather than consume, even to their own destruction.

The law sets limits on the speed on highways to protect the many from the reckless and willful behaviour of the few. That we ought not to set limits on the banking system is a remarkable bit of speciousness.

There are obvious questions of how best and how far to limit, and how to detect and prevent and prosecute violations, but the comparison is more valid than obtuse. But it is a poor argument to say that we ought not to do it at all because it is difficult, and perpetrators are always trying to find ways to circumvent the system, especially when it is the aspiring criminal element and their demimonde that is making the argument.

The comparison of this latest epidemic of bad economic behaviour is strikingly reminiscent of the Gilded Age at the end of the 19th century and the Roaring 20's. As you may recall both periods were followed by economic dislocation and a world in flames.

Why we allow this sort of bestial behaviour to ravage the many, in the mistaken support of 'free markets,' where nothing these people touch can remain free and effective and efficient for long, is truly an accomplishment of propaganda and those blinded by ideology.

Robert Reich

When Will The Recovery Begin? Never.

Thursday, July 09, 2009

The so-called "green shoots" of recovery are turning brown in the scorching summer sun. In fact, the whole debate about when and how a recovery will begin is wrongly framed. On one side are the V-shapers who look back at prior recessions and conclude that the faster an economy drops, the faster it gets back on track. And because this economy fell off a cliff late last fall, they expect it to roar to life early next year. Hence the V shape.

Unfortunately, V-shapers are looking back at the wrong recessions. Focus on those that started with the bursting of a giant speculative bubble and you see slow recoveries. The reason is asset values at bottom are so low that investor confidence returns only gradually.

That's where the more sober U-shapers come in. They predict a more gradual recovery, as investors slowly tiptoe back into the market.

Personally, I don't buy into either camp. In a recession this deep, recovery doesn't depend on investors. It depends on consumers who, after all, are 70 percent of the U.S. economy. And this time consumers got really whacked. Until consumers start spending again, you can forget any recovery, V or U shaped.

Problem is, consumers won't start spending until they have money in their pockets and feel reasonably secure. But they don't have the money, and it's hard to see where it will come from. They can't borrow. Their homes are worth a fraction of what they were before, so say goodbye to home equity loans and refinancings. One out of ten home owners is under water -- owing more on their homes than their homes are worth. Unemployment continues to rise, and number of hours at work continues to drop. Those who can are saving. Those who can't are hunkering down, as they must.

Eventually consumers will replace cars and appliances and other stuff that wears out, but a recovery can't be built on replacements. Don't expect businesses to invest much more without lots of consumers hankering after lots of new stuff. And don't rely on exports. The global economy is contracting.

My prediction, then? Not a V, not a U. But an X. This economy can't get back on track because the track we were on for years -- featuring flat or declining median wages, mounting consumer debt, and widening insecurity, not to mention increasing carbon in the atmosphere -- simply cannot be sustained.

The X marks a brand new track -- a new economy. What will it look like? Nobody knows. All we know is the current economy can't "recover" because it can't go back to where it was before the crash. So instead of asking when the recovery will start, we should be asking when and how the new economy will begin. More on this to come.

10 July 2009

The China Bubble and the Convergence of Oligarchies

This is an interesting story from a source that we will be consulting regularly for their news items and insightful analysis.

Regular readers of this blog will notice that we strike the same recurrent themes.

Some years ago Mr. Bill Gates traveled to China, and liked what he saw. This was the model of capitalism which he favored: a small but powerful elite centrally planning an economy peopled by semi-feudal serfs, and living large on the backs of the many.

With all deference to Jimmy Rogers, China is a bubble. The central government will grow increasingly repressive and manipulative as the people improve in education, health and material means. Propaganda will grow more sophisticated and remain as pervasive as it is today.

When the bubble bursts, the iron fist will be unveiled and there will be popular uprisings, and those who believe they are in elite positions now may then find themselves on the docks piled on their baggage waiting for the next ship to take them to safer destinations.

This is certainly nothing new. After the collapse of the first Federal Reserve credit bubble in the late 1920's, the West turned to Soviet Russia and the fascist countries of Italy and Germany for the answer to the 'failure' of Western free market capitalism. Hitler and Mussolini were heavily favored by Wall Street, having a firm hand to rein in the mob.

On the optimistic side, freedom wanes, but still and in remarkable ways, never seems to die.

The Daily Bell

Chinese bank announces bombshell

Issue 343 • Friday, July 10, 2009

Yesterday on their website, the People's Bank of China announced a shocker. New Chinese bank lending for June was 1.53 trillion yuan ($224 billion), double the lending in May. The total already for the year is an astounding 7.4 trillion yuan when the target for the entire year was 5 trillion.

Putting this in context, total lending this year so far has amounted to 25% of 2008 GDP. As I wrote earlier this week, Chinese regulators are getting concerned that this lending is going towards poor credit and bleeding into commodity market speculation.

As most know, bank lending is high powered monetary stimulus due to its high velocity. This is the key difference between fiscal stimulus vs. monetary stimulus. Actually, monetary stimulus will only work well if the banks receiving the funds lend them out. In the US, this is clearly not happening due to banks loan losses and caution over new lending (expanding balance sheet.) In China, this is not the case and new loans are flowing. - CNBC

Dominant Social Theme: China is heating up.

Free-Market Analysis: We've written about this before. China backed into "capitalism" about 30 years ago and the impetus for where it is now was increased by the problems with Tiananmen Square. The Chinese leaders are not interested in political theory at this point (if they ever were). Their currency is power and the way to maintain power is to create an apolitical system where citizens "can grow rich." Western systems work a good deal better than communist systems in this regard. And thus China has built a facade of a Western system.

Yes, it is really only an imitation of a Western system (from a political and big business perspective anyway) in our opinion, just as its banks are only imitations of Western banks and its stock markets are only imitations as well. In fact, to grow rich by investing in the Chinese stock market one apparently simply has to listen intently to the noises coming from the government as to what companies will grow and what companies will not. (And this is different from the US now in what way? - Jesse)

As far as the banks go, the system is probably even more basic than in the West. The central bank prints as much money as it can, and the commercial banks disseminate it. These banks may act as independent entities, but they still have a foot in state government as do many large companies in China.

It is all fairly well jury rigged. China has incorporated a façade of Westernism but to cast China as the world's financial engine is to understand how desperate the West has become. China's economy grows by 10 and 15 percent a year, and now appears be heating up even more. This is not normal growth but central banking generated growth. The same clique still runs China, but the economy has been supercharged by additional printing.

China is said to be turning inward now, as Western countries cannot afford to buy its products. But whether China will be able to maintain its growth by using its own huge population as a purchasing pool remains to be seen. What will certainly happen sooner or later is that the supercharged money being used by the Chinese will create the same boom-bust cycle as has happened elsewhere. Only when it ends in China after so many years, it will be the mother-of-all blow-offs.

Conclusion: It is difficult to see what Chinese leaders expect to happen once the bubble busts. Maybe they are gambling that they can control the unrest that will come in its wake. Maybe they assume the bubble will not bust for many years. (And this is different from the US now in what way? - Jesse)

But articles like the one excerpted above show us that sooner or later China's overheated and pseudo-Western economy will implode, and likely even more violently than Western economies ever have. And here's a thought: The Chinese in the meantime are said to be big buyers of gold on a government level and also personally. Perhaps what is going to eventually happen is better known in China than the West.

09 July 2009

SP Futures Hourly Chart

I think that most would agree that the US equity futures have put in some kind of a top, both in the short and intermediate term which is not shown here.

The question now is, 'Are they in the process of putting in some kind of bottom, or is the trend of the decline merely moderating?'

I have highlighted with horizontal lines a few levels of support and resistance that most traders are watching carefully.

It was not bullish that Alcoa was unable to hold its gains today from its 'good news.'

Goldman Sachs reports next week. That may give some spark to the financial sector, but Goldman is really a 'one-off.' One off what I am not quite sure, but whatever it is I think it says much more about them and their secret trading software and access to information than the economy or anything else.

SP Weekly Chart Updated and Some General Thoughts on Trading and Markets

Today we will take a look at the longer term SP 500 weekly price chart, updating the weekly chart which we published on March 23, 2009.

The rally, although sharp, is well within the bounds of expectations for a rally from a major market bottom off a steep decline. It was more than a technical bounce, but has not yet signalled a 'new bull market' despite the optimism of the Wall Street salespeople. Insiders are still diversifying from equities in record numbers, and the "investment banks" (if we can still speak of such an animal in their traditional commercial bank halloween costume) are spending more time 'gaming' the market than investing in the real economy for the longer term.

The target we set for the rally to the neckline around 960 'worked' which tends to validate it, for now, as a proper neckline.

If in fact this neckline holds, and the SP breaks down through key support, the chart formation sets up an objective of 360 on the weekly SP cash chart.

Here is the SP weekly chart update:

Keep in mind that the chart formation is long term, not immediate, and it must be validated further by a breakdown through key support. If, for example, the Federal Reserve decided to monetize even more aggressively than it has been doing, then it would be likely that the neckline would be broken to the upside, and we have a target showing where we think that will go.

Think of these charts as a 'map' to help us see where we have been, the most likely path, and the terrain, the lay of the land. Charts are not firmly predictive, only probabilistic. Those who make contrary claims for their system have always been shown to be exaggerated and highly selective in their result recording and reporting.

Too often "successful" traders merely exploit weaknesses and minor informational or systemic advantages or inefficiencies in the market and in essence place a 'tax' on the other market participants, usually the naive and inexperienced.

Sorry, but that is the way that it is. This even includes some of the 'too big to fail' boys who have no business exploiting the markets which need to function as efficient capital allocation mechanisms.

There is a tendency to seek to gain unfair advantage. The notion of good and rational markets that can self-regulate with participants who voluntarily obey the rules should be an obvious howler to anyone who has recently driven on a major highway. It is a fallen world, and regulation and enforcement are a sine qua non, and always in need of refreshment and improvement as are all things temporal.

Here is the original March chart.

Some traders are better than others, and some much better. The vast majority of people are in no position to trade, and have no temperament for it, and should leave it alone. They are investors, and enjoy a diversity of lifestyle. Trading is a profession, and needs to be respected as such.

The average person who is even in decent physical condition would hardly think to step into the boxing ring with the world heavyweight champion. And yet this same person thinks nothing of placing leveraged wagers in markets dominated by professionals who do little else for a living, heavily influenced even own the rules boards and help to pick the referees and pay their salaries.

So, what next?

The outlook is rather gloomy for the SP 500 in real terms, decidedly. There is no recovery in the real economy, merely fakes and the push and pull of 'flation. The Federal Reserve and the Obama Economic team are not even beginning to address the issues that will create a sustainable recovery, and are just doing the same thing that has failed before. The recovery from the 2003 market lows was nothing more than a monetary credit bubble, glossed up with statistical and accounting frauds. This is just more of the same, to a more extreme, even more cynically corrupt, degree.

So what next?

Gold still looks like a winning place as a store of value in times of corruption, decline and deception, although nothing is certain.

When the time comes and the economy appears to improve it is likely that silver will decidedly outperform gold on a percentage basis. Silver as well as gold are being heavily manipulated by a few banks who have enormous short positions. If they are ever forced to cover these there will be stretchers taking them out of the pits. But do not hold your breath, remembering who owns the casino, and the casino management. Still, all financial frauds and ponzi schemes come to their inevitable messy end. Bernie Madoff may merely not have as much company in prison as he deserves.

Yes, if you were able to time the market and buy the bottom in stocks, and pick the right ones, and hold on until the top, and then take your profits, and not been caught in the plunging decline of 2007, you have some remarkable gains and I wish you well. You are also gambling. As long as you realize this, and manage your money accordingly, you may keep some or even a good portion of your gain.

08 July 2009

Reminder: Reverse Splits in the Triple Leverered Financial ETFs After the Close Today

For all you big money playas.

DIREXION SHARES ETF TRUST

Direxion Daily Financial Bull 3X Shares

Direxion Daily Financial Bear 3X Shares

Supplement dated June 26, 2009

The Board of Trustees of Direxion Shares ETF Trust has approved reverse splits of the issued and outstanding shares of both the Direxion Daily Financial Bull 3X Shares (FAS)(“Financial Bull Fund”) and Direxion Daily Financial Bear 3X Shares (FAZ) (“Financial Bear Fund”).

After the close of the markets on July 8, 2009 (the “Record Date”), the Financial Bull Fund will effect a one for five reverse split of its issued and outstanding shares and the Financial Bear Fund will effect a one for ten reverse split of its issued and outstanding shares. As a result of these reverse splits, every five shares of the Financial Bull Fund will be exchanged for one share and every ten shares of the Financial Bear Fund will be exchanged for one share.

Accordingly, the number of the Financial Bull Fund and Financial Bear Fund’s issued and outstanding shares will decrease by approximately 80% and 90%, respectively. In addition, the per share net asset value (“NAV”) and next day’s opening market price of each the Financial Bull Fund and the Financial Bear Fund will be approximately five-times higher and ten-times higher, respectively. Shareholders of record on the Record Date will participate in the reverse splits. Shares of the Financial Bull and Financial Bear Funds will begin trading on NYSE Arca, Inc. (“NYSE Arca”) on a split-adjusted basis on Thursday, July 9, 2009 (the “Effective Date”).

The next day’s opening market value of the Financial Bull and Financial Bear Funds’ issued and outstanding shares, and thus a shareholder’s investment value, will not be affected by the reverse splits.

John Merriwether to Close Hedge Fund After Heavy Losses

The markets are brutal indeed for speculation, with a few predatory institutions, well supplied with freshly minted central bank liquidity, preying the markets with high frequency programs designed to manipulate prices, squeezing the leverage out of funds and speculators.

The marvel is not that a professional like John Merriwether has failed again, although less spectacularly this time as compared to the great flameout that was LTCM.

The marvel is that people, including the wealthy and presumably sophisticated, continue to give their funds to gamblers and ponzi dealers.

Even more amazing how the people continue to allow their economies to be so thoroughly distorted and perverted by the corrupting influence of a relatively few but powerful market participants from the financial sector.

"While boasting of our noble deeds we're careful to conceal the ugly fact that by an iniquitous money system we have nationalized a system of oppression which, though more refined, is not less cruel than the old system of chattel slavery." Horace GreeleyThe banks must be restrained, and the markets reformed, and balance restored to the economy before a sustained recovery can be achieved.

A good first step would be an independent audit of the Federal Reserve. And a second would be aggregate position limits on all commodities and traded financial instruments with disclosure. A third would be the aggressive abolition of naked shorting.

Bloomberg

Meriwether Said to Shut Hedge Fund; London Chief Plans Startup

By Katherine Burton and Saijel Kishan

July 7, 2009 21:41 EDT

July 8 (Bloomberg) -- John Meriwether plans to shut the hedge fund he started after the collapse of his Long-Term Capital Management LP in 1998 roiled global markets, according to a person familiar with the matter.

Long-Term Capital lost more than 90 percent of its $4.8 billion of assets in the weeks following Russia’s currency devaluation and bond default. The Federal Reserve orchestrated a $3.6 billion bailout by the fund’s 14 banks to calm fears that the firm’s lenders and trading partners would be dragged down.

The decline of Meriwether’s current firm, JWM Partners LLC, played out over months, with its main fund losing 44 percent from September 2007 to February 2009. The Relative Value Opportunity II fund, which sought to profit from price differences among related bonds, returned an average of 1.46 percent a year since it began trading Nov. 30, 1999. The Credit Suisse/Tremont Hedge Fixed-Income Arbitrage Index gained 2.4 percent a year in the same period.

“For many investors, John Meriwether is by now just another hedge-fund manager,” said Tammer Kamel, president of Toronto-based Iluka Consulting Group Ltd., which advises clients on investments in the private pools of capital. “LTCM’s infamy was a big story in 1998, but the events of 2008 might finally relegate LTCM and 1998 to footnote status.”

JWM Partners, based in Greenwich, Connecticut, managed about $1 billion at the beginning of 2008. Meriwether, 61, joins hedge-fund veterans Art Samberg, James Pallotta and William von Mueffling in closing funds this year. He didn’t return a telephone call and an e-mail seeking comment.

London Chief Departs

Adrian Eterovic, who ran the JWM Partners’ London office, plans to start his own fund, according to the person, who asked not to be named because the information is private.

Eterovic, 46, ran the quantitative strategies within JWM’s funds, according to the person. Eterovic registered Episteme Capital Partners (U.K.) LLP with the U.K.’s Financial Services Authority, according to the market regulator’s Web site. Calls to Episteme’s offices after business hours weren’t answered.

Long-Term Capital relied on borrowed money to enhance returns. The average leverage at the beginning of 1998 was about $28 for every $1 of net assets. JWM Partners was more conservative, aiming to produce returns of 15 percent a year and borrowing $15 or less for every dollar of net assets.

Before Long-Term Capital, Meriwether worked at Salomon Brothers, where he was vice chairman and built its proprietary trading desk. His team, with at least a half-dozen Ph.D’s, used computer models to make money from small price differences in related bonds. His group was responsible for as much as 60 percent of Salomon’s revenue in some years.

He lost his job at the firm following the 1991 government bond scandal. Regulators ruled that he’d failed to supervise traders who violated bond-auction rules.

03 July 2009

India Puts Its Weight Behind Alternatives to the Dollar Reserve Currency

When an alternative to the dollar as reserve currency does occur will this be the most widely telegraphed "black swan surprise" in history?

We would agree that it appears to be an almost classic Prisoner's Dilemma

The exits are likely to be rather crowded when this one finally comes home to roost, unless the nations can agree to a longer term phased in approach. But even then, once the announcement is made, it is beyond all doubt the endgame for the dollar bubble.

The system has not crashed, it is crashing.

Bloomberg

India Joins Russia, China in Questioning U.S. Dollar Dominance

By Mark Deen and Isabelle Mas

July 3 (Bloomberg) -- Suresh Tendulkar, an economic adviser to Indian Prime Minister Manmohan Singh, said he is urging the government to diversify its $264.6 billion foreign-exchange reserves and hold fewer dollars.

“The major part of Indian reserves are in dollars -- that is something that’s a problem for us,” Tendulkar, chairman of the Prime Minister’s Economic Advisory Council, said in an interview today in Aix-en-Provence, France, where he was attending an economic conference.

Singh is preparing to join leaders from the Group of Eight industrialized nations -- the U.S., Japan, Germany, Britain, France, Italy, Canada and Russia -- at a summit in Italy next week which is due to tackle the global economy. China and Brazil will also send representative to the G-8 summit.

As the talks have neared, China and Russia have stepped up calls for a rethink of how global currency reserves are composed and managed, underlining a power shift to emerging markets from the developed nations that spawned the financial crisis.

“There should be a system to maintain the stability of the major reserve currencies,” Former Chinese Vice Premier Zeng Peiyan said in a speech in Beijing today, highlighting the nation’s concerns about a global financial system dominated by the dollar.

Fiscal and current-account deficits must be supervised as “your currency is likely to become my problem,” said Zeng, who is now the head of a research center under the government’s top economic planning agency. The People’s Bank of China said June 26 that the International Monetary Fund should manage more of members’ reserves.

Russian Proposals

Russian President Dmitry Medvedev has repeatedly called for creating a mix of regional reserve currencies as part of the drive to address the global financial crisis, while questioning the dollar’s future as a global reserve currency. Russia’s proposals for the Group of 20 major developed and developing nations summit in London in April included the creation of a supranational currency.

“We will resume” talks on the supranational currency proposal at the G-8 summit in L’Aquila on July 8-10, Medvedev aide Sergei Prikhodko told reporters in Moscow today.

Singh adviser Tendulkar said that big dollar holders face a “prisoner’s dilemma” in terms of managing their holdings. “That’s why I’m telling them to do this,” he said.

He also said that world currencies need to adjust to help unwind trade imbalances that have contributed to the global financial crisis.

“The major imbalances which led to the current situation, the current account surpluses and deficits, have to be addressed,” he said. “Currency adjustment is one thing that suggests itself.”

Emerging-Market Dependence

For all the complaints about the dollar, emerging markets such as India remain dependent on the currency of the U.S., the world’s largest economy and a $2.5 trillion export market. The IMF said June 30 that the share of dollars in global foreign- exchange reserves increased to 65 percent in the first three months of this year, the highest since 2007.

Tendulkar said that the matter needs to be taken up in international talks, and that it emphasizes the need for those talks to go beyond the traditional G-8.

“They can meet if they want to,” he said. “The G-20 has a wider role, has representation of the countries that are likely to lead the recovery process.”

More Banks Fail in "Deepening Financial Crisis"

More green shoots for the fungus collection.

What if they gave a Great Depression but systematically rigged the statistics, manipulated the markets, inflated the currency, and were able to convince the majority that it was not all that bad?

Would it still be a Great Depression? Or a Great Delusion?

How angry would people be when they realized they had been fooled into making very destructive personal financial decisions based on this deception?

Would the perpetrators be able to claim immunity because they were performing a service to the government? This is one defense that Barrick Gold (and JP Morgan) used when they were initially sued for manipulating the price of gold in the New Orleans court case. Barrick Corp Drops Bombshell

"The conscious and intelligent manipulation of the organized habits and opinions of the [public] is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country." Edward Bernays

“It is the absolute right of the State to supervise the formation of public opinion...If you tell a lie big enough and keep repeating it, people will eventually come to believe it. The lie can be maintained only for such time as the State can shield the people from the political, economic and military consequences of the lie.” Joseph Goebbels

Bloomberg

Seven U.S. Banks Seized in Busiest Year for Closures Since 1992

By Ari Levy and Flynn McRoberts

July 3 (Bloomberg) -- Six banks in Illinois and one in Texas were seized by regulators as the deepening financial crisis pushed the toll of failed U.S. lenders this year to 52, the most since 1992.

Twelve banks have failed this year in Illinois, the most of any state. The seven lenders seized yesterday, with total assets of $1.49 billion and deposits of $1.34 billion, were closed by state or federal regulators and the Federal Deposit Insurance Corp. was named receiver, according to statements from the FDIC. Buyers were named for each of the closed institutions.

The Illinois banks are affiliates of Peotone Bank & Trust Co., in Peotone, Illinois, about 45 miles (72 kilometers) south of Chicago. The failures resulted primarily because of soured loans and losses on investments in collateralized debt obligations, the FDIC said. Illinois, with an unemployment rate above the national average, was one of seven states to begin the fiscal year without a spending plan.

"The six failed Illinois banks are all controlled by one family and followed a similar business model that created concentrated exposure in each institution," the FDIC said. CDOs, which packaged bonds and loans into notes of varying risk and yield, lost money as real estate defaults soared.

Regulators this year have closed the most banks since the savings-and-loan crisis of the 1990s as lenders struggle with mounting losses on mortgages and commercial loans. The total for 2009 is more than double the 25 banks shuttered in 2008 and surpasses the 50 that were closed in 1993. The prior year there were 181 failures or government-assisted transactions.

FDIC Fund

The FDIC estimates yesterday's seizures will cost its insurance fund $314.3 million. The regulator imposed an emergency fee in May to raise $5.6 billion to rebuild the fund, which has deteriorated in the past 18 months. More assessments are possible, the FDIC said.

Illinois Governor Pat Quinn, a Democrat, refused to sign a budget because lawmakers failed to approve raising the income tax. In his original $53 billion budget proposal in March, the governor sought personal and corporate tax increases to help eliminate an $11.6 billion deficit and maintain state services.

Chicago is 280 miles from Detroit, home to General Motors Corp. and Chrysler LLC, which were forced into bankruptcy. Lear Corp., the Southfield, Michigan-based maker of automotive seats, announced plans yesterday to enter bankruptcy. The unemployment rate in Illinois was 10.1 percent in May, compared with 9.4 percent nationally.

A Mess

"This is a mess," said Jack Ablin, who oversees $60 billion as chief investment officer at Harris Private Bank in Chicago. "We're a manufacturing state and in the Midwest, so we're influenced by the autos."

In addition to CDOs, the failed banks were plagued by losses on commercial real estate loans. Founders Bank of Worth, the biggest of the Illinois banks seized yesterday, had $374 million in construction and commercial real estate loans as of March, accounting for 63 percent of the bank's net loans and leases, according to a regulatory report.

Millennium State Bank of Texas, the Dallas-based bank taken over yesterday, had $67.5 million in such loans, or 81 percent of its total loans.

"The common denominator for most of the bank failures so far has been troubled construction loans," said Matthew Anderson of Foresight Analytics, an Oakland, California-based real estate research firm. "There's no easy way out with defaulted construction loans in today's environment..."

02 July 2009

Japan Calling: A Little More Local Color on the Japanese System

A friend in Japan is updating me on how things are going there.

Its been about ten years since I have worked in Tokyo personally, but everything he is saying is a logical extension of how things were at that time. I am very familiar with the NTT communication system, which was the basis of some of our early work here in the US. Its convenient sometimes to have a determined bureaucracy with plenty of money and power at your back when its time to get a strategic initiative achieved.

This is useful because people like to make facile comparisons between Japan and the US without really understanding some important differences in the markets, public policy, demographics, and culture.

"There are many things here that make life difficult, but on the other hand, make life much easier, some planned, some dictated by circumstances and by accident. It seems very socialist. Makes it very difficult to compare Japan and the US.

There is national health care here. Due to a focus on disease prevention (they have started to take waist measurements and warn you if your waist is say more than 34 inches), not eating too much meat, getting enough vitamin D from sunlight and getting a little exercise because you have to walk 10 minutes to the train station, you can expect, on average, to be fully functional until about 75 and live into your 80s.

Almost everyone is reimbursed for commute to work, by least expensive route, say bus and train, even if you work in a convenience store. Japanese people have told me that the idea is that everyone who wants to work should be able to work where they want without being deterred by the cost of the commute. At one firm I worked at, the limit for the reimbursement was 800 dollars per month, so a very few people commuted by bullet train from quite a distance away. More exactly, if you go to work 5 days a week, the company will reimburse you for the bus/train pass, which allows unlimited travel, so you can use the train pass to go shopping or do other things on weekends for free.

My pass for a half hour commute each way, about 40 miles round trip, is 120 dollars per month. This is why the public transportation systems work well and have continued to improve. All the trains are continuing in improve, and for example, the bullet train now uses one half the energy it did when it debuted 45 years ago. JR East, beginning with the Yamanote Line, is replacing all its trains with new regenerative braking trains that are lighter and roomier and use half the energy of the earlier models. Advertisements on the trains say it takes 1/10 the energy to go by train than by car, but I think that is for older models.

Which brings us to the biggest advantage: most people do not need a car here, and if they do need one, a household can get by with just one car.

I have long thought of cars as vampires sucking the economic life out of every household in the US. And the risk of death and serious injury from car accidents is about half what it is in the US (although the statistics may not be directly comparable).

In 45 years, only one rider has been killed on the bullet train, and that was because he tried to stick his hand in the door too late and got the sleeve of his jacket caught in the door. While there are commuter train accidents from time to time, they are rare, and I think in Tokyo, the last passenger deaths were about a decade ago when a train derailed. Since the auto fatalities in Japan are about 7,000 per year, whereas in the US they are around 40,000 per year with about double the population, I guess that if the Japanese drove as much as people in the US, there would be about another 10,000 auto fatalities per year here, so over the 20 years I have lived here, there are say 200,000 people walking around who wouldn't otherwise be here. That trumps absolutely all other considerations.

I think it is telling that during the oil price spike last year, the US cut its gasoline consumption by about 5%, whereas in Japan, gasoline consumption was cut by 14%. I said, the Japanese cut their gasoline consumption by 14%... BECAUSE THEY CAN.

Broadband, subsidized and incentivized, has been here for a decade. Around 1999, I picked up a Yahoo Broadband modem, filled out a form, brought it home, and plugged it in. 6 M/sec, 15 dollars a month. Although I didn't understand it at the time, the modem was converting my telephone calls into internet telephony, so calls to the US that were a dollar a minute by NTT were suddenly a flat 3 cents a minute. Around new year, I made a lot of phone calls, and was bracing for a thousand dollar phone bill... and then I realized that I hadn't gotten an NTT bill in months... it was instead a 20 dollar charge tacked on to my credit card.

The Japanese government has been panicking about the oil running out for more than a decade. I noticed Koizumi saying "global warming, global warming" over and over again, and mention of peak oil was conspicuous by its absence. That's when I realized that when he was addressing the captains of industry, what he was really saying was "You idiots, the oil is running out! Get the energy use of everything down!"

Because broadband is widely available, the Japanese government went from wanting 10% of workers to telecommute at least some of the time, to wanting 20% to telecommute by next year, as a means of reducing energy consumption.

Mitsubishi is advertising a split system heat pump air conditioner/heater that runs at about 6 cents per hour (and the electricity rate here is high, about 20 cents a kilowatt hour). My Sharp heat pump is 16 years old and runs for about 10 cents an hour. My total heating/cooling expense for a year is about 300 dollars.

There is a huge panic going on in the US about how bad the electricity grid is. I think there are estimates that unreliable electricity is costing the US 100 billion per year. In Tokyo, there has been only one major blackout in 20 years, and that affected only about a quarter of the city for half a day due to a crane snagging high tension wires. The only outages I have seen myself were when a construction crew accidentally severed a line (one hour) and when a fighter jet crashed into high tension wires (two hours). Quakes do not normally affect electricity, water, or telephone. Gas meters have automatic sensors that turn off gas supply, and then if it seems all clear after an hour, automatically reset. We sometimes have fairly big quakes every day for weeks on end... I'm not joking.

When a quake is detected by sensors, the sensors send signals to a central computer. The computer has models of 100,000 quake scenarios, and it matches the data to a scenario, estimating the surface shaking for each small grid square of Japan. If surface shaking in a particular location is predicted to exceed a certain level, the bullet trains automatically engage emergency braking. All city halls have automatic announcement systems that estimate the shaking and count down to the arrival of the primary wave at their particular location. Nuclear reactors and power generating stations receive advance warnings. Some residential condos also have this. I suppose it will become standard soon.

You can get warnings of a few seconds or minutes depending on how far away the quake is.

(After seeing the Kobe quake first hand, my solution was 1) buy earthquake ground shaking estimate map of Tokyo, 2) see closest station to downtown where risk drops substantially due to granite outcrop getting you off the alluvial plain. Estimates of shaking in downtown Tokyo is 10 times the estimated shaking where I live.)

This is why I think it is so difficult to compare the situations. You cannot walk away from the mortgage. On the other hand, your commute is subsidize and you do not need a car, so it is as if the condo were free."