"No correlation to the physical market.

On-going tightness in the physical gold markets.

physical tightness of flow is reflected in the price not at all.

Gold is moving in one direction from west to east with small exceptions over the last year.

The danger of less supply moving forward is more likely than the comfort of more supply."

I found this discussion between John Ward of Physical Gold Fund SP and an executive at one of the top Swiss Refiners highly informative, and suggest that you give it a listen.

The most difficult part I have found in presenting information is that once a group has amassed a great deal of data and putting it into some organized form of information, an arduous task indeed, the next step of taking that information and putting it into a relatively simple and easier to understand format is a very important task and none too easy in itself.

I certainly learned that lesson through years of making presentations to the principal executives of Fortune 100 companies. Most of the time they wish to have everything on one sheet or slide, with backup optional for their staffs or key questions they may ask in 'drilling down.' If you have ever worked at a large company I am sure you know the feeling.

I hope to have something out on this issue later day.

But this is quite interesting and stands alone. We have been hearing about this 'tightness' from quite a few quarters recently including some bank analysts and Peter Hambro.

You may read about this and listen to the actual podcast at Physical Gold Fund.

The gentleman we are interviewing is part of senior management of one of the largest Swiss refineries. His refinery is one of only 5 global LBMA referees, which takes samples from other refineries around the world and certifies them to produce gold meeting the purity and form factor of the LBMA good delivery standard, which makes it part of the very core of the industry globally.

He has over 30 years experience in the gold markets and has in our view one of the most authoritative perspectives into global physical gold flows in the world. His unique outlook, formed from internal data on gold flows through the refinery, combined with colleagues throughout the industry including the largest bullion banks (versus news outlets) is an invaluable source of information and paints an important picture for the gold markets moving forward.

Topics include:

*Why trying to correlate physical flows with the price can be misleading;

*On-going tightness in the physical gold markets;

*There is less liquidity in the physical market;

*The physical tightness of flow is reflected in the price “not at all”;

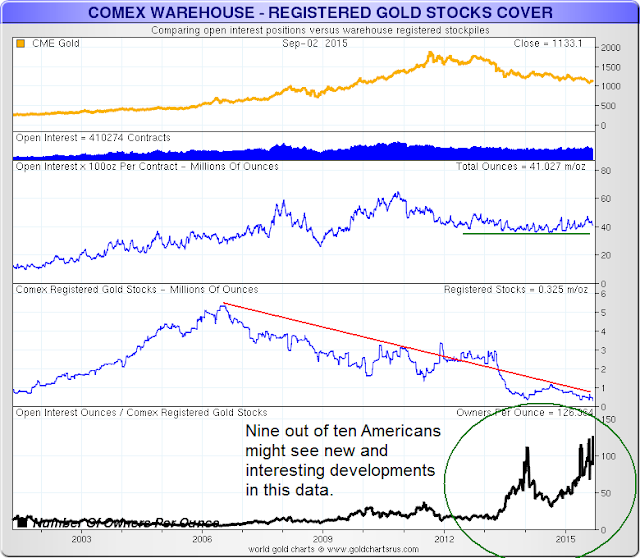

*As long as the spot market is settled with cash settlement, the physical flows are not determining price;

*If investors dealing in cash markets begin to take delivery, the physical is just not around;

*The current pricing mechanism can continue indefinitely unless investor behavior changes to taking delivery versus cash settlement;

*The gold price has “no correlation to the physical market”;

*If this behavior changes (to taking physical delivery) it could become dramatically dangerous;

*Gold is moving in one direction from west to east with small exceptions over the last year;

*90% of the refinery’s business is currently supplying demand from the east (India, China) and 10% to western markets;

*China has imposed a new standard on the LBMA good delivery system of 1 kilo, 999.9 fineness;

*400oz bars being melted and refined to 1 kilo 999.9 fine bars and shipped into China are coming out of London and particularly the ETF’s such as GLD;

*In the next gold upleg, scrap may not be readily available – overall scrap has decreased remarkably;

*Declining investment in the mining sector and geo-political issues affecting mining viability will unavoidably reduce gold supply moving forward;

*The danger of less supply moving forward is more likely than the comfort of more supply.