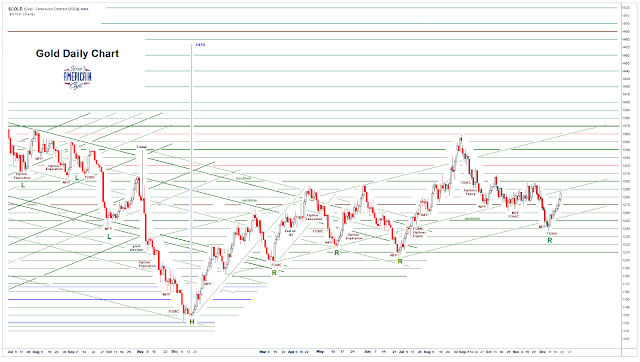

The rebound for gold and silver off the lows associated with the recent Non-Farm Payrolls and FOMC continued with gold taking and holding 1280 and silver putting a stick in the ground above 16.50. I lightened up on a largish short term position I had put on at the time. I did circle these instances of short term lows on the chart as you may recall.

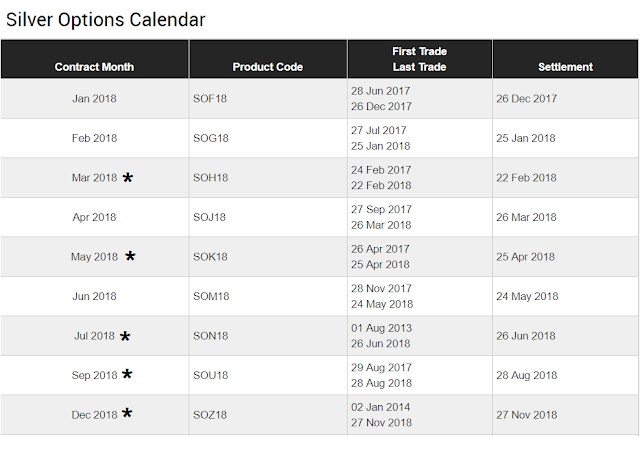

As noted with the publication of the new Comex options calendars yesterday, today was an options expiration for precious metals.

February is the new active month for gold contracts. March is the next active contract for silver.

Although it still matters for pricing, the Comex listed warehouse complex is starting to resemble a museum. Very little gold flows in or out of its approved warehouses, excepting for those in Hong Kong which is by far their largest source of physical gold movement.

Silver is a bit different, because CNT is an active wholesaler of physical silver for the Mint among others, and it uses the Comex to warehouse its inventory flows. But I just don't see the shortage of physical silver in the same light as gold. It is easy to see that JPM is sitting on a massive hoard which is interesting.

Since the young man is home for the holidays, we had a nice long conversation about blockchains and bitcoin again. He understands the technical aspects of the data structure aspects of it, and built his own GPU based bitcoin mining operation in his bedroom just for grins a few years ago.

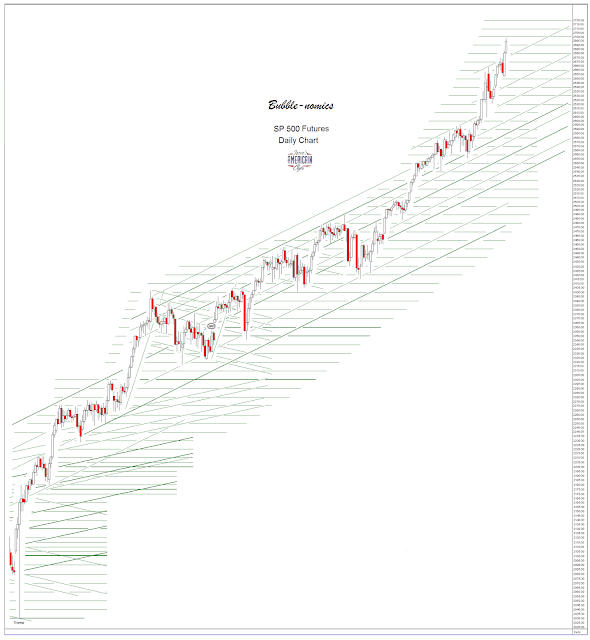

The net result of our long conversation is that bitcoin seems more like a mania that I had even thought before.

Blockchain as a data structure is an interesting way of recording transactions. But its scalability is severely constrained unless the users delegate the maintaining of the blockchain, or the decentralized ledger of transactions, to a central authority with an enormous amount of computing power at their disposal.

So at first blush it seems more suited for applications that involve fairly tight communities of users who wish to have a common record of their transactions that is decentralized. But scalability is going to be a real issue unless you bolt something on that undermines the whole 'trust' issue.

Most 'users' of bitcoin have lite wallets, and rely on some third party to insure the integrity of their 'money.' They do not generate their own blockchains, which is the very definition of how much 'money' you have. You go back and sum up all of your recorded user transactions, and what you have left is what you have.

And this is contrary to the principles that drove technocrats who distrusted the Fed, for example, to seek an 'independent' crypto-currency. And since it is unregulated, and in the hands of a few oligarchs in let's say China for example, it seems fairly dodgy even compared to a fiat currency which is transparent and regulated. And you know how I feel about that sort of thing.

Once I understood the mechanics of how the chains are updated, it became a lot clearer why it takes an hour or so for a genuine bitcoin transaction to complete. Most people who say they are using bitcoins for transactions are really just trading obligations held in trust by some third party.

If you have made money on it great. But in my own estimation, and I could be wrong, the hyping involved in bitcoin is all too reminiscent of the dot com bubble. And there is no talking to people who are seized by the desire to be rich, and those who seek power.

Like the dot com bubble, I suspect that the rewards from this digital gold rush will be taken primarily by those who sell the picks and shovels and storage and assaying services to the miners, and a few insiders and lucky early adopters. And the average person is going to get skinned.

Have a pleasant evening.

And this is contrary to the principles that drove technocrats who distrusted the Fed, for example, to seek an 'independent' crypto-currency. And since it is unregulated, and in the hands of a few oligarchs in let's say China for example, it seems fairly dodgy even compared to a fiat currency which is transparent and regulated. And you know how I feel about that sort of thing.

Once I understood the mechanics of how the chains are updated, it became a lot clearer why it takes an hour or so for a genuine bitcoin transaction to complete. Most people who say they are using bitcoins for transactions are really just trading obligations held in trust by some third party.

If you have made money on it great. But in my own estimation, and I could be wrong, the hyping involved in bitcoin is all too reminiscent of the dot com bubble. And there is no talking to people who are seized by the desire to be rich, and those who seek power.

Like the dot com bubble, I suspect that the rewards from this digital gold rush will be taken primarily by those who sell the picks and shovels and storage and assaying services to the miners, and a few insiders and lucky early adopters. And the average person is going to get skinned.

Have a pleasant evening.