We have seen comparisons of the price of gold to the adjusted monetary base and to M1. Based on intense study and reasoning about the current trends in money supply we are convinced that this comparison of growth in MZM with a lag to the change in the price of gold is significantly much more valid than any other we have been able to produce, if one only considers the correlation of the graphs. And it makes logical sense.

MZM is the most valid measure of broad 'liquid' money in the system. We formerly used M3 but this has not been available, with any published certainty, since 2006.

It would make sense that in a free market, the growth trend of a broad measure of 'liquid money,' as opposed to credit or potential money, would be statistically valid with the price of an alternative currency, or wealth asset, like gold over the longer term.

Speaking wonkishly, our preferred comparison would be to be able to measure the difference in growth between real GDP and the growth in broad money supply, and then trend and compare that with the growth in the price of gold.

Since we have no honest measure of price inflation that task is difficult. Our second preference would be to make a similar comparison per capita the economically active rather than real GDP. Is there an accurate measure of job population growth fluctuations with the ebb and flow of the illegals? We are not sure, but are looking into it.

30 January 2009

The Price of Gold and the Growth of the Money Supply

29 January 2009

When the Incoming Tide Turns to Tsunami

Not a matter of if, but when.

The Times

Gold price could treble if China divests dollars, warns mining boss

Jenny Booth

January 29, 2009

The gold price is likely to hit record highs in dollar terms as fears grow about the stability of the US currency, the chairman of Barrick Gold said today at the World Economic Forum (WEF) in Davos.

The founder of the world’s largest goldmining company said that there was even a possibility that central banks, including China’s, might start to switch from dollar holdings to gold, which could cause the price of the metal to treble.

“Gold is at record levels in every currency except dollars," Peter Munk told Reuters at the WEF meeting.

"Even within dollar terms it is within a few percentage points of an all-time high, at a time when all the other major commodities are falling.”

Mr Munk said: “Whether it’s the currency effect or a reaction to a feeling of uncertainty, gold, in my opinion, is more likely to go up than down.”

The gold price was up today, trading at about $890 at 1500GM. At present the record high is $1,030.80 an ounce, achieved in March last year.

Mr Munk emphasised that he was merely weighing the odds.

“It would be stupid to assume commodities prices can only go one way,” he said, adding that physical demand for gold jewellery was not high during the economic downturn.

Gold has been one of the best-performing assets of recent months, rising in value by nearly 17 per cent since late October even as the price of other commodities, such as oil and copper, has dropped sharply. (This is because gold is more monetary than commodity. Silver is a more even mix but it is still monetary as well as industrial. - Jesse)

Investors have bought heavily into physical bullion in the form of coins and bars, and physically backed assets, such as exchange-traded funds, as a safe store of value at a time of increased volatility in other asset prices.

Mr Munk said that downward pressure on the dollar, partly due to massive US spending and printing money to stimulate the economy, would increase gold’s attractions as an investment even further.

Gold usually moves in the opposite direction to the dollar, as it is often bought as a hedge against weakness in the US currency. (Gold has been moving with the dollar as foreigner flee out of other currencies and begin to treat gold as a safe haven alternative with, not in lieu of, the dollar - Jesse)

“My personal feeling is that with the rescue packages calling for trillions, not billions ... the value of the [US] currency has to go down,” Mr Munk said.

He said that there was a possibility that central banks, including that of China, a major dollar asset holder, might start buying gold. (Rumour is that the physical market is so tight they have been calling quietly around looking to lock in major sources of supply - Jesse)

“If they decide to diversify, we assume into gold, then we start to talk about a trebling or quadrupling of the gold price," he said. "It could be followed by Russia or Kuwait." (They could just be jawboning Tim Geithner back with a credible threat as well - Jesse)

“I don’t think it’s likely, but it’s more likely. I would not have said it two years ago — I’m not a gold bug — but it’s more likely than it was two years ago.”

He added that his company did not now hedge its output — meaning use derivatives to insure against a fall in price — and relied on the price climbing.

In the past its successful hedging allowed it to make key acquisitions.

“It would be dumb to hedge,” Mr Munk said. (Bill Murphy told you that when gold was at $300 per ounce, and he was right - Jesse)

26 January 2009

Weekly and Daily Gold Charts

Gold is in a potential breakout formation with a minimum upside measuring objective of 1200. A consolidation here that does not violate 800 to the downside is within the bounds of this formation and will be considered a right shoulder.

Such a correction is not necessary to the formation.

Gold is still in a bull market. There will be corrections, some of them quite challenging. This is the very nature of a bull market, to shake the resolve of the bulls, and continually entice and confound the bears, who struggle to hold their pessimism from one line in the sand to the next.

Some day the bull market in gold will end. But not yet.

21 January 2009

Is Gold and the Balance of Power Shifting from the West to the East?

Here is an interesting set of charts, and a unique conclusion to match, from Moneyweek.

As we recall, the folks at GATA have been showing this sort of market analysis for some time now, to a cooler reception than a Madoff whistleblower at the Chris Cox retirement party.

We'd be open to hearing of other serious interpretations of this phenomenon. But be forewarned; to say it is just nonsense is, well, nonsense. It is a statistically valid hypothesis, albeit an unexplained and a bit odd, at least for the moment.

Can a money machine really exist in free and efficient markets? Economic theory says it cannot, that it must be due to some flaw or inefficiency, or an artificial scheme such as the regular returns from the Madoff Fund.

We might agree with the surmise that it involves the steady selling of leased gold from the West into the gold markets, but that could only be confirmed by an audit, and an admission from some large central bank that they have been obligating increasingly large amounts of their inventory into the public markets in a previously undisclosed manner.

The transaction costs are a problem if you are standing at the retail counter, we fear, so don't get any ideas about playing this trade. Its a sinecure for the big boys only, who can take advantage of market inefficiencies by trading in large, ever increasing volumes, like the whiz kids at LTCM did until they blew their trade book up.

Oddly enough, the data from the Office of the Comptroller of the Currency report on Derivates shows that only two banks, JPM and HSBC, are holding almost $124,000,000,000 in gold derivatives between them, approximately 98% of all gold derivatives in the world.

At $850 per ounce, that represents about 145,882,353 ounces of gold.

As the tides of monetary bubbles recede, curiosities are turning up on the beach every day.

MoneyWeek

Gold is shifting from West to East – along with the balance of power

By Dominic Frisby

Jan 21, 2009

Twice a day – at 10:30AM and 3PM - the price of gold is set on the London market by the five members of the London Gold Pool (HSBC, SocGen, Deutsche Bank, Scotia-Mocata and Barclays). This is known as the London fix and it's used as the benchmark to price gold, gold products and derivatives in markets around the world.

I've been looking at some charts and an astonishing pattern has become apparent. It's a pattern which, if you'd traded it methodically, would have earned you 1% a week over a period of 24 years. That compounds to a staggering 24,720,000%!

What is this spectacular strategy? Read on…

The astonishing pattern in London gold fixing

The strategy is really quite simple. You buy gold at the London PM fix (3PM), as the American markets have just opened for trading, and you sell your gold the following morning at the London AM fix (10:30AM), as the Asian markets are closing.

My thanks, as always, to Tom Fischer of Herriot Watt University for the charts below. The first demonstrates the weekly 1% gain that would have been yours since 1985 (the green line).

...What is more astonishing is how this pattern has accelerated since 2007. Sell gold in the morning, buy it back in the afternoon, and a cool 1.78% weekly profit will be yours:

Why would anyone want to manipulate the gold price?

What other free market shows such a consistent behaviour over time? Unless, of course, it's not a free market and the invisible hand of Big Brother is getting involved. Many of you will have read about manipulation of the gold price, and heard that there is a deliberate conspiracy to suppress the price of gold....

Rest of the story at MoneyWeek

20 January 2009

Strong Gold, Strong Dollar

"Because the Dollar Index (DX) is an outmoded and artificial measure of dollar strength, containing nothing to account for the Chinese renminbi for example, it may not be a true reflection of the progress of this inflation."

The Fed Is Monetizing Debt and Inflating the Money Supply

A number of people have remarked about the strong dollar and strong upmove in gold today. It does seem counterintuitive.

The euro is weak because of the solvency situtations in Ireland and Spain. This is taking the euro down and the dollar higher.

At the same time there is a flight to safety occurring into gold, but not into commodities in general.

It is not a flight from inflation, it is a flight from risk to relative safety. At least for today.

But by the way, keep an eye on the Treasuries, particularly the longer end of the curve, as we have previously advised.

There is 'the tell.'

09 January 2009

Merrill Lynch: The Wealthy Are Turning to Physical Gold for Safety

And so it begins...

And so it begins...

Each person has to allow for their own circumstances, and provide for their daily needs as well as their longer term investment decisions.

Speculation and leverage are a trap in this market, because it is permeated by abusive practices and a deterioration of the conditions necessary to free markets.

It is truly amazing that the world continues to allow New York, Chicago and London to set the short term prices for their goods and labor.

The status quo will do all in its power to perpetuate itself, and hold the line on meaningful change and reforms for a variety of all too human motivations. This, we believe, is what has been causing this series of bubbles, booms and busts. Bernanke is fighting the last economic crisis.

As we can, provisions should be made for the troubles to come. We did not get where we are overnight, and we will not repair ourselves in a year either.

UK Telegraph

Merrill Lynch says rich turning to gold bars for safety

By Ambrose Evans-Pritchard

Last Updated: 10:32AM GMT 09 Jan 2009

Merrill Lynch has revealed that some of its richest clients are so alarmed by the state of the financial system and signs of political instability around the world that they are now insisting on the purchase of gold bars, shunning derivatives or "paper" proxies.

Gary Dugan, the chief investment officer for the US bank, said there has been a remarkable change in sentiment. "People are genuinely worried about what the world is going to look like in 2009. It is amazing how many clients want physical gold, not ETFs," he said, referring to exchange trade funds listed in London, New York, and other bourses.

"They are so worried they want a portable asset in their house. I never thought I would be getting calls from clients saying they want a box of krugerrands," he said.

Merrill predicted that gold would soon blast through its all time-high of $1,030 an ounce, and would hit $1,150 by June.

The metal should do well whatever happens. If deflation sets in and rocks the economic system it will serve as a safe-haven, but if massive monetary stimulus gains traction and sets off inflation once again it will also come into its own as a store of value. "It's win-win either way," said Mr Dugan. He added that deflation may prove the greater risk in coming months. "It's very difficult to get the deflation psychology out of the human brain once prices start falling. People stop buying things because they think it will be cheaper if they wait."

He added that deflation may prove the greater risk in coming months. "It's very difficult to get the deflation psychology out of the human brain once prices start falling. People stop buying things because they think it will be cheaper if they wait."

Merrill expects global inflation to hover near zero, with rates of minus 1pc in the industrial economies. This means that yields on AAA sovereign bonds now at 3pc will offer a real return of 4pc a year, which is stellar in this grim climate. "Don't start selling your government bonds," Mr Dugan said, dismissing talk of a bond bubble as misguided. (Government bonds are a safe haven for now on the short tend of the curve, but to say there is no bubble on the long end is remarkable. The only vairable is how long before that bubble bursts. The real question is whether the risk is worth the return for you, and that will vary. It seems insane to hold the long end when you can take the shorter end. - Jesse)

He warned that the eurozone was likely to come under strain this year as slump deepens. "There is going to be friction as governments in the south start talking politically about coming out of the euro.

I don't see the tensions in Greece as a one-off. It is a sign of social strain in countries that have lost competitiveness." (Wait until it really gets rolling in the US, UK, Russia and China. Then there will be headlines - Jesse)

Daily Telegraph

Gold rush erupts over financial crisis

By Nick Gardner

January 10, 2009 12:01am

THE global financial crisis has sparked a new gold rush.

Worried investors seeking a safe home for their money are ploughing billions of dollars into the precious metal in a bid to preserve their wealth.

Demand has now reached such unprecedented levels that the Perth Mint, Australia's biggest wholesaler of gold coins and bars, has been forced to ration its sales.

Perth Mint's bullion sales rose 194 per cent in the December quarter compared with the corresponding period in 2007, while silver bullion sales were up 140 per cent.

The mint has suspended sales of all gold bars and all bullion coins - except its 1oz "Kangaroo" gold bullion coin. On Monday, after a three-month suspension, it will expand its range of bullion coins for sale but the restrictions remain in place for minted gold bullion bars so the mint can sell some gold to as many customers as possible.

On Monday, after a three-month suspension, it will expand its range of bullion coins for sale but the restrictions remain in place for minted gold bullion bars so the mint can sell some gold to as many customers as possible.

"We are working three shifts a day, six days a week, and still can't keep up with demand," Perth Mint CEO Ed Harbuz said. "I've never known anything like this in the precious metals market.

"We would be working Sundays too but we are having difficulty getting enough staff."

Non-minted gold in the form of cast bars produced by Perth Mint's local refinery can still be bought, although customers who want the bigger bars often have to wait several weeks.

One customer recently bought $500,000 worth of bullion and wanted it delivered so he could hold it personally.

"For very big orders we normally keep the gold in our depository for security reasons," Mr Harbuz said.

"Orders of $10 million or more are not unusual. Often the orders are much larger if we are dealing with pension funds or institutional investors."

05 January 2009

Is the Comex Doing Fractional Reserve Delivery of Gold?

The short answer is no, but this is not a strong area of specific expertise and recent experience for us, and we never attribute to a bad intent what we can attribute to sheer incompetency, especially when dealing with large organizations.

But when one is promised specific bars with specific serial numbers of a specific size and weight one week, and they are not available the next week when you confirm that you wish to receive them, that brings up the same kind of red flags that have been so notoriously ignored by regulatory agencies in other recent cases. Of course the Comex is no Bernie Madoff.

It does bring into question the integrity of the Comex records and their contracts, and the condition of their audits and inventories. We would have a fit if someone did this to us after an online auction or a personal purchase transaction. Why should the Comex be allowed to sell what it does not have, and then dictate new terms after the fact? Especially when this same customer had been routinely taking delivery off emini contracts from Comex before this.

And it does put a fresh emphasis on the old adage, "When in doubt, take it out."

We accumulated 3 emini gold contracts on CBOT for December delivery and we had been given serial numbers and weights last week for the 3 bars we were to receive.

Today we are informed that Comex is invoking a rule in which they can deny delivery of individual mini bars (roughly 33 ounces) and issue you only a Warehouse Delivery Receipt (WDR) against your mini-contract unless you have 3 WDR's, and then they'll issue you a 100 oz. bar.

Otherwise, if you have only 1 or 2 mini-contracts, you only own a WDR, which you sell by shorting a mini against it. If you own a WDR for a 100 oz., they encourage you to safekeep the gold at the Comex and hold a vault receipt.

CLEARLY, the Comex has run out of the bars that were being delivered to holders of emini contracts. Our back-office guy told us that he's been doing Comex deliveries for 30 years and he's never seen anything like this, and he's never heard of this rule on the mini contract. (update: its in the contract if you read it - Jesse)

Fortunately we have 3 WDR's and we will be getting delivery of a 100 oz. Comex gold bar.

But this whole episode brings into the question the validity of the Comex gold inventory. More importantly, the Comex is now going to issue WDR's, which are paper.

Are they becoming a "fractional" reserve depository, where they can issue several WDR's against the same bar of gold, knowing that some of those people will opt to keep storage on Comex and never require actual physical delivery?"

JP Morgan's Forecast of Commodity Price Changes From Index Rebalancing

You may click on the link as usual for the full story and a detailed breakdown of the analysis.

You may click on the link as usual for the full story and a detailed breakdown of the analysis.

In summary JP Morgan's forecast of the commodity index rebalancing which will done around January 8-9th is:

...we expect the rebalancing to have the greatest impact in gold, COMEX copper, crude oil, gold, and live cattle. We estimate that the rebalancing of the two indices is expected to result in $877 million of selling in gold, $699 million of buying in COMEX copper, $528 million of selling in live cattle, and $523 million of buying in crude oil.

We would expect the impact of the index rebalancing to be felt this week because of 'frontrunning' of the index changes by the big commodity trading desks. Indeed we may find that by the time the changes are realized, the impact may be significantly discounted.

Financial Times - Alphaville

Beware, commodity index rebalancing ahead

By Izabella Kaminska

Jan 05 15:34

The major commodity indices rebalance their respective asset weightings once a year (or occasionally more) — and with that comes a mass dose of buying and selling. The 2009 rebalancing is expected to start sometime this week.

Luckily, JP Morgan has produced its best guess of how the 2009 reweightings of the DJ AIGCI and the S&P GSCI indices will impact the market.

The weightings for both indices are released ahead of time, but begin to kick in the first few working days of the new year. In the case of the DJ-AIGCI — which JP Morgan estimates has $25bn in funds tracking it — the new weightings come into force during the roll period that begins January 9th. The S&P GSCI index weightings kick-in after its January roll which commences January 8th. JP Morgan estimates about $50 bn of investment into that index...

28 December 2008

30 November 2008

Citigroup Memo Points to Gold as a Safe Haven

"Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses."

This is perhaps the gem in this article, the reminder that gold has proven to be one of the best stores of value through the turmoil of the turn of the century. People tend to lose sight of this, being preoccupied with the short term up and down of markets.

And it is most probable that it will continue to be an excellent store of value, a safe haven for wealth, over the next twenty or more years, as it has been over the past twenty or more centuries.

Why is this? Because although governments may seek to control it, prohibit it, monopolize it, disdain or disfavor it, they cannot create it, or prevent it from being valued by independent minds throughout recorded history as genuine wealth.

UK Telegraph

Citigroup says gold could rise above $2,000 next year as world unravels

By Ambrose Evans-Pritchard

7:29AM GMT 27 Nov 2008

Gold is poised for a dramatic surge and could blast through $2,000 an ounce by the end of next year as central banks flood the world's monetary system with liquidity, according to an internal client note from the US bank Citigroup.

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold. (A resurgence of inflation is hardly an extreme outcome, being more like the norm for the past 90 years. And we have had civil disorder and wars throughout the period of fiat inflation. - Jesse)

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

"Or it will not work because too much damage has already been done, and we will see continued financial deterioration, causing further economic deterioration, with the risk of a feedback loop. We don't think this is the more likely outcome, but as each week and month passes, there is a growing danger of vicious circle as confidence erodes," he said.

"This will lead to political instability. We are already seeing countries on the periphery of Europe under severe stress. Some leaders are now at record levels of unpopularity. There is a risk of domestic unrest, starting with strikes because people are feeling disenfranchised." (President Bush set record lows for popularity, and he did not require deflation to do it. Deflation is being held up as a boogeyman in this note. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)Gold traders are playing close attention to reports from Beijing that the China is thinking of boosting its gold reserves from 600 tonnes to nearer 4,000 tonnes to diversify away from paper currencies. "If true, this is a very material change," he said. (True and it would be an extremely intelligent move if they were to do so. - Jesse)

Mr Fitzpatrick said Britain had made a mistake selling off half its gold at the bottom of the market between 1999 to 2002. "People have started to question the value of government debt," he said. (Government debt has always been devalued and defaulted upon throughout history without exception. - Jesse)

Citigroup said the blast-off was likely to occur within two years, and possibly as soon as 2009. Gold was trading yesterday at $812 an ounce. It is well off its all-time peak of $1,030 in February but has held up much better than other commodities over the last few months – reverting to is historical role as a safe-haven store of value and a de facto currency. (This is not much of a prediction to be frank. Gold was bouncing along the 1000 level on the last leg up, and is now consolidating. A target of 2000 over the next two years seems a bit tame. - Jesse)

Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses.

21 November 2008

Is the Gold Bull Over? The Price of Gold From Various Global Perspectives

A similar question to ask would be, has the US dollar topped out yet as measured against a basket of currencies such as the DX Index?

It is important to note that this is the price of gold in US dollars.

According to this chart we are still in a downtrend, bouncing off the bottom of the decline. Americans tend to forget this since the US is such a large, almost homogenous country with its own currency and language, but with a growing element of Spanish.

Most Americans do not own passports and do not have any experience with a foreign currency excepting visits to Canada and Mexico.

Let's take a look at the price of gold in a few other world currencies.

It is a challenge to describe the color of the sky, of the trees, to people who have been wearing rose coloured glasses since birth.

"But what creates the most intense surprise

His soul looks out through renovated eyes."

John Keats, Ode to Apollo

14 November 2008

Saudi Arabia Spends $3.5 Billion to Buy Gold in the Past Two Weeks

Gulf News

Gulf News

Gold demand rises in Saudi Arabia

By Mariam Al Hakeem, Correspondent

November 12, 2008, 23:42

Riyadh: There has been an unprecedented demand for gold in the Saudi market recently, with over 13 billion Saudi riyals (equivalent to US $3,466,667,946) (Dh12.75 billion) being spent on the yellow metal during the last two weeks.

Demand is expected to rise still higher as more investors turn to gold as a safe haven in the midst of the global financial crisis, according to market sources.

Sami Al Mohna, an expert on the gold market, said the trend had resulted in a substantial rise in the gold reserves of Saudi investors....

13 November 2008

China Expected to Shift Reserves into Commodities and Gold

"Beijing's reserves could easily go up to 3,000 to 4,000 tonnes..."

"Beijing's reserves could easily go up to 3,000 to 4,000 tonnes..."

The Standard - Hong Kong

Gold rush

By Benjamin Scent

Friday, November 14, 2008

The mainland is seriously considering a plan to diversify more of its massive foreign-exchange reserves into gold, a person familiar with the situation told The Standard.

Beijing is considering changing its asset allocations during the financial tsunami in order to build up gold reserves "in a big way," the source said.

China's fears about the long-term viability of parking most of its reserves in US government bonds were triggered by Treasury Secretary Henry Paulson's US$700 billion (HK$5.46 trillion) bailout plan, which may make the US budget deficit balloon to well over US$1 trillion this fiscal year.

The US government will fund the bailout by printing new money or issuing huge amounts of new debt, either of which will put severe pressure on the value of the greenback and on government bond yields. (Is it odd that almost everyone in the world EXCEPT Americans can see this coming? - Jesse)

The United States holds 8,133.5 tonnes of gold reserves valued at US$188.23 billion. China holds gold reserves of just 600 tonnes, worth only US$13.89 billion.

Beijing's reserves could easily go up to 3,000 to 4,000 tonnes, Tanrich Futures senior vice president Colleen Chow Yin-shan said.

Until now, the United States has had little choice but to issue massive amounts of debt to fund its deficits, and China has had little choice but to purchase it, as there are not many markets deep enough to absorb the mainland's US$30 billion to US$40 billion in monthly capital inflows.

Government officials involved in the management of China's reserves are beginning to see gold as an attractive place to park some of these funds. They see it as a real, tangible asset that will not lose its value over time - in stark contrast to the greenback, which is becoming more disconnected from economic realities as more bills are printed. "It's the right time to increase the gold reserves, as the price is about US$710 to US$720 per ounce," said Wan Guoli, vice secretary general of the China Gold Association.

"It's the right time to increase the gold reserves, as the price is about US$710 to US$720 per ounce," said Wan Guoli, vice secretary general of the China Gold Association.

The International Monetary Fund has made reducing global payment imbalances one of its priorities in the aftermath of the financial tsunami.

"I think China probably will expand its strategic reserves into commodities during this downturn," said a Hong Kong-based strategist.

"China will continue to buy treasuries ... otherwise the system would get distorted," he said.

"But I think China will diversify its reserves."

06 November 2008

The Gold Bull in Context

One of the most difficult things to determine is a trend change, from a bull market to a bear market, and vice versa. The market needs a wall of worry to climb, and a slope of hope to decline.

Historical data shows that the prevailing climate in corrections in a bull market reach conditions that are bleak and worrisome, with the majority of investors bearish and pessimistic before the next upleg is taken.

This is what makes it so difficult to separate a trend change from a correction; sentiment is often a misleading indicator, and people will self-select soft indicators to suit their bias.

But sometimes a trend DOES change. So how can we tell the difference?

This is where technical analysis becomes an indispensable companion to the fundamental perspective. While the trend is intact it remains in control of the market, until it is broken.

29 October 2008

"Dubai Runs Out of Gold"

Bahrain Tribune

Bahrain Tribune

Dubai runs out of gold

Oct 29 (Bahrain) - A massive rush at jewellery shops has led to a shortage of gold at some outlets, prompting some shopkeepers to overcharge customers, reports Gulf News.

Jewellers are seeing a huge rush of buyers as gold prices are currently at a two-year low.

Shopkeepers said the rush, a combined result of the Hindu festival of Diwali and lower prices has resulted in a shortage of gold bars. But they denied any hoarding by outlets.

"There is enough gold available in the market and sales are at their peak over the last couple of days with the market falling drastically," jewellers said across the emirate.

A buyer who asked not to be named said: "The price of gold prompted me to visit the Gold Souq in Sharjah. However, most retailers claimed they were sold out. Outlets where gold was available were openly overcharging. They said it was in short supply. The price of 24 carat stood at Dh88.75 but they were openly charging Dh92.50. This is clearly an unfair practice."

Shubash Golati, a buyer, said: "It is a tradition to buy gold during the four-day Indian festival of Diwali. I bought 22 carat jewellery worth Dh5,000. I wanted to buy a 100 gramme gold bar but was told that it is out of stock."

HR Bafna, financial controller from Siroya Jewellers, said a physical shortage of gold is happening worldwide.

He said: "It is matter of physical delivery. It might take a day or two to replenish the stocks. But I am sure that there is no hoarding by jewellers because the market rate has dropped. This has resulted in a tremendous rush of buyers and so the gold bars are out of stock."

In reply to buyers’ complaints that gold outlets are cashing in on the limited stocks and buyer rush, Bafna said: "There is a possibility, but I can’t confirm this."

A counter salesman at the Joy Alukkas outlet in Bur Dubai said for the last couple of days there have been no fluctuations in gold prices.

He said: "From a customer’s point of view this is an excellent time to buy."

He too denied any hoarding taking place. "If the demand for gold is high it is but obvious that some stocks will run out. Some retailers take advantage of this."

27 October 2008

IMF: Gold Leases, Loans, Swaps and the Gold Forward Rate

As you may recall we have a hypothesis that gold, the swiss franc, and the yen have all been helping to fuel the carry trade.

The yen has exploded higher, while the swiss franc has languished because of that country's heavy exposure to the financial system (16% of GDP) and the toxic debt problems throughout Europe.

As far as we know, gold does not have a similar issue with toxic bank debt, and from the numbers still looks to be heavily involved in carry trades based off leased central bank gold.

In reading this, it becomes clear that the IMF believes that once gold is lent out it becomes the property of the borrower who may in turn lend it out to third parties. What the lender holds is the 'promise' of the return of the gold at some future date.

What we find shocking however is that on the books there is no accounting for this potential liability. The gold that is lent out is still marked as 'gold reserves.'

What is the extent of this lending? How many ounces of central bank gold are really just paper promises for its return? If the dominos start falling in this carry trade it is very likely that there will be a declaration of force majeure, and the contracts will be settled in paper.

But it could be very embarrassing to the monetary authorities who have dealt away the possessions of their countries without inquiring about their ability to do so, or making their behind the scenes deals public. One way to settle this ahead of time is to promote 'gold sales' in which the paper settlement process is accelerated.

Watch this, because its sure to get interesting.

The Nature of Lease Payments on Gold Loans

BOPTEG ISSUES PAPER # 21A

IMF COMMITTEE ON BALANCE OF PAYMENTS STATISTICS

BALANCE OF PAYMENTS TECHNICAL EXPERT GROUP (BOPTEG)

Prepared by International and Financial Accounts Branch

Australian Bureau of Statistics

November 2004

Gold Loans

Gold loans or deposits are undertaken by monetary authorities to obtain a non-holding gain return on gold. The physical stock of gold is "lent to" or "deposited with" a financial institution (such as a bullion bank) or another party in the gold market (such as an intermediary for a gold dealer or gold miner with a temporary shortage of gold). In return, the borrower may provide the monetary authority with high quality collateral, but no cash, and will make a series of payments, known as lease payments.

The party who borrows the gold from a monetary authority may in turn "lend" the gold to a dealer or miner.

This ability to on-lend indicates that, while the package of transactions which makes up a gold loan is clearly very different from an outright sale of the gold, the rights and privileges associated with ownership of the gold have changed from the monetary authority to the borrower.

The loan or deposit may be placed on demand or for a fixed period. The amount of gold to be returned is based on the volume initially lent, regardless of any changes in the gold price.

The security and liquidity aspects of the monetary authority's gold loan claims on the depository corporations are regarded as a substitute for physical gold, such that the loan values are retained within the monetary authority's monetary gold reserves, leaving monetary gold stocks unchanged. If the loan is for a fixed period, it is usually available on short notice, to help meet the criteria for inclusion in reserve assets.

Gold loans or deposits share many of the characteristics of securities repurchase agreements (repos) and securities lending, the statistical treatment of which has proved intractable.

Gold Swaps

In order to analyse gold loans, it is useful to first understand gold swaps.

A gold swap involves an exchange of gold for foreign exchange deposits, with an agreement that the transaction be unwound at an agreed future date, at an agreed price. Gold swaps are usually undertaken between monetary authorities, although gold swaps sometimes involve transactions when one of the parties is not a monetary authority. In this case, the other party is usually a depository corporation. (A monetary authority is a central bank or Treasury. We wonder if J. P. Morgan is one of these swap parties since they are the major player int he global gold derivatives market - Jesse)

Gold swaps are undertaken when the cash-taking monetary authority has need of foreign

exchange but does not wish to sell outright its gold holdings. The monetary authority acquiring the foreign exchange pays an agreed rate, known as the gold forward rate. At maturity, the volume of gold returned is the same as that swapped, while the value of the foreign exchange - as determined at the time of initiation of the swap - is returned.

While, because of the limited number of players, gold swaps are unlikely to be tradable, they have all of the other characteristics of a financial derivative. The gold forward rate, which determines the payments associated with a gold swap, is set taking into account current and expected interest rates and gold prices. If gold swaps are considered financial derivatives, in statistical terms the payments associated with a gold swap are transactions in a financial derivative. Otherwise, the payments may be considered margin payments on a forward contract.

Components of a Gold Loan

A gold loan can be seen as a gold swap where the borrower of the gold provides no foreign exchange in exchange for the transfer of the gold. That is, a gold loan is a gold swap with an extra leg, whereby the gold lender lends the money received back to the gold borrower.

In order to gain an understanding of a gold loan, it is useful to separate it into three parts:

1. Change of Ownership of Gold - the monetary authority transfers the physical stock of gold to the borrower. The borrower can (and usually does) sell the gold to a third party.

2. Loan - as the borrower has ownership of the gold but has not paid for it, the monetary authority is deemed to have issued a loan to the borrower equal to the value of the gold. The borrower has a loan liability to the monetary authority. (Is the gold still reported in the lender's listed reserves? - Jesse)

3. Forward Contract - the borrower enters into a forward contract to deliver the original quantity of gold borrowed, to the monetary authority when the gold loan matures. At the maturity date, the monetary authority extinguishes the loan claim on the borrower in exchange for the receipt of the borrowed gold.

Analysing these components helps to understand the multiple positions and flows which are combined to make up a gold loan, and hence to understand the nature of the loan and the lease payments.

Lease Rates

In the case of a gold swap, the gold lender (cash taker) makes payments at an agreed rate, the gold forward rate, to the gold borrower.

If the above view of gold loans is correct, one component of the lease payments is the same payments as in a swap, but these are more than offset by interest on the loan going in the other direction, resulting in a net payment by the gold borrower to the gold lender (the opposite direction of the payment under a swap).

These payments are called gold lease payments and, according to the above view of gold loans, are made up of:

• interest on the loan, and

• transactions in a financial derivative or margin payments on a forward contract.

London Bullion Market Association Statistics

London Bullion Market Association Gold and Silver Fix and Forwards

To test the validity of this view, it is useful to look at how gold lease rates are determined in the market:

Gold lease rate = LIBOR - GOFO rate

LIBOR is the London Inter-Bank Offered Rate, a widely used international risk-free interest rate.

The GOFO rate is the Gold Forward Offered rate, which is the rate at which contributors (the market making members of the London Bullion Market Association) are prepared to swap gold against US dollars.

The charts below show the daily gold price and the daily one year LIBOR, GOFO, and gold lease rates over the past seven years.

The relationship of LIBOR and the GOFO rate to the lease rate is shown in Chart 2.

Comparing Chart 1 and Chart 2 shows that the gap between GOFO and LIBOR is significant in times of falling gold prices, and GOFO approaches LIBOR in times of rising gold prices.

The composition of the lease rate supports the view of the components of a gold loan outlined above. The payment of interest indicates the existence of a loan and the use of the GOFO rate indicates the existence of a gold swap.

Conclusion

The topic of this paper is the treatment of the lease payments on gold loans. The analysis of the positions and the flows has been done together as it is not possible to draw conclusions on the nature of the flows without looking at the positions to which they relate.

The description of components of a gold loan in this paper is likely to be controversial given the state of the overall debate on reverse transactions, but it is hopefully a useful contribution to that debate. The empirical support lent by the derivation of the lease rate, that is that the loan is seen by those setting the rate as a loan and a swap, may prove useful in that debate.

The conclusion on the nature of the lease payments is that they are the net of two flows, interest on a loan and transactions in a financial derivative or margin payments on a forward contract.

These should be recorded separately.

Hat tip to Steve Williams at CyclePro for bringing this paper to our attention.

21 December 2007

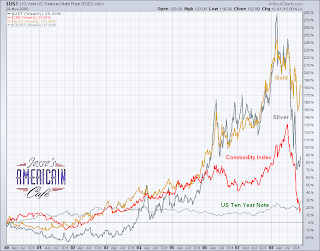

Investment Performance for 2007

We Trust In God, Everyone Else Shows the Data

We like to check the data. The reason should be obvious, but if not, its because often people deal with the complexities of life by using assumptions, which are a kind of shorthand way of breaking reality down into manageable chunks. Everyone does it. You have to. But every once in a while its useful to check those assumptions you make, and that other people are making, to see if they are still valid, especially if they involve things that are important. Does your wife still love you? Is there a bus coming down the road you are crossing? Do you really still look as hot as you did last year? Are you financially solvent? Those sorts of things.

2007 Returns of Some Major Stock Indices

Let's compare the 2007 year-to-date performance of some of the major stock indices. As always, if you click on the chart you will see a larger, much easier to read version.

Its a little suprising that the Russell 2000 is still not quite positive for the year, not including dividends or subtracting fees and commissions. There was quite a bit more divergence in the gains of the major stock indices. An index after all is just a grouping of things for measurement purposes. The Russell is the broadest, most inclusive of the indexes we normally watch.

Its a little suprising that the Russell 2000 is still not quite positive for the year, not including dividends or subtracting fees and commissions. There was quite a bit more divergence in the gains of the major stock indices. An index after all is just a grouping of things for measurement purposes. The Russell is the broadest, most inclusive of the indexes we normally watch.It looks like tech was the champ of the broad stock sectors this year, if for no other reason that they are NOT financial and NOT housing. The Wall Street storyboard is that tech is invulnerable to the vagaries of housing and financial bubbles, and actually benefits from the weakened US dollar because the we are the champions, the kings of tech, and are selling it to the rest of the world, although very little of it is actually made here anymore, and what we do invent is copied and pirated shamelessly. Its a revenue concept thing perhaps, moreso than real hard cash, like page views and web searches and collateralized debt obligations.

Let's Get Physical

Let's take a look at a different type of investment. How about something that is supposed to be impervious to inflation, a barbarous relic, the bane of central banksters and financial voodoo? Since the generally transitory, subjective, and vaporous nature of financially engineered products is in the headlines it might not be a bad idea to throw in something with a long track record as a hardened test of monetary value into the mix.

Let's take a look at a different type of investment. How about something that is supposed to be impervious to inflation, a barbarous relic, the bane of central banksters and financial voodoo? Since the generally transitory, subjective, and vaporous nature of financially engineered products is in the headlines it might not be a bad idea to throw in something with a long track record as a hardened test of monetary value into the mix.Holy goldaroney, Batman! That is one surprisingly fine performance for gold this year. Even we did not think that it has been this good. The assumption has been, at least lately, that gold's day will come soon, especially when the Central Banks get finished monkeying with it. Well, its been a much better return this year than most would think offhand. We're in that group, and we watch it! See how easy it is to fall prey to your own assumptions, especially when you think you have been watching something for a long time.

The Usual Investment Suspects Let's widen the data net a little more, and see how different things compare. We apologize for the lack of variation in colors on this chart, but we had to tinker with the charting tool a little to get so many items on a single snapshot.

Let's widen the data net a little more, and see how different things compare. We apologize for the lack of variation in colors on this chart, but we had to tinker with the charting tool a little to get so many items on a single snapshot.

Well, there you have it. Some real information about how various investments performed during 2007. We new the US dollar was doing badly. We did not know that gold had done so well, and had outperformed most of the other major alternative so handily (don't forget about those dividends guys. Gold does not pay any, just like a high performing tech stock).

Let's have one more look at a sector that we have admittedly been cool towards for the latter half of this year, because of the general reluctance we have had toward equities.

Data Mining

Well, as someone who has not owned miners for the latter part of the year, we're just a little

disappointed that we overlooked such a hot performing sector. Its been a wild ride, and keep in mind that with high returns comes higher beta (variability of return aka risk, and lately that includes return of capital). Remember this is the HUI gold bugs index, and if you have been playing the junior miners heavily you might have ground your teeth to a fine white powder trying to ride those bucking beta broncos.

disappointed that we overlooked such a hot performing sector. Its been a wild ride, and keep in mind that with high returns comes higher beta (variability of return aka risk, and lately that includes return of capital). Remember this is the HUI gold bugs index, and if you have been playing the junior miners heavily you might have ground your teeth to a fine white powder trying to ride those bucking beta broncos. Our personal preference is to find a few well financed miners that have a shot at paying dividends for a long time if the dollar really tanks and stocks gets smacked down. Bennie and Hank and crew are working overtime to make sure this happens, make no mistake about it. They are just trying to push the date of reckoning into the future. We admit to a bias that says the dollar will inflate significantly further, and then at some point deflate. Its just that we think the deflation will be when they knock a couple zeros off buckaroo. It might not happen that way. We'll stay flexible.

When people put forward ideas that might be important to you, ask for the data. People are often afraid to ask, because they don't want to look foolish. Some people like to put forward their ideas with great ceremony and pomp, and browbeat and belittle anyone who disagrees with them. They often speak with great confidence bordering on arrogance. We'll let you in on a little secret. What we have learned over the years is that if someone can't explain their ideas to you, it just might be that they do not understand the idea themselves. Don't get us wrong. There are some very fundamental beginner questions that people must and should as. Its just that they aren't necessarily best directed to the advanced class. But that doesn't mean you shouldn't ask. Just try to ask the right person in the right places in the right way.

Questions can be annoying. But we find that often they provide the kind of impedance that causes us to revisit them and test our assumptions, to try to explain things over again to ourselves. If you put in an honest effort, it makes our assumptions and ideas stronger, more reliable. Some people might even publish their ideas so that they can be tested in an environment of peer review. Just putting ideas down on paper forces one to really thing them through. You might even decide to put them into charts and a blog, to force your own performance to a higher standard. Interesting concept.