As I mentioned on Friday morning, despite the awful jobs numbers it was likely that the stock markets would find support into the FOMC meeting, which is tomorrow. I also suggested that despite the moves higher, gold and silver would be capped going into this meeting. Check and double check.

The story being promulgated by the oligarchs, with a strong lead from Robert Rubin and friends, is that the economy is doing well on its own and recovering, and no stimulus is required, except for tax cuts for the wealthy and for corporations.

This is America today, and that theme utterly dominated the conversation on Bloomberg television with hardly a dissenting voice from any of the guests.

Even the NY Times can only manage to squeeze out a piece of corporatized news such as this, The Rise of the Perma Bears.

09 August 2010

SP 500 and NDX September Futures Daily Charts; Gold Daily Chart; NY Times Disses Bears

Why the Official Antipathy to Gold and Silver? The Second Oldest Profession

Every so often someone asks, 'Why do the government and the banks manipulate the price of gold and silver?'

There is a great deal of circumstantial evidence to support this, even some blatant quotes pertinent to the topic from the likes of Volcker, Greenspan, and Bank of England governor Eddie George. Of course it can all be denied. People can deny anything, even well known historical events with many witnesses, if it suits their bias and purposes.

But putting aside the operational aspects, what is the motive?

Most recently a correspondent from India asked the question 'why do the banks wish to control silver from the short side? Why would they not blow it into a bubble like they do with stocks and make their profit there? Why do the banks wish to hold these prices down and make people think badly of silver and gold which we here value so much?'

When asked this, I will usually attempt some explanation that begins with the fact that the banks involved are the Primary Dealers for the most part, and very involved with the Federal Reserve and the government on a variety of levels in the issuance and arbitrage of official US debt.

The motive therefore involves aspects from an 'official' monetary perspective. It will often include a reference to Gibson's Paradox, a paper by Larry Summers involving the price of gold and its perceptual relationship with the long end of the curve. It might include Volcker's and Greenspan's comments about the price of gold casting a negative light on the stability of the currency if it rises too high or too quickly. I may even get into the Second Bank of the United States, and Andrew Jackson's populist role in exposing its frauds, and refusing to renew its Charter in favor of constitutional money.

But if I am ever asked about this in the future, I can think of no better, no more concise statement of a possible motive for the manipulation of gold and silver than this:

“The central economic problem plaguing this country since 1913 has been the presence of the Federal Reserve System. Without the Federal Reserve System’s debt-currency scheme having effectively supplanted the constitutional monetary system based upon silver and gold, it would have been impossible - not simply improbable, or difficult, but impossible - for politicians in the public sector and speculators in the private sector to have amassed the staggering level of unpayable, unconstitutional, and unconscionable debt that now bears down upon this country.”

Dr. Edwin Vieira, Jr., Going to the Roots of the Problem

It's enabling the fraud, always and everywhere, and the power obtained in controlling the supply and issuance of money. There are those who are involved in productive labor, and those who wish to unproductively tax it. It is an old story with deep roots in history.

And once again, the government and the financiers seem to have formed an unholy alliance to harness the real economy with excessive, unjust, and unproductive taxes for the private benefit of a privileged few, protecting and promoting their schemes when they win, and covering and subsidizing their losses when they do not. In either case the money is coming out of the real economy, and like a paraiste is starving it of its vitality.

So there is your motive, from what might be called the second oldest profession. Find out what people need to have, and then seek to control it to obtain your wealth by exacting a tax on it, but without having to deliver anything for it, a mere exploitation of informational and procedural advantage.

There is a difference between amassing capital, building a business, and assuming the risks for its success and failure, and this modern form of banking which is nothing more than an enormous tax on the productive economy granted by a corrupted government that turns a blind eye to fraud and abuses. And when its schemes go wrong, it obtains subsidies and relief from its partners in government.

As Andrew Jackson noted of the Second Bank of the United States, the predecessor to the Fed which came back into being 80 years after:

"Gentlemen, I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter, I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I intend to rout you out, and by the grace of the Eternal God, will rout you out."

Matt Simmons Found Dead of Drowning, Apparent Heart Attack

In addition to promoting alternative energy, Matt Simmons was also a noted proponent of the 'peak oil' theory. He was also an outspoken critic of BP and the US government, and their handling of the Gulf Oil spill.

His most recent extended interview on the Gulf Oil spill was on King News World in July.

Be he right or wrong, as time will tell, he was a human being with a family and friends who loved him. His untimely death is their loss, and we should remember this even as he becomes a target for political back and forth, given his involvement in controversial topics.

Kennebec Journal

Energy expert Simmons dies in North Haven

By Tux Turkel

Matthew Simmons, an international oil expert who most recently focused on developing renewable energy from the waters off Maine, died Sunday night of an apparent heart attack, his office is reporting. He was 67.

Simmons founded the Ocean Energy Institute in 2007, hosting a grand opening of its new office last month in Rockland. The goal of the think tank and venture capital fund was to attract investment in research to make Maine a global leader in offshore wind and other ocean energy sources.

According to police reports, Simmons suffered a heart attack while in a hot tub at his home on North Haven. An autopsy is planned for today in Augusta, according to the Knox County Sheriff's Office.

Simmons was a leading energy investment banker, a former energy adviser to President George W. Bush, and author. He wrote the 2005 book “Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy,” which laid out an argument that the world was approaching peak oil production.

Trial Balloon For First Steps Toward Quant Ease 2: FT Says Fed Set to Downgrade Outlook for US

The Federal Reserve had used Washington Post business reporter John Berry to release trial balloons ahead of its actions to gauge market sentiment and to soften any reactions to changes in their policy outlooks.

The Federal Reserve had used Washington Post business reporter John Berry to release trial balloons ahead of its actions to gauge market sentiment and to soften any reactions to changes in their policy outlooks.

Since John is no longer on the scene, have they switched to the Financial Times? This reporters speaks as though someone has already disclosed the intentions of the upcoming FOMC meeting.

This does sound like the sort of trial balloon we would expect to pre-release a change in the Fed outlook so that it does not suprise the bond markets.

Given the oversized percentage that the financial sector is taking from the real economy, like an unproductive tax on commercial business, it is unlikely that any measures will rejuvenate the US without creating another bubble.

"From 1973 to 1985, the financial sector never earned more than 16 percent of domestic corporate profits. In 1986, that figure reached 19 percent. In the 1990s, it oscillated between 21 percent and 30 percent, higher than it had ever been in the postwar period. This decade, it reached 41 percent." Simon JohnsonIt is unlikely the Fed will announce any new programs on Tuesday. That will come intra-meeting, probably after another bad round of economic news, or on some event that makes it clear that the economic "recovery" is floundering.

Financial Times

Fed set to downgrade outlook for US

By James Politi in Washington

August 8 2010

The Federal Reserve is set to downgrade its assessment of US economic prospects when it meets on Tuesday to discuss ways to reboot the flagging recovery.

Faced with weak economic data and rising fears of a double-dip recession, the Federal Open Market Committee is likely to ensure its policy is not constraining growth and to use its statement to signal greater concern about the economy. It is, however, unlikely to agree big new steps to boost growth.

Smaller measures to help the economy could initially take the form of a decision to reinvest proceeds from maturing mortgage-backed securities held by the US central bank, thereby preventing the Fed’s balance sheet from shrinking naturally.

Investors will also examine closely any changes to the pledge made by the FOMC in June to “employ its policy tools as necessary to promote economic recovery and price stability”, which could be hardened if policymakers choose to signal the potential for more aggressive move to boost the economy in the future.

But even if that happens, most economists believe that it would take several more months of poor data for the Fed to actually begin a new round of asset purchases on the scale of those carried out during the recession....

08 August 2010

Chris Whalen: Nothing Has Changed Because It's The Fraud and Corruption, Stupid

Chris Whalen provides a devastating analysis of the Financial Reform legislation, and then goes on to eviscerate the Federal Reserve as regulator.

"Even as the big banks make a public show for the media of implementing the new Dodd-Frank law with respect to limits on own account trading and spinning off private equity investments, these same firms are busily creating the next investment bubble on Wall Street -- this time focused on structured assets based upon corporate debt, Treasury bonds or nothing at all -- that is, pure derivatives."

What I resent most about this current climate are the whispering campaigns and not so subtle attacks on the whistleblowers and victims: the unemployed, the homeless, the dislocated. These use stereotypes, character assassination, prejudice, and the darker elements of the human soul.

The better educated and fortunate members of the middle class are too often too willing to stand by and permit this without lifting a finger or saying a word, sometimes because it is to their benefit, or so they think. That is a mistake, because as history as shown, it is only a matter of time before the predators come for them.

Enjoy.

Institutional Risk Analyst

Is Fed Supervision of Big Banks Really Changing?

By Chris Whalen

With the passage of the Dodd-Frank Wall Street reform legislation, many financial analysts and members of the press believe that investment banking revenues and resulting earnings are in danger, but nothing is further from the truth. The Volcker Rule and other limitations on the principal trading and investment activities of the largest universal banks.

It is not own account trading but the derivatives sales desks of the largest BHCs whence the trouble lies. Even as the big banks make a public show for the media of implementing the new Dodd-Frank law with respect to limits on own account trading and spinning off private equity investments, these same firms are busily creating the next investment bubble on Wall Street -- this time focused on structured assets based upon corporate debt, Treasury bonds or nothing at all -- that is, pure derivatives. Like the subprime deals where residential mortgages provided the basis, these transactions are being sold to all manner of investors, both institutional and retail. It is the perverse structure of the OTC markets and not the particular collateral used to define these transactions that creates systemic and institution specific risk.

One risk manager close to the action describes how the securities affiliates of some of the most prominent and well-respected U.S. BHCs are selling five-year structured transactions to retail investors. These deals promise enhanced yields that go well into double digits, but like the subprime debt and auction rate securities which have already caused hundreds of billions of dollars in losses to bank shareholders, the FDIC and the U.S. taxpayer, these securities are completely illiquid and often come with only minimal disclosure. The dirty little secret of the Dodd-Frank legislation is that by failing to curtail the worst abuses of the OTC market in structured assets and derivatives, a financial ghetto that even today remains virtually unregulated, the Congress and the Fed are effectively even encouraging securities firms to act as de facto exchanges and thereby commit financial fraud. Allowing securities firms to originate complex structured securities without requiring SEC registration is a vast loophole that Senator Christopher Dodd (D-CT) and Rep. Barney Frank (D-MA) deliberately left open for their campaign contributors on Wall Street. But it must be noted these same firms have a captive, client relationship with the Fed and other regulators as well, thus a love triangle may be the most apt metaphor.

The dirty little secret of the Dodd-Frank legislation is that by failing to curtail the worst abuses of the OTC market in structured assets and derivatives, a financial ghetto that even today remains virtually unregulated, the Congress and the Fed are effectively even encouraging securities firms to act as de facto exchanges and thereby commit financial fraud. Allowing securities firms to originate complex structured securities without requiring SEC registration is a vast loophole that Senator Christopher Dodd (D-CT) and Rep. Barney Frank (D-MA) deliberately left open for their campaign contributors on Wall Street. But it must be noted these same firms have a captive, client relationship with the Fed and other regulators as well, thus a love triangle may be the most apt metaphor.

Of course retail investors love the higher yields on complex structured assets. Who can blame them for trying to get a higher yield than available on treasuries, while the Fed keeps rates at historic lows to, among other things, re-capitalize the zombie banks. The only trouble is that the firms originating these ersatz securities, as with the case of auction rate municipal securities, have no obligation to make markets in these OTC structured assets or even show clients a low-ball bid. And because of the bilateral nature of the OTC market, only the firm which originates the security will even provide an indicative valuation because the structures and models behind them are entirely opaque.

In fact, we already know of two hedge funds that are being established specifically to buy this crap from distressed retail investors as an when rates start to rise. The sponsors expect to make returns in high double digits by making a market for the clients of large BHCs who want to get out of these illiquid assets. But the one thing that you can be sure of is that nobody at the Fed or the other bank regulatory agencies know anything about this new bubble. As with the early warnings brought to the Fed about private loan origination and securitization activities as early as 2005, the central bank and other regulators are so entirely compromised by the political pull of the large banks that they will do nothing to get ahead of this new problem.

Consider a specific example:

Shall We Reward Incompetence? The Case of Sarah Dahlgren and the Fed of New York

Despite initial indications that Congress would reduce the scope of Federal Reserve's financial company supervision, in the end the Dodd-Frank legislation substantially increases the Federal Reserve's responsibility. Chairman Ben Bernanke and other Federal Reserve officials made the argument that the Fed's supervision function didn't do any worse than any other financial regulators -- an assertion we cannot validate. This combined with heavy lobbying by other Reserve Bank Presidents and the grudging acknowledgement to the Congress by Fed Chairman Bernanke and Fed Governor Daniel Tarullo that significant improvements are necessary ultimately won the day.

Given its second lease on regulatory life, one might expect that the Fed's bank supervision function would be gearing-up to take a fresh, smart, and tough line with respect to financial company oversight. However, a recent key supervisory officer appointment by the Federal Reserve Bank of New York (FRBNY) indicates this may not be the case. The largest and most important of regional Reserve Banks appears to be going back to the future with its choice of Sarah Dahlgren as Head of Supervision. See FRBNY press release link. If the name sounds familiar, that's because Ms Dahlgren has been at the center of many of the Federal Reserve's most embarrassing failures in the area of bank supervision and in particular with respect to the failure of American International Group (AIG). Going back in time now and remembering the period before the crisis, Dahlgren typified the arrogance and refusal of Fed officials to acknowledge warnings from various members of the financial community that the subprime mortgage market was melting down after years of unsafe and unsound lending and underwriting practices by the largest banks. Roger Kubarych, a former economist for the FRBNY, described the refusal of Fed officials to acknowledge the crisis in a 2008 interview with The IRA ('Fed Chairmen and Presidents: Roundtable with Roger Kubarych and Richard Whalen', October 30, 2008).

If the name sounds familiar, that's because Ms Dahlgren has been at the center of many of the Federal Reserve's most embarrassing failures in the area of bank supervision and in particular with respect to the failure of American International Group (AIG). Going back in time now and remembering the period before the crisis, Dahlgren typified the arrogance and refusal of Fed officials to acknowledge warnings from various members of the financial community that the subprime mortgage market was melting down after years of unsafe and unsound lending and underwriting practices by the largest banks. Roger Kubarych, a former economist for the FRBNY, described the refusal of Fed officials to acknowledge the crisis in a 2008 interview with The IRA ('Fed Chairmen and Presidents: Roundtable with Roger Kubarych and Richard Whalen', October 30, 2008).

"It makes me so mad to think back how ignorant, arrogant, and dismissive she was with people who knew what they were talking about pre-crisis," one former Fed colleague told The IRA. Dahlgren was running the AIG show for the FRBNY. She ignored the recommendations from the Fed's own advisors and the Board of the FRBNY that AIG counterparties be forced to take haircuts. For her to ignore good advice on AIG and then deliberately take steps to hide that decision from the Congress and the public, and then be rewarded with a promotion, is quite disheartening..."

Read the rest here.

The Fall of the American Republic: The Quiet Coup By Simon Johnson

"From 1973 to 1985, the financial sector never earned more than 16 percent of domestic corporate profits. In 1986, that figure reached 19 percent. In the 1990s, it oscillated between 21 percent and 30 percent, higher than it had ever been in the postwar period. This decade, it reached 41 percent."

Now might be a good time to re-read The Quiet Coup by Simon Johnson which appeared in The Atlantic Magazine.

Although he keeps using the term "emerging market governments" in fact he is discussing a post bubble country that has experienced a period of express, fostered by a partnership between business and government that is known as crony capitalism.

Here is his description of the rise of the financial sector in the US from his book, 13 Bankers, which describes how the rise of concentrated financial power poses a threat to economic well-being is a must read as well.

"The financial industry has not always enjoyed such favored treatment. But for the past 25 years or so, finance has boomed, becoming ever more powerful. The boom began with the Reagan years, and it only gained strength with the deregulatory policies of the Clinton and George W. Bush administrations. Several other factors helped fuel the financial industry’s ascent. Paul Volcker’s monetary policy in the 1980s, and the increased volatility in interest rates that accompanied it, made bond trading much more lucrative. The invention of securitization, interest-rate swaps, and credit-default swaps greatly increased the volume of transactions that bankers could make money on. And an aging and increasingly wealthy population invested more and more money in securities, helped by the invention of the IRA and the 401(k) plan. Together, these developments vastly increased the profit opportunities in financial services.Not surprisingly, Wall Street ran with these opportunities. From 1973 to 1985, the financial sector never earned more than 16 percent of domestic corporate profits. In 1986, that figure reached 19 percent. In the 1990s, it oscillated between 21 percent and 30 percent, higher than it had ever been in the postwar period. This decade, it reached 41 percent. Pay rose just as dramatically. From 1948 to 1982, average compensation in the financial sector ranged between 99 percent and 108 percent of the average for all domestic private industries. From 1983, it shot upward, reaching 181 percent in 2007."

I have not read his book yet, but it's on my list. I hope he includes some information on the decade long campaign to repeal Glass-Steagall, led by Sandy Weill and Robert Rubin, which opened Pandora's box in 1999. It is a mistake to view what happened as some accident, or a natural development. It was a pre-meditated campaign to subvert the economy and the political protections of the vast majority of US citizens.

In the meanwhile, here are a few quotes from his piece in Atlantic Magazine which is a prelude piece to his book.

Typically, these countries are in a desperate economic situation for one simple reason—the powerful elites within them overreached in good times and took too many risks. Emerging-market governments and their private-sector allies commonly form a tight-knit—and, most of the time, genteel—oligarchy, running the country rather like a profit-seeking company in which they are the controlling shareholders.

But inevitably, emerging-market oligarchs get carried away; they waste money and build massive business empires on a mountain of debt. Local banks, sometimes pressured by the government, become too willing to extend credit to the elite and to those who depend on them. Overborrowing always ends badly, whether for an individual, a company, or a country. Sooner or later, credit conditions become tighter and no one will lend you money on anything close to affordable terms.

"Squeezing the oligarchs, though, is seldom the strategy of choice among emerging-market governments. Quite the contrary: at the outset of the crisis, the oligarchs are usually among the first to get extra help from the government, such as preferential access to foreign currency, or maybe a nice tax break, or—here’s a classic Kremlin bailout technique—the assumption of private debt obligations by the government. Under duress, generosity toward old friends takes many innovative forms. Meanwhile, needing to squeeze someone, most emerging-market governments look first to ordinary working folk—at least until the riots grow too large."

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.

I am not so optimistic that this reform is possible, because there has in fact been a soft coup d'etat in the US, which now exists in a state of crony corporatism that wields enormous influence over the media and within the government. To be clear about this, the oligarchs are flush with victory, and feel that they are firmly in control, able to subvert and direct any popular movement to the support of their own ends and unslakable will to power.

07 August 2010

Silver Short: Days of World Production To Cover Certain Commodity Short Positions

There is a case to be made that world production is not the only issue, but the available supply is just as important, if not more.

In the case of gold, a relatively small portion of supply is consumed, as the bulk of it is held as jewelry and bullion. One might say that if the bullion banks get into a pinch, the central banks can bail them out by 'leasing' gold to them for sale. In fact there is quite a bit of circumstantial evidence that the central banks have been doing this for some time, and would be in serious difficulty if they faced external audits.

In the case of silver however, quite a bit of it is used in industrial production. The counter case is that as the price rises, additional material is available in recycling operations from scrap. There is also a significant supply of bullion, but unlike gold it is widely dispersed in ownership, with central banks holding little or none in their reserves.

There is a remarkable concentration in the short position in silver and gold.

All things considered, silver looks like an accident waiting to happen to a handful of banks who may have crossed up one market too far.

chart courtesy of Sharelynx

06 August 2010

Gold Daily and Weekly, Miners, and Silver Charts at Week's End

Gold rallied up to big resistance today on the weaker than expected economic news and weakness in US equities, in yet another example of the 'Risk-on, risk-off' trade.

Next Tuesday is the FOMC meeting for August, and on such auspicious occasions gold is frequently subjected to short selling to express official discouragement by the banking establishment towards a competitive currency.

August is a stronger seasonal month, so the metals will have the wind at their backs. We would be looking to buy on weakness.

Gold Daily Chart

Gold Daily Chart with 50 Day Moving Average

Gold rallied up to its 50 Day moving average which is now just over 1211. I would not expect the momentrum traders to get on board until that metric is taken out and nailed to the daily chart.

Gold Weekly Chart

This is not even a log chart, and the trend in the weekly price of gold looks like a thrown rope. You might want to keep this chart in mind when making your buy and sell decisions, and not allow yourself to get caught up in the short term hype of the daytraders and assorted knuckleheads.

Silver Weekly Chart

Mining Index (HUI)

SP 500 and NDX September Futures @ the Close For the Week

"A long habit of not thinking a thing wrong gives it a superficial appearance of being right." Thomas Paine

The SP futures fell to the bottom of the trendline associated with a rising wedge that is likely to be quite bearish if activated by a confirmed break.

A late day technical rally was able to lift prices back to support on weak volumes, a classic short squeeze. The manipulation in the US equity markets by the big trading desks and high frequency traders is centered around the SP 500 futures. Their fingerprints are all over these markets if you are watching the quotes on Level II access.

The spin from the talking heads will be that the Fed will 'do something' by way of liquidity and further easing for the markets at the upcoming FOMC meeting which is on Tuesday, 10 August.

It is likely the Fed will do nothing next week, but the traders will play their games with the small specs, especially the bears who are an easy squeeze, the markets being what they are.

For my own perspective these markets now are guilty until proven bullish, which means they must break out and stick it, and further, that there must be some substance to support the breakout, even if it is just liquidity from the Fed, aka another asset bubble. The fundamentals just do not support prices at these levels, and the volumes of buyers are not there. But it can drift higher if selling continues to be weak. That is the dangerous, Ponzi like structure of a market that sets up things like the flash crash.

SP Futures

NDX Futures

The Jobs Report In Four Pictures

The recovery in employment has clearly faltered.

The most positive spin that can be put on it is that the rise and dip was caused by the secular hiring in census workers. But that removes the big increase, and leaves one with no recovery yet at all. Which is roughly the same thing as a recovery and a resumption, a dip.

Here is a comparison of the Seasonally Adjusted and the Raw Numbers

When the distortion of the imaginary jobs added and occasionally subtracted by the BLS 'Birth Death Model' are removed, the lack of recovery is made more clear. If one were to also subtract the temporary census workers which are the cause of that spike higher, the lack of recovery is even more apparent.

Here is the detail on the current shenanigans in the Birth Death Model. As previously discussed, the BLS shows dips in the imaginary jobs numbers around the big seasonality events in January and July. Since these birth-death jobs are added to the non-seasonalized raw number, the big seasonal adjustment blunts, if not largely negates, their impact.

But considering that the economy has undergone a sea change, an epic collapse in a credit bubble, the regularity of this metric should remove any doubts that it is at best largely 'a plug,' and at worst a means of distorting the numbers in the short term to make them look better.

Does this lack of recovery mean that stimulus has not had an effect? No. The results could have been much worse, and very likely would have been if the government had done nothing.

But it also shows that the actions have not had traction, are not yet creating jobs. Why should that surprise us? Subtracting out the bubble jobs in housing and servicing the financial frauds in mortgages, job growth in the US, and confirmed by the median wage, has been anemic for a long time.

This is what is called a structural problem. It is a problem that was caused by government policy decisions in deregulation, largely one sided free trade agreements trading jobs for cheap good and corporate profits, decisions that favored offshoring and importation, lack of a coherent immigration policy, taxation subsidies for the wealthy, lack of regulatory oversight, and an industrial policy of decline in favor of 'service jobs' that could be more properly be called 'servant jobs.'

What would we expect from a restoration of the status quo that does not include bubbles? A stagnating economy most likely at least from a wage and jobs perspective, with increasing disparity in income distribution.

The Inflation and Deflation Debate Deconstructed

'What most people call reason is really rationalization. Given a new set of data, most people will search through it only for those examples that support their existing beliefs. Their beliefs are really opinions, a tenuous collection of myths, anecdotes, slogans, and prejudices based largely on justifying personal fear and greed. This is what makes modern propaganda so powerful; people do not bother to think critically and objectively and act for the greatest good. And in their ignorance they can find the will to do increasingly monstrous things, and rationalize them.' Jesse

In a purely fiat regime, the question of a general (monetary) deflation and inflation is a policy decision. Anyone who does not understand this does not understand the modern mechanism of money creation. As the pundit said, "The mind rebels..."

But rather than engage in the usual facile intramurals about the topic, let's consider something more important. How does one 'play this' which is really what all these discussions are about: self interest.

The champion of deflation is the Treasury Bond (and the Dollar), and of the inflationists, Gold.

The champion of deflation is the Treasury Bond (and the Dollar), and of the inflationists, Gold.There are extremes on both sides, and probably more sense in the middle, since life rarely sustains the extreme unless there are people messing about with it. The only naturally efficient markets are in ... nature, and that only as measured over the long term.

Anyone who doesn't think Treasuries have been in a long bull market are blind fools.

But the same is true of gold.

I will leave the dollar aside for now to simplify the discussion, but it hardly lends itself to the deflationary theory.

People who have taken positions and held them in both Treasuries and Gold over the past ten years have made money, a very nice return. When one has a theory that consistently and reasonably encompasses that, you might have something worthwhile.

The deflationists will say that gold is a bubble fueled by mistaken speculators, and the inflationists will say that the Treasuries are being supported and manipulated by the Fed. Neither is able to look out from their deep wells of subjectivity.

You may wish to consider that the great part of this discussion, inflation versus deflation, is a diversion. But that is a discussion for another time.

You may wish to consider that the great part of this discussion, inflation versus deflation, is a diversion. But that is a discussion for another time.The question for all failing theories is, as always, what next. What is the alternate count.

Oh boy oh boy, [our desired outcome] is finally coming and when it gets here its going to be good. We are finally turning [Japanese / Weimar].

Things are in bull markets, or bear markets, until they are not. The undeniable trend break is the best indication of change in momentum.

But things in the world of complexity are rarely as simple or straightforward as the average mind will allow, or can accept.

Anyone who thinks the Fed is impotent has not been paying attention to the last one hundred years. The Fed is not impotent, merely constrained. Their constraint is the policy arm of the government, the dollar, and the bond, in the absence of some external standards including external force.

Until one understands that, nothing can or will make sense. That is why the current discussion is so nasty and propaganda-like. It is not about what will happen, but rather about a public policy decision, about what people want to happen.

Until one understands that, nothing can or will make sense. That is why the current discussion is so nasty and propaganda-like. It is not about what will happen, but rather about a public policy decision, about what people want to happen.Consider that these debates are merely diversions, to distract people away from the most significant factors in their troubles, which are exploitation and fraud, and a military-industrial complex that is largely unproductive in terms of organic growth, and is quite simply no longer sustainable.

Paid professionals who were arguing the virtue of credit expansion as the bubbles blossomed are now arguing just as strenuously for austerity now that the bubbles are collapsing, their masters having taken their spoils. They will say for pay, without regard for the solutions that are in the best interest of the country. Few are thinking of their country anymore, as the individual is conditioned to think of themselves as globalized abstractions.

As always, be careful what you wish for, because you may get it. In this current climate, this class warfare, the American nation is a house divided. And you know what happens to those.

And the winners may inherit the wreckage, a pyrrhic victory indeed, but they can console themselves with the satisfaction that they have won the irrelevant debate.

05 August 2010

Obama's Economic Advisor Romer Out Over Differences with Larry Summers (and Timmy)

Christina Romer is a fine economist, but she frankly does not have the skillset to deal with accomplished Tidal Basin pond snakes like Larry Summers and his sidekick Tim Geithner.

Christina Romer is a fine economist, but she frankly does not have the skillset to deal with accomplished Tidal Basin pond snakes like Larry Summers and his sidekick Tim Geithner.

She is said to have left at her own request. It is nice to see a principled resignation once in a while. Good for her. I hope that is the case. In addition to pushing for more stimulus, I had also heard that Romer was promoting Elizabeth Warren as the head of the new Financial Consumer Protection Agency, a move that is adamantly opposed by Timmy and Larry, the Rubin twins.

If Obama asked her to leave then that should settle all questions about his policy, his relationships with his supporters, and his intentions.

I could not help but wonder if someone is falling on her sword ahead of tomorrow's Jobs Report, or Bernie Madoff's nomination to head the Financial Consumer Protection Agency.

Hotline On Call

Romer To Leave White House

By Kirk Victor

August 5, 2010 5:54 PM

Christina Romer, chairwoman of Pres. Obama's Council of Economic Advisers, has decided to resign, according to a source familiar with her plans.

Romer, an economics professor at the University of California (Berkeley) before taking the key admin post, did not respond to repeated calls to her office."She has been frustrated," a source with insight into the WH economics team said. "She doesn't feel that she has a direct line to the president. She would be giving different advice than Larry Summers [director of the National Economic Council], who does have a direct line to the president."

"She is ostensibly the chief economic adviser, but she doesn't seem to be playing that role," the source said. The WH has been pounded for its faulty forecast that unemployment would not top 8% after its economic stimulus proposal passed.

Instead, the jobless rate is 9.5%, after exceeding 10% last year. It was "a horribly inaccurate forecast," said Bert Ely, a banking consultant. "You have to wonder why Summers isn't the one that should be taking the fall. But Larry is a pretty good bureaucratic infighter."

Daily Finance

Is Christina Romer Out as Chief Economic Advisor?

By PETER COHAN

8:00 PM 08/05/10

Christina Romer, a Berkeley economics professor, is reportedly leaving the White House as Chair of President Barack Obama's Council of Economic Advisors, according to the NationalJournal.com, which cites an anonymous source. Is she taking the blame for policies hatched by director of the National Economic Council, Larry Summers -- policies that she disagrees with?A source told NationalJournal: "She has been frustrated. She doesn't feel that she has a direct line to the President. She would be giving different advice than Larry Summers who does have a direct line to the President."

Romer could be the fall guy for the White House's forecast that unemployment would stay below 8% -- jobless rates blew through the projection to peak at 10.2% in October 2009 and now sit at 9.5%. Whether Romer is responsible for this forecast or not, her resignation would signal that she has taken the blame.

The NationalJournal quotes Bert Ely, a banking consultant: "You have to wonder why Summers isn't the one that should be taking the fall. But Larry is a pretty good bureaucratic infighter."

Far From a Fix

With a Labor Department jobs report coming out tomorrow -- experts predict a loss of 87,000 nonfarm payroll jobs for July 2010 and a boost to 9.6% in the unemployment rate -- the rumor of Romer's resignation could signal that tomorrow's numbers are going to be worse than expected. Regardless, Romer's departure will likely not go far enough to fix the policies that have been keeping the jobless rate so high.

Given Summers' direct line to the President, it's doubtful that Romer's departure will unleash a dramatic improvement in the administration's job-creation strategy.

NY Times

Romer Leaves as Head of Council of Economic Advisers

By GERRY MULLANY

August 5, 2010, 8:35 pm

Christina D. Romer, the chairwoman of the White House Council of Economic Advisers, will step down from the post next month, the White House announced Thursday night.Her resignation comes as the Obama administration continues grappling with a choppy economy as it heads into the midterm elections.

The White House said that Ms. Romer was leaving to return to California “where her son will be starting high school in the fall” and that she would be teaching at the University of California at Berkeley.

Mr. Obama issued a statement praising Ms. Romer:“Christy Romer has provided extraordinary service to me and our country during a time of economic crisis and recovery,” the President said. “The challenges we faced demanded more of Christy than any of her predecessors, and I greatly valued and appreciated her skill, commitment and wise counsel.”

There was no word on Ms. Romer’s successor. As head of the Council, she helps formulate the administration’s economic policy, often meeting daily with the President and his top economic advisers.

Ms. Romer is among the camp of advisers calling for more stimulus measures to boost the ailing economy, a position opposed by those concerned about the growing deficit.

Gold Seasonality In a Presidential Midterm

Keep in mind that this is an 'average' and that exogenous events can greatly affect the normalized results.

Chart courtesy of friend Brian at ContraryInvestor.

Gold Seasonality with Gold 2010 Daily Price Chart Overlay

04 August 2010

The Road to Serfdom Is Lawlessness: Inside Goldman Sachs

"Giving sophisticated models and fast computers to traders is like giving handguns and tequila to teenage boys. Only complete mayhem can result (and as we saw recently, complete mayhem did result)."

Here is a piece I found interesting from a quant who left Goldman Sachs. It matches what I have seen first hand over the years doing business with the brokers and exchanges, and from friends who joined other high energy Wall Street firms including Lehman and Bear Stearns and Morgan Stanley.

The investment banks and brokers are an adolescent culture, high on macho and low on expansiveness in thinking to put it politely.

I do not have a problem with that, per se. I enjoyed hanging with most of these guys, their odd sense of irreverent cynicism and gallows humour, and the grab-asstic frat life style. It is fun, if you do not take it too seriously. I used to follow an annual race among brokers on the stairs of a large NY skyscraper with interest, a friend phoning in the results. Big money was bet on it. It's a good time, and a means of relieving the tremendous pressures of a high stress profession.

The difficulty is that over the past ten years the financial sector, including the once staid commercial banks, has been absolutely overwhelmed by the hedge fund and investment banking mentality, which in turn has been influencing serious policy discussions in Washington to the detriment of the nation. Most of it had to do with deregulation smearing the boundaries, and opening new opportunities for control frauds through innovation in complexity.

Banks must keep up with their competitors, and if one does it, they all must do it to stay in business. That is why regulation is so vital in this highly competitive sector. One cannot be virtuous as a commercial entity with obligations to shareholders and customers under brothel rules.

Goldman Sachs is primarily a big hedge fund with a lot of political clout and an inside line with the Fed. They have a trading, hedge fund culture these days. It was not always like this. At one time a firm's reputation and their word was everything in a system founded on confidence. With a trading culture it's all about the bottom line, with profit as virtue, and deceit in the name of profit is no vice. You do not wish to have fellows with this mindset running any substantial part of your country.

Quite a bit of that came with their change in status from a predatory trader to mainstream bank in name only, with a predator's instincts and reward system. And this multiplied their potentially negative impact and influence on the entire financial system.

Even worse, their self-centered and short term thinking and clever manipulation of the rules has become the tail wagging the big dog of the country, because the political climate in Washington, and elsewhere, has been largely corrupted by money. And in a bubble economy, the financial centers are where the money is.

Wall Street is like the Gauls (or the Ferengi for the sci-fi fans), ruthlessly obvious and lacking in subtlety, wallowing in the raw and often ostentatious use of amoral power for gain. Washington, on the other hand, tends to effete decadence and studied pretense, the sly and subtle subornation of character and too often the law in the service of power. The mix of these two cultures is an antichrist on the rocks, a deadly cocktail indeed.

I had the opportunity to work with several congressional and even presidential campaigns and administrations starting with Nixon. I don't claim to be an insider, but I have seen a side of things that is transparent to most. I liked that culture as well. I used to go to Washington for the State of the Union message each year, to meet old acquaintances from the Staffs for drinks and chat at Bullfeathers or The Palm to catch up on things, while the big dogs were attending the show. You get the best view of things from the servants, especially if you are benign, an interested non-player.

The deterioration in Washington is evident. These men are not the brightest stars in the firmament, and at times they are downright ignorant of things we might take for granted because they often live a rarefied existence with access to people and information managed by staffs. That is an unfortunate necessity because they are drinking from a firehose of information, and the side effect is a vulnerability to manipulation and well-crafted persuasion.

Their chief ability seems to be to know what to say and to whom, what levers to pull to get something done, making deals, gaining and trading power, and how to get elected. They are great at networking. But this leaves them terribly vulnerable to influence, and group think, and brother, inside the Beltway these days it is all about lawyers, guns (power) and money.

There has always been an element of this, but over the past twenty years, with the whole deregulatory movement, it has become supersized, like a feeding frenzy. I have had the opportunity to discuss this with some older friends in the business and they tend to agree that things have changed.

There are always creepy and seriously warped people who are attracted to the halls of power. I have met a few who were simply chilling. More common are the broken people, with drugs and drink and sex filling the holes in their being, hollowed out by the power and fame that lured them in. But these were always the exceptions.

In government there always had been an element of service to the country and a kind of dignity underpinning the system, a kind of shared camaraderie, that seems to have been tossed in a ditch of expediency and greed, and the lust for power on a mass scale.

What had been the exception is now the rule, at least beneath the urbane, often pietistic, veneer. You can still be tossed out of office in the government for doing things that would still make you a legend on Wall Street.

When the politicos were doing something wrong back then at least they knew it, and they were ashamed of it, despite the usual bluff and bravado. A stiff conversation with a federal prosecutor would make a Congressional staffer's blood run cold. Now it is more like business as usual, and even getting caught is not all that bad, given the current trend to bipartisan professional courtesy, mavericks excepted.

Greed is indeed the greatest good, the fatal flaw behind the decline of the 'me generation.'

The law, that much maligned government of regulations and restraints, abused and fallible as it may sometimes be, is the bulwark of society, and often the only thing standing between the people and packs of ravening wolves.

Those who would tear down the law in some misguided pursuit of reform, or of an adolescent anarchy or utopia of 'no rules' at all, might find it hard to stand when the cold winds of avarice and tyranny of power blow across the land, with no laws to stop or restrain them. The madness serves none, consuming all.

"Equal protection" under the law is the best safeguard that the average person enjoys. Remove the law and you remove the protection, and it is every man for himself, and the individual is irrelevant.

This is why the Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery. And underpinning all of this is the integrity of the regulatory and law enforcement process, and a serious pass at campaign finance reform and limitation of the power of large corporations and organizations to buy influence with other people's money.

The story of the 21st century will be the struggle of the individual versus the organization, the machine controlled by the elite few. A cyclical theme no doubt, but the powerful few seem to become more efficient in their promotion of tyranny on each iteration.

adgrokNote to Antonio. I have been where you are now. Watch out for the venture capitalists, and who they attempt to place on your board. They will steal your company and beggar your common shareholders if you allow them, and clap you in financial chains. Keep a close eye on cashflow and burn rates, because if you ever need second tier financing, you're done unless you are very, very lucky. Sandhill Road is the new Tortuga.

Why founding a three-person startup with zero revenue is better than working for Goldman Sachs

By Antonio

23 Jul, 2010

I joined Goldman Sachs in 2005, after five flailing years in a physics Ph.D. program at Berkeley.

The average salary at Goldman Sachs in 2005 was $521,000, and that’s counting each and every trader, salesperson, investment banker, secretary, mail boy, shoe shine, and window cleaner on the payroll. In 2006, it was more like $633,000.

In the summer of 2005, I took one look at my offer letter and the Goldman Sachs logo above it, another look at my sordid grad student pad, and I got on a plane to New York within the week. I packed my copy of Liar’s Poker for reference.

My job on arrival? I was a pricing quant on the Goldman Sachs corporate credit trading desk1. We traded credit-default swaps, both distressed and investment-grade credit, and in the bizarre trading experiment assigned to me, the equity part of the corporate capital structure as well.

There were other characters in this drama. The sales guys were complete tools, with a total IQ, summing over all of them, still safely in the double digits. The traders were crafty and quick-witted, but technically unsophisticated and with the attention span of an ADHD kid hopped up on meth and Jolly Ranchers. And the quants (strategists in Goldman speak)? Mostly failed scientists (like me) who had sold out to the man and suddenly found themselves, after making it through two years of graduate quantum mechanics, with a bat-wielding gorilla peering over their shoulder (that would be the trader) asking them where their risk report was.

Wall Street is inward-looking and all-consuming. There exists nothing beyond the money game, and nothing that can’t be quantified into dollars and cents...

Hey Rube, Here's Why Your Lawmakers Ignored All Those Calls and Faxes

"The financial industry has spent $251 million on lobbying so far this year as lawmakers hammered out new rules of the road for Wall Street, according to the latest lobbying reports compiled by a watchdog group."

Money Talks. And money in the hands of the man who is sitting in the offices and standing in the halls of Congress is an effective tool for buying the influence and the laws that you want.

Political campaign financing reform, including stricter limitation of direct contributions by special interests to targeted lawmakers, is at the heart of it.

Does the First Amendment cover soft bribery? That is how they will spin it.

Goldman Sachs has the right to express its opinion to your congressman, while wrapping it in a thick rolls of hundred dollar bills, charged to expenses, and paid for by you.

And while it is a nice cushion, $251 million is small potatoes compared to the real payoff in jobs and speaking engagements with huge stipends, consulting fees, and sinecures after leaving office. And that is on top of their fat pensions and cadillac benefits.

Corporatism is the parternship of big business and government. And in the organizational state, the individual (that's you Mr. Potato Head) is irrelevant. Except for comic relief, someone to be played for the fool, the emotional plaything of paid pundits and party politics. Someone whom they can whip into a frenzy, who really enjoys the show.

Yeah boy, we'll show those new crooks a thing or two, and vote the old crooks back in November. Especially the ones that make no bones about being in it for the money and the power, and appeal to the worst in us with stereotypes and caricatures. That will teach Washington something about us.

You bet it will.

CNN

Wall Street's lobbying pricetag: $251 million

By Jennifer Liberto

August 2, 2010: 2:08 PM ET

WASHINGTON (CNNMoney.com) -- The financial industry has spent $251 million on lobbying so far this year as lawmakers hammered out new rules of the road for Wall Street, according to the latest lobbying reports compiled by a watchdog group.

The financial sector spent more than any other special interest group from April through the end of June -- a whopping $126 million, according to the Center for Responsive Politics' latest estimates. Wall Street banks, as well as insurance and real estate firms, hiked the amount they spent on lobbying by 12% in the second quarter compared to the same period last year.

"Financial reform certainly drove Wall Street lobbying efforts," said Dave Levinthal, spokesman for the Center for Responsive Politics. "Even as the economy remains beaten and bruised, with some financial institutions continuing to struggle, most banks and securities houses found it in their budgets to hire lobbyists - and lots of them."

In the first half of 2010, Goldman Sachs spent $2.7 million, just $100,000 shy of the total the firm spent on lobbying in all of 2009. The firm's reports to the federal government said it lobbied Treasury, White House and the Commodity Futures Trading Commission, as well as Congress...

There was plenty of evidence of financial sector lobbying throughout in the period leading up to final passage of the Wall Street reform bill last month.

In June, during the final 20-hour meeting of the panel to reconcile differences between the House and Senate reform bills, lobbyists suddenly packed a congressional office meeting room a bit after midnight, as lawmakers started tackling the final details of making derivatives more transparent. In hallways, they cornered House members who serve on the Agriculture Committee, in particular.

In late May, JPMorgan Chase chief executive Jamie Dimon made calls to a couple of lawmakers who were expected to be named to the conference panel.JP Morgan Chase spent $3 million on lobbying in the first half of the year, about the same as in 2009, according to the Center.

While the financial sector was active, other industries also dug deep into their wallets to talk to lawmakers. Despite the fact that the health care bill passed in March, the Center said health firms spent nearly as much as Wall Street firms did in the second quarter, $125 million. So far this year, the health care industry has spent $267 million on lobbying.

Overall, all lobbying totaled $1.78 billion in the first half of the year, up 7.5% in from the same six months in 2009. If it continues at that pace, 2010 will be a record year for lobbying, according to the Center for Responsive Politics.

However, fewer lobbyists are pounding the pavement, as the number of lobbyists dropped 5% compared to the same period in 2009.

SP 500 September Futures Daily chart: It's Long Way to 1,000

Although stocks may break out of the trend and go higher, it is better than even odds that the SP fails below 1135 and drops down in a test of 1,000.

03 August 2010

Gold Daily Chart; Silver Daily Chart; US Dollar Daily Chart

Gold Daily Chart

The cup and handle formation held intact, but the toughest part of overhead resistance is dead ahead, all the way up to 1212.

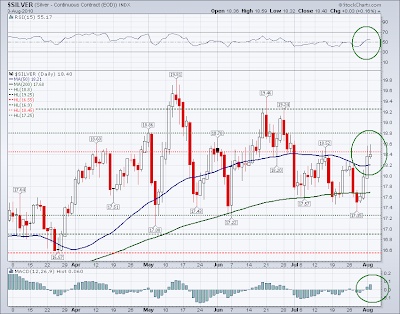

Silver Daily Chart

Silver looks to be on the verge of a breakout to the upside to test 19.20.

US Dollar Daily Chart

The dollar sliced through support like it was not even there. A test of 80 area support is in the card, and the dollar is getting short term oversold.

Mutual Fund Cash Levels Are at Bearish Record Levels

These sort of record low cash levels in the funds are generally indicative of a short term top in equities.