20 February 2009

Major Banks Will Be Nationalized Eventually: Wall Street's Dirty Little Secret

Why doesn't the Street wish you to realize this? First and foremost, the days of big bonuses and big earnings are over. Banks will increasingly become, once again, institutions to support savings and lending, with insured depositors accounts as a major source of capital.

The leveraged days and market speculation for the big money center banks is over.

We no longer need big salaries to retain traders in the banks because they won't be doing much trading for their own accounts anymore. That will be left to the brokerages.

They won't be writing insurance, they won't be taking huge short positions in commodities, and they won't be to big to fail, at least not to this degree with single institutions threatening national solvency.

We need to strike a model of what wish to have as a national financial system, and begging to invest towards that, and not try to reflate a bubble that ought never to have existed in the first place.

Nationalization does not mean the banks will be run by the government. It means that they will be taken into receivership, broken up, and made once more into banks. Those which are not nationalized must be constrained by a new "Glass-Steagall" law limiting their ability to imperil the national economy for their own personal gambling interests.

That is the point that is being lost in this opaque analysis and muddled discussion. The Big Money Center Banks will be nationalized one way or the other. The only real variable is how much money they can take out of the system before it happens.

Bloomberg

Dodd Says Short-Term Bank Takeovers May Be Necessary

By Alison Vekshin

Feb. 20 (Bloomberg) -- Senate Banking Committee Chairman Christopher Dodd said banks may have to be nationalized for “a short time” to help lenders including Citigroup Inc. and Bank of America Corp. survive the worst economic slump in 75 years.

“I don’t welcome that at all, but I could see how it’s possible it may happen,” Dodd said on Bloomberg Television’s “Political Capital with Al Hunt” to be broadcast later today. “I’m concerned that we may end up having to do that, at least for a short time.”

Citigroup and Bank of America, which received $90 billion in U.S. aid in the past four months, fell as much as 36 percent today on concern they may be nationalized. Citigroup, based in New York, fell as low as $1.61. Bank of America, based in Charlotte, North Carolina, tumbled as low as $2.53.

President Barack Obama’s administration is resisting the idea of nationalizing banks, said Dodd, a Connecticut Democrat. “They prefer not to go that way for all of the reasons that we’re familiar with in terms of the symbolic notion of nationalization of major lending institutions,” he said.

The Obama administration strongly believes a “privately held banking system is the correct way to go,” White House spokesman Robert Gibbs told reporters at a briefing today. “That’s been our belief for quite some time, and we continue to have that,” Gibbs said.

‘Leeway’ on Compensation

Treasury Secretary Timothy Geithner has “an awful lot of leeway” in interpreting the restrictions on executive compensation included in the economic stimulus bill and opposed by the banking industry, Dodd said today.

Treasury officials are still examining how to implement the new compensation restrictions and have not yet determined whether they will apply to participants in the administration’s rescue plan or only to banks and companies that get cash injections from the Troubled Asset Relief Program.

Compensation consultants including Alan Johnson, founder of Johnson Associates Inc. in New York, said the rules may be “catastrophic” to Wall Street’s talent base. The caps made top- producing employees “nervous,” and those who can find other jobs will probably leave, said James Reda, who heads a compensation firm in New York.

“I’m sort of stunned in a way that some people are reacting the way they are about all of this,” Dodd said. “At a time like this, everyone needs to pull in the same direction.”

Dodd also said he doesn’t want U.S. automakers to go through a prepackaged bankruptcy or a “forced merger.” General Motors Corp., Ford Motor Co. or Chrysler LLC risk liquidation with such actions, Dodd said on the broadcast.

China Invests in Production and Commodities While the US Feeds the Sharks

China is securing long term supplies of oil, aluminum, iron and other hard commodities at 'favorable prices for years to come.'

The United States is investing in increasingly worthless paper, insolvent banks, crony capitalist ponzi schemes, non-productive consumption, and enormous bonuses for Wall Street financiers.

After a visit to China a few years ago, touring their factories with workers quietly hunched over their worktables in fear, working whatever hours were offered in difficult conditions, Bill Gates observed that this was 'his kind of capitalism.'

The choices you make, what you choose to do or not to do, will pay significant returns, either good or ill, for your children and your children's children.

Plus ça change, plus c'est la même chose.

NY Times

With Cash to Spend, China Starts Investing Globally

By David Barboza

February 21, 2009

SHANGHAI — With the world suffering through a tight credit market, China has suddenly gone shopping.

Beijing said on Friday that one of its big state-owned banks, the China Development Bank, agreed to lend the Brazilian oil giant Petrobras $10 billion in exchange for sending China a long-term supply of oil.

That investment came after similar deals were signed this week with Russia and Venezuela, bringing China’s total oil investments this month to $41 billion.

China’s biggest aluminum producer also agreed earlier this month to invest $19.5 billion in Australia’s Rio Tinto, one of the world’s biggest mining companies. And last Monday, the China Minmetals Corporation bid $1.7 billion to acquire Australia’s OZ Minerals, a huge zinc mining company...

China wants reliable supplies of crude oil, to fuel its growing transport sector; it needs iron ore for steel production, and copper and aluminum to build homes and consumer goods...

Analysts say China could continue to make deals for a variety of small oil and gas companies, mineral producers and mining firms.

This week, for instance, shares of the Australian miner Fortescue Metals Group rose after reports the company was in talks with China over a big investment to help the company expand.

In many cases, China has struck deals in countries that have access to large supplies of oil and minerals but where American and European countries are not well-positioned, like parts of Africa and the Middle East.

In one deal this week, China made an alliance with the government of Hugo Chávez, the president of Venezuela, who has denounced American leadership.

While the oil deals announced vary in terms, analysts say they ensure China a steady supply of oil for decades to come, sometimes at favorable prices....

19 February 2009

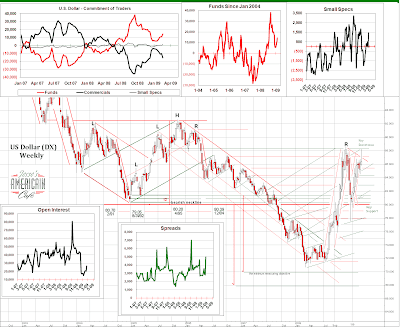

The SP 500 and Short Term Indicators

The short term indicators are getting stretched to the downside, and the other narrower indices are approaching their own support levels.

Perhaps a techinical bounce at some point, but no higher than overhead resistance. A stairstep decline such as this can be quite damaging, and often will continue until it finds strong support, a footing and a V bottom. It may require a plunge, otherwise it just keeps bleeding.

The SP 500 seems likely to test the prior low at 741. We may get a legitimate double bottom. The overhead resistance will cap any purely technical bounces. That is how we will tell them apart.

The McClellan Oscillator is getting overextended to the downside.

This has 'plunge to a bottom' written on it. But we might just continue to slowly bleed.