Yesterday it was Yves Smith who took Paul Krugman to task. And I defended him in that instance in the comments. But now alas it's my turn, and I don't take this up lightly. So I must think it is important.

And I do. Because a false premise is being used to justify a false conclusion and by extension a matter of serious public policy in an ongoing debate. And people are in the streets about it.

In a recent op-ed Way Off Base Paul Krugman says:

"I see some commenters reacting to the failure of major inflation to break out by insisting that inflation is defined as an increase in the monetary base — that is, the bank reserves plus currency that are what increases when the Fed “prints money”. As it happens, that’s wrong: very old dictionaries defined inflation as a rise in money and/or credit, but the modern usage is, of course, a rise in prices.

But that’s really a side issue. Nobody would care about the size of the monetary base except for the belief that increasing the base leads to a rise in prices. That’s not a question of definitions, it’s a question of your model of the economy."

For those unfamiliar with measures of money supply and the monetary base, see Money Supply: A Primer.

I don't know who these commenters are, but they *could be* those from the Austrian school, who tend to look to what they call True Money Supply. I would have to read up to find out what the anticipated lag times are between expansion and its aftereffects. It could also be from those who are forecasting hyperinflation, but those are few and I am not among them. My forecast has long called for a credit bubble followed by a financial collapse and stagflation as the most like outcome but it is no economic model, more of a judgement call. The variables are too many and too exogenous for any model that I could possibly devise. . Or the model Paul references could be just a strawman.

Except for the Austrians, and of course perhaps Paul Krugman when it suits him, I don't know of many rational financial people who would look to a very narrow measure of money supply, especially the Monetary Base, and expect a simple causal effect in prices over a short period of time of even a few years, in an ongoing great recession with a very low velocity of money and little lending. And of course the Fed is taking steps to ring fence their market operations. And it seems to be working.

I thought the allusion to 'old dictionaries' versus 'new dictionaries' was an appeal to an authority that does not quite work anymore, as if Economics is somehow making steady progress, despite its most recent terrible flop and sometimes scandalous behaviour. Yes Paul can point to a few timid warnings in old columns, but his models were remarkably silent in predicting the financial credit bubbles and collapse.

The answer of course is-- ta da, better models. And the definition is my shiny new model versus your old outdated model as I choose to define them. But at the end of the day, the ideal economic model dictates policy with pristine mathematical objectivity.

Adjusted Monetary Base, who could care about it?

Well, the Fed spends quite a bit of time on it, and those who understand anything about economics know that in periods when the financial system breaks down, especially from some excesses promoted by central bank economists, the Fed becomes the 'lender of last resort.' And what they are lending is money they have created by expanding their balance sheet. If they were only providing temporary liquidity the balance sheet would not be expanding in such a parabolic manner and more importantly, remaining there.

In other words, the Fed becomes the 'money creator' and provider of last resort, expending a significant amount of effort to prevent monetary deflation which they find to be against their mandate of what-- a stable money supply and rate of inflation.

The monetary base is a source of money, not broad money in public hands, which the Fed provides under the duress of stressful financial conditions, rather than mere economic cyclical turns. Which is fine, because that is their job as currently defined. And the Monetary Base is one way of measuring it.

The Monetary Base has a particularly long lead time, or lag as economists call it, before even large changes appear in the real economy in the form of higher prices and a money supply that is growing in excess of some organic demand. I am sure Paul is aware of the devaluation of the dollar and the dramatic expansion of the monetary base undertaken in the 1930's by FDR, and the rather dramatic change in trend for consumer prices that followed, albeit not only from that, but other price support programs.

There is definitely a kernel of truth in what Paul says. "By contrast, the model of an economy in a liquidity trap, in which big increases in the monetary base don’t matter, comes through just fine." And Ben and the Fed are managing their activity with an eye to targeting it to the banking system, and taking steps to keep it from moving into the broader money supplies too quickly.

Adding liquidity from the monetary base in the face of sagging aggregate demand is not having a profound effect on broad prices in the relatively short term. I mean, duh. If the model suggested this it is right.

But that does not imply that some connection is not there, that it is meaningless. What it means is that so far at least, the Fed is managing their quantitative easing reasonably well. Unfortunately so well that it is not having the desired effect on the real economy or the banking system for that matter, except that the zombies are still standing. Just because something is not yet a smoking ruin does not bring cause for celebration.

The Fed is 'bottling up' the expansion of the monetary base in the banks, and quite a bit more of it than we had suspected as eurodollars, money provided to banks overseas. And they stopped measuring eurodollars a few years ago in one of the broadest money measures, M3.

The Fed, and I assume Paul Krugman know all this, but believe that they will have the tools, and knowledge, and the latitude to reduce their balance sheet when the time is appropriate and the real economy and banking system recovers. 'Volcker did it.' And so can we, because the models say so.

What the Fed and Paul Krugman are really saying is "Trust us." And our models. And don't think that the BLS and the government are tinkering with the econometric measures. Are you kidding me? It takes a willful blindness to ignore some of the more egregious tinkering that the government is doing in the name of perception management.

As for the comment about 'printing money,' it was Ben himself that said, 'the Fed owns a printing press.' And he was telling the truth.

I am not a believer in True Money Supply and greatly prefer broader money supply measures. And I know what the Fed is doing is providing an inflation risk that they believe that they know how to handle when the time is right.

And I also know that inflation is starting to pop up in certain sectors and items. And why it is not a broad increase yet, which is what we might call inflation. With most of the increase in money supply flowing to a very few in the form of income, well, this is all understandable.

So what was the point of Paul bringing all this up? It was this.

"Here are the data — I’ve included commodity prices (IMF index) as well as consumer prices for the people who believe that the BLS is hiding true inflation (which it isn’t)"Let's see. The BLS is not distorting inflation measures because the model is working, and we know the model is working because of the BLS inflation measures. That seems a little shaky to me. Especially in light of the other data that shows that certain price sensitive assets are rising in price, and sharply, in response to negative real interest rates, as some other models and theories would hold.

Yes the US is in a liquidity trap. And yes, the actions of the Fed so far have not triggered a broad monetary inflation because of the slack demand, and the consequent lack of lending and real economic growth.

And yes some well targeted stimulus could help to break this self-perpetuating situation.

And anything that does not agree with my model is a bubble, and anomaly, or someone else's fault.

The root causes of the problems in the real economy have not yet been changed, and the system has not been reformed. And the model which Paul points to is really only one correlation in a broader model that has failed, and badly, because it is an abstraction that only has a tenuous relationship with reality.

It is not so much that Paul Krugman is wrong. There are others who are much, much worse, the purveyors of austerity, and efficient market based deregulation, and supply side economics.

But Krugman is swinging open the door for the Modern Monetary Theory crowd whether he realizes it or not, by going a bridge too far in his misplaced conclusions and triumphalism. Extremism in defense of stimulus is no vice, but it is an offense to reason.

Hey, we haven't blown up the economy lately, so why worry?

Don't get me wrong. I wish Keynes was still alive, so Keynesian economics could evolve based on new data, which I am quite sure it would. In response to new data, JMK changed his mind. And I am sure he would do so again. I find myself at odds with almost every economic school because I am not an economist by training, and their dogmas and models grate on rational minds.

I liked Roosevelt, because as a non-economist he was open to trying things, but changing them if they didn't work. If he would have had a model, he would have beaten the country to death with it. That was the difference between Hoover and Roosevelt, the lack of intellectual pretension.

Well, if we only had more stimulus it would have worked. Yes that is a thought, except the system is BROKEN. The only thing we are stimulating is more money for the wealthy, more jobs for China, and more debt for the people. Yes I think there is some short term benefit for those in the most distress in some of the programs, and that is a good thing. But pouring stimulus into a broken system is only going to mask the rot, and hasten the final reckoning. I thought this is what Greenspan tried after the tech bubble collapse. And here we are again.

Better for the Fed and the economists to proceed in fear and trembling, showing their work clearly, and engaging in honest and open discussion, than risk the final, utter and total repudiation of their profession when 'trust us' fails again.

And I think it is incredibly naive to make that case that since the Fed has not blown the economy up yet, that all is well, and that printing money in whatever amounts has no significant consequences. No one believes that except a few economists who frighten me in their slavery to their models, and I would hope that you are not one of them.

Perhaps the most useful thing that Paul Krugman could do is go join Occupy Wall Street, and demand the Congress and the President take some serious action in reforming the system, because that is the only thing that is going to provide a sustainable recovery.

"Economic models are no more, or less, than potentially illuminating abstractions...The belief that models are not just useful tools but also are capable of yielding comprehensive and universal descriptions of the world has blinded its proponents to realities that have been staring them in the face. That blindness was an element in our present crisis, and conditions our still ineffectual responses.and the associated essay of mine, The Seduction of Science in the Service of Power

Economists – in government agencies as well as universities – were obsessively playing Grand Theft Auto while the world around them was falling apart."

John Kay, An Essay on the State of Economics

Paul Krugman has been good at calling Obama and his advisors on their financial policy errors, and was roundly and unjustly criticized for it. I link to his columns frequently, because he is good at what he does, and he often speaks his mind with honest authority. And compared to many others in his profession he has been a paragon of virtue. But when it comes to their models, most economists have a fatal attraction that leads them astray.

As in all discredited professions, even if it has been due to the actions of a minority, the others must be beyond reproach, and take special care in choosing their words and their arguments. I am sorry to say that is the case with other professions now, and it is also the case with economists.

As a great economist once said, "Economics is extremely useful as a form of employment for economists." As for the rest of it, well, they have their place. They just get giddy sometimes, especially when exposed to real power, and fawn all over it.

But don't most people. They just do it with a little more humility, and with more sense of uncertainty and attention to the downsides of risk, the so-called 'black swans' that economists' models do not describe or permit, and sometimes do not even acknowledge until face meets dirt.

Obama is failing, but the alternatives are worse. Small consolation. I think the US can do better.

A great leader in a similar crisis said,

"Confidence...thrives on honesty, on honor, on the sacredness of obligations, on faithful protection and on unselfish performance. Without them it cannot live."

If most leaders in Congress and the Administration stood up and said that today, the audience would be rolling in the aisles with laughter. And if anyone from the financial sector said that, well, I would not wish to be in the radius of a lightning strike, God's work notwithstanding.

And that points to the heart of the problem. We are caught in a credibility trap, in which the leaders are so complicit in the abuse and corruption of the system that they cannot even begin to speak to it honestly and plainly, with their pockets weighted down with corporate money. And they are teaching the rest of us by their example.

October 7, 2011, 3:15 pm

Way Off Base

By Paul Krugman

I see some commenters reacting to the failure of major inflation to break out by insisting that inflation is defined as an increase in the monetary base — that is, the bank reserves plus currency that are what increases when the Fed “prints money”. As it happens, that’s wrong: very old dictionaries defined inflation as a rise in money and/or credit, but the modern usage is, of course, a rise in prices.

But that’s really a side issue. Nobody would care about the size of the monetary base except for the belief that increasing the base leads to a rise in prices. That’s not a question of definitions, it’s a question of your model of the economy. The underlying belief of all the people accusing Ben Bernanke of doing something dastardly is that “printing money” has caused or will cause high inflation in the ordinary sense.

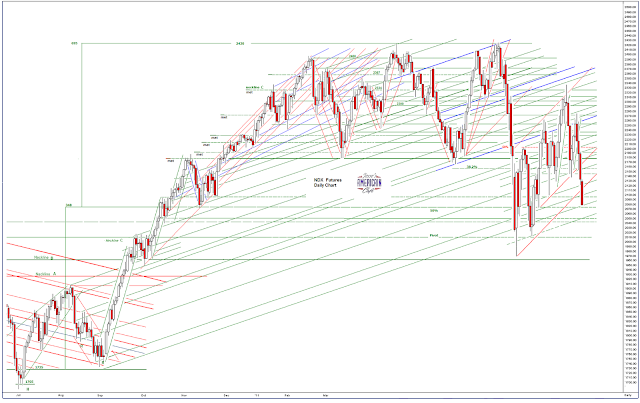

The thing is, of course, that the past three years — the post-Lehman era during which the Fed presided over a tripling of the monetary base — have been an excellent test of that model, which has failed with flying colors. Here are the data — I’ve included commodity prices (IMF index) as well as consumer prices for the people who believe that the BLS is hiding true inflation (which it isn’t):

A couple of notes: for the commodity prices it matters which month you start, because they dropped sharply between August and September 2008. I use the IMF index for convenience– easy to download. (Thomson Reuters I use when I just want to snatch a picture from Bloomberg). But none of this should matter: when you triple the monetary base, the resulting inflation shouldn’t be something that depends on the fine details — unless the model is completely wrong.

And the model is completely wrong. You don’t get more conclusive tests than this in economics. By contrast, the model of an economy in a liquidity trap, in which big increases in the monetary base don’t matter, comes through just fine.

And this in turn tells you something about the people pushing this stuff. They had a model; it made predictions; the predictions were utterly, totally wrong; and they have just dug in further.

I do not know who 'the people pushing this stuff' are, but that last sentence applies to almost every economist and financial pundit that I can think of, with only a few notable exceptions.

A great economist would come up with something new from this, some variation on a theme, would have LEARNED something. The original thinkers are often geniuses, but their adherents are too often true believers and interpreters of doctrine. My graduate academic experience with economists of some years ago is that they lag reality, and especially the sea changes, by quite a few years, always making plans for the last war and crushing the data to fit their abstractions.

And this sadly is what may have brought the Austrian, Classical, Marxist and Keynesian schools into a type of relative stagnation, with a lack of original thought and an adherence to learned models and learned dogma. Monetarism seems to be waning as well into an American obsession with statistics, often for hire. Each of the schools have something to contribute. I have long been convinced however, that out of this new experience we are having that a new school of economic thought would rise out of the ashes. So far it is not apparent, just attempts to revive the old ideas.

Perhaps this 'digging in' is the natural reaction to a crisis. Who has the presence of mind to 'think differently.' But it is killing off the ability of the country to move forward, especially given the media's penchant for airing an issue for the public by bringing out two professional 'strategists' who throw lies and distortions and cartoon examples at one another for ten minutes, and then call it a discussion. Ok, time to vote.

No wonder the people are confused and afraid. And beginning to take to the streets. And I shudder to forecast the outcome.

By the way, Robert Reich has a nice description that touches on the credibility trap in Occupiers of Wall Street and the Democratic Party.

And Michael Hudson does a fine job describing the heart of the Occupy Wall Street phenomenon and their desire for reform and their resistance to being used and diverted as has happened to the Tea Party. As he goes into his own economic prescriptions, I obviously do not agree with all his views, but he certainly makes some interesting points.

The system is broken. It needs to be reformed. People are tired of being used and lied to. They voted for change and were ignored when they expressed their views and quite strongly. And when they complain, they are ridiculed. And now they are getting really angry. And the powers-that-be are trying to figure out how to play them for their own ends.

As Dr. Zoidberg would say, 'Wow, the President is gagging on my gas bladder. What an honor.'