The Treasury bubble is likely to be much less destructive than the Internet and Housing Bubbles.

The Treasury bubble is likely to be much less destructive than the Internet and Housing Bubbles.

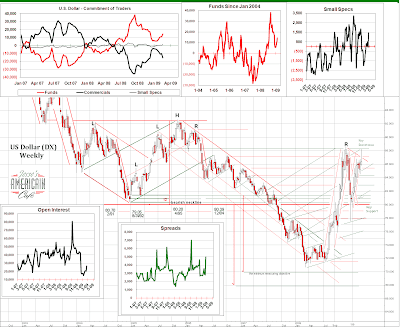

The bubble in the US dollar, however, if one wishes to consider it as an adjunct or outcome of the bubble in Treasuries, has the potential to be disruptive and devastating

Reuters

Buffett says U.S. Treasury bubble one for the ages

By Jonathan Stempel

Sat Feb 28, 2009 9:31pm GMT

NEW YORK (Reuters) - Warren Buffett, whose Berkshire Hathaway Inc. sits on $25.54 billion (17.8 billion pounds) of cash, said worried investors are making a costly mistake by buying up U.S. Treasuries that yield almost nothing.

In his widely read annual letter to Berkshire shareholders, the man many consider the world's most revered investor said investors are engulfed by a "paralyzing fear" stemming from the credit crisis and falling housing and stock prices. Treasury prices have benefited as investors flocked to the perceived safety of the "triple-A" rated debt.

But Buffett said that with the U.S. Federal Reserve and Treasury Department going "all in" to jump-start an economy shrinking at the fastest pace since 1982, "once-unthinkable dosages" of stimulus will likely spur an "onslaught" of inflation, an enemy of fixed-income investors.

"The investment world has gone from underpricing risk to overpricing it," Buffett wrote. "Cash is earning close to nothing and will surely find its purchasing power eroded over time."

"When the financial history of this decade is written, it will surely speak of the Internet bubble of the late 1990s and the housing bubble of the early 2000s," he went on. "But the U.S. Treasury bond bubble of late 2008 may be regarded as almost equally extraordinary."

DISMAY OVER MORTGAGE PRACTICES

Investors' flight to quality followed years of excessive borrowing, especially in housing, and Buffett used his letter to make plain his dismay with a variety of mortgage lenders.

He said many ignored Lending 101 by not checking customers' ability to pay off home loans, or foisting "teaser" rates that reset to higher unaffordable levels.

In contrast, Buffett said, Berkshire's manufactured housing unit Clayton Homes had a 3.6 percent foreclosure rate at year end on loans it made, up from 2.9 percent in 2006, though more than one in three borrowers had "subprime" credit scores. The unit was profitable in 2008, earning $206 million before taxes, though earnings fell 61 percent, Berkshire said.

"The present housing debacle should teach home buyers, lenders, brokers and government some simple lessons that will ensure stability," Buffett wrote. "Home purchases should involve an honest-to-God down payment of at least 10 percent and monthly payments that can be comfortably handled by the borrower's income. That income should be carefully verified."

28 February 2009

The Bubble In US Treasuries and Its Implications

HSBC Expected to Cut Dividend, Raise Capital in $17 Billion Shares Offering

This could make Monday's trade interesting.

The Economic Times (India)

HSBC plans $17 bn share sale to raise funds

28 Feb 2009, 1100 hrs IST

SINGAPORE: HSBC, Europe's biggest bank, plans to raise more than 12 billion pounds ($17 billion) in a share sale aimed at propping up its capital base in order to cope with the economic crisis, a media report said on Saturday.

The report said the share issue would likely be announced alongside its full-year 2008 results due on Monday.

The report quoted unidentified people involved in the discussions as saying the offer price for the sale had not been set and the deal could still be postponed.

The bank is also expected to announce a cut in its dividend, the report said.

It said the share sale was underwritten by Goldman Sachs and JPMorgan Cazenove and the deal could set a new record in Britain for a rights issue funded by private investors after Royal Bank of Scotland's 12 billion pound share offering last April.

HSBC has traditionally been one of the best capitalised banks in the world and has not raised capital while rivals have scrambled for cash as the credit crisis has deepened.

27 February 2009

GE Slashes Dividend For the First Time Since 1938 to Preserve Capital

GE cut their dividend by a whoppoing 68% to preserve capital in 'uncertain markets.' The company also said that there are no plans to raise additional capital and dilute common shareholders, with the same confidence which they had in January when Jeff Immelt said that they would not cut the dividend in 2009.

GE cut their dividend by a whoppoing 68% to preserve capital in 'uncertain markets.' The company also said that there are no plans to raise additional capital and dilute common shareholders, with the same confidence which they had in January when Jeff Immelt said that they would not cut the dividend in 2009.

Here is a February 5, 2009 video interview with Jeff Immelt:

Immelt Says Important for GE Not to Cut Divident in 2009

The Wall Street Journal interviewer provides an example of an interview from the prior March in which Jeff Immelt was optimistic about earnings and then shortly thereafter "BAM! A big miss. Does this mean you and your guys don't know what's going on?"

Well, BAM again.

Reuters

GE cuts quarterly dividend to protect liquidity

Fri Feb 27, 2009 2:50pm EST

BOSTON (Reuters) - General Electric Co plans to cut its quarterly dividend to 10 cents a share starting in the second half of 2009, a move that it said would provide it with more "flexibility" in the face of a recession.

The U.S. conglomerate said it had no plans to raise additional equity, and that reducing its dividend from 31 cents a share would save it about $9 billion a year.

"We have determined that reducing the dividend ... is a prudent measure to further enhance our balance sheet and provide us with additional flexibility," said Chief Executive Jeff Immelt in a statement.

As recently as January, Immelt had defended the dividend. In November, the Fairfield, Connecticut-based company said it planned to pay the 31-cent quarterly dividend through 2009.

Still, troubles at its GE Capital finance unit had led some investors to wonder whether keeping the dividend was a good idea....

GDP Number Far Worse Than Expected by Most Economists (But Not Here)

The Fourth Quarter GDP number came in at a negative 6.2% versus the original negative 3.8 percent announcement earlier this year.

The Fourth Quarter GDP number came in at a negative 6.2% versus the original negative 3.8 percent announcement earlier this year.

That is not a big adjustment. It is a HUGE adjustment. That first number was so obviously cooked by a high side inventories estimate and a lowball chain deflator that it was a knee-slapping howler to anyone who is following this economy closely.

This decline did not happen overnight. It is merely being reported that way.

There should be little doubt in most people's minds that Bernanke, Greenspan, Paulson, and many in the Bush Administration were deceiving us about the state of the economy, for years, almost routinely as a matter of course.

That is important to understand. This was no act of God, no hurricane or meteor strike. And a lot of folks on Wall Street and in Washington playing dumb now knew what was coming. You can decide their motives for yourself, but fear and greed should be high on the top of your list.

The economy has been rotten for a long time, since at least 2001 if not before, and as it worsened more and more money was taken off the table by the Bush Administration and their corporate cronies through no bid contracts and welfare for the wealthy. Coats of paint were slapped over the growing imbalances, market manipulation, malinvestment, fraud and corruption.

Remember that. Don't let it go. Because as sure as the sun will rise, these jokers will be back in business given half the chance. They are shameless, greedy beyond all reason, and persistent. The fiscal responsibility being preached now by the Republican minority is repulsive hypocrisy.

That is why it is so disappointing to see what looks like business as usual from the Obama Administration. Larry Summers appears to be a tragic choice as chief economic advisor. And Tim Geithner, while a capable fellow, is not a thinker, but a doer, an implementer, and a disciple of the fellows that caused this mess.

What to do? Let them know now we expect reform. Don't fall for the same old rhetoric from the 'conservative' think thanks and paid pundits who misled you for the past eight years. They are not conservatives. They are jackals who play on your emotions. And let's not accept a new batch of paid pundits and clever deceivers either. But don't give up and pull over a blanket of cynicism.

Typically Americans will give a new president like Obama 100 days to get his bearings and deal with a tidal wave of problems that he did not create. We do not expect him to fix them, but we want to see a decent start in the right direction. We gave Bush far too much allowance, primarily because of 911 which his handlers played for all it was worth.

So far, with some noted exceptions in non-financials, we the people have not seen what we voted for last November.

President Obama recently said that Wall Street reform is coming, but it will take time.

Mr. President, you may not have the leisure to show us that you know what needs to be done. You are riding a high tide of bipartisan support in the people who voted for you. Once you lose them it will be very difficult to get them back.

We must demand action from the Congress and the Administration who we recently put in place through the elections to clean this mess up and then change the system that delivered it.

Contact the White House

Contact Your Senator

We do not want fewer, bigger banks exacting a fee on every commericial transaction in this country.

1. Bring back Glass-Steagall.

2. Clean up the derivatives market, starting with J.P. Morgan and their 90 Trillion dollar positions.

3. Enforce the various anti-trust laws, enacting new ones where necessary, and break up the media and banking conglomerates.

4. Enact aggregate position limits in all commodity markets and transparency with immediate disclosure of all position over 5% in any market.

5. Effective restrictions and enforcement of naked short selling, price manipulation, reinstatement of the 'uptick rule,' the prohibition of regulated banks from engaging in any speculative markets either for themselves or as agents, and usury laws and regulation of all interstate financial transactions at the national level.

And for the sake of the country, establish a vision, a model, of what the system should look like in accord with the Constitution. And then strike out for it, as painful as that may be, and stop this management by crisis.

Bloomberg

U.S. Economy Shrank 6.2% Last Quarter, Most Since ’82

By Timothy R. Homan

Feb. 27 (Bloomberg) -- The U.S. economy shrank in the fourth quarter at a faster pace than previously estimated as consumer spending plunged, companies cut inventories and exports sank.

Gross domestic product contracted at a 6.2 percent annual pace from October through December, more than economists anticipated and the most since 1982, according to revised figures from the Commerce Department today in Washington. Consumer spending, which comprises about 70 percent of the economy, declined at the fastest pace in almost three decades.

The recession is forecast to persist at least through the first half of this year as job losses mount and purchases plummet. The Obama administration’s attempts to break the grip of the worst financial crisis in 70 years are unlikely to bring immediate relief as companies from General Motors Corp. to JPMorgan Chase & Co. cut payrolls.

“There has been no evidence that the pace of decline is slowing at all, there are other shoes waiting to drop,” Bill Cheney, chief economist at John Hancock Financial Services Inc. in Boston, said in an interview with Bloomberg Television. “There is a chance that the stimulus package will kick in” in the middle of this year, he said.

Jim Rogers On the Economy and the Obama Administration

It was interesting to see Jimmy's gloom being cast into the relatively mainstream media. BusinessWeek is like Time Magazine for those who have discovered that the money fairy does not fill their wallets each evening.

Pithy excerpts only. Clink the link for the full interview and Maria's questions.

BusinessWeek

Jim Rogers Doesn't Mince Words About the Crisis

By Maria Bartiromo

...It's pretty embarrassing for President Obama, who doesn't seem to have a clue what's going on—which would make sense from his background. And he has hired people who are part of the problem. ...These are people [Geithner and Summers] who think the only solution is to save their friends on Wall Street rather than to save 300 million Americans.

...What would I like to see happen? I'd like to see them let these people go bankrupt, let the bankrupt go bankrupt, stop bailing them out. There are plenty of banks in America that saw this coming, that kept their powder dry and have been waiting for the opportunity to go in and take over the assets of the incompetent. Likewise, many, many homeowners didn't go out and buy five homes with no income. Many homeowners have been waiting for this, and now all of a sudden the government is saying: "Well, too bad for you. We don't care if you did it right or not, we're going to bail out the 100,000 or 200,000 who did it wrong." I mean, this is outrageous economics, and it's terrible morality.

...Well, if Long-Term Capital Management had been allowed to fail, Lehman and the rest of them would've lost a huge amount of money, their capital would've been impaired, and it would've put a terrible crimp on Wall Street. It would've slowed them down for years. Instead of losing capital, losing assets, and losing incompetent people, they hired more incompetent people.

... banks and investment banks and insurance companies have been failing for hundreds of years. Yes, we would've had a terrible two years. But you're dragging out the pain. We had 10 years of the worst credit excesses in world history. You don't wipe out something like that in six months or a year by saying: "Oh, now let's wake up and start over again."

...They [Citigroup and the car companies] should be allowed to go bankrupt. Why should American taxpayers put up billions to save a few car companies? They made the mistakes! We didn't make the mistakes! I'm sure they'll give them the money, but I'm telling you, it's a mistake. It's a horrible mistake.

...They [the Wall Street Banks] all took huge, huge profits. Who was the head of Citigroup? Chuck Prince? I mean, how many hundreds of millions of dollars did Prince take out of the company? How many hundreds of millions of dollars did other Citibank execs take out of the company? Wall Street has paid something like $40 billion or $50 billion in bonuses in the past decade. Who was that guy who was the head of Merrill Lynch (MERR)?

.....Stan O'Neal. He got $150 million for leaving, even though he ruined the company. Look at the guy at Fannie Mae (FNM), Franklin Raines. He did worse accounting than Enron. Fannie Mae and Freddie Mac (FRE) alone did nothing but pure fraudulent accounting year after year, and yet that guy's walking around with millions of dollars. What the hell kind of system is this?

...Always in the past, when people have printed huge amounts of money or spent money they didn't have, it has led to higher inflation and higher prices. In my view, that's certainly going to happen again this time. Oil prices are down at the moment, but that's temporary. And you're going to see higher prices, especially of commodities, because the fundamentals of commodities are enhanced by what's happening.

... I really think agriculture is going to be the best place to be. Agriculture's been a horrible business for 30 years. For decades the money shufflers, the paper shufflers, have been the captains of the universe. That is now changing. The people who produce real things [will be on top]. You're going to see stockbrokers driving taxis. The smart ones will learn to drive tractors, because they'll be working for the farmers.

It's going to be the 29-year-old farmers who have the Lamborghinis. So you should find yourself a nice farmer and hook up with him or her, because that's where the money's going to be in the next couple of decades.

26 February 2009

Economist Niall Ferguson on the Financial Crisis: "There Will Be Blood"

"The way to make money is to buy when blood is running in the streets."

John D. Rockefeller

Here are excerpts of a lengthy interview with the noted economist Niall Ferguson. The entire interview can be read at the link provided to The Globe and Mail where it appeared.

Niall Ferguson, MA, D.Phil., is Laurence A. Tisch Professor of History at Harvard University and William Ziegler Professor of Business Administration at Harvard Business School. He is also a Senior Research Fellow at Jesus College, Oxford University, and a Senior Fellow at the Hoover Institution, Stanford University.Who can truly say what will happen? After all, life is a school of probability. But if the trends of hubris and reckless disregard for justice continue we may very well have an opportunity to test John D. Rockefeller's investment advice.

The Globe and Mail

'There will be blood'

By Heather Scoffield

February 23, 2009 at 6:45 PM EST

...Policy makers and forecasters who see a recovery next year are probably lying to boost public confidence, he said. And the crisis will eventually provoke political conflict, albeit not on the scale of a world war, but violent all the same.

"There will be blood."

...And much of today's mess is the fault of central bankers who targeted consumer-price inflation but purposefully turned a blind eye to asset inflation. (The emphasis is not only purposely, but willfully so - Jesse)

....Partly because they can throw so much at it, and they can do it at a lower cost than anybody else, because the U.S. retains the safe-haven status, which makes the world so unfair. Here is the world's biggest economy, which gave us subprime mortgages, rampant securitization, the collateralized debt obligation, Lehmann Brothers, Merrill Lynch. It is, in a sense, the fons et origo of this crisis. And yet, because it retains safe-haven status, in a global crisis, investors want to increase their exposure to the U.S. Hence, the dollar rally. Hence 10-year Treasuries down below 3 per cent yields. It's almost paradoxical that an American crisis ... reinforces the status of the United States as a safe haven.

...As you know, Chimerica – the fusion of China and America – is one of my big ideas. It's really the key to how the global financial system works, and has been now for about a decade. At the end of The Ascent of Money, I speculate about whether or not that relationship will survive. If it breaks down, then all bets are off, for the U.S. and indeed for Asia. I think that's really the key point. Both sides stand to lose from a breakdown of Chimerica, which is why both sides are affirming a commitment to it.”

... “There will be blood, in the sense that a crisis of this magnitude is bound to increase political as well as economic [conflict]. It is bound to destabilize some countries. It will cause civil wars to break out, that have been dormant. It will topple governments that were moderate and bring in governments that are extreme. These things are pretty predictable.

The question is whether the general destabilization, the return of, if you like, political risk, ultimately leads to something really big in the realm of geopolitics. That seems a less certain outcome....

...It's just that I don't see it producing anything comparable with 1914 or 1939. It's kind of hard to envisage a world war. Even when most pessimistic, I struggle to see how that would work, because the U.S., for all its difficulties in the financial world, is so overwhelmingly dominant in the military world.”

....“It's obvious, surely we know by now, that this is something quite different. It's a crisis of excessive debt, the deleveraging process has barely begun, the U.S. consumers are not going to suddenly bounce back and hit the shopping malls just because they get a tax cut. The savings rate is going to continue to rise. These processes have tremendous momentum that quite clearly differentiates them from anything that we've seen, including the early 80s, including 73, 74, 75. Those big crises, the ones that we have lived through, were bad. But seems certain to be deeper, and more protracted.” ...“One possibility is that policy makers are lying in order to encourage people and prevent depression from become a self-fulfilling psychological conditions. That's why it's called a depression … Maybe they don't really believe this, but they're saying it in order to cheer people up, and if they're sufficiently consistent, perhaps people will start to believe it, and then it will magically happen.”

...“One possibility is that policy makers are lying in order to encourage people and prevent depression from become a self-fulfilling psychological conditions. That's why it's called a depression … Maybe they don't really believe this, but they're saying it in order to cheer people up, and if they're sufficiently consistent, perhaps people will start to believe it, and then it will magically happen.”

...“August, 2007, was when this crisis began. And if you were really watching the markets carefully, April is when it began, when the various hedge funds started to hemorrhage. The stock markets carried on until October of that year. And in many ways, consumer behaviour in the U.S. did not change until the third quarter of 2008. So there was a massive denial problem. It was like Wile E. Coyote running off a cliff, and they'd run off a cliff and they didn't look down so they didn't start falling. As soon as people realized it was bad, the behaviour switched. Now, people have to try to unscare them before this thing becomes a self-perpetuating downward spiral. I think that's why you have to say ‘growth will return in 2010' with your fingers crossed behind your back.”

...“We kind of have had a bubble in the sense that we've seen such a rally in U.S. government bonds. It's tempting to say that will burst and we'll see yields go back up. Because, you know, $2-trillion worth of debt is going to hit the market this year, maybe more. Supply is exploding just when demand is contracting. You don't need to be a Nobel laureate to see that that has to impact on the price. The difference is there is this thing called the Fed that can step in and start buying the stuff if the foreign demand fades. So it's not completely guaranteed that we'll see bonds sell off in price. (Yes but if the Fed starts overtly monetizing Treasury Debt the limiting factor will be the value of the dollar. It is a 'hinged' constraint, Bonds and Dollar - Jesse)

“There is still this inertia that prevents the dollar from falling off a cliff, that keeps the Treasury market from falling off a cliff. That's really important to bear in mind. I don't think we'll see a bubble distressed assets, because I think the price of these assets has started to fall. Anybody who comes into the market now is essentially paying a premium. There will be better bargains in the middle of this year, and maybe even better bargains later on. If I were in the market to buy distressed assets, I would wait, I would wait a bit longer until they're really desperate. And it might even be better to wait until they're bankrupt.”

...“In the Ascent of Money, I argue that you can't really have a bubble if you don't have a monetary authority that has been excessively generous. From John Law in 1719 to Alan Greenspan in the late 90s, there's always a banker, there's always a central banker making credit too readily available. The second thing is, though, that regulation may not prevent that.” ..."The two great zones of conflict in the 20th century were central and eastern Europe, and a critical part of northeast Asia – Manchuria, Korea. It makes me a little nervous that those are also places that are going to take a very heavy share of the pain. But we're looking at a Great Recession, not a Great Depression. We may be looking at a Lost Decade.

..."The two great zones of conflict in the 20th century were central and eastern Europe, and a critical part of northeast Asia – Manchuria, Korea. It makes me a little nervous that those are also places that are going to take a very heavy share of the pain. But we're looking at a Great Recession, not a Great Depression. We may be looking at a Lost Decade.

There was a time when if you said the United States was going to suffer a lost decade like Japan did in the 1990s, everybody would have said you were a mad pessimist. That begins to look like quite a good scenario. And I think it's a realistic scenario.

One of the facts is if you subtract mortgage equity withdrawal from the Bush years, the real underlying rate of growth of the U.S. economy was 1 per cent. So much of the consumption has been fuelled by mortgage equity withdrawal. So that seems like a reasonable growth rate for 10 years.

We just don't have an improvement of standard of living of the sort we're grown used to. And indeed if you have a more equitable redistribution through the tax system, which Obama is committed to, it might actually be no discernible downside for middle America and lower-class Americans. So many of the benefits of the boom went to the elites. If you have a lost decade plus redistribution, it may not be that dramatic a change for many, many people. People just have to get over the fact that their wealth wasn't worth what they thought it was in 2006. Whether it's their stock market portfolio or their housing. If we simply go back to where we were, in 2005, that's surely not the worst thing that could happen to us.”

25 February 2009

How the Economy Was Lost

Paul Craig Roberts was Assistant Secretary of the Treasury in the Reagan administration.

"How long can the US government protect the dollar’s value by leasing its gold to bullion dealers who sell it, thereby holding down the gold price? Given the incompetence in Washington and on Wall Street, our best hope is that the rest of the world is even less competent and even in deeper trouble. In this event, the US dollar might survive as the least valueless of the world’s fiat currencies."

Counterpunch

Doomed by the Myths of Free Trade

How the Economy was Lost

By PAUL CRAIG ROBERTS

The American economy has gone away. It is not coming back until free trade myths are buried six feet under.

America’s 20th century economic success was based on two things. Free trade was not one of them. America’s economic success was based on protectionism, which was ensured by the union victory in the Civil War, and on British indebtedness, which destroyed the British pound as world reserve currency. Following World War II, the US dollar took the role as reserve currency, a privilege that allows the US to pay its international bills in its own currency.

World War II and socialism together ensured that the US economy dominated the world at the mid 20th century. The economies of the rest of the world had been destroyed by war or were stifled by socialism [in terms of the priorities of the capitalist growth model. Editors.]

The ascendant position of the US economy caused the US government to be relaxed about giving away American industries, such as textiles, as bribes to other countries for cooperating with America’s cold war and foreign policies. For example, Turkey’s US textile quotas were increased in exchange for over-flight rights in the Gulf War, making lost US textile jobs an off-budget war expense.

In contrast, countries such as Japan and Germany used industrial policy to plot their comebacks. By the late 1970s, Japanese auto makers had the once dominant American auto industry on the ropes. The first economic act of the “free market” Reagan administration in 1981 was to put quotas on the import of Japanese cars in order to protect Detroit and the United Auto Workers.

Eamonn Fingleton, Pat Choate, and others have described how negligence in Washington DC aided and abetted the erosion of America’s economic position. What we didn’t give away, the United States let be taken away while preaching a “free trade” doctrine at which the rest of the world scoffed.

Fortunately, the U.S.’s adversaries at the time, the Soviet Union and China, had unworkable economic systems that posed no threat to America’s diminishing economic prowess.

This furlough from reality ended when Soviet, Chinese, and Indian socialism surrendered around 1990, to be followed shortly thereafter by the rise of the high speed Internet. Suddenly, American and other first world corporations discovered that a massive supply of foreign labor was available at practically free wages.

To get Wall Street analysts and shareholder advocacy groups off their backs, and to boost shareholder returns and management bonuses, American corporations began moving their production for American markets offshore. Products that were made in Peoria are now made in China.

As offshoring spread, American cities and states lost tax base, and families and communities lost jobs. The replacement jobs, such as selling the offshored products at Wal-Mart, brought home less pay.

“Free market economists” covered up the damage done to the US economy by preaching a New Economy based on services and innovation. But it wasn’t long before corporations discovered that the high speed Internet let them offshore a wide range of professional service jobs. In America, the hardest hit have been software engineers and information technology (IT) workers.

The American corporations quickly learned that by declaring “shortages” of skilled Americans, they could get from Congress H-1b work visas for lower paid foreigners with whom to replace their American work force. Many US corporations are known for forcing their US employees to train their foreign replacements in exchange for severance pay.

Chasing after shareholder return and “performance bonuses,” US corporations deserted their American workforce. The consequences can be seen everywhere. The loss of tax base has threatened the municipal bonds of cities and states and reduced the wealth of individuals who purchased the bonds. The lost jobs with good pay resulted in the expansion of consumer debt in order to maintain consumption. As the offshored goods and services are brought back to America to sell, the US trade deficit has exploded to unimaginable heights, calling into question the US dollar as reserve currency and America’s ability to finance its trade deficit.

As the American economy eroded away bit by bit, “free market” ideologues produced endless reassurances that America had pulled a fast one on China, sending China dirty and grimy manufacturing jobs. Free of these “old economy” jobs, Americans were lulled with promises of riches. In place of dirty fingernails, American efforts would flow into innovation and entrepreneurship. In the meantime, the “service economy” of software and communications would provide a leg up for the work force.

Education was the answer to all challenges. This appeased the academics, and they produced no studies that would contradict the propaganda and, thus, curtail the flow of federal government and corporate grants.

The “free market” economists, who provided the propaganda and disinformation to hide the act of destroying the US economy, were well paid. And as Business Week noted, “outsourcing’s inner circle has deep roots in GE (General Electric) and McKinsey,” a consulting firm. Indeed, one of McKinsey’s main apologists for offshoring of US jobs, Diana Farrell, is now a member of Obama’s White House National Economic Council.

The pressure of jobs offshoring, together with vast imports, has destroyed the economic prospects for all Americans, except the CEOs who receive “performance” bonuses for moving American jobs offshore or giving them to H-1b work visa holders. Lowly paid offshored employees, together with H-1b visas, have curtailed employment for older and more experienced American workers. Older workers traditionally receive higher pay. However, when the determining factor is minimizing labor costs for the sake of shareholder returns and management bonuses, older workers are unaffordable. Doing a good job, providing a good service, is no longer the corporation’s function. Instead, the goal is to minimize labor costs at all cost.

Thus, “free trade” has also destroyed the employment prospects of older workers. Forced out of their careers, they seek employment as shelf stockers for Wal-Mart.

I have read endless tributes to Wal-Mart from “libertarian economists,” who sing Wal-Mart’s praises for bringing low price goods, 70 per cent of which are made in China, to the American consumer. What these “economists” do not factor into their analysis is the diminution of American family incomes and government tax base from the loss of the goods producing jobs to China. Ladders of upward mobility are being dismantled by offshoring, while California issues IOUs to pay its bills. The shift of production offshore reduces US GDP. When the goods and services are brought back to America to be sold, they increase the trade deficit. As the trade deficit is financed by foreigners acquiring ownership of US assets, this means that profits, dividends, capital gains, interest, rents, and tolls leave American pockets for foreign ones.

The demise of America’s productive economy left the US economy dependent on finance, in which the US remained dominant because the dollar is the reserve currency. With the departure of factories, finance went in new directions. Mortgages, which were once held in the portfolios of the issuer, were securitized. Individual mortgage debts were combined into a “security.” The next step was to strip out the interest payments to the mortgages and sell them as derivatives, thus creating a third debt instrument based on the original mortgages.

In pursuit of ever more profits, financial institutions began betting on the success and failure of various debt instruments and by implication on firms. They bought and sold collateral debt swaps. A buyer pays a premium to a seller for a swap to guarantee an asset’s value. If an asset “insured” by a swap falls in value, the seller of the swap is supposed to make the owner of the swap whole. The purchaser of a swap is not required to own the asset in order to contract for a guarantee of its value. Therefore, as many people could purchase as many swaps as they wished on the same asset. Thus, the total value of the swaps greatly exceeds the value of the assets.

The next step is for holders of the swaps to short the asset in order to drive down its value and collect the guarantee. As the issuers of swaps were not required to reserve against them, and as there is no limit to the number of swaps, the payouts could easily exceed the net worth of the issuer.

This was the most shameful and most mindless form of speculation. Gamblers were betting hands that they could not cover. The US regulators fled their posts. The American financial institutions abandoned all integrity. As a consequence, American financial institutions and rating agencies are trusted nowhere on earth...

The Risk in US Treasuries

One of the lunch regulars, Dave the BondMan, notes to our suprise that the Rate for a Credit Default Swap, the cost of insuring against default, on a 5 Year US Treasury Note is now a full 100 basis points.

The cost of credit default insurance is a real world, market assessment of the risk of default of the U.S. Govt, as opposed to the fantastical ratings issued by Moodys and S&P.

The Yield on a 5 Year T Bond is 1.92%.

It now costs more than one half of your return to guarantee a midrange US sovereign debt note.

Now if you take the next step, and view that return on a guaranteed US 5 Year Note as effectively .92%, you would have to believe that the rate of inflation will remain under one percent for the next five years in order for there to be any real return at all (Return on Guaranteed Interest Minus Inflation).

That is probably a 'flight to safety' phenomenon more than anything else, especially if one looks out on the yield curve to the 10+ durations.

That, my friends, represents an extremely dim view of the US economic situation, and a potential bubble in Treasuries.

Source: Markit

As an aside, as someone experienced in evaluating the financing of projects and companies, we wonder what figure companies are using as the basis for their 'riskless' rate of return calculations? Are they using 1.92% or 2.92% for a five year duration?

In other words, are US Treasuries still a risk free asset? Or are they risk free only with an unusually expensive Credit Default Swap? Expensive, that is, for the reserve currecy of the world.

Usually that detail is so small its lost in the noise, but with default risk now at about 50% of nominal return, that is a significant consideration.

Three Fourths of the European Public Blames the Central Banks for the Financial Crisis

This just in from the central-bank-friendly folks over at the Central Bank Publications of the UK.

"Although people still think that commercial and investment bankers are primarily to blame, according to the latest FT/Harris poll of European public opinion 74% of respondents think central bankers were entirely or largely responsible (with less than 60% blaming regulators or governments)."

Our interpretation of the poll is that the European public believes that the financial crisis was caused undoubtedly by the commercial and investment bankers, but that the central bankers promoted the environment that allowed it to occur and had the responsibility for preventing it.

That is rather surprising, because Trichet and his predecessors have been as Jacksonian stalwarts compared to Easy Al and Zimbabwe Ben.

It would have been interesting to see the poll, and to have added a question about monetary policy and a return to 'hard money.'

A similar poll in the States, however, had very different results:

Q: Who is responsible for the financial crisis sweeping the world?

34% Whatever is wrong, Obama will save us.

33% Will they reschedule American Idol because of the President?

11% Sorry I'm in a hurry to buy 'supplies' and apply for a passport

22% Can I have a bite of your sandwich?

One might infer that the Federal Reserve and Wall Street have a much closer relationship with the mainstream media, among other things.

Central Bank News (UK)

The public starts to blame central bankers

Central bankers have had a pretty good crunch so far. Mervyn King came in for a lot of stick for being caught off guard at the beginning, when the Bank of England dropped the ball over Northern Rock, but as the financial tempest has gathered force, engulfing so many of the great names of finance, that episode has faded into relative insignificance.

At the ECB, Jean-Claude Trichet has had a good credit war, appearing to take the cares of the entire world on his shoulders while maintaining his dignity. Ben Bernanke, like the others, has been seen to be innovative in devising innumerable new schemes to support the banking system and the wider economy. All have used whatever instruments are available to them, stretching their legal powers and mandates to the limit. As they had to.

Yet the forces unleashed by the crisis are so powerful all this could change very quickly. Already there is evidence that the general public is ready to pin more of the blame for the crisis on central banks. Although people still think that commercial and investment bankers are primarily to blame, according to the latest FT/Harris poll of European public opinion 74% of respondents think central bankers were entirely or largely responsible (with less than 60% blaming regulators or governments).

With the likelihood that the financial landscape to emerge from this firestorm, once the fog has cleared, will bear very little resemblance to the former one, it seems inevitable that central banks' mandates and modus operandi will also need to be recast. But that can wait.

24 February 2009

Coup d'Etat by Crisis

"Necessity is the plea for every infringement of human freedom. It is the argument of tyrants; it is the creed of slaves." William Pitt (1759-1806)

Quite the dire, almost inflammatory piece from Time Magazine. It certainly paints Bank of America, Citigroup, General Motors, and AIG in a bad, almost villainous light.

It is time to for a real change. It is time to stop allowing the country to be held hostage by a relatively small number of financiers who have gamed the system and corrupted the regulatory and legislative process. It is time to stop allowing those deeply involved with the problem to manage the investigation and the solutions.

Put the money center banks into a managed restructuring, and stop calling it nationalization, which wrongfully suggests the British socialism of the post World War II era. We did not have to use that sort of language or raise these emotional issues when the Savings and Loan scandal was cleared.

Let's get this open sore cleaned, bound and stitched.

But one thing we might wish to keep in mind is that it may not be AIG, BAC, and C that are pulling the strings, that are at the center of this. They look more like patsies than prime motivators.

Transparency would be interesting in this case with regards to the CDS market and the derivatives markets.

Who has the most to gain and lose if Citi, Bank of America, and AIG are put into managed restructuring? Who has the most and biggest bets on their failure?

Let's have transparency of positions now. And we cannot afford to take anyone's word on this.

The real sticking point is not the shareholders or managers of these companies, although they may be making the most noise at this point.

We will be surprised, if transparency is actually provided, and new and independent regulators armed with the full array of investigative tools, dig into this mess to see where the strings lead, if we do not find many of them in the hands of the other major Wall Street banks, media giants, and corporate conglomerates, among others.

We will keep an open mind, but do not expect any light or serious new information to come from these Congressional Committees with their circus, show trial atmosphere.

Time to bring back Glass-Steagall and to enforce the Sherman Anti-Trust laws. Time to compel the three or four banks to unwind their trillions in opaque derivatives. Time to audit the Federal Reserve, and clarify their role in our system to them, and nail a copy of the Constitution to their front door.

We do not need or want fewer, bigger, more powerful banks as a drag on the real economy, taking a tax on each transaction whether it be through credit cards or fees or loans or subsidies.

Time for a real change. Time to remind Congress where the power and legitimacy of their offices resides. Time for the lobbyists, corrupt regulators, corporate princes and the enablers and motivators of this grand theft to find a place in an unemployment line or a witness stand.

We must demand action from the Congress and the Administration who we recently put in place through the elections to clean this mess up and then change the system that delivered it.

Contact the White House

Contact Your Senator

We do not want fewer, bigger banks exacting a fee on every commericial transaction in this country.

1. Bring back Glass-Steagall.

2. Clean up the derivatives mess, starting with J.P. Morgan.

3. Enforce the various anti-trust laws, enacting new ones where necessary, and break up the media and banking conglomerates.

4. Enact aggregate position limits in all commodity markets and transparency with immediate disclosure of all position over 5% in any market.

5. Effective restrictions and enforcement of naked short selling, price manipulation, reinstatement of the 'uptick rule,' the prohibition of regulated banks from engaging in any speculative markets either for themselves or as agents, and usury laws and regulation of all interstate financial transactions at the national level.

And for the sake of the country, establish a vision, a model, of what the system should look like in accord with the Constitution. And then strike out for it, as painful as that may be, and stop this management by crisis, and weaving a shroud for our freedom out of a web of endless fixes, concessions and necessities.

"If there must be trouble, let it be in my day, that my child may have peace." Thomas Paine

Time

AIG's Plan to Bleed the Government Dry

By Douglas A. McIntyre

Tuesday, Feb. 24, 2009

Management at AIG has calculated exactly how much money the Treasury and Fed will have access to after all of the TARP, financial stimulus, and mortgage bailout projects have been funded. The insurance company then plans to ask for whatever is left to fund its deficits so that it can stay in business, effectively making the federal government insolvent.

According to CNBC, AIG is about to post another huge loss. "Sources close to the company said the loss will be near $60 billion due to writedowns on a variety of assets including commercial real estate." The financial channel also reports that the need for capital may be so great that AIG might have to enter Chapter 11, something the government has spent over $130 billion trying to prevent.

Just like Detroit, Bank of America (BAC), and Citigroup (C), AIG is playing a game of chicken with Washington that the government does not feel it can afford to lose. Imagine what it would be like if all of these businesses failed at the same time.

It is actually worth imagining. The government has so many balls in the air between the financial systems and deteriorating parts of the industrial sector that it may not have either the capital or intellectual capacity to go around. The Treasury has just appointed a prominent investment banker to help oversee the mess in Detroit, but it would take an army of financiers to first comprehend and then advise on what should happen to GM (GM) and Chrysler. The period for comprehension is already in the past. The trouble in the auto industry has to be addressed in the next few weeks or its capacity to operate will go up in flames.

The government made noises about taking a larger position in Citigroup (C). Based on the market's reaction, not may analysts and investors believe that the action will solve much. The poison of bad investments is in the blood of the financial system. Quarantining Citigroup will not solve that problem. The Treasury and Fed will have to take a holistic approach which involves healing the entire financial system. It is not clear that can even be done. How it would be done is an even more complicated matter.

The Little Dutch Boy is running out of fingers. The water that threatens to swamp the international financial system is getting closer to breaching the walls and pouring in. A month ago that seemed inconceivable. Now the odds that the government will have to allow large operations like AIG go into bankruptcy are fairly high. The trouble with that is not what will happen to AIG. As the market found out with the Lehman Brothers bankruptcy, many of the firms that are doing business with a very large financial institution when it becomes insolvent can have transactions worth billions of dollars wither voided or devalued.

In the intricate global financial system, there is no such things as one big player going down in a vacuum.

SP Monthly Chart and Short Term Indicators

The SP 500 is on a critical support level.

We're getting very close to the point where we either get a technical bounce, or the stock markets start breaking down dramatically.

Keep an eye out for one more plunge down and then a short covering rally. If that rally fails we could see a continuation down in a crash, albeit one in slow motion.

A technical bounce here is a higher probability but more downside is very possible.

23 February 2009

Our Orwellian World: The Language of Looting

What "Nationalize the Banks" and the "Free Market" Really Mean in Today's Looking-Glass World

The Language of Looting

By Michael Hudson

...Exactly what does “a free market” mean? Is it what the classical economists advocated – a market free from monopoly power, business fraud, political insider dealing and special privileges for vested interests – a market protected by the rise in public regulation from the Sherman Anti-Trust law of 1890 to the Glass-Steagall Act and other New Deal legislation?

Or is it a market free for predators to exploit victims without public regulation or economic policemen – the kind of free-for-all market that the Federal Reserve and Security and Exchange Commission (SEC) have created over the past decade or so?

It seems incredible that people should accept today’s neoliberal idea of “market freedom” in the sense of neutering government watchdogs, Alan Greenspan-style, letting Angelo Mozilo at Countrywide, Hank Greenberg at AIG, Bernie Madoff, Citibank, Bear Stearns and Lehman Brothers loot without hindrance or sanction, plunge the economy into crisis and then use Treasury bailout money to pay the highest salaries and bonuses in U.S. history.

Terms that are the antithesis of “free market” also are being turned into the opposite of what they historically have meant. Take today’s discussions about nationalizing the banks. For over a century nationalization has meant public takeover of monopolies or other sectors to operate them in the public interest rather than leaving them so special interests. But when neoliberals use the word “nationalization” they mean a bailout, a government giveaway to the financial interests....

Read the rest of Michael Hudson's essay here.

Nassim Taleb Says "US Financial System Designed to Blow Up"

Nassim Taleb had an extraordinarily good interview on Bloomberg Television today.

It is worth it. The story on Bloomberg does not really capture what he said and how he said it.

Click here to See the Nassim Taleb On Bloomberg Television

The Fed's Balance Sheet Strategy to Support Qualitative Easing: A Synopsis

“They [the Fed's financial crisis programs] all make use of the asset side of

the Federal Reserve’s balance sheet. That is, each involves the Fed’s

authorities to extend credit or purchase securities.”

Ben Bernanke, London School of Economics, January 13, 2009

The Fed's strategy is to expand Balance Sheet and to change the mix of the financial assets it holds to stimulate specific troubled markets.

As you will recall, the Fed's Balance Sheet provides the backing for the US Dollar currency among other things, and traditionally has consisted of gold, US Treasury Debt, and the explicitly guaranteed debt of agencies like Ginnie Mae.

What the Fed is doing is expanding the assets on its Balance Sheet, which is quantitative easing, but is doing it by adding specifically targeted non-traditional assets.

The Bernake Fed distinguishes its own approach from the "quantitative easing" of the Bank of Japan. It is an expansion of the central bank's balance sheet, but in the case of the Fed, with a bias. Bernanke calls it 'credit easing' while we prefer to call it 'qualitative easing.'

The Fed is deciding specifically where and to whom to apply its qualitative easing.

This is the controversial part of the program, because the Fed no longer manages the money supply and interest rates, and the general health of the banking system, but targets specific markets and companies for its monetization efforts.

In effect, one might say that the Fed has begun to assume a central planning role for the economy that decides, with specifics, who fails and who survives to succeed. What is troubling in particular is that so far the Fed has retained the perogative to do this without disclosure of the specifics even to Congress.

Bernanke divides the use of balance sheet assets into three groups:

1. lending to financial institutions,

2. providing liquidity to key credit markets, and

3. purchasing longer-term securities.

What does "Buying Longer Term Securities" mean? In November 2008, the Federal Reserve announced plans to purchase the direct

obligations of the housing-related government-sponsored enterprises (GSEs),

specifically Fannie Mae, Freddie Mac, and the Federal Home Loan Banks. In

principle, the extra demand for these obligations is designed to increase the

price of the securities and thereby lower rates paid for mortgages.

Additionally, the Fed outlined plans to purchase mortgage-backed securities

backed by Fannie Mae, Freddie Mac, and Ginnie Mae. These actions were designed

to improve the availability of credit for the purchase of houses, therefore

supporting the housing markets and financial markets in general.Source: The Federal Reserve

Europe to Push Broader Regulatory Agenda at G20

This is interesting because it tees up the European agenda ahead of the G20 meeting, and helps to highlight some points of contention between Europe and the Anglo-American financiers.

The IMF subject is a reflection of Europe's decentralized status. The ECB does not possess the broad powers of the Federal Reserve Bank, and there is a difference of opinion in Europe about its future role, and the centralization of power overall.

This is highly reminiscent of the US debate between the Federalists and the Jeffersonians.

MarketWatch

Europe supports broad financial regulation

By MarketWatch

12:42 p.m. EST Feb. 22, 2009

SAN FRANCISCO (MarketWatch) -- The European leaders of the Group of 20 called Sunday for more transparency and regulation of all financial markets, products and investors, including hedge funds, according to published reports.

Heads of state and finance ministers from France, Germany, Italy, the Netherlands, Spain, the United Kingdom, the Czech Republic and Luxembourg met in Berlin to come up with a European position ahead of the G20 summit in London scheduled for April 2...

Leaders also reportedly proposed increasing to $500 billion the International Monetary Fund's financial resources for crisis management, in light of problems recapitalizing banks in Central and Eastern Europe. The IMF now has $250 billion in resources and already used $50 billion.

The call for increased IMF funding follows remarks from French Finance Minister Christine Lagarde, who said Thursday that euro-zone countries should come to the aid of any troubled member-state and avoid IMF involvement, if a bailout becomes necessary....

SP 500 Still Overvalued by 46% as Dividends Plummet at Record Pace

We have not reached a sustainable bottom yet in US equity prices despite the infomercials and chief strategist's exhortations to buy them while they are cheap on the financial news channels.

We have not reached a sustainable bottom yet in US equity prices despite the infomercials and chief strategist's exhortations to buy them while they are cheap on the financial news channels.

Stocks are valued based on their returns, and those returns are based on real cash flow and profits paid out to shareholders as dividends or stock buybacks to boost share prices.

For too many years US companies have essentially robbed Peter to pay Paul, servicing short term profits by offshoring US jobs, manipulating their balance sheets, and appropriating the savings of the world through the US reserve currency mechanism.

We've just about run out of track on that line, and are heading for a hard stop at a much lower level. At some point the market will perceive that the economy is improving and that the outlook for corporate profits is positive. Stocks will reflect this about six months in advance.

But there will be no recovery until the banking system is reformed and restructured, and the median wage begins to increase enough to support both savings and increased consumption.

Making additional debt available first as a cure is nonsensical, because the debt we have cannot be serviced and must be written off. To do so is Ponzi economics, which is what Greenspan was practicing, and why the decline has been so precipitous.

The longer we avoid making the necessary changes, the more we risk an involuntary default.

Bloomberg

Dividends Falling Most Since ’55 Means S&P 500 Still Expensive

By Michael Tsang

Feb. 23 (Bloomberg) -- The fastest reduction in U.S. dividends since 1955 is depriving investors of the only thing that gave stocks an advantage over government bonds in the last century.

U.S. equities returned 6 percent a year on average since 1900, inflation-adjusted data compiled by the London Business School and Credit Suisse Group AG show. Take away dividends and the annual gain drops to 1.7 percent, compared with 2.1 percent for long-term Treasury bonds, according to the data. (And don't bother factoring in anything for that old-fashioned concept called 'risk' - Jesse)

A total of 288 companies cut or suspended payouts last quarter, the most since Standard & Poor’s records began 54 years ago, when Dwight D. Eisenhower was president. While the S&P 500 is trading at the lowest price relative to earnings since 1985 and all 10 Wall Street strategists tracked by Bloomberg forecast a rally this year, predictions based on dividends show shares are overvalued by as much as 46 percent.

“It’s a greater fool theory if we always buy stocks based on earnings and we never get a penny out of it, hoping for someone to buy that stock at a higher price,” said James Swanson, chief investment strategist at MFS Investment Management in Boston, which oversees $134 billion. “Dividends have been a cushion in bad times. If they go to zero it’s a disaster.” (The real disaster is that the US is running out of greater fools. - Jesse)

Twenty-five companies in the S&P 500 saved almost $17 billion by cutting or suspending outlays this year, more than all the reductions from 2003 to 2007, when the index returned 83 percent. On a per-share basis, S&P 500 companies may trim payouts 13 percent this year, the biggest drop since 1942 ...

US Considers a 40% Ownership of Citigroup, Diluting the Common Shares

Citigroup is the prime candidate for receivership.

Citigroup is the prime candidate for receivership.

The only reason to continue this charade, other than to inspire us with confidence in the opaque duplicity of this Administration, is to preserve the shareholders who would almost certainly be wiped out, and the bondholders who would get a high and tight haircut, in the kind of restructuring that Citigroup requires as an insolvent institution.

Larry Summers and Tim Geithner are promoting this crony capitalist approach to preserve the wealth of a few at the expense of the many.

Wall Street Journal

U.S. Eyes Large Stake in Citi

By David Enrich and Monica Langley

February 23, 2009

Taxpayers Could Own Up to 40% of Bank's Common Stock, Diluting Value of Shares

Citigroup Inc. is in talks with federal officials that could result in the U.S. government substantially expanding its ownership of the struggling bank, according to people familiar with the situation.

While the discussions could fall apart, the government could wind up holding as much as 40% of Citigroup's common stock. Bank executives hope the stake will be closer to 25%, these people said.

Any such move would give federal officials far greater influence over one of the world's largest financial institutions. Citigroup has proposed the plan to its regulators. The Obama administration hasn't indicated if it supports the plan, according to people with knowledge of the talks.

When federal officials began pumping capital into U.S. banks last October, few experts would have predicted that the government would soon be wrestling with the possibility of taking voting control of large financial institutions. The potential move at Citigroup would give the government its biggest ownership of a financial-services company since the September bailout of insurer American International Group Inc., which left taxpayers with an 80% stake. The talks reflect a growing fear that Citigroup and other big U.S. banks could be overwhelmed by losses amid the recession and housing crisis. Last week, Citigroup's share price fell below $2 to an 18-year low. Bank executives increasingly believe that the government needs to take a larger ownership stake in the institution to stop the slide.

The talks reflect a growing fear that Citigroup and other big U.S. banks could be overwhelmed by losses amid the recession and housing crisis. Last week, Citigroup's share price fell below $2 to an 18-year low. Bank executives increasingly believe that the government needs to take a larger ownership stake in the institution to stop the slide.

Under the scenario being considered, a substantial chunk of the $45 billion in preferred shares held by the government would convert into common stock, people familiar with the matter said. The government obtained those shares, equivalent to a 7.8% stake, in return for pumping capital into Citigroup.

The move wouldn't cost taxpayers additional money, but other Citigroup shareholders would see their stock diluted. A larger ownership stake by the government could fuel speculation that other troubled banks will line up for similar agreements.

Bank of America Corp. said Sunday that it isn't discussing a larger ownership stake for the government. "There are no talks right now over that issue," said Bank of America spokesman Robert Stickler. "We see no reason to do that. We believe the goal of public policy should be to attract private capital into the bank, not to discourage it...."

22 February 2009

Why Is This Bubble Different From All Other Bubbles?

This Bubble is different from all other bubbles not because of its size, which is truly enormous, but because home ownership is much more broadly held by the public and more integral to the real economy than all the other bubble components which the lunatic Fed has nutured in the US in the last 100 years.

This is going to leave a mark.

The Word for This Week

Demagoguery refers to a strategy for gaining political power by appealing to the popular prejudices, emotions, fears and expectations of the public — typically via impassioned rhetoric and propaganda, and often using nationalist or populist themes, usually singling out a group or groups.

Also see Demagogue

The word for this week, and likely for this year, and the next.

No, not demagogue or demagogy. The Word for the Week is "them."

Why should we help them.

Why should we help them.We are being dragged down by them.

Blaming them feels good. It makes one feel as if they were successful, not part of the problem.

It wasn't us, it was them.

They caused their own problems. They caused our problems. It is unfortunate but they would be better off somewhere else, out of sight, no longer an impairment or competition for scarce resources.

They are the scapegoats, usually singled out by the group or groups that caused the problems, and even those who benefited indirectly, made some money out of the bubble, less deservedly  than they might like to imagine.

than they might like to imagine.

They are the weak, the poor, the defenseless, the different, the other.

And the circle of the ones that are considered them spreads wider and wider.

Because even those shouting and waving their fists in the crowds against them are also them to someone else higher in the power structure. Useless eaters is a relative objectification of the human.

And then someone will come and take them away, where they do not wish to go.

And then comes the descent into madness and destruction, for all.

One might ask, "But Jesse, you have inveighed against the Bankers on numerous occasions. How is that different? Aren't you a demagogue too, with just a different opinion?

No. All banks are not bad. All who work at banks, even the biggest Wall Street banks, are not bad. Even all those who turned a blind eye to what went on around them are not bad, just weak, distracted, overwhelmed.

But there were prime actors in this tragedy. The first objective is to stop it, to reform the system, to end the imbalances. And it would be disingenuous to not notice that the big Wall Street Banks, and the rating agencies and accounting firms, were at the epicenter of the financial crises for the past ten years. They were the lobbyists, the financial engineers, the architects of fraud, the enablers of many frauds going back to Enron and beyond.

Cui bono? Who benefited the most?

It was not so much the poor slob acting foolishly on bad advice. It was the joker taking millions off the table time after time by gaming the system, and actively promoting the bubble culture and deep capture that knocked out the regulatory process and the rule of law.

And then the law can deal with individual transgressions, and the emphasis here is "individual." Not a lynching of the bystanders. A serious investigation with individual accountability and equal protection.

That is not demagoguery. That is justice, because it is based on law and individual actions.

20 February 2009

Volcker's Vision of a Return to Narrow Banking

A return to 'narrow banking' is in the cards. This is the kind of bank which takes depositors funds and originates and services loans to its own customers.

A return to 'narrow banking' is in the cards. This is the kind of bank which takes depositors funds and originates and services loans to its own customers.

These banks will be separate from investment banks and hedge funds, which will perform the speculation and packaging, and what can loosely be called financial engineering.

But look for much more uniform regulation and transparency to appear in these non-banking operations, and less acceptance for 'dark pools' and opaque market manipulation.

And for those who say we will lose this type of person to less regulated overseas venues, there will be a new attitude to cross border banking and restrictions on the activity of institutions that do not adhere to a uniform set of standards.

It will be an even greater step in the right direction if we can realize that this same sort of regime should prevail in overseas trade as well. There will be little taste for the toleration of sweatshops, child labor, and the virtual slavery that multinational business craves, and justifies with the most venal and shallow of arguments.

AP

Volcker sees crisis leading to global regulation

By Eileen Aj Connelly, AP Business Writer

Friday February 20, 6:29 pm ET

Volcker sees greater international cooperation on regulations growing from economic crisis

NEW YORK (AP) -- "Even the experts don't quite know what's going on."

Speaking to a number of those experts Friday, Paul Volcker, a top economic adviser to President Barack Obama, cited not only the lack of understanding of the global financial meltdown but the "shocking" speed with which it had spread across the world.

"One year ago, we would have said things were tough in the United States, but the rest of the world was holding up," Volcker told a conference featuring Nobel laureates, economists and investors at Columbia University in New York. "The rest of the world has not held up."

In fact, the 81-year-old former chairman of the Federal Reserve said, "I don't remember any time, maybe even the Great Depression, when things went down quite so fast."

He noted that industrial production is falling in countries across the globe faster than in the U.S., one result of the decline caused by the breakdown of unbridled financial markets that operated on a global scale. "It's broken down in the face of almost all expectation and prediction," he noted.

"It's broken down in the face of almost all expectation and prediction," he noted.

Volcker didn't offer specifics on how long he thinks the recession will last or what will help start a recovery. But he predicted there will be some lasting lessons from the experience.

"I don't believe it will be forgotten ... and we will revert to the kind of financial system we had before the crisis," he said.

While he assured his audience of his confidence that capitalism will survive, Volcker said stronger regulations are needed to protect the world economy from such future shocks.

And he said he is concerned about the amount of power central banks, treasuries and regulatory agencies have acquired while trying to contain the meltdown.

"It is evident in the United States, and not just in the United States, the central bank is taking on a role that is way beyond what a central bank should be taking," he said.

Volcker stressed the importance of international cooperation in creating a new regulatory framework, particularly for major banks that operate across national boundaries -- the reverse of what's happened in recent years.

"The more international agreement we have on where we want to get to, the better off we'll be," Volcker said.

And while major banks should be more tightly controlled and less able to make the sort of risky bets that led to their current debacle, Volcker said there should also be more oversight of some kind for hedge funds, equity funds and the remaining investment banks.

He scoffed at the notion that those entities must be free to innovate -- stating that financial "innovations" like asset backed securities and credit default swaps have brought few benefits. The most important "innovation" in banking for most people in the last 20 or 30 years, he maintained, is the automatic teller machine.

Major Banks Will Be Nationalized Eventually: Wall Street's Dirty Little Secret

Why doesn't the Street wish you to realize this? First and foremost, the days of big bonuses and big earnings are over. Banks will increasingly become, once again, institutions to support savings and lending, with insured depositors accounts as a major source of capital.

The leveraged days and market speculation for the big money center banks is over.

We no longer need big salaries to retain traders in the banks because they won't be doing much trading for their own accounts anymore. That will be left to the brokerages.

They won't be writing insurance, they won't be taking huge short positions in commodities, and they won't be to big to fail, at least not to this degree with single institutions threatening national solvency.

We need to strike a model of what wish to have as a national financial system, and begging to invest towards that, and not try to reflate a bubble that ought never to have existed in the first place.

Nationalization does not mean the banks will be run by the government. It means that they will be taken into receivership, broken up, and made once more into banks. Those which are not nationalized must be constrained by a new "Glass-Steagall" law limiting their ability to imperil the national economy for their own personal gambling interests.

That is the point that is being lost in this opaque analysis and muddled discussion. The Big Money Center Banks will be nationalized one way or the other. The only real variable is how much money they can take out of the system before it happens.

Bloomberg

Dodd Says Short-Term Bank Takeovers May Be Necessary

By Alison Vekshin

Feb. 20 (Bloomberg) -- Senate Banking Committee Chairman Christopher Dodd said banks may have to be nationalized for “a short time” to help lenders including Citigroup Inc. and Bank of America Corp. survive the worst economic slump in 75 years.

“I don’t welcome that at all, but I could see how it’s possible it may happen,” Dodd said on Bloomberg Television’s “Political Capital with Al Hunt” to be broadcast later today. “I’m concerned that we may end up having to do that, at least for a short time.”

Citigroup and Bank of America, which received $90 billion in U.S. aid in the past four months, fell as much as 36 percent today on concern they may be nationalized. Citigroup, based in New York, fell as low as $1.61. Bank of America, based in Charlotte, North Carolina, tumbled as low as $2.53.

President Barack Obama’s administration is resisting the idea of nationalizing banks, said Dodd, a Connecticut Democrat. “They prefer not to go that way for all of the reasons that we’re familiar with in terms of the symbolic notion of nationalization of major lending institutions,” he said.

The Obama administration strongly believes a “privately held banking system is the correct way to go,” White House spokesman Robert Gibbs told reporters at a briefing today. “That’s been our belief for quite some time, and we continue to have that,” Gibbs said.

‘Leeway’ on Compensation

Treasury Secretary Timothy Geithner has “an awful lot of leeway” in interpreting the restrictions on executive compensation included in the economic stimulus bill and opposed by the banking industry, Dodd said today.

Treasury officials are still examining how to implement the new compensation restrictions and have not yet determined whether they will apply to participants in the administration’s rescue plan or only to banks and companies that get cash injections from the Troubled Asset Relief Program.

Compensation consultants including Alan Johnson, founder of Johnson Associates Inc. in New York, said the rules may be “catastrophic” to Wall Street’s talent base. The caps made top- producing employees “nervous,” and those who can find other jobs will probably leave, said James Reda, who heads a compensation firm in New York.

“I’m sort of stunned in a way that some people are reacting the way they are about all of this,” Dodd said. “At a time like this, everyone needs to pull in the same direction.”

Dodd also said he doesn’t want U.S. automakers to go through a prepackaged bankruptcy or a “forced merger.” General Motors Corp., Ford Motor Co. or Chrysler LLC risk liquidation with such actions, Dodd said on the broadcast.