"US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941."

No matter how they wrap it, spin it, try to hide it, we have seen an epic expansion in the US monetary base not seen since 1932.

This monetary expansion has not yet reached into the broader money supply figures because it is not reaching the public, despite the chant from the "Yes We Can" Kid. Bernanke has most of that liquidity bottled up in a few big banks collecting an easy riskless spread, with some of it chasing beta in the speculative markets.

Ben can talk a tough game, and jawbone rates with his plans to someday return to normalcy. But at the end of the day, the US is playing out a well worn script that is highly predictable.

There are three choices the Sith Lords at the Fed and their western central bank apprentices have at this point: inflation, inflation, and inflation.

The only question is how and when it will become obvious even to the most stubborn believers in the

Dollar Über Alles. Ben will seek to control it, to unleash it from its cage very slowly, spread the pain to the US trading partners overseas.

The US dollar reserve currency status is faltering, but not yet under a serious assault. The monied elite will try to eliminate any serious competition, such as the euro or precious metals, by any and all means possible.

Greece is roughly 2.6% of the Eurozone GDP. California is 13% of the US.

How long they can continue this is anyone's guess. These things tend to play out slowly, over years. I do not expect the US dollar to fail precipitously in the manner of the Zimbabwe dollar or with Weimar Reichsmark, but rather to be devalued in a step-staggered manner, over time, until it stabilizes and the debts are liquidated.

When the US starts closing the greater portion of its 700+ overseas military bases, we will know that it has become serious about financial reform and balancing its books. Until then, all is posturing, self-interest, demagoguery, and deception.

Financial TimesA Greek crisis is coming to America

Financial TimesA Greek crisis is coming to America

By Niall FergusonFebruary 11 2010 02:00

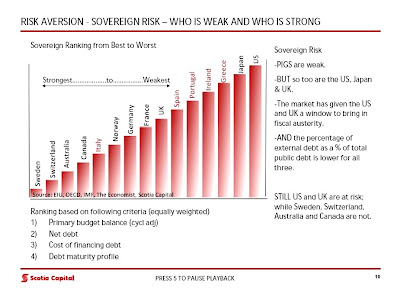

It began in Athens. It is spreading to Lisbon and Madrid. But it would be a grave mistake to assume that the sovereign debt crisis that is unfolding will remain confined to the weaker eurozone economies. For this is more than just a Mediterranean problem with a farmyard acronym.

It is a fiscal crisis of the western world. Its ramifications are far more profound than most investors currently appreciate...

Yet the idiosyncrasies of the eurozone should not distract us from the general nature of the fiscal crisis that is now afflicting most western economies.

Call it the fractal geometry of debt: the problem is essentially the same from Iceland to Ireland to Britain to the US. It just comes in widely differing sizes.

What we in the western world are about to learn is that there is no such thing as a Keynesian free lunch. Deficits did not "save" us half so much as monetary policy - zero interest rates plus quantitative easing - did. First, the impact of government spending (the hallowed "multiplier") has been much less than the proponents of stimulus hoped. Second, there is a good deal of "leakage" from open economies in a globalised world. Last, crucially, explosions of public debt incur bills that fall due much sooner than we expect

For the world's biggest economy, the US, the day of reckoning still seems reassuringly remote. The worse things get in the eurozone, the more the US dollar rallies as nervous investors park their cash in the "safe haven" of American government debt. This effect may persist for some months, just as the dollar and Treasuries rallied in the depths of the banking panic in late 2008.

Yet even a casual look at the fiscal position of the federal government (not to mention the states) makes a nonsense of the phrase "safe haven". US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941.

Even according to the White House's new budget projections,

the gross federal debt in public hands will exceed 100 per cent of GDP in just two years' time. This year, like last year, the federal deficit will be around 10 per cent of GDP. The long-run projections of the Congressional Budget Office suggest that the US will never again run a balanced budget. That's right, never.

The International Monetary Fund recently published estimates of the fiscal adjustments developed economies would need to make to restore fiscal stability over the decade ahead. Worst were Japan and the UK (a fiscal tightening of 13 per cent of GDP). Then came Ireland, Spain and Greece (9 per cent). And in sixth place? Step forward America, which would need to tighten fiscal policy by 8.8 per cent of GDP to satisfy the IMF.

Explosions of public debt hurt economies in the following way, as numerous empirical studies have shown. By raising fears of default and/or currency depreciation ahead of actual inflation, they push up real interest rates. Higher real rates, in turn, act as drag on growth, especially when the private sector is also heavily indebted - as is the case in most western economies, not least the US.

.jpg)

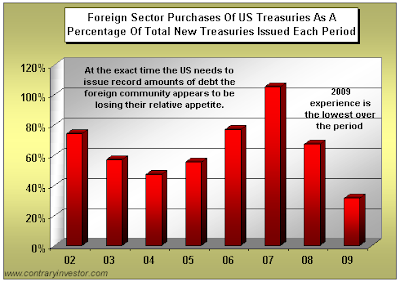

Although the US household savings rate has risen since the Great Recession began, it has not risen enough to absorb a trillion dollars of net Treasury issuance a year.

Only two things have thus far stood between the US and higher bond yields: purchases of Treasuries (and mortgage-backed securities, which many sellers essentially swapped for Treasuries) by the Federal Reserve and reserve accumulation by the Chinese monetary authorities.

But now the Fed is phasing out such purchases and is expected to wind up quantitative easing. Meanwhile,

the Chinese have sharply reduced their purchases of Treasuries from around 47 per cent of new issuance in 2006 to 20 per cent in 2008 to an estimated 5 per cent last year. Small wonder Morgan Stanley assumes that 10-year yields will rise from around 3.5 per cent to 5.5 per cent this year. On a gross federal debt fast approaching $1,500bn, that implies up to $300bn of extra interest payments - and you get up there pretty quickly with the average maturity of the debt now below 50 months.

The Obama administration's new budget blithely assumes real GDP growth of 3.6 per cent over the next five years, with inflation averaging 1.4 per cent. But with rising real rates, growth might well be lower. Under those circumstances, interest payments could soar as a share of federal revenue - from a tenth to a fifth to a quarter.

Last week Moody's Investors Service warned that the triple A credit rating of the US should not be taken for granted. That warning recalls Larry Summers' killer question (posed before he returned to government):

"How long can the world's biggest borrower remain the world's biggest power?"On reflection, it is appropriate that the fiscal crisis of the west has begun in Greece, the birthplace of western civilization. Soon it will cross the channel to Britain. But the key question is when that crisis will reach the last bastion of western power, on the other side of the Atlantic.

.jpg)