A "Cup and Handle" is a bullish continuation pattern in an uptrend.

The 'cup' is best shaped as a "U" and the broader the bottom the better. The 'handle' is a retracement when the right side of the 'cup' reaches its prior highs. The handle often resembles a bullish pennant.

The retracement usually does not exceed 1/3 of the advance of the cup to its second high, although it can go as deep as 1/2 in a volatile market.

Here is a textbook picture of a 'cup and handle formation' from Investopedia.

Here is the daily chart of Gold. It is in a classic cup and handle formation, with the handle having dropped down today near the 1/3 retracement target of 1183. A number of technicians have been watching it form. The advance to a new high, and the subsequent pullback, have made it now worth noting.

The handle has been shaping for four days from the peak at 1249.30. The handle generally takes from four days to two weeks to form before price advances again with fresh buying to retest the resistance around the prior high.

One might watch for the current Comex option expiration to pass next Tuesday, given the large concentration of calls around the 1200 level before gold can make its move higher. There is always the possibility of a counter squeeze, but it is difficult to fight paper with paper given the wide availablility of derivatives, and the laxness of regulation by the CFTC despite recent noises made about reform. Nothing has changed yet.

There is a possibility of a triple top, although this is why it is important that the cup have a broadly tested bottom.

The target for a breakout in this cup and handle formation above would be a minimum of 1450. The breakout should be accompanied by increasing volume. The more volume the more bullish the post breakout run will be.

This is consistent with the weekly chart which we posted a few days ago that shows an inverse H&S continuation pattern targeting 1350 as a minimum objective. In fact, one could draw the cup more conservatively, ignoring the intra-day spikes, and strike a target much closer to 1350.

And what makes this gold manipulation such a perfect con is that they are bullying the public using money taken from the Federal Reserve and the Congress, the public's own money.

What levels might be expected after the intermediate targets are reached?

My friend Brian at the Contrary Investor has produced a series of targets based on the prior high deflated by a number of measures. Here is one that I thought had a certain 'ring' to it. Keep in mind that M2 is a moving target, and moving lower for now. If it turns around and begins to expand again, the price could be much higher. But for now it is in a firm downtrend. So it conceivably could be lower.

Gold Deflated By M2 Projects to $3,912 to Match Its Prior High

Here are targets for gold and silver based on their prior highs but adjusted for inflation using the Bureau of Labor Statistics CPI, and John Williams' (SGS) unadjusted CPI estimates.

If Silver were to reach $450 per ounce, and gold to $7,500, the junior miners might provide a quite impressive performance. lol.

19 May 2010

Gold Is In a Classic Cup and Handle Formation Targeting 1,450

Bear Raid In Gold Results in an Historic One Day Liquidation: Höllenmädchen Merkel und die Straßenschreier

According to John Brimelow:

"Open interest plunged 21,256 lots, 66.11 tonnes or 3.53%, one of the largest changes in history..."And this was before the latest round today after this early report.

Open Interest is the total number of contracts for a given future category. When the Open Interest declines on a marked price decrease this is generally considered the net liquidation of long positions. And conversely, on a rising price it is considered short covering. The weekly reports give more insight into who was doing the buying and selling. The report should be daily, and should include specific position changes for traders with aggregate positions higher than 5 percent of any total market for a specific product.

Next Tuesday is the option expiration for Calls and Puts on the Comex gold futures. There was a particularly large concentration of contracts at the 1200 level which we were watching from Monday when we promised you many market shenanigans in the coming option expiration, for both the mining stocks and precious metals.

We also picked up quite a bit more activity on the part of 'posting trolls,' who are traders both independent and with hedge funds who set the stage for major bear raids with sensationalistic statements and exaggerated 'headlines.'

The impunity with which this bear raid was conducted makes us wonder if the CFTC and SEC will ever do anything to clean up these markets. The best defense is not to rise to the bait, and trade in the short term in markets so obviously given to manipulation by large trading interests with fraudulent intents. These markets are tainted.

If the trend is broken it will be time to step aside. Until then we sell strength and buy weakness, slowly. For most it is better to take small incremental positions and then just let them ride the ups and downs.

As an aside, the hysteria, or Straßenschreier, with which the actions of Germany to curb naked short selling were greeted was very funny last night, and highly entertaining.

As you may not realize, naked short selling has been illegal in the US for some time, as least as far as equities are concerned. It was not enforced as the regulators turned a blind eye to many abuses that crept into the 'naturally efficient markets' on their watch. It is tantamount to counterfeiting, and in the hands of a party with pockets deep enough to permit it to dominate small markets, it is a blatant form of control fraud.

By the way, I hear that there has been almost no coverage of William K. Black's highly credible and shocking revelations on the public media in the States, outside of a piece on Bill Moyers' Journal. Can anything be so obvious as the control wielded by the corporatists?

But what is of concern to the Wall Street demimonde are their beloved CDS, which are as foul a form of white collar criminal abuse as ever has been seen since the creation of the Federal Reserve Bank. Any attempts to limit them will be resisted with threats, promises of dire outcomes and ruin, and buckets of money for politicians and regulators.

The rest of the world is beginning to act with revulsion at the destructive corruption of Washington and New York, and the American oligarchs.

Merkel made them squeal with her own version of shock and awe, and it was music to many ears. You go, Höllenmädchen.

Merkel und die Banken (Sarkozy ist Salieri)

18 May 2010

Merkel to The Banks and Hedge Funds: Sprechen Sie Deutsche? Then Droppen Sie Dead

There is much surprise that the German government has declared a ban on naked short selling, including CDS, as of midnight tonight, with no prior notice and the courtly deference demanded by the Banks when government chooses to regulate them. This action seems to have perturbed some and confused many.

The reason for this may be quite simple.

After tonight, when hedge funds and The Banks call upon German financial firms and European governments to make payments on Credit Default Swaps or other financial instruments that are subject to the ban, the Germans will have a rather large hammer in hand to help them to negotiate the terms, and respond to any threats and coercion.

Since the CDS will be deemed to be no longer legal, at least in the quantity and leverage desired by those gaming the system, the opportunity to default on them with the backing of the government may be an option. This seems quite similar to the stance that the Chinese government took on behalf of some Chinese firms that were caught on the wrong side of energy derivatives.

I have heard from several sources that there was a general disappointment in Europe and in some parts of Asia at the lack of progress being made in the US Congress towards creating meaningful reforms in their financial system. In fact, there is a widespread belief that Washington is being dictated to by the Banks, and that their lobbyists are directing the conversation, and in many cases writing the actual legislation. The final straw was when the Obama Administration itself sought to water down and block key provisions of the legislation to limit the power and size of the Banks.

"To some degree this is a battle between the politicians and the markets," she said in a speech in Berlin. "But I am firmly resolved -- and I think all of my colleagues are too -- to win this battle....The fact that hedge funds are not regulated is a scandal," she said, adding that Britain had blocked previous efforts to do this. "However, this will certainly have taken place in Europe in three weeks," she said, without giving more details." Reuters 6 May 2010

"German Chancellor Angela Merkel accused the financial industry of playing dirty. 'First the banks failed, forcing states to carry out rescue operations. They plunged the global economy over the precipice and we had to launch recovery packages, which increased our debts, and now they are speculating against these debts. That is very treacherous,' she said. 'Governments must regain supremacy. It is a fight against the markets and I am determined to win this fight.'"UK Telegraph 6 May 2010

The financiers have been saying that 'Europe cannot print money faster than Goldman Sachs can create naked Credit Default Swaps.' Well, Goldman can still create those swaps, but they may have trouble finding counterparties for them in Europe. And those who buy them may do so at their peril, since Europe is obviously seeking to isolate itself from the consequences of speculative excess by an overleveraged financial system.

The financiers have been saying that 'Europe cannot print money faster than Goldman Sachs can create naked Credit Default Swaps.' Well, Goldman can still create those swaps, but they may have trouble finding counterparties for them in Europe. And those who buy them may do so at their peril, since Europe is obviously seeking to isolate itself from the consequences of speculative excess by an overleveraged financial system.Merkel said she was going to reassert the primacy of government over the multinational speculators.

This is only the opening salvo. It will not be effective without further effort. And it is likely to draw the ire and criticism of the corporate media in NY and London, and the financiers' well-kept demimonde.

"Oh no, naked CDS are essential to price discovery. Naked shorting adds liquidity. The system will fall apart if you do not let the Banks have their way with the global economy. Oh my God, someone in government actually did something that was not vetted and pre-approved by the Wall Street Banks. They have actually outlawed naked shorting, which is tantamount to legalized counterfeiting. How dare that headstrong and impertinent frau Dr. Merkel attempt to protect her people from the gangs of New York!"But one has to admit that the lady has style, and, unlike her American counterpart, is not afraid to occasionally take the wheel and drive, rather than sit in the back seat offering platitudes, and fine sounding words, and toothlessly petulant criticism.

Bloomberg

Germany to Ban Naked Short-Selling at Midnight

By Alan Crawford

May 18, 2010

May 18 (Bloomberg) -- Germany will temporarily ban naked short selling and naked credit-default swaps of euro-area government bonds at midnight after politicians blamed the practice for exacerbating the European debt crisis.

The ban will also apply to naked short selling in shares of 10 banks and insurers that will last until March 31, 2011, German financial regulator BaFin said today in an e-mailed statement. The step was needed because of “exceptional volatility” in euro-area bonds, the regulator said.

The move came as Chancellor Angela Merkel’s coalition seeks to build momentum on

financial-market regulation with lower- house lawmakers due to begin debating a bill tomorrow authorizing Germany’s contribution to a $1 trillion bailout plan to backstop the euro. U.S. stocks fell and the euro dropped to $1.2231, the lowest level since April 18, 2006, after the announcement.

“You cannot imagine what broke lose here after BaFin’s announcement,” Johan Kindermann, a capital markets lawyer at Simmons & Simmons in Frankfurt, said in an interview. “This will lead to an uproar in the markets tomorrow. Short-sellers will now, even tonight, try to close their positions at markets where they can still do so -- if they find any possibilities left at all now.”

Merkel, Sarkozy

Merkel and French President Nicolas Sarkozy have called for curbs on speculating with sovereign credit-default swaps. European Union Financial Services Commissioner Michel Barnier this week called for stricter disclosure requirements on the transactions.

Allianz SE, Deutsche Bank AG, Commerzbank AG, Deutsche Boerse AG, Deutsche Postbank AG, Muenchener Rueckversicherungs AG, Hannover Rueckversicherungs AG, Generali Deutschland Holding AG, MLP AG and Aareal Bank AG are covered by the short-selling ban.

“Massive” short-selling was leading to excessive price movements which “could endanger the stability of the entire financial system,” BaFin said in the statement.

The European Union last month proposed that the Financial Stability Board, the group set up by the Group of 20 nations to monitor global financial trends, should “closely examine the role” of CDS on sovereign bond spreads. Merkel said earlier today that she will press the Group of 20 to bring in a financial transactions tax.

Merkel’s ‘Battle’

“In some ways, it’s a battle of the politicians against the markets” and “I’m

determined to win,” Merkel said May 6. “The speculators are our adversaries.”

Germany, along with the U.S. and other EU nations, banned short selling of banks and insurance company shares at the height of the global financial crisis in 2008. The country still has rules requiring disclosure of net short positions of 0.2 percent or more of outstanding shares of 10 separate companies.

The disclosure of the rules drew criticism from lawyers who said that they should have been announced well ahead of time.

“The way it’s been announced is very irresponsible, and it’s sent many market participants into panic mode,” said Darren Fox, a regulator lawyer who advises hedge funds at Simmons & Simmons in London. “We thought regulators had learned their lessons from September 2008. Where is the market emergency that necessitates the introduction of an overnight ban?”

Short-selling is when hedge funds and other investors borrow shares they don’t own and sell them in the hope their price will go down. If it does, they buy back the shares at the lower price, return them to their owner and pocket the difference.

Credit-default swaps are derivatives that pay the buyer face value if a borrower -- a country or a company -- defaults. In exchange, the swap seller gets the underlying securities or the cash equivalent. Traders in naked credit-default swaps buy insurance on bonds they don’t own.

A basis point on a credit-default swap contract protecting $10 million of debt from default for five years is equivalent to $1,000 a year.

17 May 2010

Gold and Silver Intermediate Targets

Both Gold and Silver bullion have inverse H&S formations 'working' on their weekly charts with the breakouts above their current necklines.

As is easily seen on the gold chart below, this bull market move is a series of inverse head and shoulders bottoming formation as the gold bull struggles to rise against determined shorting from the bullion banks. Each formation is more properly called a 'consolidation formation in an uptrend' rather than a bottom.

Gold is currently above the neckline which is around $1200. While it remains above this neckline, the target for this leg of the move would be $1350 as a minimum measuring objective.

If the price breaks below 1200 it is no longer an active formation, but it remains potential while the price is above 1044.

Silver is much more volatile than gold, with a significantly higher risk beta. This is important to note if you are using any sort of leverage, including miners that have a heavy exposure to silver.

Silver has a massive inverse H&S bottom, that is 'working' while it is above 18.80. The target for this move is around $30 per ounce. But it remains valid and potential while the price of silver is above 16.

If the price of silver falls below 18.80 then the formation is not active. It remains valid however while the price is higher than 17.

The relationship between the miners and the bullion is leveraged, with a beta exposure to the SP 500. Further, gold is a more pure currency play than silver, which has a partial correlation to its industrial use.

It should be noted that in our opinion both markets are being subjected to significant manipulation by large short interests, which are particularly concentrated in the case of silver, and especially stubborn and 'official' in the case of gold, involving the central banks. This is our judgement based on the circumstantial evidence.

We also suspect that the Fed is buying across the US Treasury curve, but especially at the longer durations, and that the Treasury and Fed are working with one or more groups to support the equity markets primarily through the SP futures.

This adds quite a bit to the picture, although it is difficult to forecast since it is not natural market action and can distort the trends, but only in the short term.

SP Futures Have an Inauspicious Open for Options Expiration Week

The SP 500 Futures dropped to 1120 off the open this evening on weakness in Asia, and continued concerns about sovereign debt in the Eurozone. There is still plenty of overnight, thin volume trade to permit a bounce.

This is an option expiration week, so shenanigans will be in vogue as the banks trading desks take out the wash, and rinse.

16 May 2010

Western Elite Are in the Firm Grip of Fear, Fraud, and Denial

The lie is comfortable, an illusion easy to live with, familiar, and safe.

Writing from the 'disgraced profession' of economics, James K. Galbraith speaks of the unspoken, the many frauds and deceptions underlying the recent financial crisis centered in the US. Many will read this and shake their heads in agreement, but will be unable to take the next logical step and internalize the implications of the depth and breadth of the dishonesty that enabled it then, and continues to sustain it, even today. Galbraith is asking 'why' and framing a further inquiry into the consequences of this unwillingness to reform.

"Some appear to believe that "confidence in the banks" can be rebuilt by a new round of good economic news, by rising stock prices, by the reassurances of high officials – and by not looking too closely at the underlying evidence of fraud, abuse, deception and deceit. As you pursue your investigations, you will undermine, and I believe you may destroy, that illusion."It is easier to go with the flow, relax, rationalize, and be diverted and entertained by 'the show.' The truth may set you free, but before that it can make you feel very insecure and uncomfortable, especially when it requires challenging the 'official story' and policy decisions. Better to say nothing offensive to the oligarchs, and even occasionally to utter intelligent sounding condemnations of those who dare to question the very things you wonder about, and fear, in order to prove your loyalty and to reassure yourself that you are a right-thinking, practical individual. For the disparity that is unavoidably noticed between what is seen and what is said makes one uneasy, fearful that they are losing their bearings, if not reason. And the vested interests play on those fears. See Techniques of Propaganda

The consequences of 'extend and pretend' will be to worsen the final outcome, the day of reckoning.

"The initial deviation from the truth will be multiplied a thousandfold." AristotleThe banks must be restrained, the financial and political system reformed, and balance restored to the economy, before there can be any sustained recovery.

Alternet

Why the 'Experts' Failed to See How Financial Fraud Collapsed the Economy

By James K. Galbraith

May 16, 2010

Editor's Note: The following is the text of a James K. Galbraith's written statement to members of the Senate Judiciary Committee delivered this May.

Chairman Specter, Ranking Member Graham, Members of the Subcommittee, as a former member of the congressional staff it is a pleasure to submit this statement for your record.

I write to you from a disgraced profession. Economic theory, as widely taught since the 1980s, failed miserably to understand the forces behind the financial crisis. Concepts including "rational expectations," "market discipline," and the "efficient markets hypothesis" led economists to argue that speculation would stabilize prices, that sellers would act to protect their reputations, that caveat emptor could be relied on, and that widespread fraud therefore could not occur. Not all economists believed this – but most did.

Thus the study of financial fraud received little attention. Practically no research institutes exist; collaboration between economists and criminologists is rare; in the leading departments there are few specialists and very few students. Economists have soft- pedaled the role of fraud in every crisis they examined, including the Savings & Loan debacle, the Russian transition, the Asian meltdown and the dot.com bubble. They continue to do so now. At a conference sponsored by the Levy Economics Institute in New York on April 17, the closest a former Under Secretary of the Treasury, Peter Fisher, got to this question was to use the word "naughtiness." This was on the day that the SEC charged Goldman Sachs with fraud.

There are exceptions. A famous 1993 article entitled "Looting: Bankruptcy for Profit," by George Akerlof and Paul Romer, drew exceptionally on the experience of regulators who understood fraud. The criminologist-economist William K. Black of the University of Missouri-Kansas City is our leading systematic analyst of the relationship between financial crime and financial crisis. Black points out that accounting fraud is a sure thing when you can control the institution engaging in it: "the best way to rob a bank is to own one." The experience of the Savings and Loan crisis was of businesses taken over for the explicit purpose of stripping them, of bleeding them dry. This was established in court: there were over one thousand felony convictions in the wake of that debacle. Other useful chronicles of modern financial fraud include James Stewart's Den of Thieves on the Boesky-Milken era and Kurt Eichenwald's Conspiracy of Fools, on the Enron scandal. Yet a large gap between this history and formal analysis remains.

Formal analysis tells us that control frauds follow certain patterns. They grow rapidly, reporting high profitability, certified by top accounting firms. They pay exceedingly well. At the same time, they radically lower standards, building new businesses in markets previously considered too risky for honest business. In the financial sector, this takes the form of relaxed – no, gutted – underwriting, combined with the capacity to pass the bad penny to the greater fool. In California in the 1980s, Charles Keating realized that an S&L charter was a "license to steal." In the 2000s, sub-prime mortgage origination was much the same thing. Given a license to steal, thieves get busy. And because their performance seems so good, they quickly come to dominate their markets; the bad players driving out the good.

The complexity of the mortgage finance sector before the crisis highlights another characteristic marker of fraud. In the system that developed, the original mortgage documents lay buried – where they remain – in the records of the loan originators, many of them since defunct or taken over. Those records, if examined, would reveal the extent of missing documentation, of abusive practices, and of fraud. So far, we have only very limited evidence on this, notably a 2007 Fitch Ratings study of a very small sample of highly-rated RMBS, which found "fraud, abuse or missing documentation in virtually every file." An efforts a year ago by Representative Doggett to persuade Secretary Geithner to examine and report thoroughly on the extent of fraud in the underlying mortgage records received an epic run-around.

When sub-prime mortgages were bundled and securitized, the ratings agencies failed to examine the underlying loan quality. Instead they substituted statistical models, in order to generate ratings that would make the resulting RMBS acceptable to investors. When one assumes that prices will always rise, it follows that a loan secured by the asset can always be refinanced; therefore the actual condition of the borrower does not matter. That projection is, of course, only as good as the underlying assumption, but in this perversely-designed marketplace those who paid for ratings had no reason to care about the quality of assumptions. Meanwhile, mortgage originators now had a formula for extending loans to the worst borrowers they could find, secure that in this reverse Lake Wobegon no child would be deemed below average even though they all were. Credit quality collapsed because the system was designed for it to collapse.

A third element in the toxic brew was a simulacrum of "insurance," provided by the market in credit default swaps. These are doomsday instruments in a precise sense: they generate cash-flow for the issuer until the credit event occurs. If the event is large enough, the issuer then fails, at which point the government faces blackmail: it must either step in or the system will collapse. CDS spread the consequences of a housing-price downturn through the entire financial sector, across the globe. They also provided the means to short the market in residential mortgage-backed securities, so that the largest players could turn tail and bet against the instruments they had previously been selling, just before the house of cards crashed.

Latter-day financial economics is blind to all of this. It necessarily treats stocks, bonds, options, derivatives and so forth as securities whose properties can be accepted largely at face value, and quantified in terms of return and risk. That quantification permits the calculation of price, using standard formulae. But everything in the formulae depends on the instruments being as they are represented to be. For if they are not, then what formula could possibly apply?

An older strand of institutional economics understood that a security is a contract in law. It can only be as good as the legal system that stands behind it. Some fraud is inevitable, but in a functioning system it must be rare. It must be considered – and rightly – a minor problem. If fraud – or even the perception of fraud – comes to dominate the system, then there is no foundation for a market in the securities. They become trash. And more deeply, so do the institutions responsible for creating, rating and selling them. Including, so long as it fails to respond with appropriate force, the legal system itself.

Control frauds always fail in the end. But the failure of the firm does not mean the fraud fails: the perpetrators often walk away rich. At some point, this requires subverting, suborning or defeating the law. This is where crime and politics intersect. At its heart, therefore, the financial crisis was a breakdown in the rule of law in America.

Ask yourselves: is it possible for mortgage originators, ratings agencies, underwriters, insurers and supervising agencies NOT to have known that the system of housing finance had become infested with fraud? Every statistical indicator of fraudulent practice – growth and profitability – suggests otherwise. Every examination of the record so far suggests otherwise. The very language in use: "liars' loans," "ninja loans," "neutron loans," and "toxic waste," tells you that people knew. I have also heard the expression, "IBG,YBG;" the meaning of that bit of code was: "I'll be gone, you'll be gone."

If doubt remains, investigation into the internal communications of the firms and agencies in question can clear it up. Emails are revealing. The government already possesses critical documentary trails -- those of AIG, Fannie Mae and Freddie Mac, the Treasury Department and the Federal Reserve. Those documents should be investigated, in full, by competent authority and also released, as appropriate, to the public. For instance, did AIG knowingly issue CDS against instruments that Goldman had designed on behalf of Mr. John Paulson to fail? If so, why? Or again: Did Fannie Mae and Freddie Mac appreciate the poor quality of the RMBS they were acquiring? Did they do so under pressure from Mr. Henry Paulson? If so, did Secretary Paulson know? And if he did, why did he act as he did? In a recent paper, Thomas Ferguson and Robert Johnson argue that the "Paulson Put" was intended to delay an inevitable crisis past the election. Does the internal record support this view?

Let us suppose that the investigation that you are about to begin confirms the existence of pervasive fraud, involving millions of mortgages, thousands of appraisers, underwriters, analysts, and the executives of the companies in which they worked, as well as public officials who assisted by turning a Nelson's Eye. What is the appropriate response?

Some appear to believe that "confidence in the banks" can be rebuilt by a new round of good economic news, by rising stock prices, by the reassurances of high officials – and by not looking too closely at the underlying evidence of fraud, abuse, deception and deceit. As you pursue your investigations, you will undermine, and I believe you may destroy, that illusion.

But you have to act. The true alternative is a failure extending over time from the economic to the political system. Just as too few predicted the financial crisis, it may be that too few are today speaking frankly about where a failure to deal with the aftermath may lead.

In this situation, let me suggest, the country faces an existential threat. Either the legal system must do its work. Or the market system cannot be restored. There must be a thorough, transparent, effective, radical cleaning of the financial sector and also of those public officials who failed the public trust. The financiers must be made to feel, in their bones, the power of the law. And the public, which lives by the law, must see very clearly and unambiguously that this is the case. Thank you.

James K. Galbraith is the author of The Predator State: How Conservatives Abandoned the Free Market and Why Liberals Should Too, and of a new preface to The Great Crash, 1929, by John Kenneth Galbraith. He teaches at The University of Texas at Austin.

Rick Santelli: Paper Gold Defaults and US Dollar Distortions

It is questionable whether Rick Santelli, maverick commentator on CNBC, gave Larry Kudlow the answer he was fishing for.

Santelli brings up the question of a divergence between the paper commitments to gold ownership, with the claims outstripping the actual bullion available. Rick keys in on the ETFs, but other disclosures seem to indicate that the problem is much more serious and close than even he might know.

The other point he raises of course is the distorted strength in the US dollar because of the outmoded structure in the DX index. It is heavily weighted to the euro, yen and the pound, which is hardly indicative of the state of the world trade or even GDP distribution perhaps.

The problem according to Santelli is that this apparent strength is causing people to ignore developing problems in the basis of dollar denominated assets, and slowing the calls for reform, and the restructuring of the economy that will help it to withstand the cold winds that will start blowing shortly in the States.

Rare to hear the truth spoken on CNBC these days, and refreshing when it comes out.

These hidden shoals are the foundation of the panic to come. And when it does come, it may sweep aside the facade of strength and stability like a hurricane. It will certainly exposed much corruption, and the decay of justice and public stewardship.

h/t Stacy Herbert at Max Keiser

14 May 2010

SP Futures Daily Chart

The SP futures set a higher low at support around 1122, and managed to rebound.

Follow through next week is everything. The prior low beckons, but the volumes are once again thin, and so amenable to efforts towards reflation.

“Pleasure can be supported by an illusion; but happiness rests upon truth.”

Sébastien-Roch Nicolas De Chamfort

Here is a slightly more detailed version of the same chart.

The resistance and support are part of a complex arithmetic progression.

The implications may not be so obvious, but they are worth thinking about.

13 May 2010

Bianco on Gold: And Now for Something Completely Different....

Jim Bianco noted on Bloomberg television this afternoon that gold has reached new highs in all major currencies this week, with the most recent high in the Swiss franc, for the first time in over thirty years.

The reason for this is a rush from, or a revulsion towards, paper assets. Gold is now the 'anti-paper' currency, particularly in mainland Asia and Europe.

What is ironic is that I told a friend three weeks ago that if gold went to new highs with the dollar while stocks fell, then he should watch out because it would mark a growing revulsion towards paper assets that would mark a sea-change in the world economy, and the beginning of the end for the dollar reserve currency. A long end perhaps, but the endgame nonetheless.

Investors who rush for safety into the dollar will discover that Bernanke is using their confidence rather badly as he continues to expand the money supply and direct liquidity to support the toxic balance sheets of the banks, including now his own.

The move in precious metals so far has been impressive. It is commonplace, or a truism, to say that 'everyone is long gold' and to short it here because it has moved to a new high.

This is a possible trade. But it could turn out badly if this trend continues, and even moreso, if the faith in the dollar becomes wobbly. As Jesse Livermore once said, 'never short a stock simply because it has gone up. '

If the dollar wobbles we will see a move in the metals that will make what has happened in this bull market so far this year look like a bump on the charts.

Why There is Fear and Resentment of Gold's Ability to Reveal the True Value of Financial Assets

There were a few questions raised about the note on the long term chart of the SP 500 deflated by gold which was posted last night, and which is reproduced here on the right, which read "This is why the financial engineers like Bernanke hate and fear gold; it defies their plans and powers."

The chart shows something that most investors have suspected. There has been no genuine recovery in the price of stocks since the decline that cannot be fully explained by the monetary inflation of the dollar, as can be discovered by the ultimate store of value, which is gold.

The chart shows something that most investors have suspected. There has been no genuine recovery in the price of stocks since the decline that cannot be fully explained by the monetary inflation of the dollar, as can be discovered by the ultimate store of value, which is gold.I thought that this was a fairly straightforward observation, but it apparently jarred a few people and their thinking. So perhaps we have some new readers who are not familiar with the long standing animosity towards gold that is uniformly expressed by all those who promote centralized command and control economies, from both the left and the right.

Can any astute observer doubt the Fed's desire to act in secret and privacy? Their obsession with this is almost unbelievable and beyond comprehension, unless one understands that they are in a 'confidence game,' and use persuasion and even illusion to shape perceptions, especially at the extremes of their financial and monetary engineering of the real economy.

This animosity and desire for secrecy was described by Alan Greenspan in his famous essay, Gold and Economic Freedom, first published in 1966. In a fairly amusing exchange between Congressman Ron Paul and the former Chairman a couple of years ago, Mr. Paul asked Sir Alan about this essay, and if he had any corrections or misgivings about it after so many years. Would he change anything?

"Not one word." replied Greenspan, in one of his few candidly honest and straightforward statements.

It helps to understand the dynamics of the money world, which appear so mysterious to those who do not specialize in it, even economists, although some may feign ignorance to promote their cause or avoid unpleasant disclosures.

Money is power. Ownership of the means of production may provide for the control of groups of disorganized labor. But the power of the issuance of money allows for the control of whole peoples and governments, through the distribution and transference of wealth, by the most subtle of means. And this is why the US Constitution relegated this power to the Congress and by their explicit appropriation, and denied it to the States and private parties except in the form of specie, that is, gold and silver which have intrinsic value.

It might be useful to review a prior post in reaction to the self-named maverick economist Willem Buiter, who wrote a few attacks on gold, prior to his leaving academia and the Financial Times to take a senior position with Citibank. Willem Buiter Apparently Does Not Like Gold

It may seem a bit perverse, but I do not favor a return to a gold, or a bi-metallic gold and silver standard at this time. Each nation can be free to devalue or deflate their own money supply as their needs require, with the consent and knowledge of the people and their representatives.

What I do promote is for gold and silver to trade freely without restraint or manipulation as a refuge from monetary manipulation, and a secure store of value for private wealth. When nations adopt the gold standard, they invariably seek to 'fix' and manipulate its price, and reserve the ownership to themselves, with the tendency to seize the wealth of their citizen under the rationale of such an ownership, or dominant privilege.

Let those who have a mind to it have the means of securing their labor and efforts, and let the state do as it will, with the open knowledge and consent of the world.

"Gold is not necessary. I have no interest in gold. We will build a solid state, without an ounce of gold behind it. Anyone who sells above the set prices, let him be marched off to a concentration camp. That's the bastion of money."A draconian approach no doubt. It is much more common for the ruling parties to debase the coinage secretively while advantaging their friends and supporters, thereby manipulating the value of gold and silver covertly.

Adolf Hitler

In modern times of non-specie currency one might choose to select a few cooperative banks and the central money authority to manipulate the price using paper and markets, and hope that this scheme will remain undiscovered. But it always comes out, the truth is always known in the end.

"With the exception only of the period of the gold standard, practically all governments of history have used their exclusive power to issue money to defraud and plunder the people."There are any number of amateur economists and investing pundits around these days who betray an almost irrational opposition to gold, becoming jubilant in every decline, and despondent at every rally. And some of them even take the label of 'Austrianism' in their thoughts which is quite odd given that it is one of their schools strongest bulwarks.

F. A. Von Hayek

Most often this can simply explained as the envy of those who have not prepared for a crisis, and wish ill upon those who have, regretting and hoping for another chance to provide for their own security. And yet they will fail to take advantage of every opportunity to do so, as they are creatures betrayed alternatively by their own fear and greed.

One of the best indications of quack advice on the question of investing in precious metals is when one of the reasons against it includes the scurrilous non sequitur, 'You can't eat it,' as if nutritional content is a valid measure of the durability of wealth. It betrays a lowness of argument and intellectual integrity that should promptly urge one to run in the other direction.

And regrettably, there are always those who will say almost anything for money, and the profession of economist seems to be particularly infested with that sort, given the stochastic nature of the discipline, and its lack of scientific rigor, being based on principles which do not easily lend themselves to objectification with serious damage to the data being made by the assumptions in their equations and proofs.

But most of all, the financial engineers, politicians, and Wall Street Banks fear gold because it is the antidote to their frauds, and the informant to their confiscation of wealth.

Do not expect them to capitulate once and for all, but only slowly and grudgingly as it becomes more difficult for them to sustain their illusions and persuasion. Protecting wealth against official adventurism is never easy.

Here is Alan Greenspan's famous essay on Gold and Economic Freedom. I suggest your read it, because it will help you to understand much of what is said and done as the global reserve currency system changes and evolves.

Gold and Economic Freedom

by Alan Greenspan

Published in Ayn Rand's "Objectivist" newsletter in 1966, and reprinted in her book, Capitalism: The Unknown Ideal, in 1967.

An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense - perhaps more clearly and subtly than many consistent defenders of laissez-faire - that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other.

In order to understand the source of their antagonism, it is necessary first to understand the specific role of gold in a free society.

Money is the common denominator of all economic transactions. It is that commodity which serves as a medium of exchange, is universally acceptable to all participants in an exchange economy as payment for their goods or services, and can, therefore, be used as a standard of market value and as a store of value, i.e., as a means of saving.

The existence of such a commodity is a precondition of a division of labor economy. If men did not have some commodity of objective value which was generally acceptable as money, they would have to resort to primitive barter or be forced to live on self-sufficient farms and forgo the inestimable advantages of specialization. If men had no means to store value, i.e., to save, neither long-range planning nor exchange would be possible.

What medium of exchange will be acceptable to all participants in an economy is not determined arbitrarily. First, the medium of exchange should be durable. In a primitive society of meager wealth, wheat might be sufficiently durable to serve as a medium, since all exchanges would occur only during and immediately after the harvest, leaving no value-surplus to store. But where store-of-value considerations are important, as they are in richer, more civilized societies, the medium of exchange must be a durable commodity, usually a metal. A metal is generally chosen because it is homogeneous and divisible: every unit is the same as every other and it can be blended or formed in any quantity. Precious jewels, for example, are neither homogeneous nor divisible. More important, the commodity chosen as a medium must be a luxury. Human desires for luxuries are unlimited and, therefore, luxury goods are always in demand and will always be acceptable. Wheat is a luxury in underfed civilizations, but not in a prosperous society. Cigarettes ordinarily would not serve as money, but they did in post-World War II Europe where they were considered a luxury. The term "luxury good" implies scarcity and high unit value. Having a high unit value, such a good is easily portable; for instance, an ounce of gold is worth a half-ton of pig iron.

In the early stages of a developing money economy, several media of exchange might be used, since a wide variety of commodities would fulfill the foregoing conditions. However, one of the commodities will gradually displace all others, by being more widely acceptable. Preferences on what to hold as a store of value will shift to the most widely acceptable commodity, which, in turn, will make it still more acceptable. The shift is progressive until that commodity becomes the sole medium of exchange. The use of a single medium is highly advantageous for the same reasons that a money economy is superior to a barter economy: it makes exchanges possible on an incalculably wider scale.

Whether the single medium is gold, silver, seashells, cattle, or tobacco is optional, depending on the context and development of a given economy. In fact, all have been employed, at various times, as media of exchange. Even in the present century, two major commodities, gold and silver, have been used as international media of exchange, with gold becoming the predominant one. Gold, having both artistic and functional uses and being relatively scarce, has significant advantages over all other media of exchange. Since the beginning of World War I, it has been virtually the sole international standard of exchange. If all goods and services were to be paid for in gold, large payments would be difficult to execute and this would tend to limit the extent of a society's divisions of labor and specialization. Thus a logical extension of the creation of a medium of exchange is the development of a banking system and credit instruments (bank notes and deposits) which act as a substitute for, but are convertible into, gold.

A free banking system based on gold is able to extend credit and thus to create bank notes (currency) and deposits, according to the production requirements of the economy. Individual owners of gold are induced, by payments of interest, to deposit their gold in a bank (against which they can draw checks). But since it is rarely the case that all depositors want to withdraw all their gold at the same time, the banker need keep only a fraction of his total deposits in gold as reserves. This enables the banker to loan out more than the amount of his gold deposits (which means that he holds claims to gold rather than gold as security of his deposits). But the amount of loans which he can afford to make is not arbitrary: he has to gauge it in relation to his reserves and to the status of his investments.

When banks loan money to finance productive and profitable endeavors, the loans are paid off rapidly and bank credit continues to be generally available. But when the business ventures financed by bank credit are less profitable and slow to pay off, bankers soon find that their loans outstanding are excessive relative to their gold reserves, and they begin to curtail new lending, usually by charging higher interest rates. This tends to restrict the financing of new ventures and requires the existing borrowers to improve their profitability before they can obtain credit for further expansion. Thus, under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth. When gold is accepted as the medium of exchange by most or all nations, an unhampered free international gold standard serves to foster a world-wide division of labor and the broadest international trade. Even though the units of exchange (the dollar, the pound, the franc, etc.) differ from country to country, when all are defined in terms of gold the economies of the different countries act as one — so long as there are no restraints on trade or on the movement of capital. Credit, interest rates, and prices tend to follow similar patterns in all countries. For example, if banks in one country extend credit too liberally, interest rates in that country will tend to fall, inducing depositors to shift their gold to higher-interest paying banks in other countries. This will immediately cause a shortage of bank reserves in the "easy money" country, inducing tighter credit standards and a return to competitively higher interest rates again.

A fully free banking system and fully consistent gold standard have not as yet been achieved. But prior to World War I, the banking system in the United States (and in most of the world) was based on gold and even though governments intervened occasionally, banking was more free than controlled. Periodically, as a result of overly rapid credit expansion, banks became loaned up to the limit of their gold reserves, interest rates rose sharply, new credit was cut off, and the economy went into a sharp, but short-lived recession. (Compared with the depressions of 1920 and 1932, the pre-World War I business declines were mild indeed.) It was limited gold reserves that stopped the unbalanced expansions of business activity, before they could develop into the post-World War I type of disaster. The readjustment periods were short and the economies quickly reestablished a sound basis to resume expansion.

But the process of cure was misdiagnosed as the disease: if shortage of bank reserves was causing a business decline — argued economic interventionists — why not find a way of supplying increased reserves to the banks so they never need be short! If banks can continue to loan money indefinitely — it was claimed — there need never be any slumps in business. And so the Federal Reserve System was organized in 1913. It consisted of twelve regional Federal Reserve banks nominally owned by private bankers, but in fact government sponsored, controlled, and supported. Credit extended by these banks is in practice (though not legally) backed by the taxing power of the federal government. Technically, we remained on the gold standard; individuals were still free to own gold, and gold continued to be used as bank reserves. But now, in addition to gold, credit extended by the Federal Reserve banks ("paper reserves") could serve as legal tender to pay depositors.

When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage. More disastrous, however, was the Federal Reserve's attempt to assist Great Britain who had been losing gold to us because the Bank of England refused to allow interest rates to rise when market forces dictated (it was politically unpalatable). The reasoning of the authorities involved was as follows: if the Federal Reserve pumped excessive paper reserves into American banks, interest rates in the United States would fall to a level comparable with those in Great Britain; this would act to stop Britain's gold loss and avoid the political embarrassment of having to raise interest rates. The "Fed" succeeded; it stopped the gold loss, but it nearly destroyed the economies of the world, in the process. The excess credit which the Fed pumped into the economy spilled over into the stock market, triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed. Great Britain fared even worse, and rather than absorb the full consequences of her previous folly, she abandoned the gold standard completely in 1931, tearing asunder what remained of the fabric of confidence and inducing a world-wide series of bank failures. The world economies plunged into the Great Depression of the 1930's.

With a logic reminiscent of a generation earlier, statists argued that the gold standard was largely to blame for the credit debacle which led to the Great Depression. If the gold standard had not existed, they argued, Britain's abandonment of gold payments in 1931 would not have caused the failure of banks all over the world. (The irony was that since 1913, we had been, not on a gold standard, but on what may be termed "a mixed gold standard"; yet it is gold that took the blame.) But the opposition to the gold standard in any form — from a growing number of welfare-state advocates — was prompted by a much subtler insight: the realization that the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state). Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes. A substantial part of the confiscation is effected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.

Under a gold standard, the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government's promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets. A large volume of new government bonds can be sold to the public only at progressively higher interest rates. Thus, government deficit spending under a gold standard is severely limited. The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. They have created paper reserves in the form of government bonds which — through a complex series of steps — the banks accept in place of tangible assets and treat as if they were an actual deposit, i.e., as the equivalent of what was formerly a deposit of gold. The holder of a government bond or of a bank deposit created by paper reserves believes that he has a valid claim on a real asset. But the fact is that there are now more claims outstanding than real assets. The law of supply and demand is not to be conned. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise. Thus the earnings saved by the productive members of the society lose value in terms of goods. When the economy's books are finally balanced, one finds that this loss in value represents the goods purchased by the government for welfare or other purposes with the money proceeds of the government bonds financed by bank credit expansion.

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

Given his Randian audience and the mood at the time, it is interesting that Greenspan defines the culprits in the scheme of fiat monetization as 'welfare statists.' How ironic, that over a period of time there is indeed a group of welfare statists behind the latest debasement of the currency, the US dollar, but the recipients of this welfare are the Banks and the financial elite, who through transfer payments, financial fraud, and federally sanctioned subsidies are systematically stripping the middle class of their wealth. Perhaps they decided that if you cannot beat them, beat them to the trough and take the best for themselves until the system collapses through their abuse.

Gold and Oil Weekly Charts: SP 500 Bubble Deflated by Gold

Gold is moving within a fairly well defined uptrending channel. It is at a minor resistance point, and has more room to the upside.

Oil is approching an oversold condition and the bottom of its trend channel.

The recent 'recovery' in the SP 500 deflated by gold is instructive. This should help those who see no recovery in the real economy, but were confused by the amazing spike in the US equity market. It was a monetary phenomenon.

Jim Rickards on the May 12 IMF Meeting:SDR as World Reserve Currency

Rickards has a target of $2,000 for gold in the near term, and $5,000 for the intermediate term.

ECB has capitulated on the monetization of debt and joined the Fed, but it is hard to see how this will really solve the problem.

Europeans are running to buy physical bullion, rather than paper pledges in a kind of a 'run on the bank' over fears of the future of the Euro.

The subject of the meeting in Zurich yesterday was for the G20 to discuss the composition and role of SDR's as a reserve currency.

Triffin's dilemma: need for a 'liquidity pump' to drive world trade, someone who is able to sustain deficits without going broke. Now that the US is going broke, a new source of liquidity has to be found.

Rickard views SDR's as pure fiat on a pro rata basis. He does not see any accountability on the part of the IMF or any sort of external control.

While I see some of his points, I think Jim is confused about the notion that the SDR is a 'basket of currencies,' that already exist, unless they are changing the basis of the SDR to debt of their own issuance. I was not at all clear on this, and I would be a little surprised if that is the case.

What the IMF has been proposing with the support of the BRIC countries, is to put the SDR forward as a 'clearing mechanism' for international trade. They are also actively lobbying for a recomposition of the SDR to shift some of the monetary authority from the west to the east.

If the SDR is a 'basket of currencies,' each with their own debt balance sheet, and the SDR is not intended to replace or supplant domestic currencies, and especially if the SDR contains some element of gold and silver, then I view it as a natural development from the Bretton Woods system, and the failure of the US Federal Reserve to responsibly manage its currency 'like it was a gold standard.'

The IMF is attempting to replace the US dollar as the world's reserve currency with a portfolio of major fiat currencies, with the notion that the result will be more stable, more diversely based. Again, an element of gold and silver would further strengthen it.

I could be mistaken in what the IMF intends. But I have seen nothing to indicate that yet, and I think for now that Jim Rickards is mistaken in the assumptions underlying some of his statements.

IF the IMF decides to create a fiat currency of its own, and call it the SDR, and base it solely on its own balance sheet, with an arbitrary ability to expand and distribute it, then it really is the beginning of a new world order, and a one world government. But for now I do not see that to be the case. I can find no statement on the IMF homepage to this effect.

Why not go directly to a gold and silver standard? The greatest obstacle is that the Anglo American nations, or more properly their central banks and politicians, would not accept it. It would be inimical to their monetary power and financial engineering. The US Federal Reserve will not even agree to be audited by its own government! And do you think they would agree to the constraint of an external gold standard? This is a highly political as well as economic topic, and to ignore that is to completely misunderstand what is happening.

An evolutionary path to something less arbitrary than the dollar, but not quite as strict as gold, is most likely. This is being driven by China and Russia and the developing countries, and on the other side of the table are the Anglo-American banks, and to a less extent, Europe, after having been whipped into place by assaults on its monetary union.

It is an interesting interview. I only caution that more details need to be given from the IMF on what they are doing before conclusion can be drawn. I have been expecting this for a long time, and it is a development that the BRIC countries have been lobbying to obtain. The Anglo-Americans exert considerable influence over the IMF. This is a classic struggle for power between the old world powers and the developing world.

This is not to say that I am comfortable with the IMF. I have attempted to lay out the parameters to assess what they are doing with respect to a basket and clearing house versus a completely new global currency. Since the US and UK hold inordinate sway over the IMF, we have to be aware of the possibility that the IMF could merely become a much larger successor to the Federal Reserve, and owned and controlled by the Anglo-American banking interests. This is why gold and silver are the ultimate solution, and why the status quo will oppose them with all their power.

His follow on discussion of how hedge funds and financial institutions can attack a nation's currency using derivatives is very worth hearing.

Click here to listen to the Rickards Interview on King World News.

12 May 2010

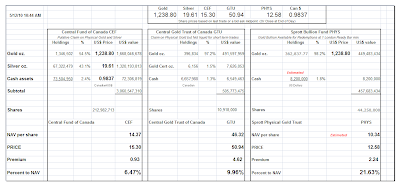

Net Asset Value of Certain Precious Metal Funds and Trusts: Comments on CEF

Management does makes a difference.

The Central Fund's offering led by CIBC is allowing the underwriters and others given access to this offering to obtain a windfall, being given the right to purchase additional shares at 14.85.

Presumably this will create a weight holding down the premium to NAV of this fund until they have taken their profits by selling those units which they have obtained at discount prices. Perhaps this is not the case, and the news is misleading. But it would certainly explain the contraction in the premium when gold and silver are hitting new highs.

This looks to me like the habit of using an old, familiar method of obtaining funds that may be more suited to other times and different markets. Old habits die hard, and sometimes even harder when new competition enters the markets and changes are not made with the times.

Since CEF will be in the market buying gold and silver bullion, it drives up prices at the very time it is giving its bank underwriters a discount price on their stock.

Yes I understand the difficulty of selling a large tranche like that in the marketplace. But I would contrast this approach with that of PHYS and Sprott Asset Management, which managed to sell an equally large amount of units and buy bullion while continually providing the benefits to shareholders, and not to the banks with whom they are doing business.

To say I am not impressed by the CEF management would be about right. While I do not doubt they have the bullion they represent, I am disappointed by their method of obtaining the greatest value and consideration for shareholders.

I will flip their shares for a trade, but if I want to buy and hold something besides bullion when the metals are running I think there are better ways to play that trade. Some of the miners have higher beta and a better index to the metal moves. PHYS had been a great play but its premium now is a bit prohibitive for my taste. SLW is da bomb when silver runs but it too can get ahead of itself.

Still, you have to have something to hang onto when gold and silver are on a run like this. There is a huge surge of bullion and coin purchases in Europe because of worries about their currencies. When the currency concerns eventually spread to the dollar, which they almost certainly will, the buying will make what we are seeing now seem like a bump on the charts.

11 May 2010

General Motors Wants to Get Back into Financing to Increase Its Profits

Bloomberg reports that GM Considers Buying back GMAC

Or starting a new unit.

Having its own financing unit will 'increase its profitabiltiy.'

"As a dog returns to his vomit, so a fool doth repeat his folly." Proverbs 26:11

Unless of course you get to keep the gains, and a greater fool, the public, assumes your losses.

It's good to be the King, but cheaper to lease one.

AP

GM wants to re-enter auto financing

Tom Krisher

Tuesday May 11, 2010

DETROIT (AP) -- General Motors Co. executives want their own auto-financing arm so they can offer more competitive lease and loan deals, according to a person briefed on their plans.

The executives want to buy back the auto financing business from the former GMAC Financial Services or start their own operations, said the person, who asked not to be identified because the plans have not been made public.

A top GM executive has told dealers about the plans, the person said.

GM sold a 51 percent stake in GMAC Financial Services in 2006 when it was starved for cash. The new owners, led by private equity firm Cerberus Capital Management LP, ran into trouble in 2008 with bad mortgage loans and had to be bailed out by the federal government, which now owns 56 percent of the company.

Earlier this month, GMAC changed its name to Ally Financial.

GM dealers say that since GMAC is responsible for making its bottom line look good, it is less likely to lose money by offering to finance sweet lease deals or zero-percent financing. A GM-owned auto financing business would be more likely to "take a bullet" for the company to sell more cars and trucks, the person said.

Competitors, such as Ford Motor Co. or Toyota Motor Corp., control their own financing arms.

GM spokesman Tom Wilkinson said Tuesday that the company would not comment on speculation....

Here Is Why the Fed Cannot Simply Continue to Inflate Its Way Out of Every Financial Crisis That It Creates

The chart below is from the essay, Not Just Another Greek Tragedy by Cornerstone.

I have been watching this chart for the past ten years, as part of the dynamic of the sustainability of the bond and the dollar as the limiting factor on the Fed's ability to expand the money supply.

The ability to expand debt is contingent on the ability to service debt. If the cost of the debt rises over the net income of the country's capital investment, or even gets close to it, the currency issuing entity is trapped in a debt spiral to default without a radical reform.

In other words, if each new dollar of debt costs ten percent in interest, largely paid to external entities, and it generates less than ten cents in domestic product, it is a difficult task to grow your way out of that debt without a default or dramatic restructuring.

So we are not quite there yet. But we are getting rather close on an historic basis. Without the implicit subsidy of the dollar as the world's reserve currency it would be much closer.

As it is now, this chart indicates that stagflation at least, rather than a hyperinflation, is in the cards for the US. But the trend is not promising, and the lack of meaningful reform is devastating.

A 'soft default' through inflation is the choice of those countries that have the latitude to inflate their currencies. Greece, being part of the European Monetary Union, did not. The US is not so constrained, especially since it owns the world's reserve currency.

The economy is out of balance, heavily weighted to a service sector, especially the financial sector which creates no new wealth, but merely transforms and transfers it. With stagnation in the median wage, and an historic imbalance in income distribution skewed to the top few percent, with the banks levying de facto taxation and inefficiency on the economy as a function of that income transfer, there should be little wonder that the growth of real GDP is sluggish in relation to new debt.

Or as Joe Klein so colorfully phrased it, the elite have been strip-mining the middle class in America for the past thirty years.

Along with the 'efficient market hypothesis,' trickle-down economics is also a fallacy. This is why the stimulus program being conducted by the Federal Reserve, in an egregious expansion of its authority to conduct monetary policy, in subsidies and transfer payments to Wall Street is not working to stimulate the real economy. It merely inflates the bonuses of the few, and extends the unsustainable.

So obviously one might say, "The Banks must be restrained, and the financial system reform, and the economy brought back into balance, before there can be any sustained recovery.

The Net Asset Value of Certain Precious Metal Funds and Trusts

The Central Fund of Canada is selling 23,600,000 units from their shelf offering at 14.85.

The proceeds will be used to buy additional gold and silver bullion. This action tends to dampen the premium. The calculations will be updated when the transactions are completed and announced on their website. Closing is expected to occur on or about May 18, 2010.

Note: As a reminder, The Cafe is long gold and silver, and has been since 2001. All that varies is the form and the degree with occasional hedging.

Silver S Q U _ _ Z _ : Would You Like to Buy a Vowel?

"Whoever commits a fraud is guilty not only of the particular injury to him who he deceives, but of the diminution

of that confidence which constitutes not only the ease but the existence of society."

Dr. Samuel Johnson

Another vertical move in silver from the New York open, as the bullion bears who are heavily short silver attempt to cover their paper shorts, which is a trick considering how tight the physical market is, and how vulnerable they are to discovery now that their attempt to suppress the price is falling apart.

It is like watching the Hunt Brothers silver gambit in reverse. As you might suspect, this is not the kind of action one sees in healthy markets. These volatile price swings are unnerving to most investors, and to the industries who rely on the markets to set prices for their planning in the real economy.

If you like your markets opaque, imbalanced, and dangerous, the NYMEX is your Bartertown.

If this turns into a serious short panic the price of silver could reach its all time high. Markets that are allowed to become this out of sync with legitimate price discovery are inefficient and disruptive to the real economy.

But now we will see if the bullion banks who have sowed the wind, reap the whirlwind.

But for now, the Administration is failing to reform the markets, as seen by the SEC's latest attempt to deal with a sudden 1,000 point drop in the Dow. It is almost funny to hear the Wall Street squeaktoys explaining that one away on bubblevision.

The Banks must be restrained, the financial system reformed, the economy brought back into balance, before there can be any sustained recovery.

10 May 2010

Trading in Hubris: Pride, Overreach, and the Inevitable Blowback and Consequences

"We have always known that heedless self-interest was bad morals; we know now that it is bad economics. Out of the collapse of a prosperity whose builders boasted their practicality has come the conviction that in the long run economic morality pays...

We are beginning to abandon our tolerance of the abuse of power by those who betray for profit the elementary decencies of life. In this process evil things formerly accepted will not be so easily condoned..."

Franklin D Roosevelt, Second Inaugural Address, January 1937

The hubris associated with the trading crowd is peaking, and heading for a fall that could be a terrific surprise. It seems to be reaching a top, trading now in a kind of triumphant euphoria after the European capitulation and the recent equity market volatility.

I had a conversation this morning with a trader that I have known from the 1990's, which is a lifetime in this business. I have to admit that he is successful, more so than any of the popular retail advisory services you might follow such as Elliott Wave, for example, which he views with contempt, a useful distraction for the little guy, the same way that casino operators view most gambling systems except counting cards. He is a bit of an insider, and knows the markets internals and what makes them tick. I remember a time when some of the more obvious market shenanigans used to bother his conscience a little. But he is well beyond that point now.

He likes to pick my brain on some topics that he understands much less, such as the economic relationships and monetary developments, and sometimes weaves them into his commentary, always without attribution. He has been a dollar bull forever, and his worst trading is in the metals. He likes to short gold and silver on principle, and always seems to lose because he rarely honors his first stop loss, which is a shocking lapse in trading discipline. That stubbornness is probably what kept him from making top management.

His tone was ebullient. The Street has won, it owns the markets. They can take it up, and take it down, and make money on both sides, any side, of any market move. I have to admit that in the last quarter his trading results are impeccable.

We diverged into the dollar, which he typically views as unbeatable, with the US dominating the international financial system forever. He likes to ask questions about formal economic terms and relationships, or monetary systems and policy. He relies on others for that knowledge, although he almost never admits it and will argue from pure emotion if necessary, until he gets what he wants to know.

I am not a social worker. Its a quid pro quo. He gives me insights into the trading world, and the pits where he dwells. What they are thinking, and what is going around in his crowd, with which I rarely associate these days.

He thinks the euro is done, and the dollar will remain the sole currency. His attitude is, "What will replace it?" He cannot even imagine anything different than what we have today. But interestingly enough he does not believe that the US government is running things. "Things are being run by a new world order, and have been for some time." He said that so matter of factly that it made me catch my breath.

And he's good with that. Does not bother him in the least little bit, as long as he is making money. And that is where our conversation started to go downhill, quickly. I was in no mood to hear his usual perspective on the future and the triumph of the willful.

If there is a new Mussolini in the US to maintain order, he's good with that. If they start putting people on trains to resettlement camps in the southwest, he's ok. If there are starving people in the streets, it doesn't bother him because he lives in a gated community. If the middle class gets crushed by a new market crash that is ok. He made a killing shorting the Crash of 1987, and was able to enjoy the resort where he spent the winter even more than ever because they were so few people there.

I would like to say he is an outlier, a one of a kind. But he is not. He is typical. He is driven purely and almost solely by personal greed, and he makes no bones about it. Life is a war, and he wants to conquer you.

But he is not a monster. If you met him you might like him. He's affable, conservative, a decent conversationalist, and personally well kept and engaging. But he is missing something, like the derivative of a human being. If you talk about the 'bad guys' he doesn't identify with them. He thinks he is 'us.' It's never occurred to him that he is the problem. Because his value system is utterly one dimensional and egocentric. In some ways he is the most intelligent twelve year old I have ever met. But I am sure he considers me a fool and an idealist. And I might agree. But it is not so much who you are, but why. Who or what do you serve?

He is a microcosm of Wall Street, and the prevailing attitudes in the Big Banks in particular. If you wish to form public policy, if you want to create a stable system, one based on human values, never ask a trader or a trading company for advice. They are incapable of framing the question in a way that will provide you a workable answer. What is good is whatever works for them in the most narrow definition of the terms. They think they are being altruistic when they take a little bit of a haircut on terms that are already well into the realm of usury.

The problem is the ability of Wall Street to buy power and influence among the regulators and politicians, and bring their unbalanced world view to bear so heavily on the formation of public policy and governance.

That is not to say that they are necessarily bad people. They are what they are. It's just that they need to be restrained by regulation, and certainly should not be in the driver's seat of anything outside of their own accounts, and those with external supervision and transparency. But certainly not in control of things in general, of running the system by proxy, which is where they are today. Or at least where they think they are.

Goldman trades big, but more probes loom

By Steve Eder

May 10, 2010, 11:55 am EDT

NEW YORK (Reuters) - Goldman Sachs Group Inc on Monday showed how its trading operations are stronger than ever, but warned that more litigation and investigations loom.