"Goldman Sachs had said in the past that its exposure to A.I.G.’s financial trouble was 'immaterial'."

It appears that it was immaterial because Goldman Sachs, through their ex-CEO Hank Paulso, had set things up so they could not lose on their counterparty risk.

This story from last September documents Goldman Sachs involvement, at the highest levels, in the AIG bailout with then Treasury Secretary Hank Paulson.

AIG: A Blind Eye to Risk - NYT Sept 28, 2008It seems fairly obviously that a relatively small department within

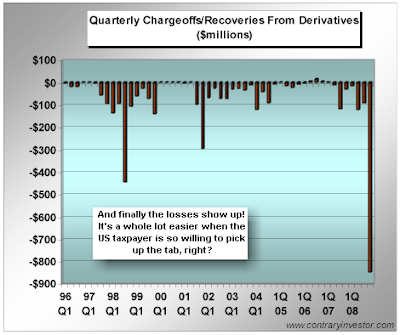

AIG, the Financial Products division, was operating under the regulatory radar and was used as a patsy by a number of the Wall Street banks, who had no worries about losses because of their power to obtain the US government as a backstop to losses.

This is a scandal of epic proportion.

'Outrage' barely manages to express the appropriate reaction.

Obama is an educated, intelligent President, and can hardly retreat behind the

clueless buffoon defense in vogue with so many

CEO's and public officials. He has a directly responsible for this outcome now along with the Bush Administration and the Republicans.

Geithner and Summers should resign over their handling of AIG.

The Fed has no business regulating anything more complex than a checking account.

The difficulty with which we are faced is that despite their mugging for the camera and emotional words the Democrats and Republicans are owned by Wall Street and Big Business because of the existing system of lobbying and campaign funding.

Getting behind a third party for president is symbolic but ineffective. Giving a significant number of congressional seats to a third party will send a chilling and practical message to both the President and the Congress that enough is enough.

And in the meantime--

Contact Your Elected OfficialsNY Times

A.I.G. Lists the Banks to Which It Paid Rescue FundsBy MARY WILLIAMS WALSHMarch 16, 2009

Amid rising pressure from Congress and taxpayers, the American International Group on Sunday released the names of dozens of financial institutions that benefited from the Federal Reserve’s decision last fall to save the giant insurer from collapse with a huge rescue loan.

Financial companies that received

multibillion-dollar payments owed by A.I.G. include

Goldman Sachs ($12.9 billion),

Merrill Lynch ($6.8 billion),

Bank of America ($5.2 billion),

Citigroup ($2.3 billion) and

Wachovia ($1.5 billion).Big foreign banks also received large sums from the rescue, including

Société Générale of France and

Deutsche Bank of Germany, which each received nearly $12 billion;

Barclays of Britain ($8.5 billion); and

UBS of Switzerland ($5 billion).

A.I.G. also named the 20 largest states, starting with California, that stood to lose billions last fall because A.I.G. was holding money they had raised with bond sales.

In total, A.I.G. named nearly 80 companies and municipalities that benefited most from the Fed rescue, though many more that received smaller payments were left out.

The list, long sought by lawmakers, was released a day after the disclosure that A.I.G. was paying out hundreds of millions of dollars in bonuses to executives at the A.I.G. division where the company’s crisis originated. That drew anger from Democratic and Republican lawmakers alike on Sunday and left the Obama administration scrambling to distance itself from A.I.G.

“There are a lot of terrible things that have happened in the last 18 months, but what’s happened at A.I.G. is the most outrageous,” Lawrence H. Summers, an economic adviser to President Obama who was Treasury secretary in the Clinton administration, said Sunday on “This Week” on ABC. He said the administration had determined that it could not stop the bonuses.

(Among the outrages was the appointment of that sly old fox Larry Summers and his sidekick Tim Geithner by President Obama, and their continued tenure in any so-called reform government. - Jesse)

But some members of Congress expressed outrage over the bonuses. Representative Elijah E. Cummings, a Democrat of Maryland who had demanded more information about the bonuses last December, accused the company’s chief executive, Edward M. Liddy, of rewarding reckless business practices. (Well duh, that was and is the modus operandi of Wall Street Congressman - Jesse)

“A.I.G. has been trying to play the American people for fools by giving nearly $1 billion in bonuses by the name of retention payments,” Mr. Cummings said on Sunday. “These payments are nothing but a reward for obvious failure, and it is an egregious offense to have the American taxpayers foot the bill.” (Hey I have a good idea, lets elect some officials to make the laws and prevent these outrages through regulation. Oh yeah we did. Its you Congress! Its you Obama - Jesse)

An A.I.G. spokeswoman said Sunday that the company would not identify the recipients of these bonuses, citing privacy obligations.

Ever since the insurer’s rescue began, with the Fed’s $85 billion emergency loan last fall, there have been demands for a full public accounting of how the money was used. The taxpayer assistance has now grown to $170 billion, and the government owns nearly 80 percent of the company.

But the insurance giant has refused until now to disclose the names of its trading partners, or the amounts they received, citing business confidentiality.

A.I.G. finally relented after consulting with the companies that received the government support. The company’s chief executive, Edward M. Liddy, said in a statement on Sunday: “Our decision to disclose these transactions was made following conversations with the counterparties and the recognition of the extraordinary nature of these transactions.” (How about the threat of subpoena from the Attorney General? - Jesse)

Still, the disclosure is not likely to calm the ire aimed at the company and its trading partners.

The Fed chairman, Ben S. Bernanke, appearing on “60 Minutes” on CBS on Sunday night, said: “Of all the events and all of the things we’ve done in the last 18 months, the single one that makes me the angriest, that gives me the most angst, is the intervention with A.I.G.” (Considering you are presiding over the looting of the middle class, Ben my man, that speaks volumes - Jesse)

He went on: “Here was a company that made all kinds of unconscionable bets. Then, when those bets went wrong, they had a — we had a situation where the failure of that company would have brought down the financial system.” (AIG was a setup with the very banks, Goldman Sachs and crew, that you are bending our economy over backwards to save, Ben - Jesse)

In deciding to rescue A.I.G., the government worried that if it did not bail out the company, its collapse could lead to a cascading chain reaction of losses, jeopardizing the stability of the worldwide financial system.

The list released by A.I.G. on Sunday, detailing payments made between September and December of last year, could bolster that justification by illustrating the breadth of losses that might have occurred had A.I.G. been allowed to fail.

Some of the companies, like Goldman Sachs and Société Générale, had exposure mainly through A.I.G.’s derivatives program. Others, though, like Barclays and Citigroup, stood to lose mainly because they were customers of A.I.G.’s securities-lending program, which does not involve derivatives. (There ought to have been the managed unwinding and default on those derivatives - Jesse)

But taxpayers may have a hard time accepting that so many marquee financial companies — including some American banks that received separate government help and others based overseas — benefiting from government money.

The outrage that has been aimed at A.I.G. could complicate the Obama administration’s ability to persuade Congress to authorize future bailouts. (I would hope so. Obama has lost all credibility compliments of Geithner, Summers and Bernanke - Jesse)

Patience with the company’s silence began to run out this month after it disclosed the largest loss in United States history and had to get a new round of government support. Members of Congress demanded in two hearings to know who was benefiting from the bailout and threatened to vote against future bailouts for anybody if they did not get the information.

“A.I.G.’s trading partners were not innocent victims here,” said Senator Christopher J. Dodd, the Connecticut Democrat who presided over one recent hearing. “They were sophisticated investors who took enormous, irresponsible risks.” (Do something about it then you windbag - Jesse)

The anger peaked over the weekend when correspondence surfaced showing that A.I.G. was on the brink of paying rich bonuses to executives who had dealt in the derivative contracts at the center of A.I.G.’s troubles.

Representative Barney Frank, Democrat of Massachusetts and chairman of the House Financial Services Committee, implicitly questioned the Treasury Department’s judgment about the whether the bonuses were binding. (I would question if Barney Frank is competent to hold office since he has also been a key player - Jesse)

“We need to find out whether these bonuses are legally recoverable,” Mr. Frank said in an interview Sunday on Fox News.

Many of the institutions that received the Fed payments were owed money by A.I.G. because they had bought its credit derivatives — in essence, a type of insurance intended to protect buyers should their investments turn sour.

As it turned out, many of their investments did sour, because they were linked to subprime mortgages and other shaky loans. But A.I.G. was suddenly unable to honor its promises last fall, leaving its trading partners exposed to potentially big losses.

When A.I.G. received its first rescue loan of $85 billion from the Fed, in September, it forwarded about $22 billion to the companies holding its shakiest derivatives contracts. Those contracts required large collateral payments if A.I.G.’s credit was downgraded, as it was that month.

Among the beneficiaries of the government rescue were Wall Street firms, like Goldman Sachs, JPMorgan and Merrill Lynch that had argued in the past that derivatives were valuable risk-management tools that skilled investors could use wisely without any intervention from federal regulators. Initiatives to regulate financial derivatives were beaten back during the administrations of Presidents Bill Clinton and George W. Bush.

Goldman Sachs had said in the past that its exposure to A.I.G.’s financial trouble was “immaterial.” A Goldman Sachs representative was not reachable on Sunday to address whether that characterization still held. When asked about its exposure to A.I.G. in the past, Goldman Sachs has said that it used hedging strategies with other investments to reduce its exposure.

Until last fall’s liquidity squeeze, A.I.G. officials also dismissed those who questioned its derivatives operation, saying losses were out of the question.

Edmund L. Andrews and Jackie Calmes contributed reporting.