I am no legal expert, and therefore have no idea of the merits of this as a prospective case. The law involves things like intent, opportunity, evidentiary proof, and so forth. Apparently one can sue another entity for just about anything, but that does not mean that the case has any merit. And I certainly could not advance such a case based on even industry knowledge. That strikes to the heart of my own issue.

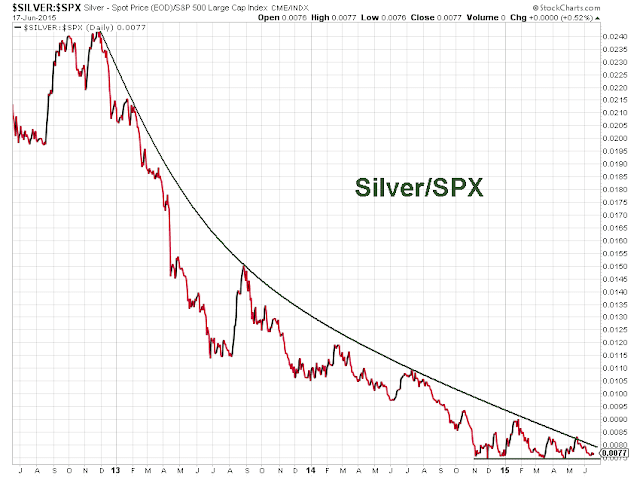

My primary concern is a lack of transparency. And that lack of transparency in these markets is not conducive to market efficiency. It allows for gaming the system, either occasionally or, as we have seen, systematically.

I cannot tell if these markets are manipulated because so much of what is being done is hidden. And it does not help that the CFTC conducted a five year long study into the subject, and then quietly killed it without ever having issued

any information about their findings.

Some have shown evidence they say that proves that it is the tech funds that set price, and that JPM is just 'making a market.' If this is true, then additional transparency on the part of JPM and the other market makers would be perfectly reasonable to allay any doubts about the honesty and fairness of the markets for precious metals. This is why the people have established, and paid for, regulators. So they do not have to resort to lawsuits in order to achieve justice and equity in their transactions.

Considering the widespread rigging of key benchmarks and prices, I think to just dismiss these concerns with a sneer and a snigger is unreasonable, requiring people to maintain an almost slavish belief in the integrity of the Banks, trading desks, and the system. Given the amount of abuse that has been exposed already along these same lines, that does not seem to be a thing that a thinking person would ask.

The major objection to transparency, by the way, is that it would diminish the profits of those in the position of market makers. Well, market making is intended to be a utility function, with a small but regular return. It is not appropriate for market making to be in the hands of those who are also major market players. It is a certain invitation to corruption.

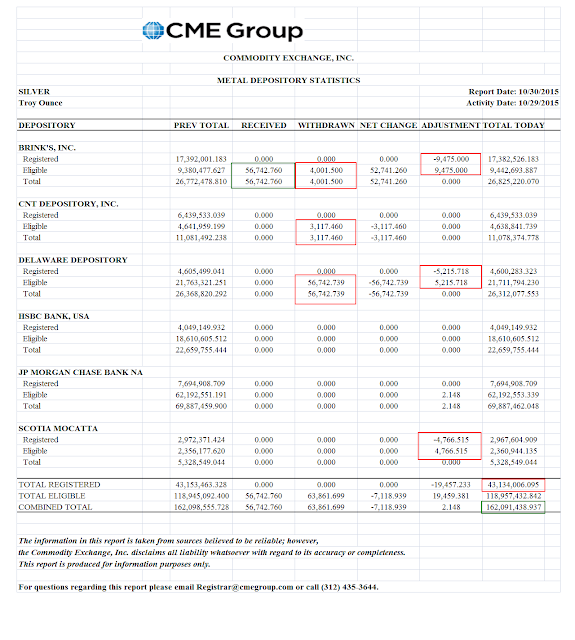

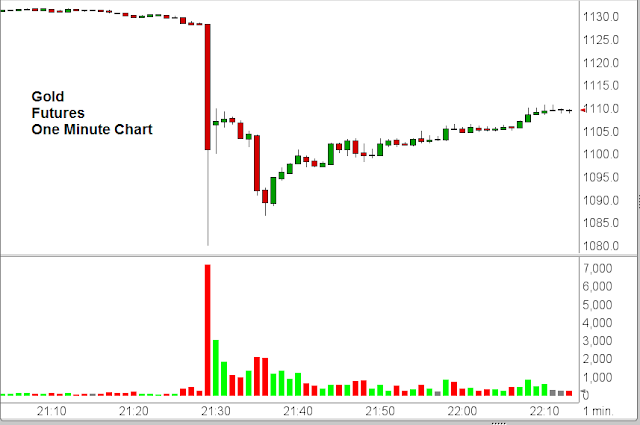

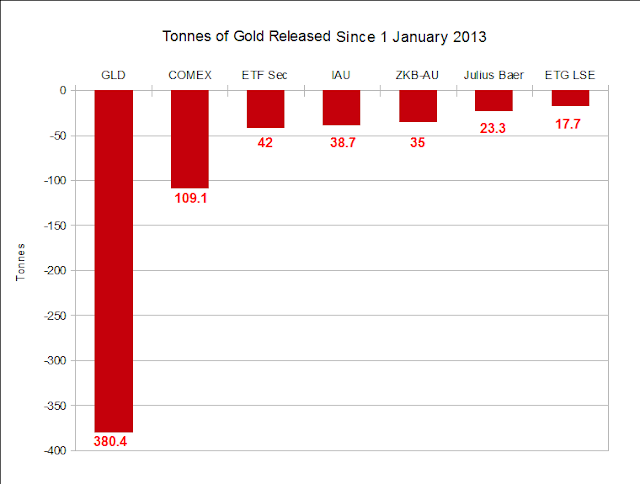

One of the more general things that struck home in this commentary by Ted is the concern that the Comex is becoming like a

bucket shop, a betting parlor that is at arms length from the markets for which they are presumably setting prices. The lack of delivery and the ability to create large amounts of contracts to receive or deliver on the fly, and then to transact them at whatever price you wish without seeming constraint

if you are big enough, with deep enough pockets and enough advantageous information, is tantamount to setting up a con game, and then trusting in men to be angels.

Relying on self-regulation, under the discipline of private lawsuits, merely reinforces our increasingly bifurcated society, in which a small minority have ease and rights and freedom and even justice, because they can afford it. And those many who rely on the justice provided by government will be faced with an upward facing and unresponsive bureaucracy, and with that, hard times. Like quality Healthcare, there will be Justice, for some.

As you know I am no longer hopeful of change in the short term, given the nature of the credibility trap that has encompassed the political party process and the mainstream media. To paraphrase the discouragement pessimism of Czech author and political figure Václav Havel:

“No attempt at reform could ever hope to set up even a minimum of resonance in the rest of society, because that society is ‘soporific,’ submerged in a consumer rat race... Even if reform were possible, however, it would remain the solitary gesture of a few isolated individuals, and they would be opposed not only by a gigantic apparatus of national (and supranational) power, but also by the very society in whose name they were mounting their reform in the first place.”

It is no accident that the nascent movements for financial reform were either ruthlessly crushed, as in the case of the almost rudderless Occupy Wall Street, or co-opted by money and politics, as unfortunately happened with the Tea Party. Co-opt if you can, crush if you must.

Ted presents some of the facts in the contrary case, and I found them to be interesting. It is hard to believe that the London Fix is so corrupt, but the Comex, which is the major pricing platform, is pristine, since the players are playing across all global markets.

Suing JPMorgan and the COMEX

Theodore Butler|

March 21, 2014

I’ve had some recent conversations with attorneys who were considering class-action lawsuits regarding a gold price manipulation stemming from reports about the London Gold Fix. I told them that while there is no doubt that gold and, particularly, silver are manipulated in price, I didn’t see how the manipulation stemmed from the London Fix. I wished them well and hoped that they may prevail (the enemy of my enemy is my friend), because you never know – if the lawyers dig deep enough they might find the real source of the gold and silver manipulation, namely, the COMEX (owned by the CME Group) and JPMorgan.

So I thought it might be constructive to lay out what I thought a successful lawsuit might look like, although I’m speaking as a precious metals analyst and not as a lawyer. I’ll try to put the whole thing into proper perspective, including the premise and scope of the manipulation as well as the parties involved...

Read the entire article for free here.